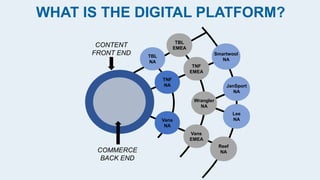

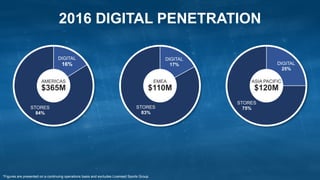

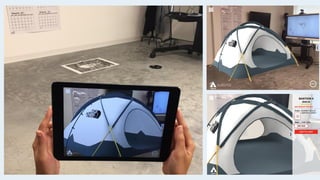

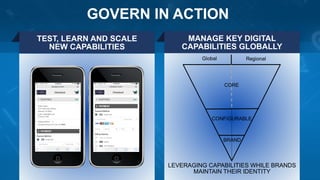

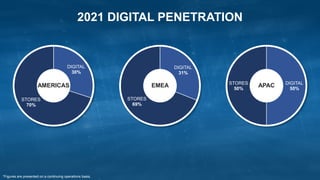

This document discusses VF Corporation's digital strategy and investments. It outlines the goals of the VF Digital Lab in accelerating digital capabilities across brands globally. It also describes the VF digital platform, key digital investments, and financial performance exceeding goals with 29% annual growth in digital sales from 2012-2016. The strategy focuses on informing decisions with data and analytics, innovating through partnerships, and governing digital capabilities globally.