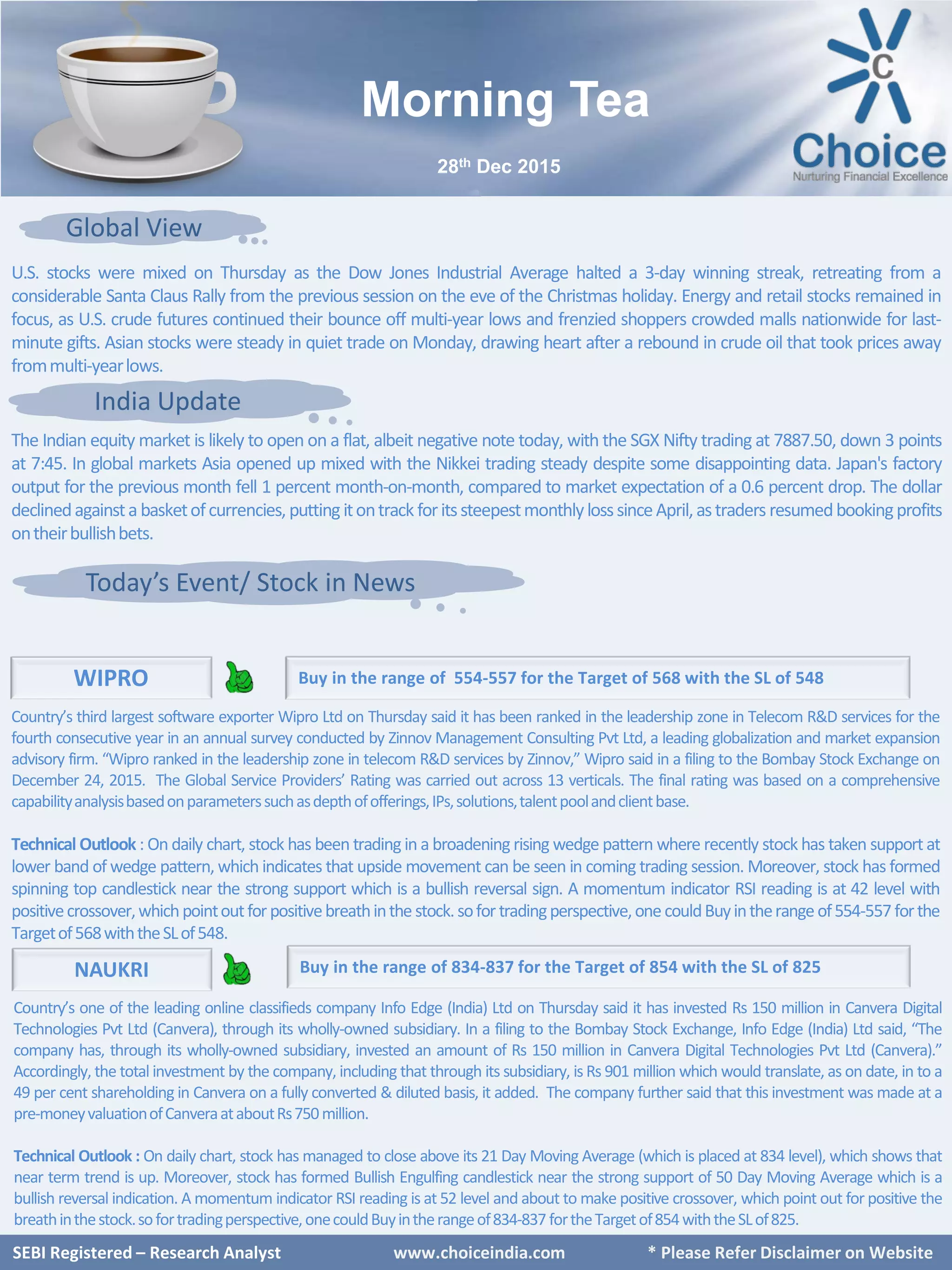

Wipro Ltd has been ranked in the leadership zone for telecom R&D services by Zinnov for the fourth consecutive year, with technical indicators suggesting potential upward movement in the stock. Info Edge (India) Ltd has invested Rs 150 million in Canvera Digital Technologies, increasing its shareholding to 49%. The Indian equity market is expected to open flat amid mixed global stock performances and declining dollar values.