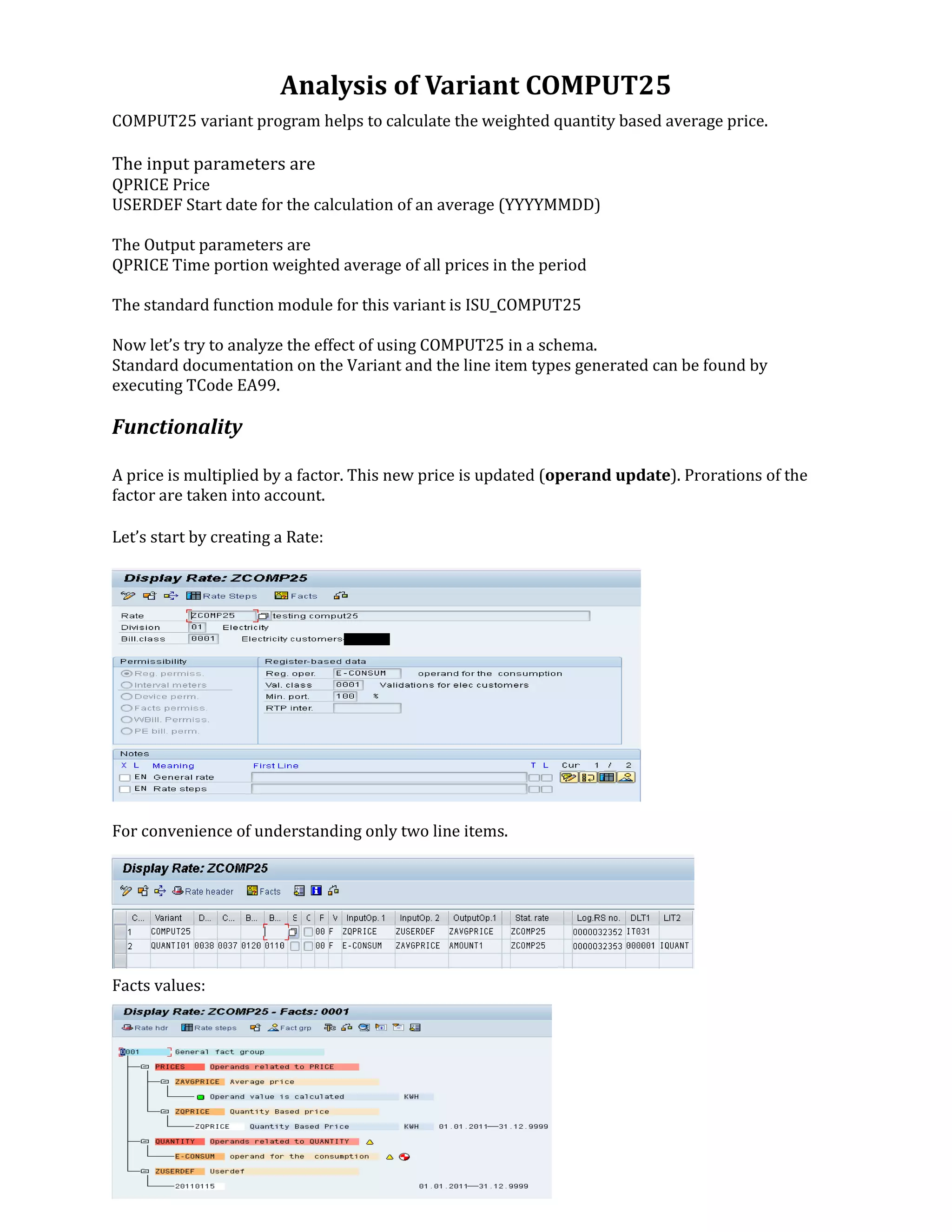

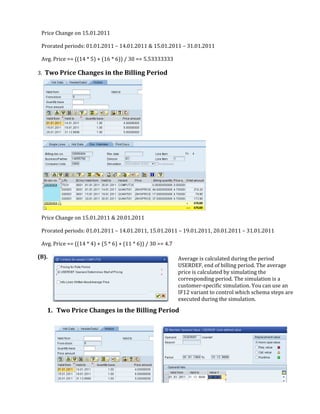

This document summarizes how the COMPUT25 variant program calculates a weighted quantity-based average price. It takes the price, start date, and outputs the average price. The standard function module is ISU_COMPUT25. It provides examples of calculating average price with no price changes, one price change, and two price changes between periods. It also discusses how the average is calculated based on the USERDEF start date or end of billing period.