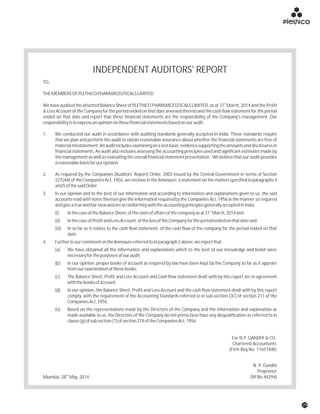

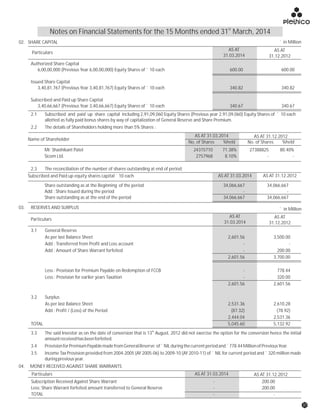

The document discusses the challenges faced by the pharmaceutical industry and the company in the past year. It summarizes key regulatory changes affecting the industry including new pricing policies for drugs and foreign direct investment rules. It notes the company faced a difficult year with cash flow issues due to macroeconomic conditions, currency fluctuations, and delays in debt repayment. Looking ahead, it emphasizes the need for compliance with global quality and regulatory standards to achieve sustainable long-term growth.