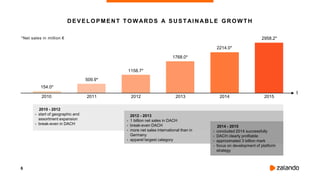

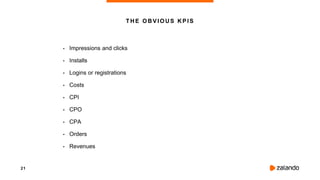

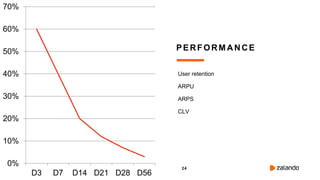

This document summarizes a presentation on marketing intelligence and key performance indicators (KPIs) for an online fashion retailer called Zalando. It provides an overview of Zalando's business facts and figures, including annual net sales, customer base, product selection, and geographic reach. It then discusses best practices for working with KPIs, including defining clear goals, asking the right questions, understanding different data sources, and looking beyond obvious metrics to more nuanced engagement and performance indicators. The presentation emphasizes quantifying business questions and not overfocusing on numbers.