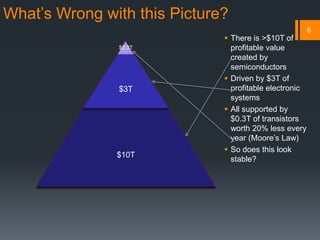

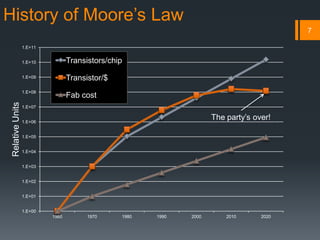

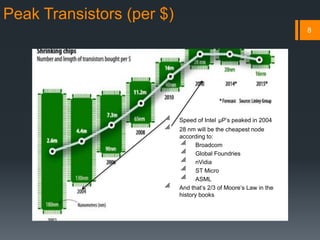

The document discusses the end of Moore's Law and its implications. It notes that transistor costs are rising with each new node, contrary to the historical trend of declining costs. This breaks the virtuous cycle of ever-cheaper transistors driving growth. The stagnation of declining transistor costs could lower global GDP growth and China's economy. It may also impact America's technological leadership. The end of exponential transistor growth marks a profound change that will require new approaches to computing and innovation.