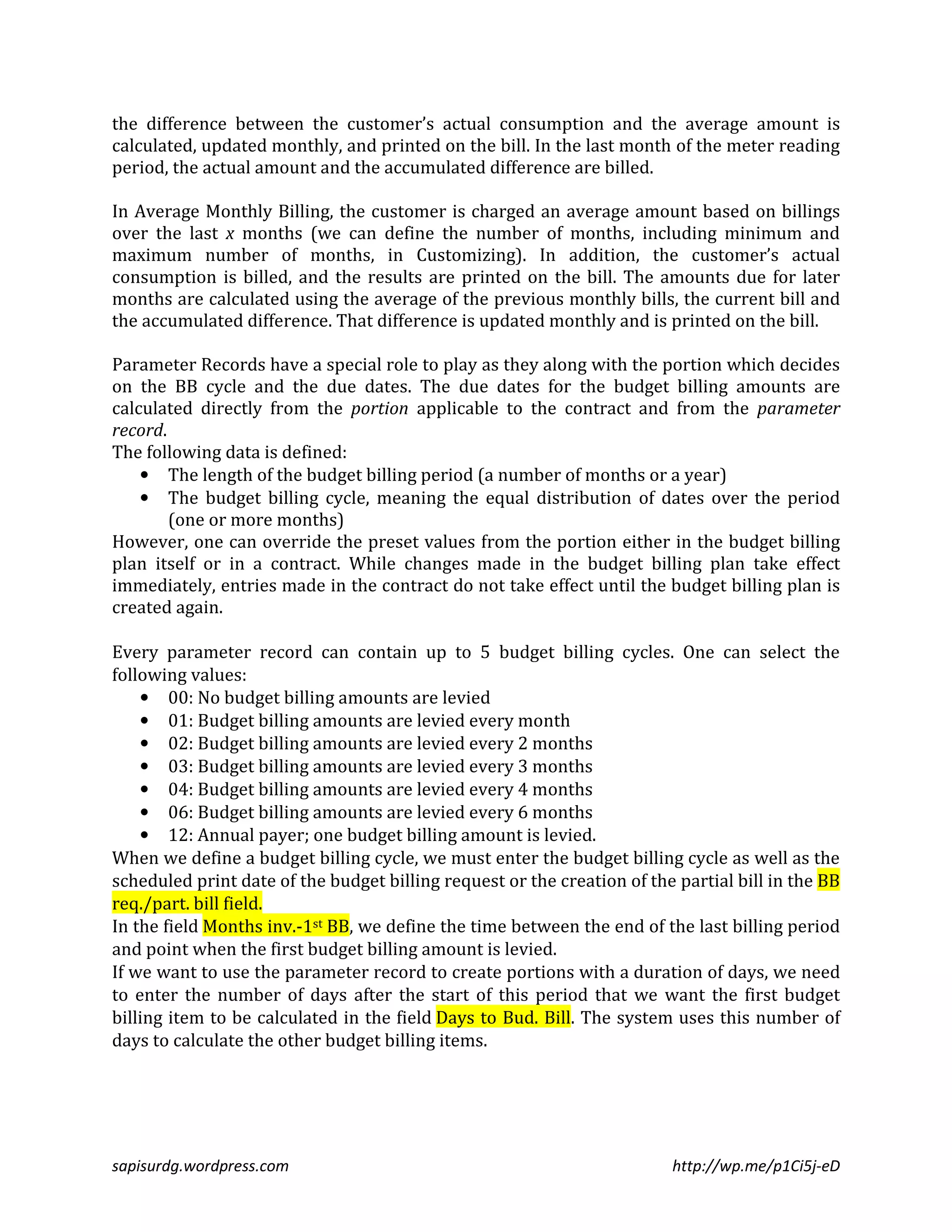

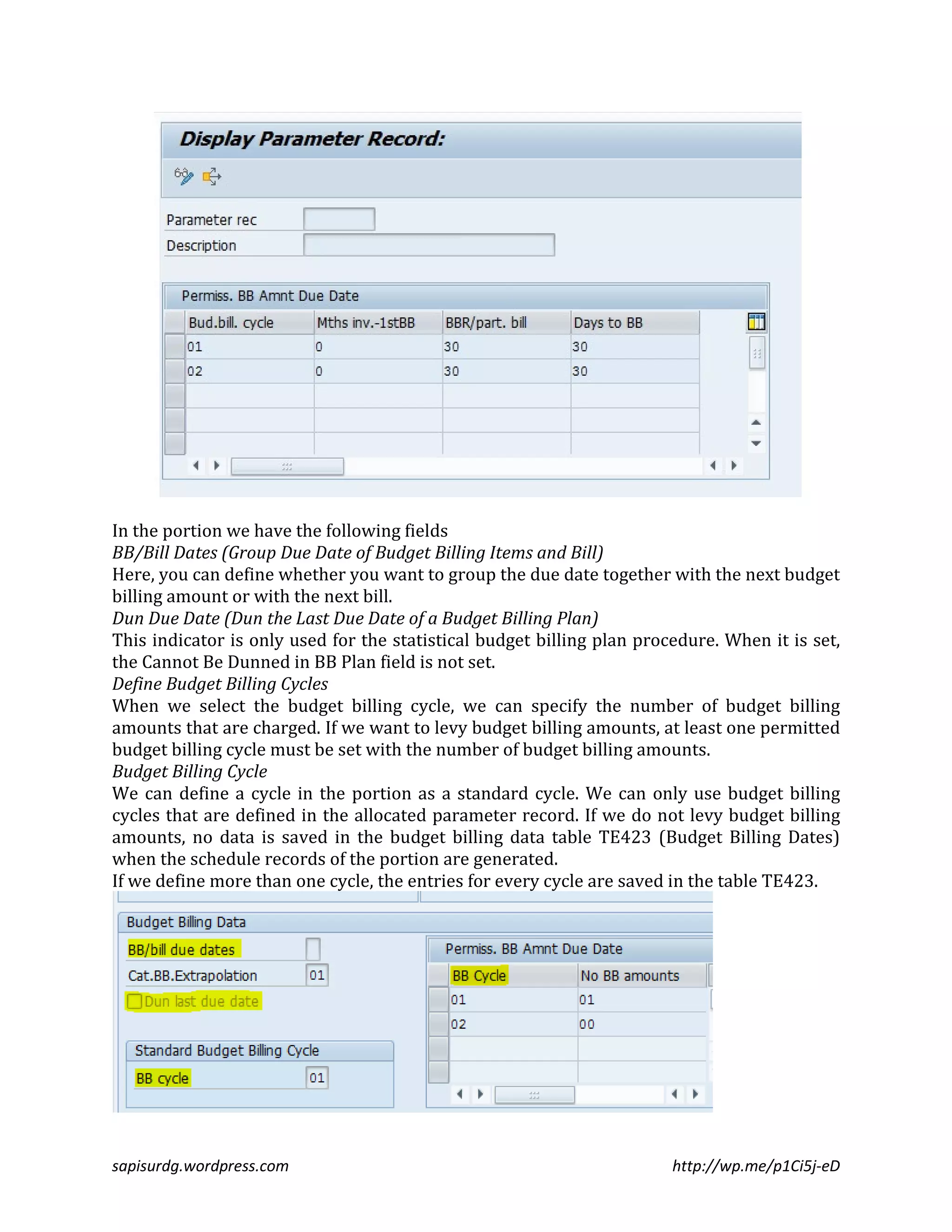

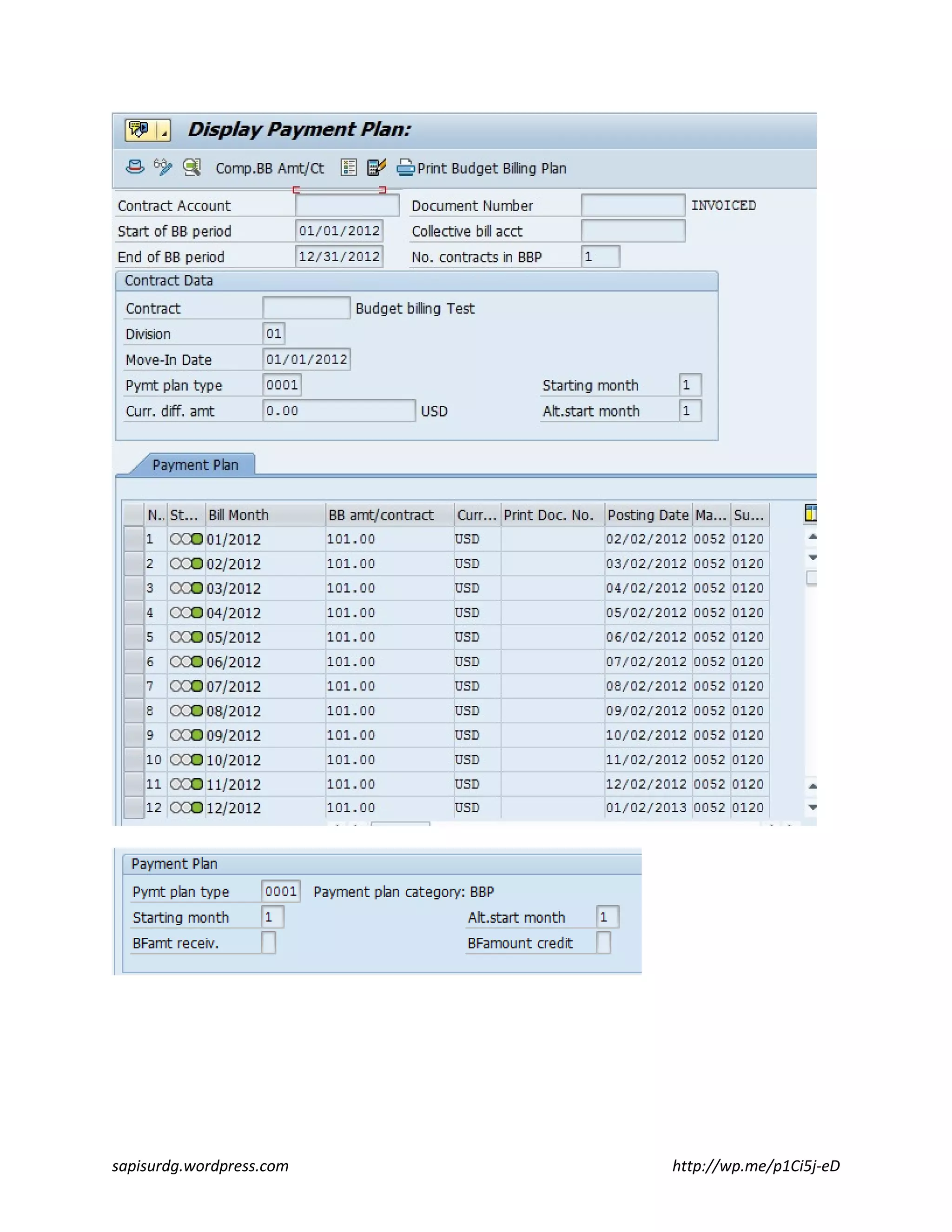

This document discusses budget billing procedures for utility companies. It describes four budget billing procedures: 1) statistical procedure, 2) debit entry (partial bills) procedure, 3) payment plan procedure, and 4) payment scheme procedure. It provides details on how budget billing amounts are calculated and distributed over monthly periods to maintain steady cash flow for the utility company and steady monthly payments for customers.