- Varun Beverages Ltd is an Indian beverage company and sole franchise of PepsiCo products in several countries.

- In 2017, the company divested its stake in a loss-making Mozambique subsidiary and increased its stake in a profitable Zambia subsidiary. It also established new production facilities in Zimbabwe and India.

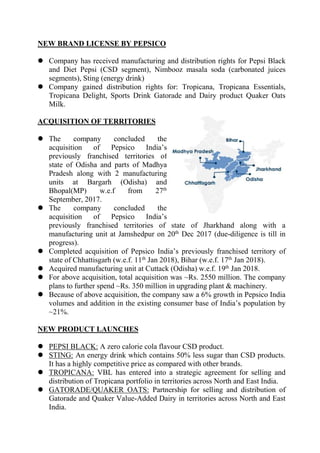

- The company received rights to produce and distribute additional PepsiCo brands and acquired new territories in India through the purchase of PepsiCo's franchised territories in several states.

- Financial highlights show increased assets but decreased profits compared to the previous year. The company expects future profitability to rise through consolidation efforts and expanded product portfolio and territories.