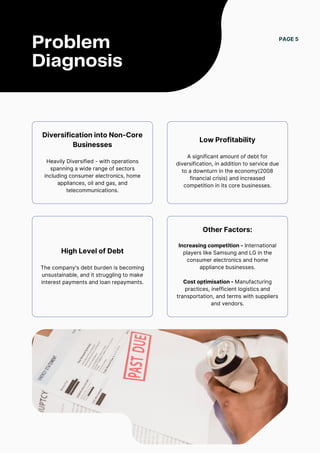

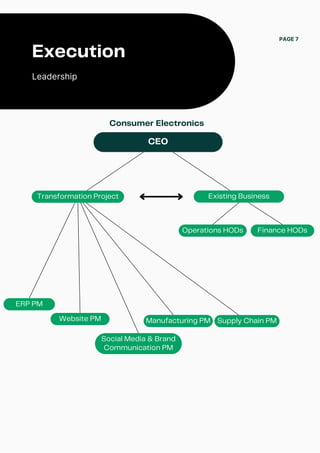

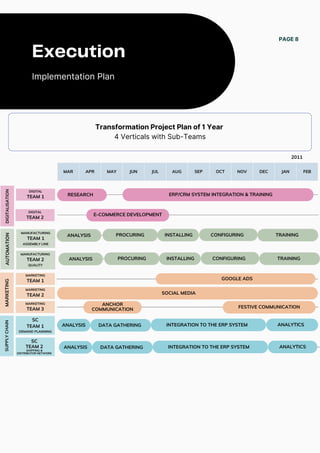

The document outlines a contingency strategy for Videocon Industries, detailing the company's decline due to reckless diversification, high debt, and competition. As the newly appointed CEO, Anindya Singh presents a turnaround plan focusing on divesting non-core businesses, digital transformation, and workforce optimization to boost profitability within a year. The financial plan estimates the transformation will require approximately INR 11 crore and emphasizes the importance of avoiding further debt while enhancing customer engagement and operational efficiency.