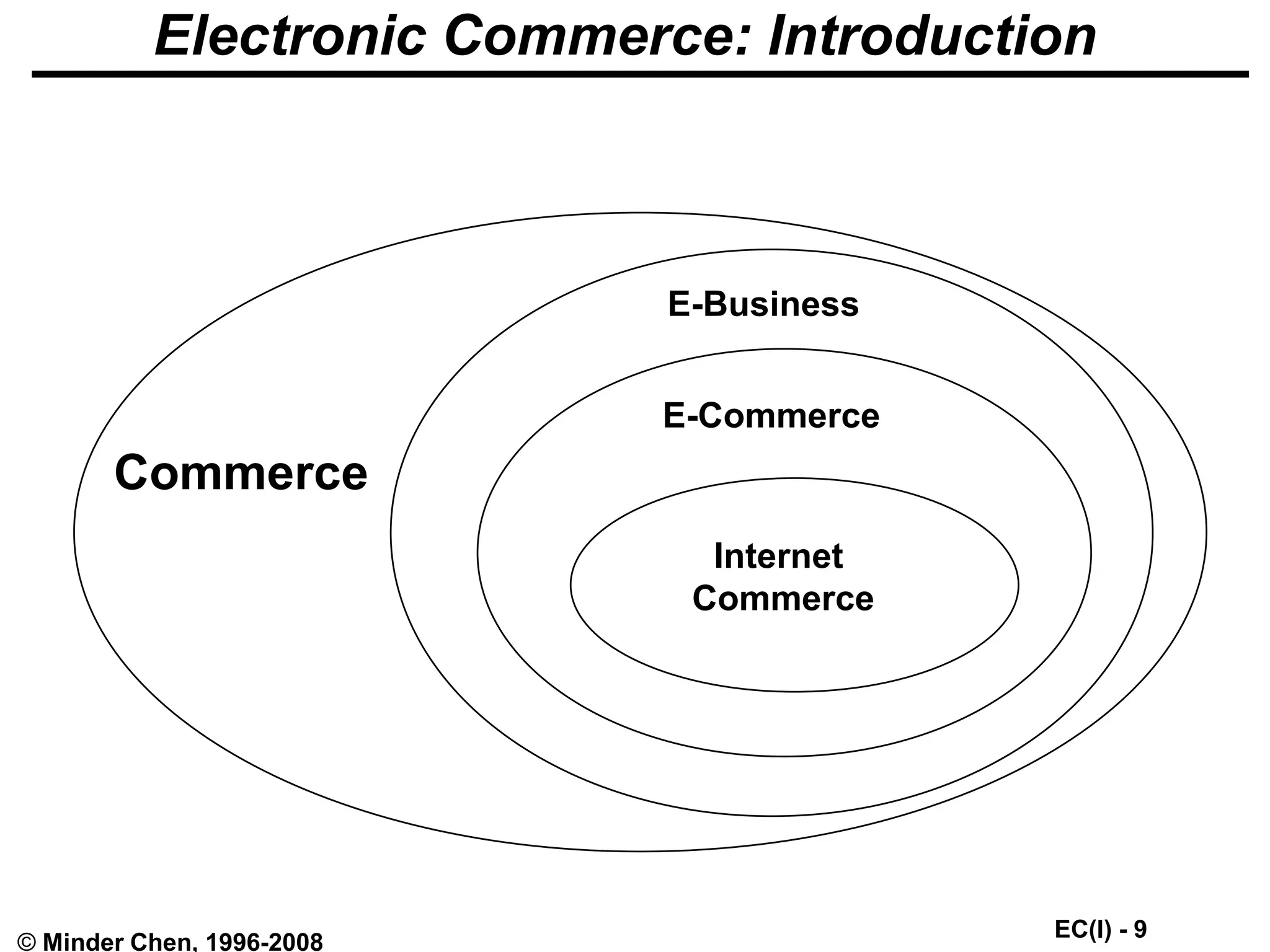

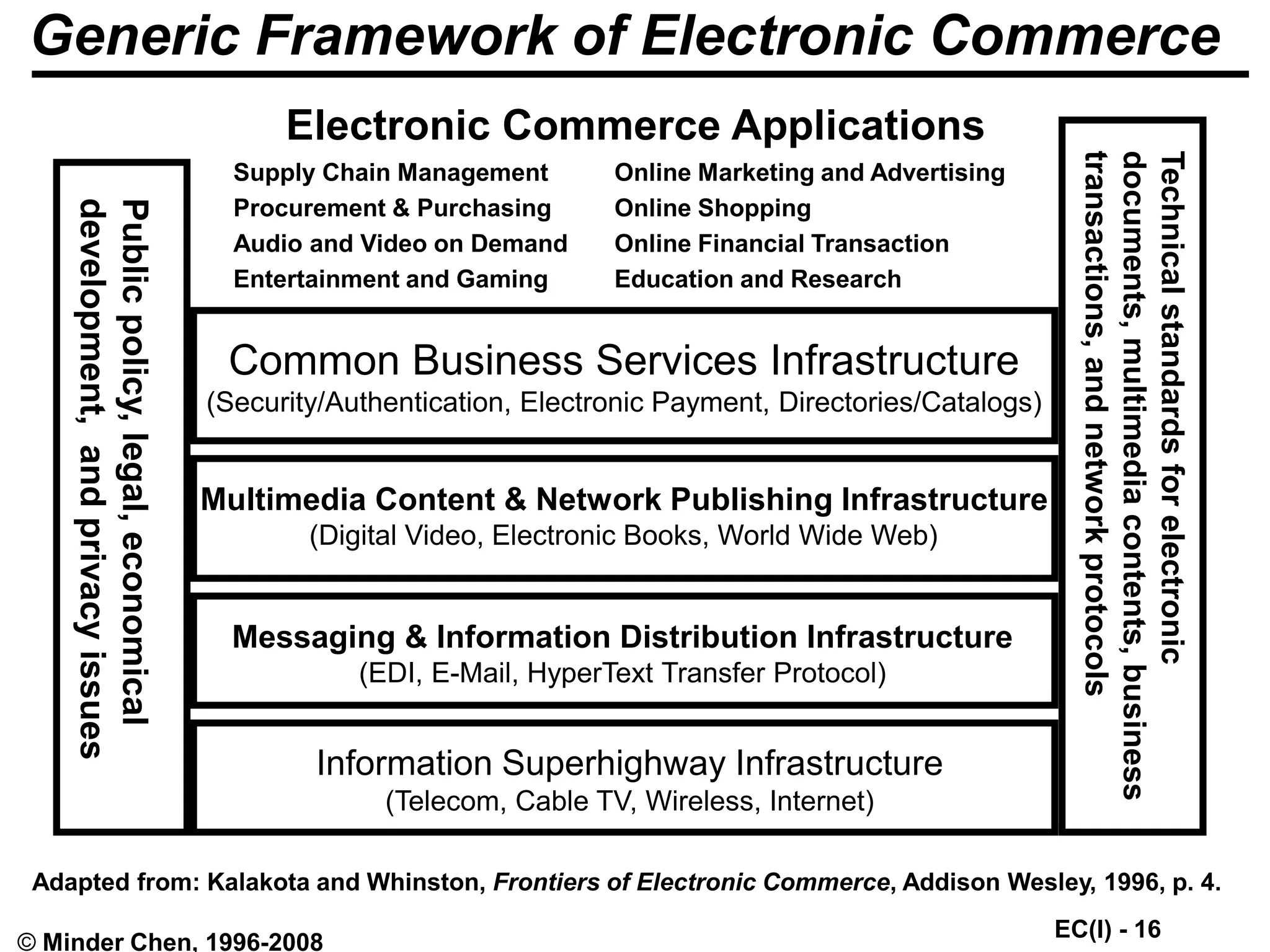

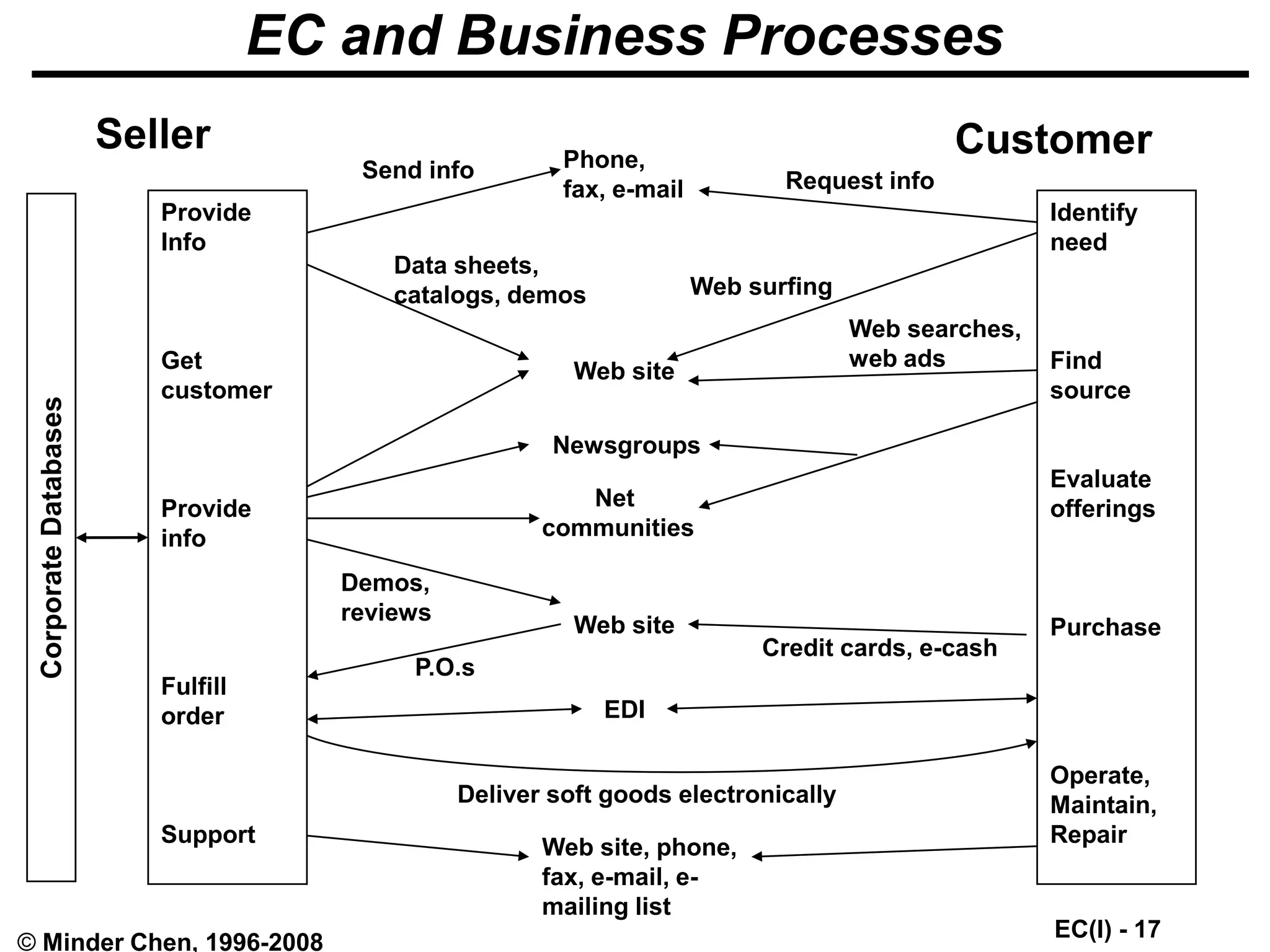

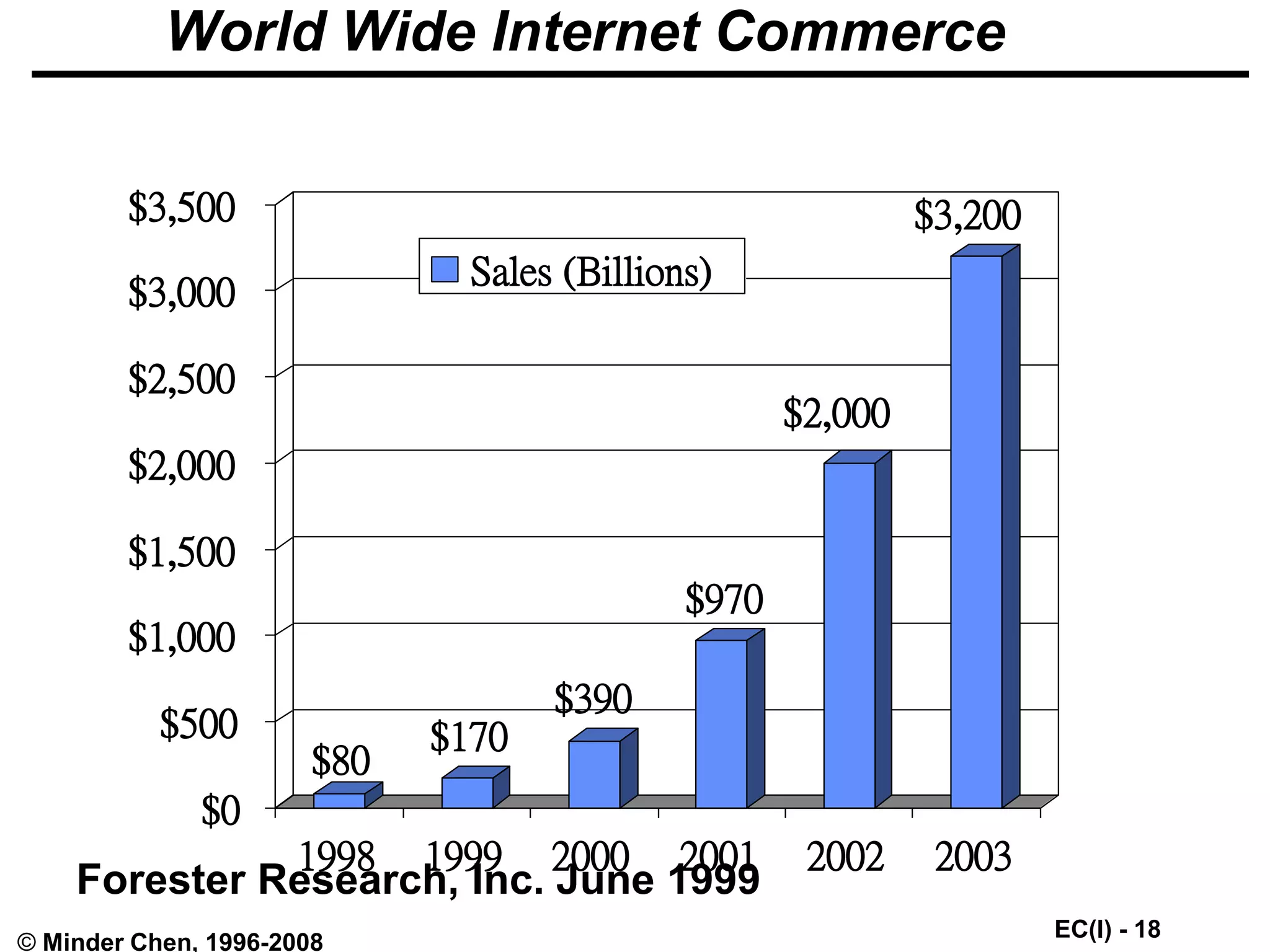

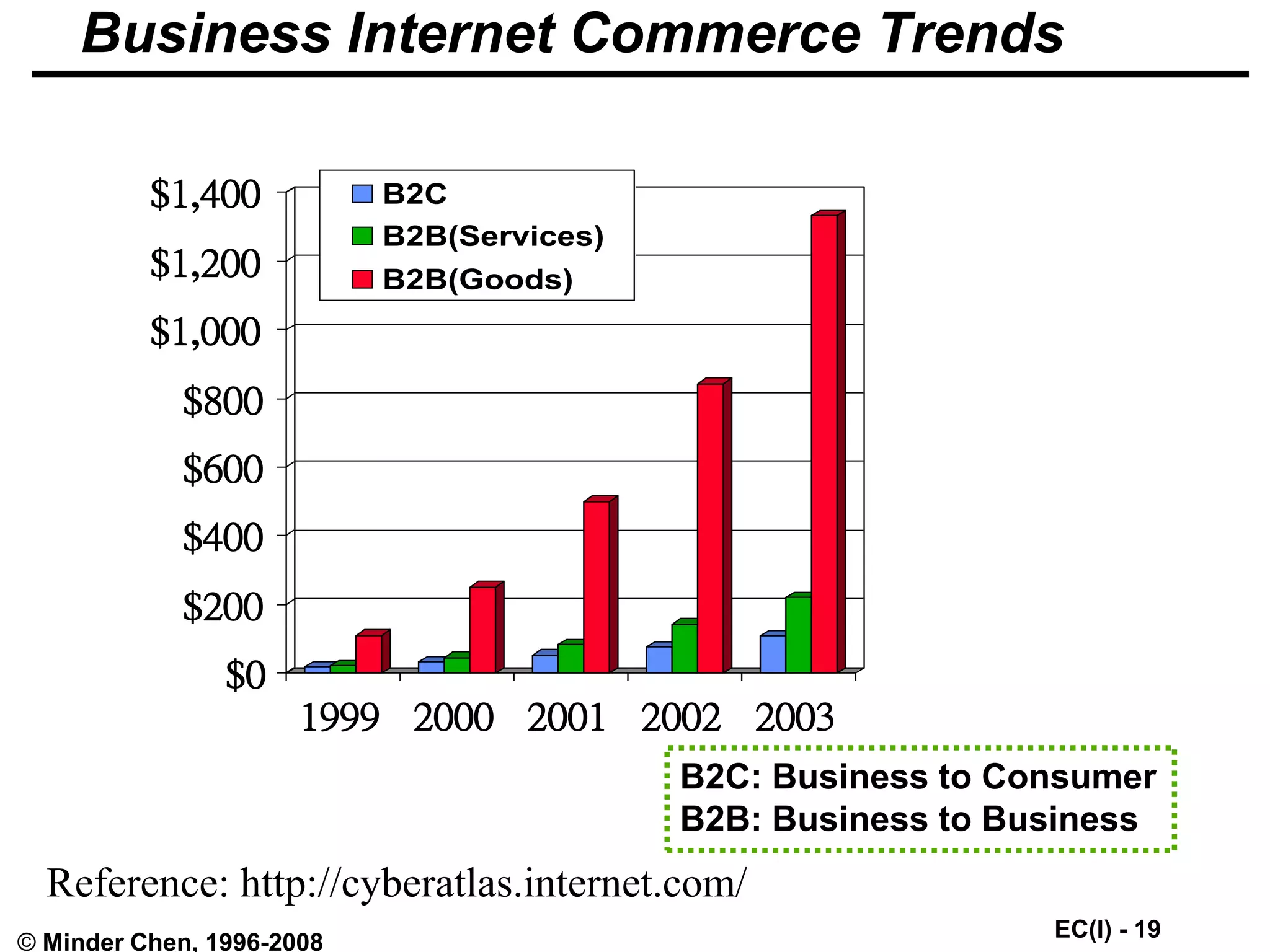

This document provides an overview of electronic commerce and discusses key concepts. It begins with an introduction to electronic commerce and the cycle of electronic commerce transactions. It then discusses how electronic commerce relates to and transforms traditional business processes. The document also provides statistics on the growth of electronic commerce and business-to-business electronic commerce revenues. Finally, it introduces the concepts of the network economy and how information and network effects are changing market dynamics.

![EC(I) - 13

© Minder Chen, 1996-2008

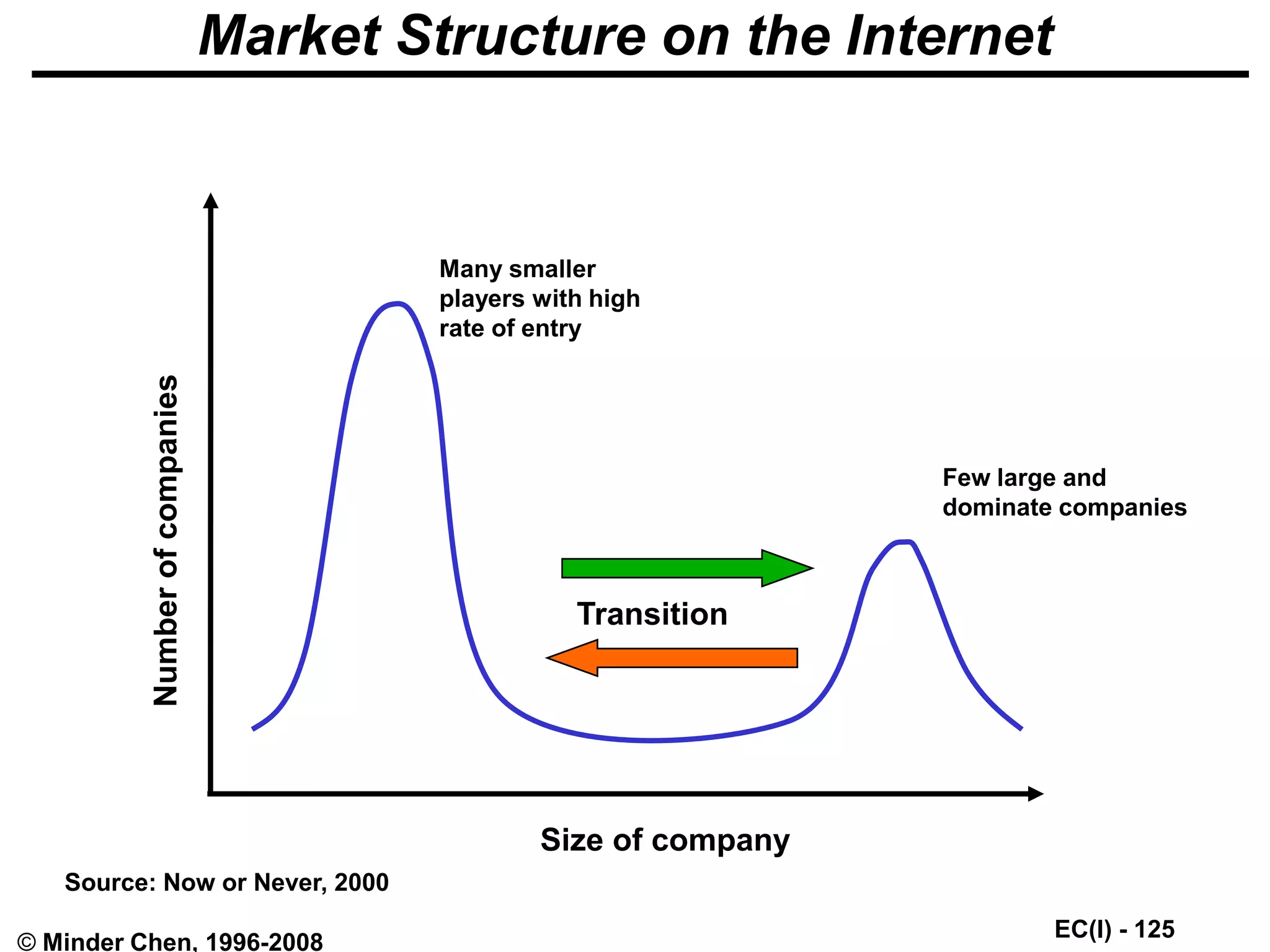

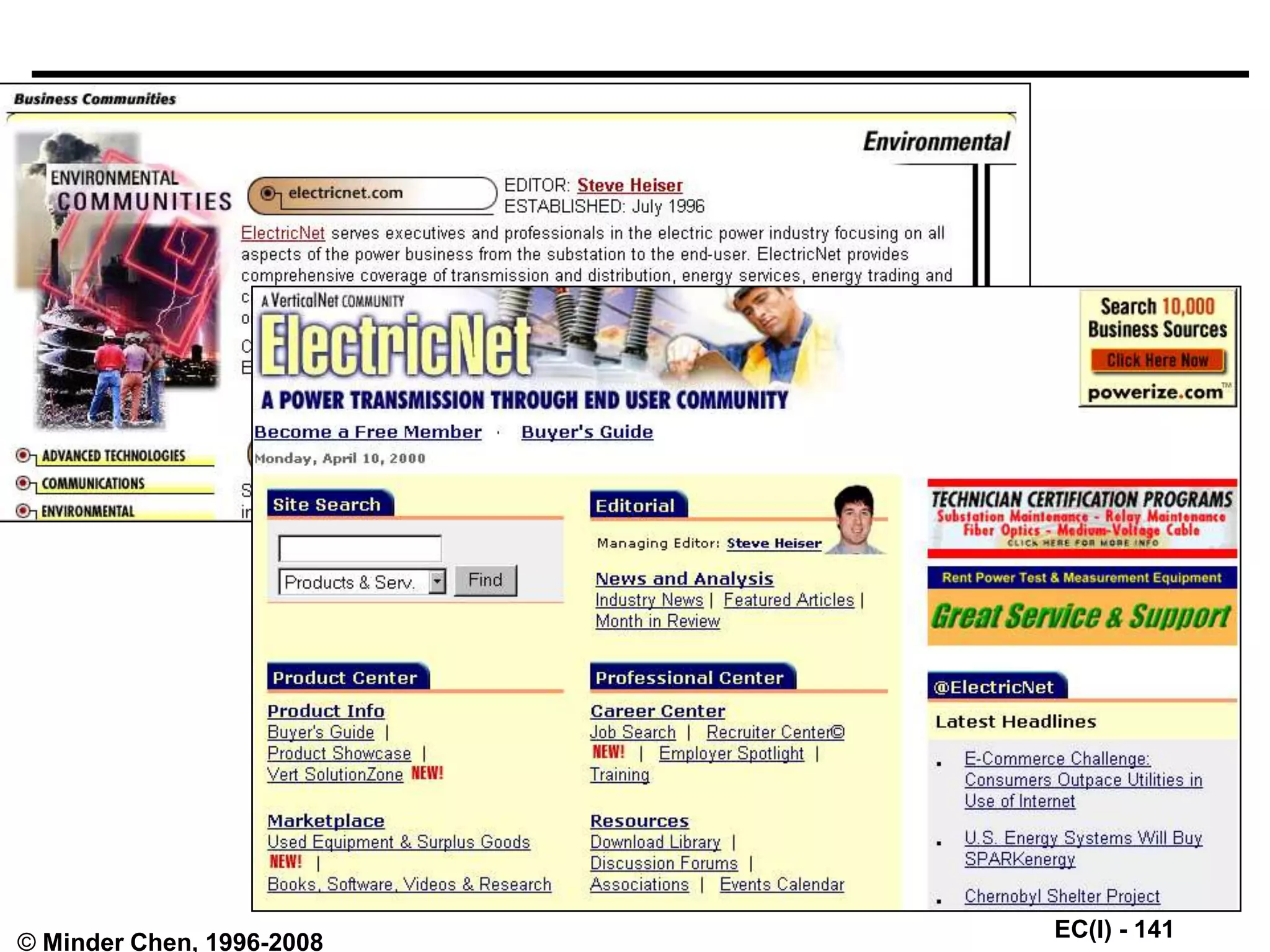

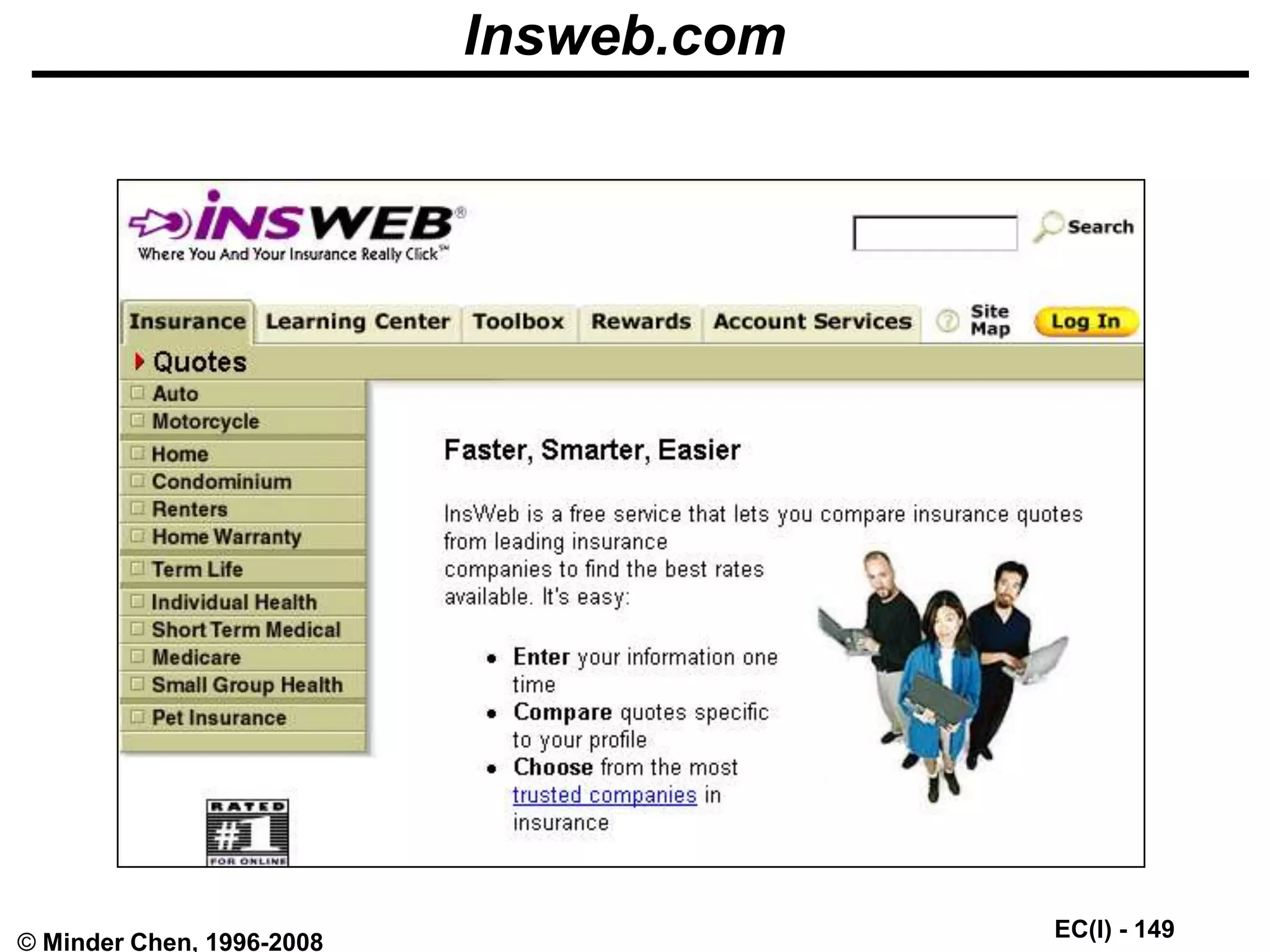

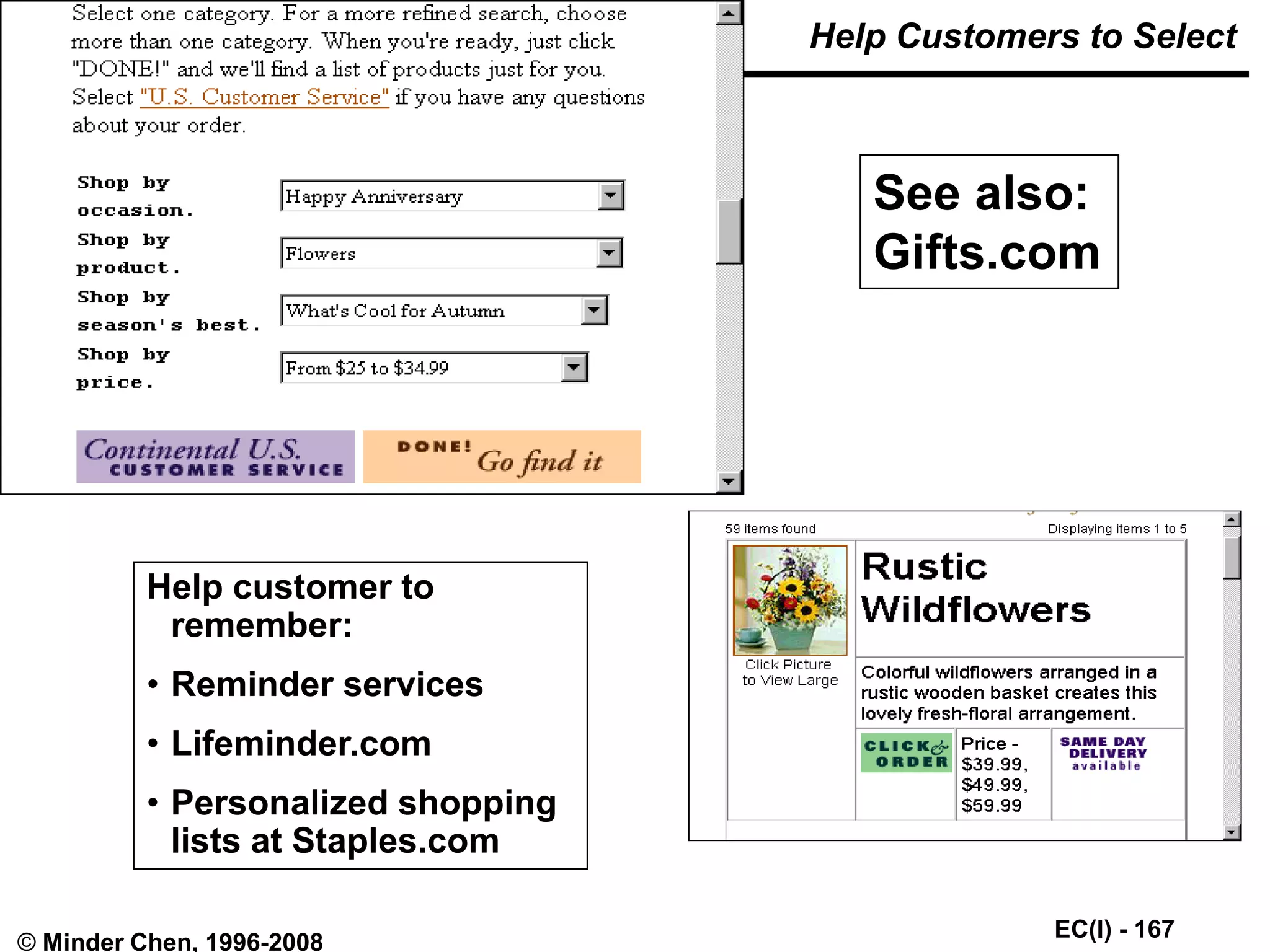

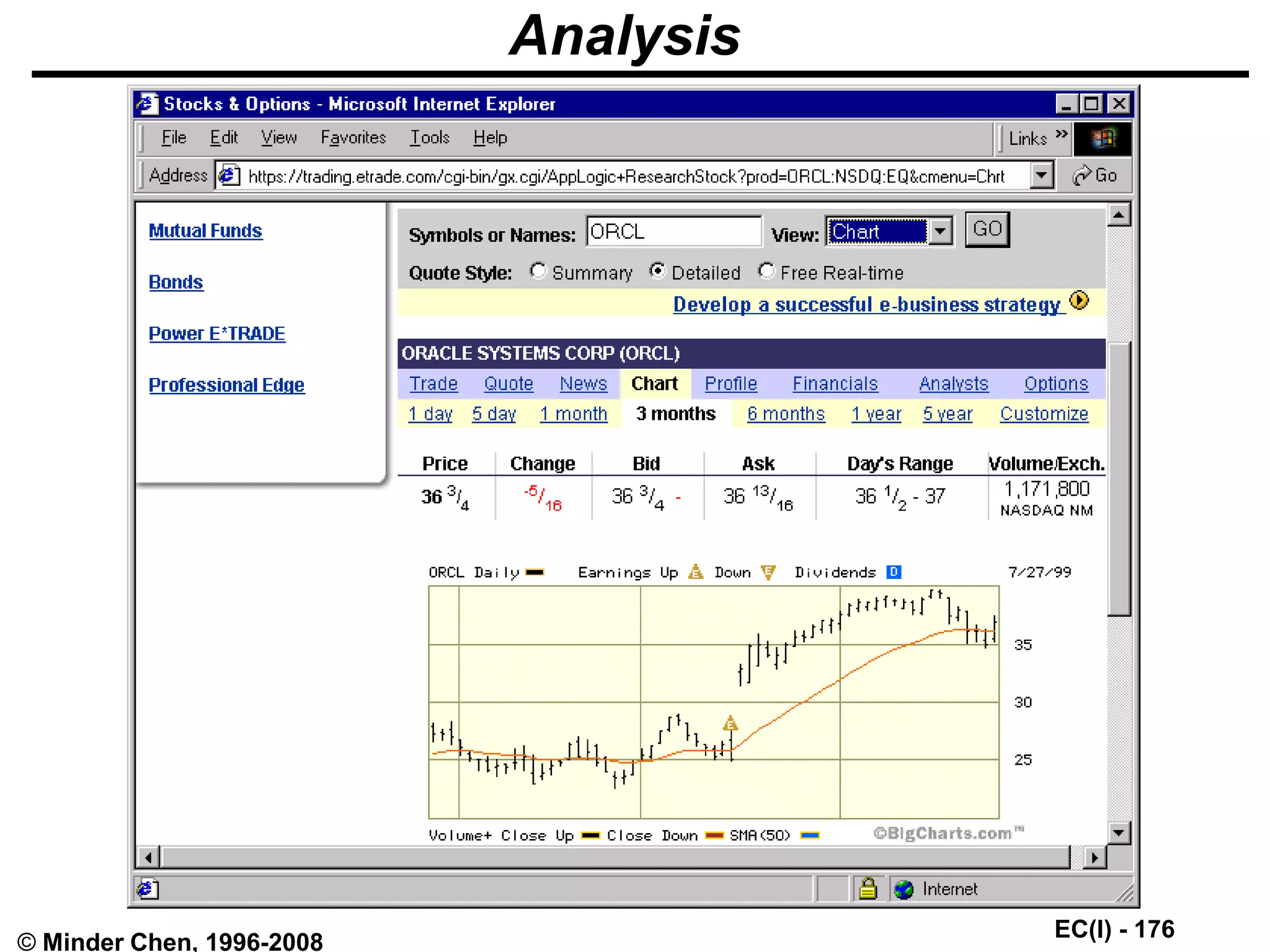

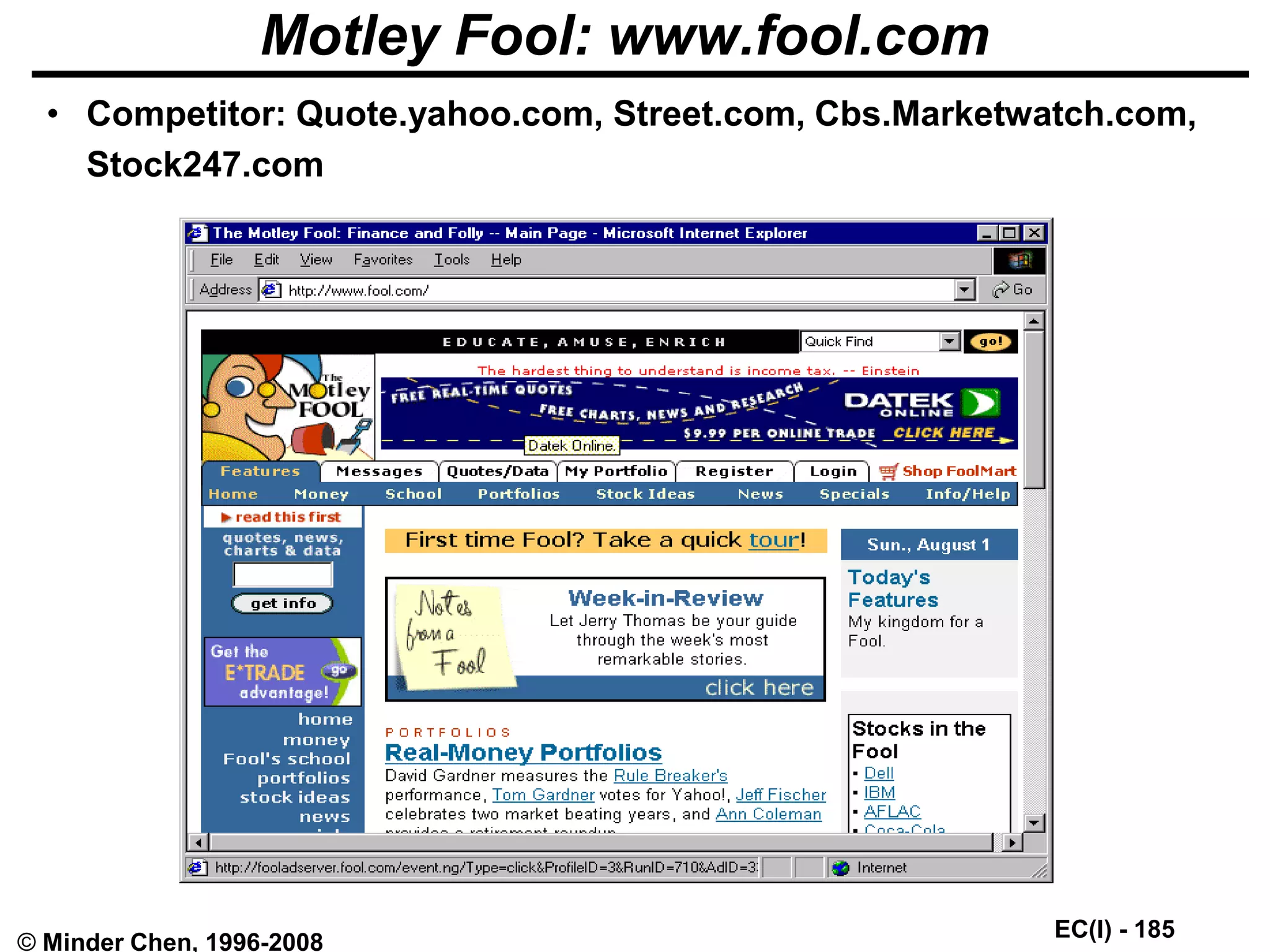

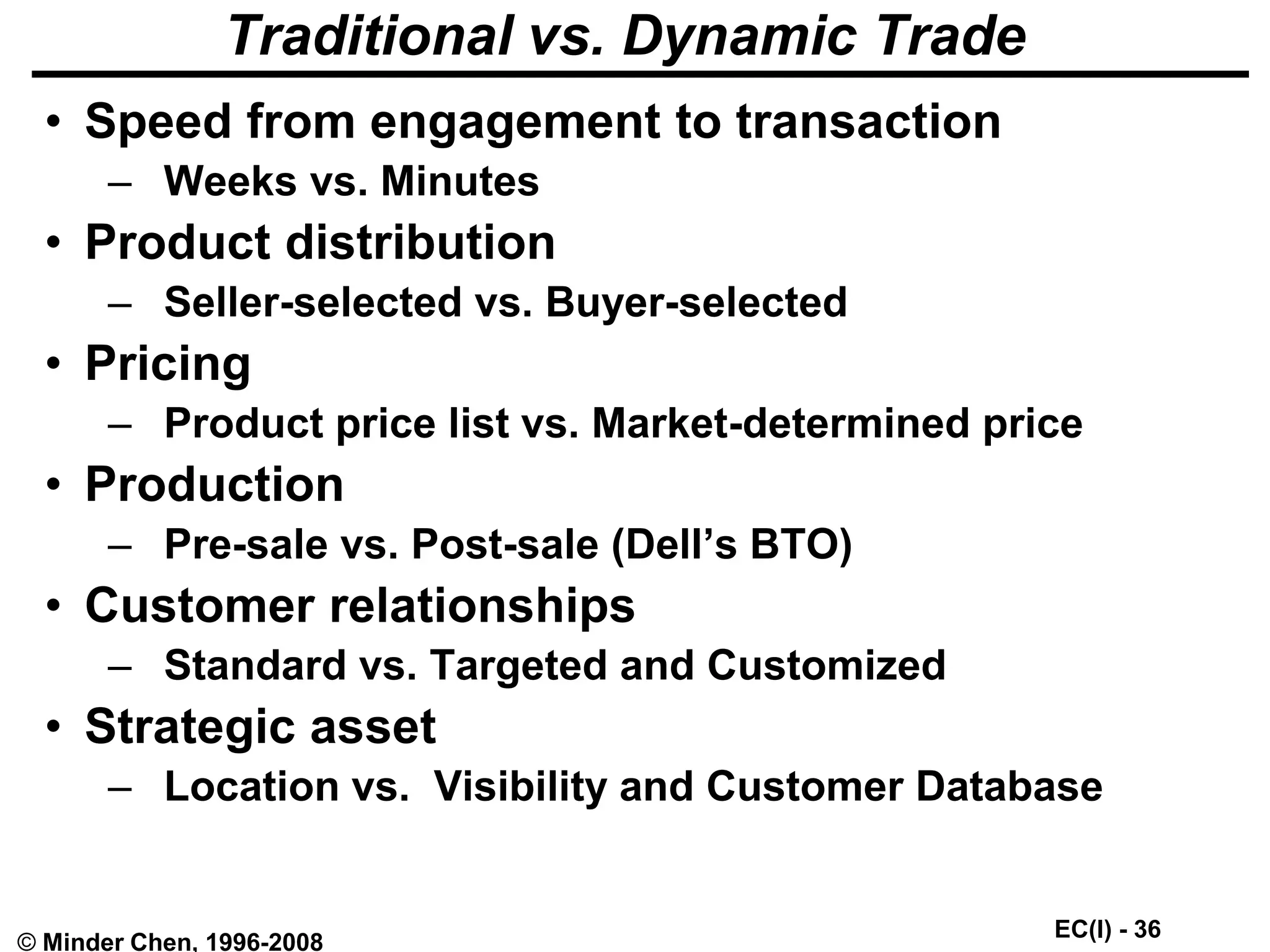

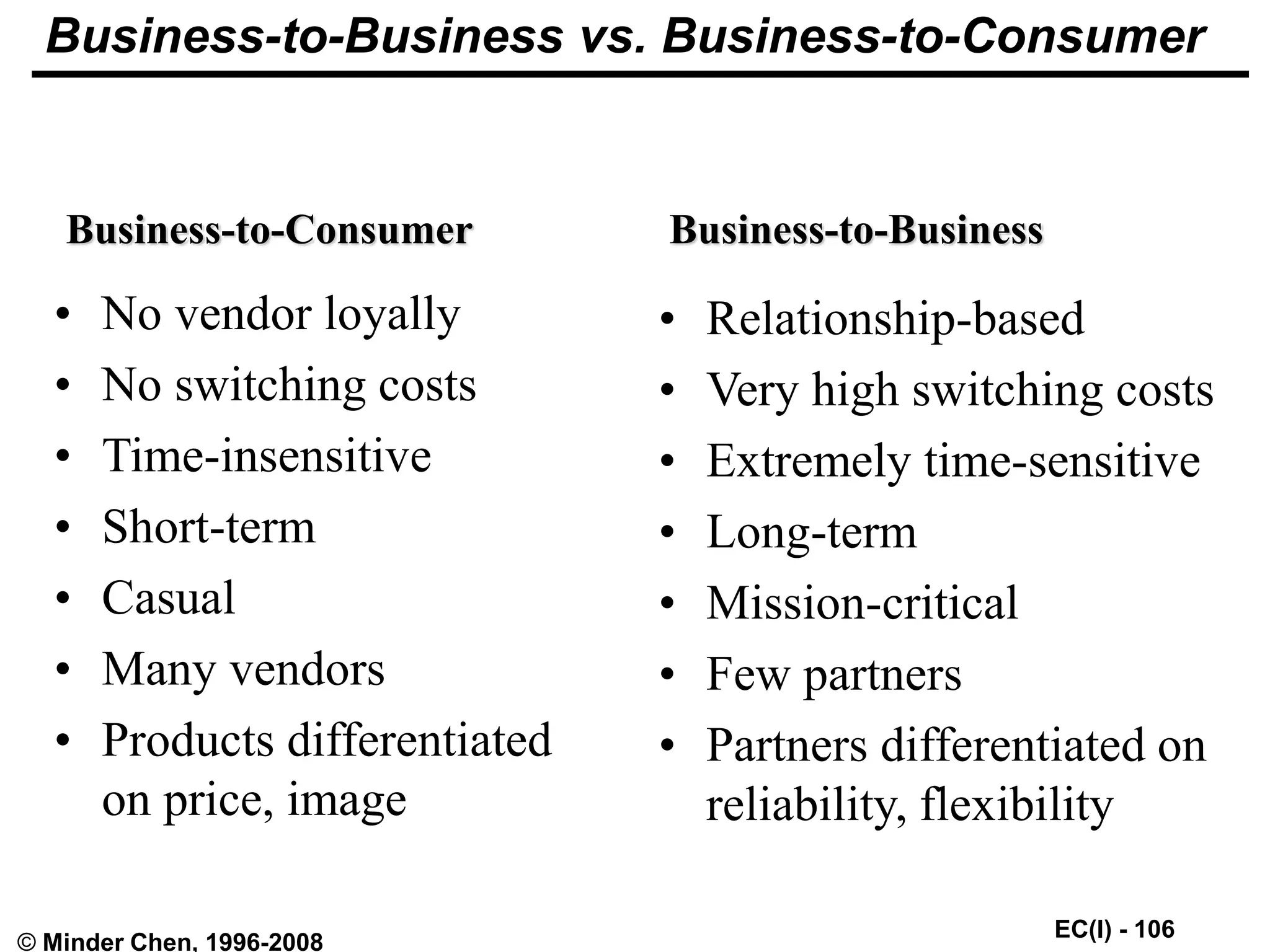

The Low-Friction Market

"[The Internet] will carry us into a

new world of low friction, low-

overhead capitalism, in which market

information will be plentiful and

transaction costs low."

-- Bill Gates, The Road Ahead

"Where there is a friction,

there is opportunity!"

-- Net Ready.](https://image.slidesharecdn.com/valuechainofe-commerce-230926061447-8e47566a/75/Value-Chain-of-e-commerce-ppt-13-2048.jpg)

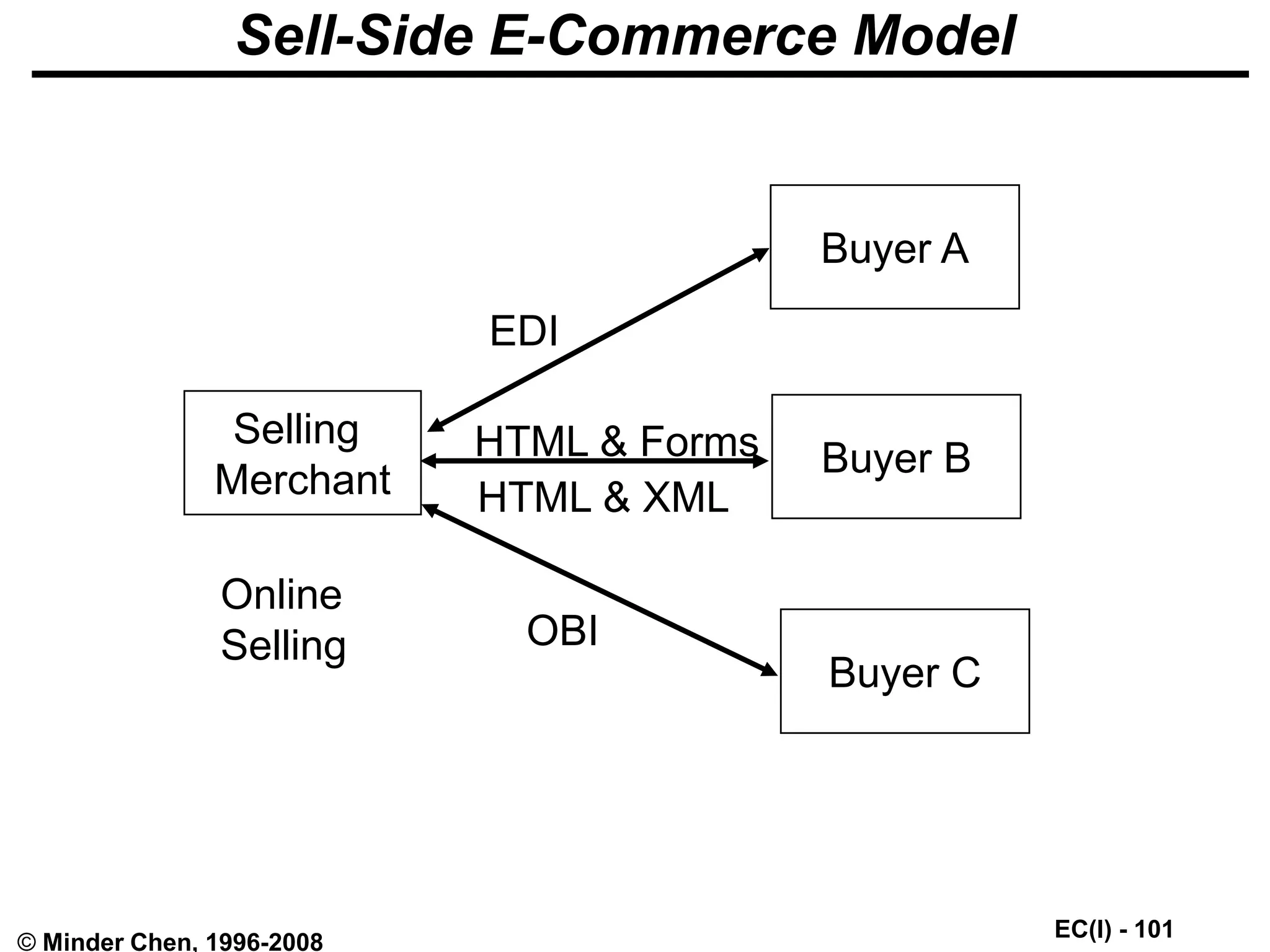

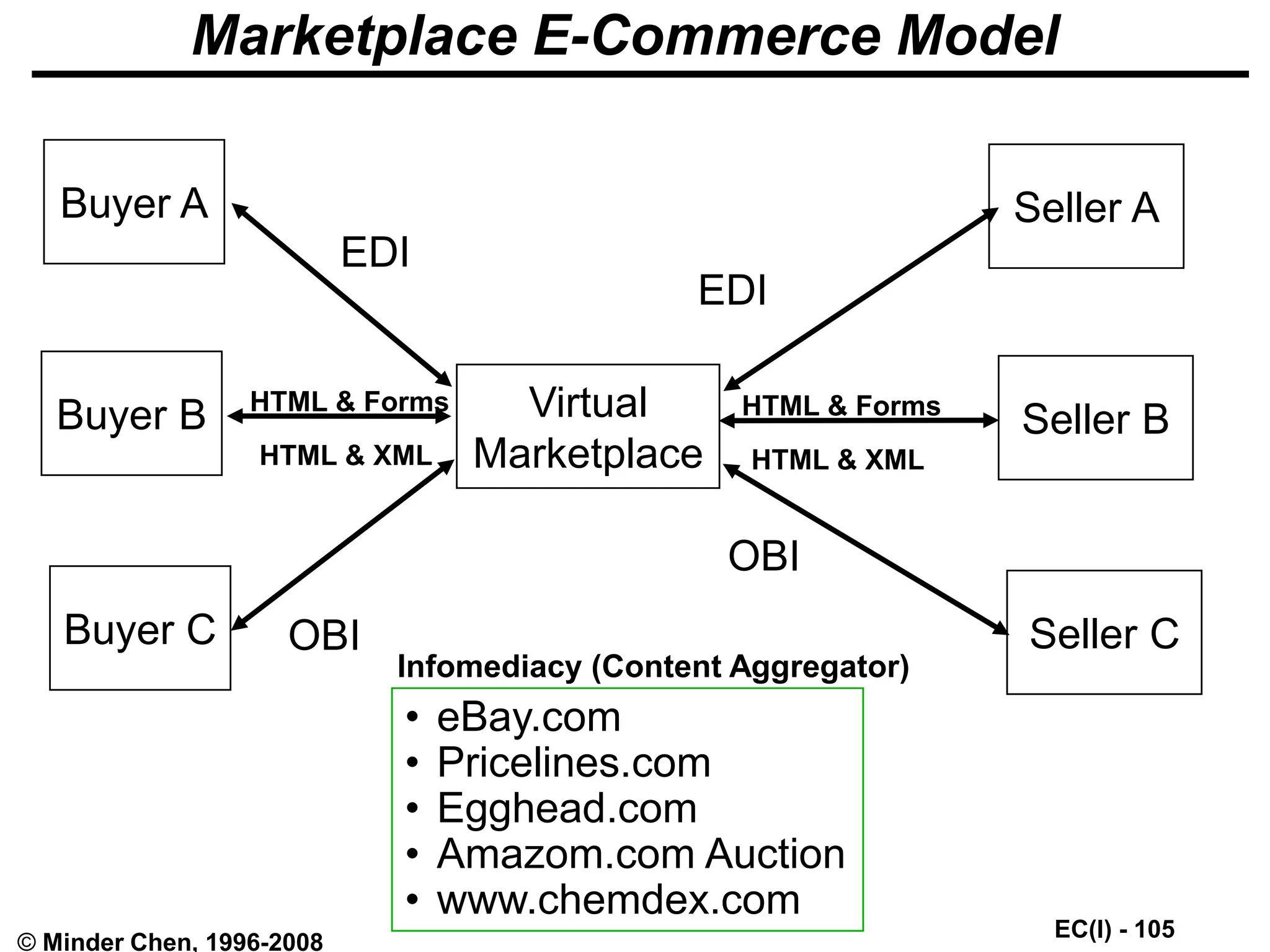

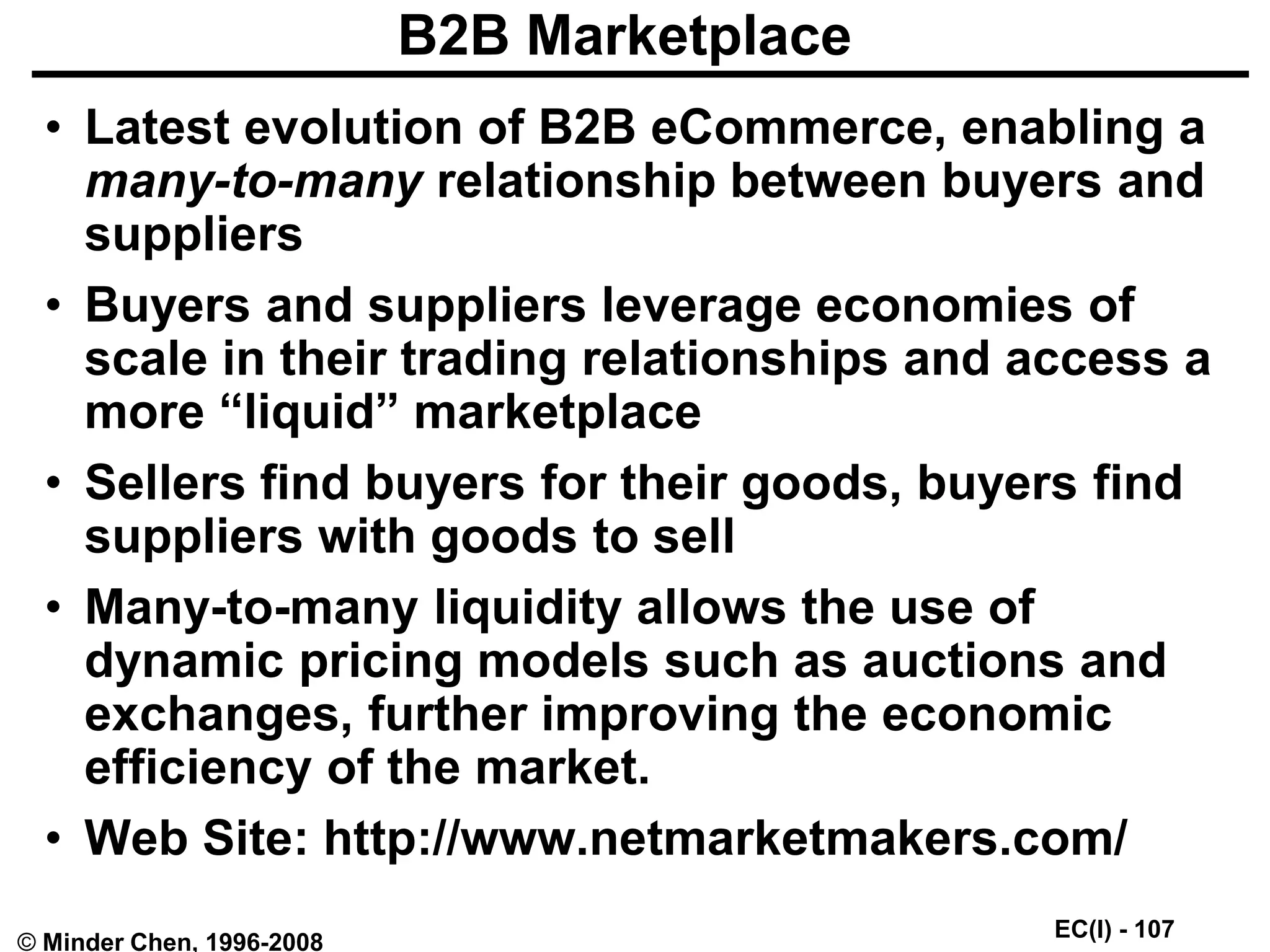

![EC(I) - 108

© Minder Chen, 1996-2008

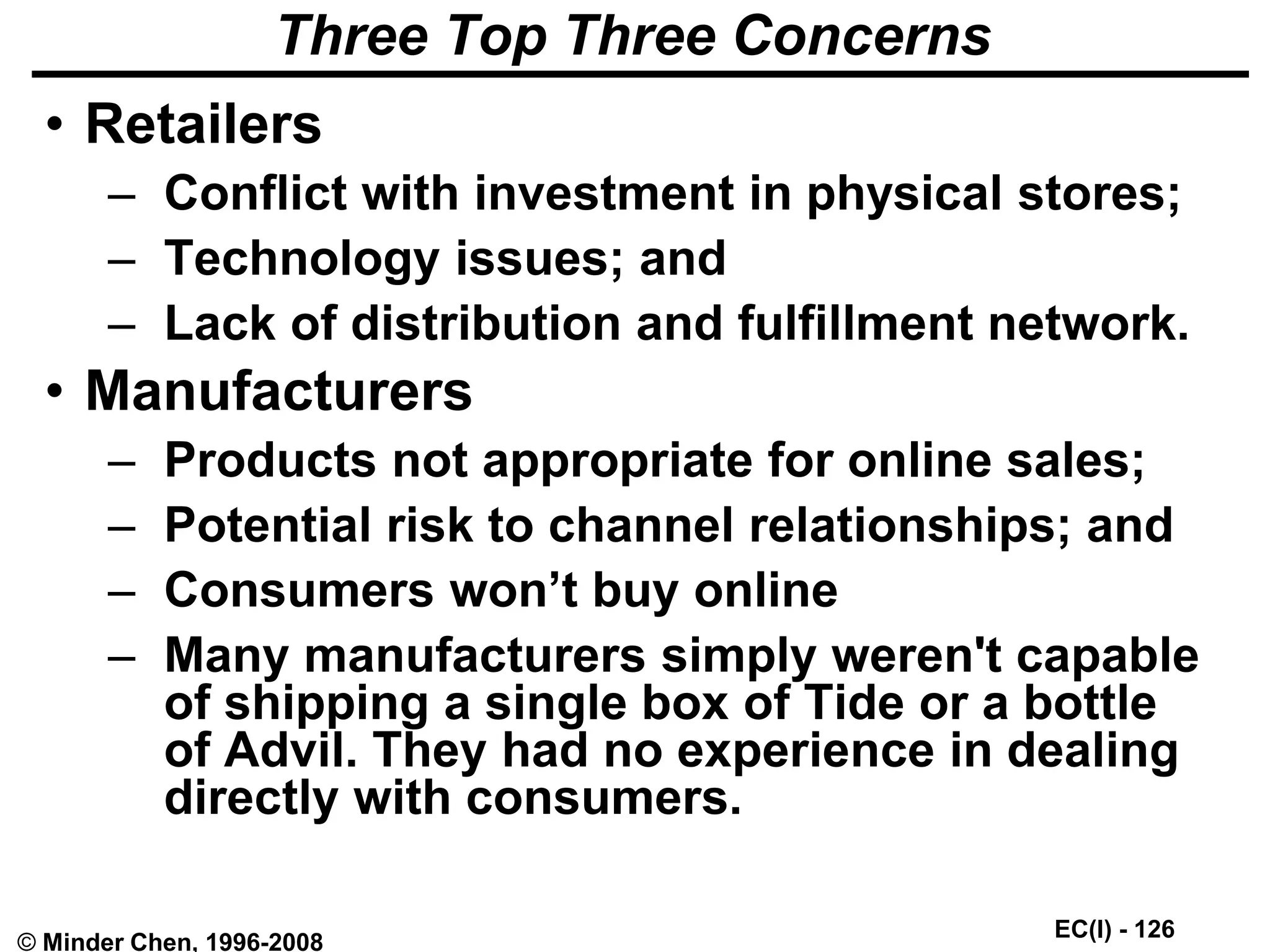

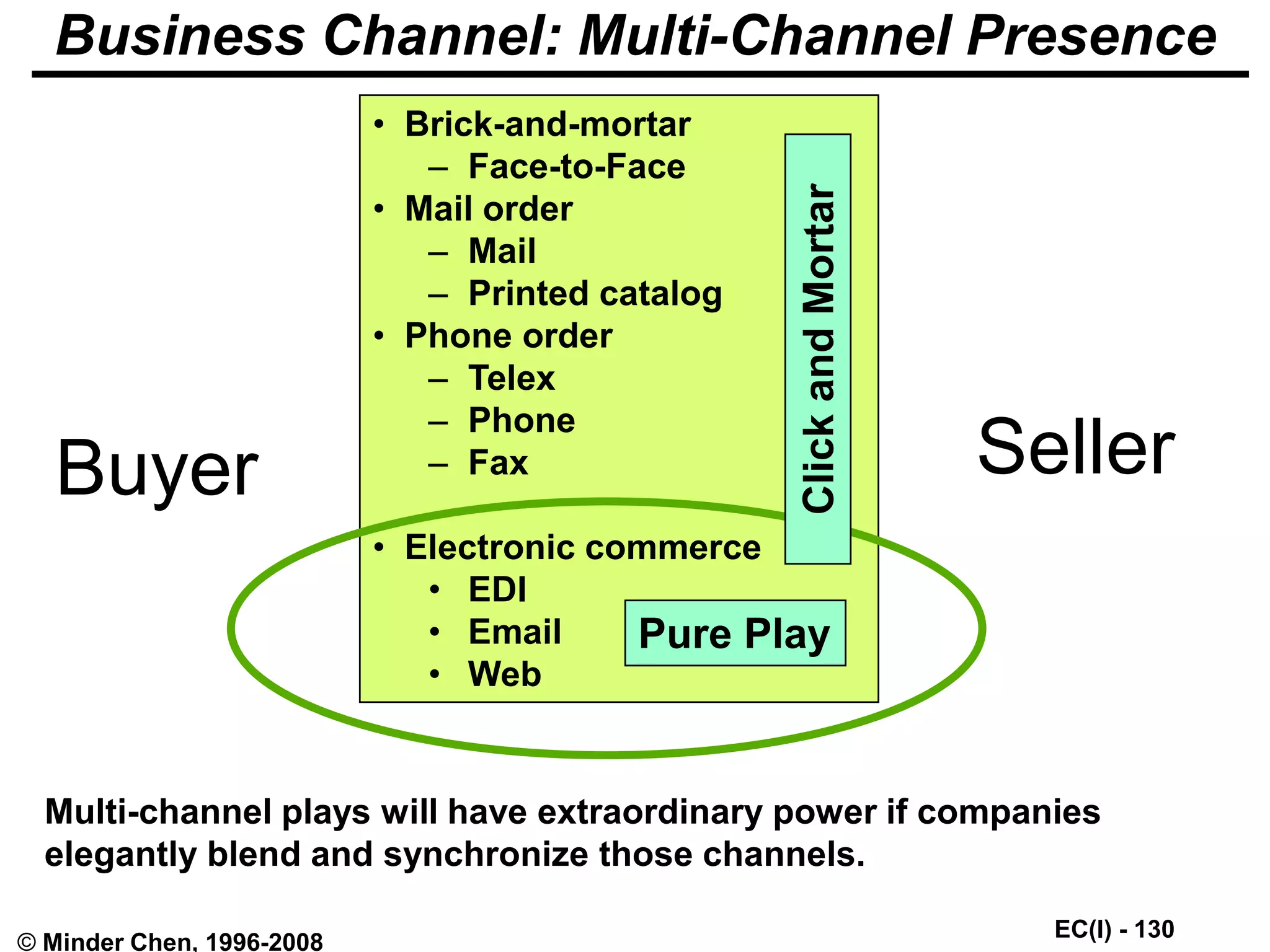

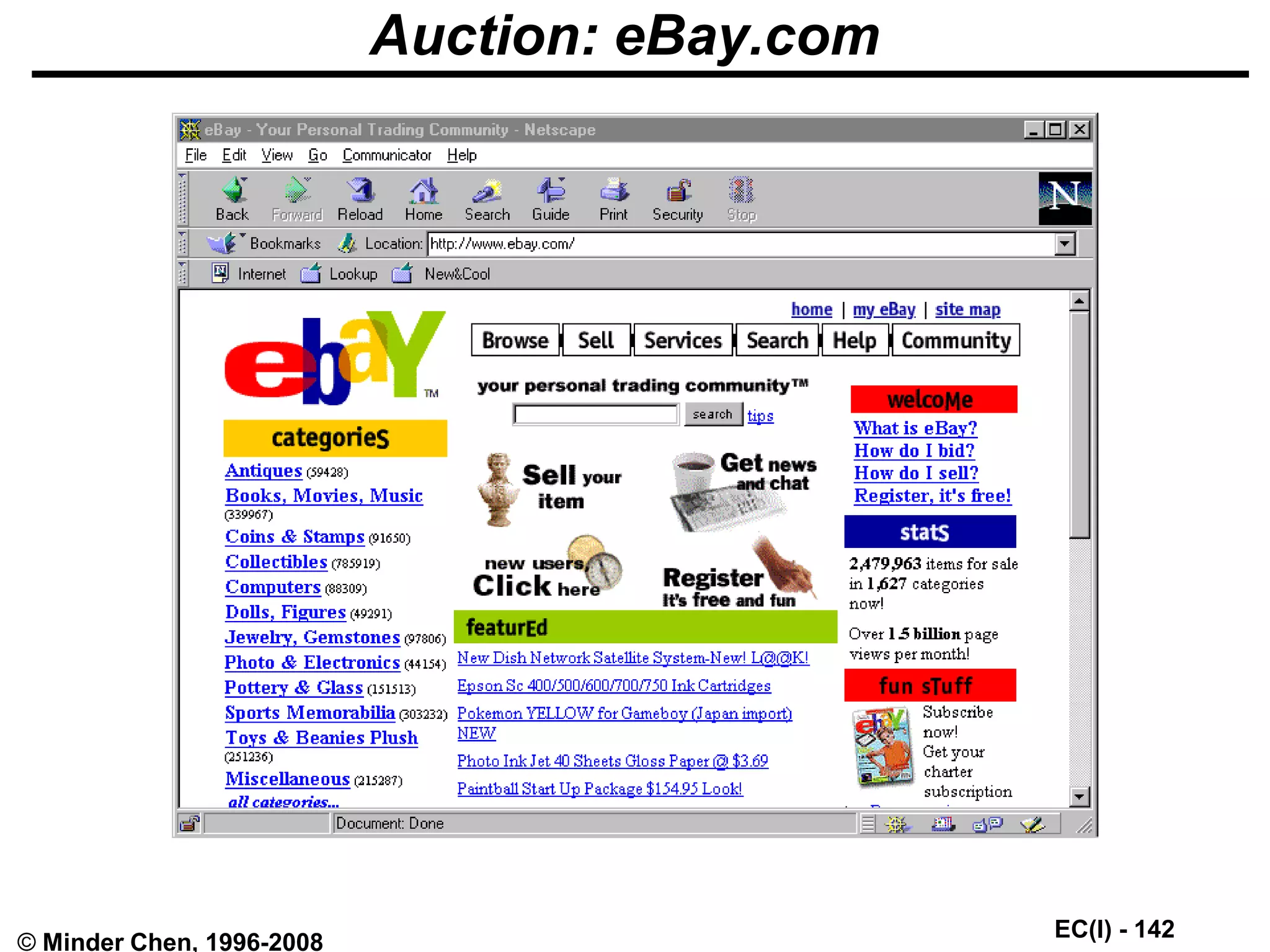

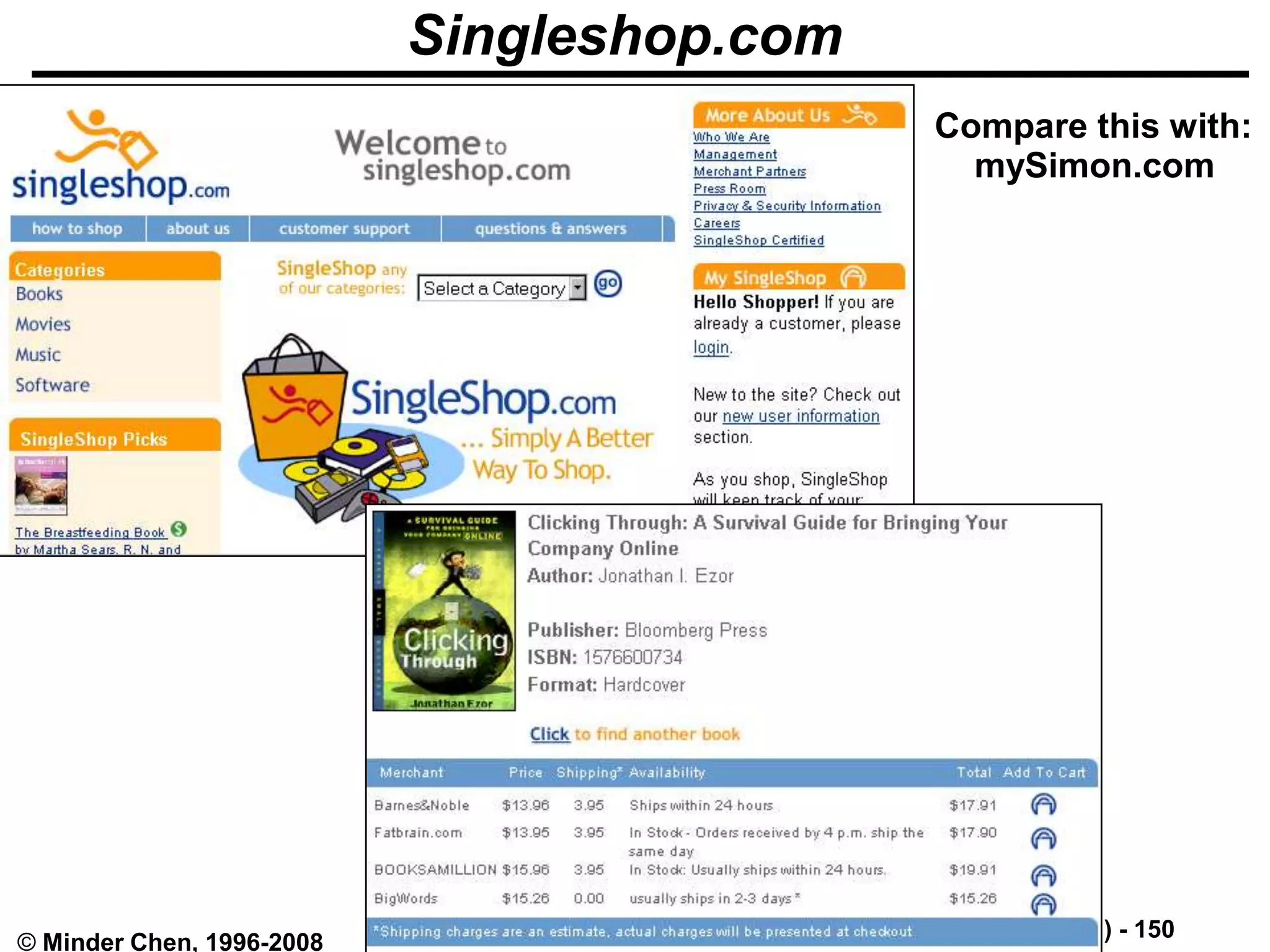

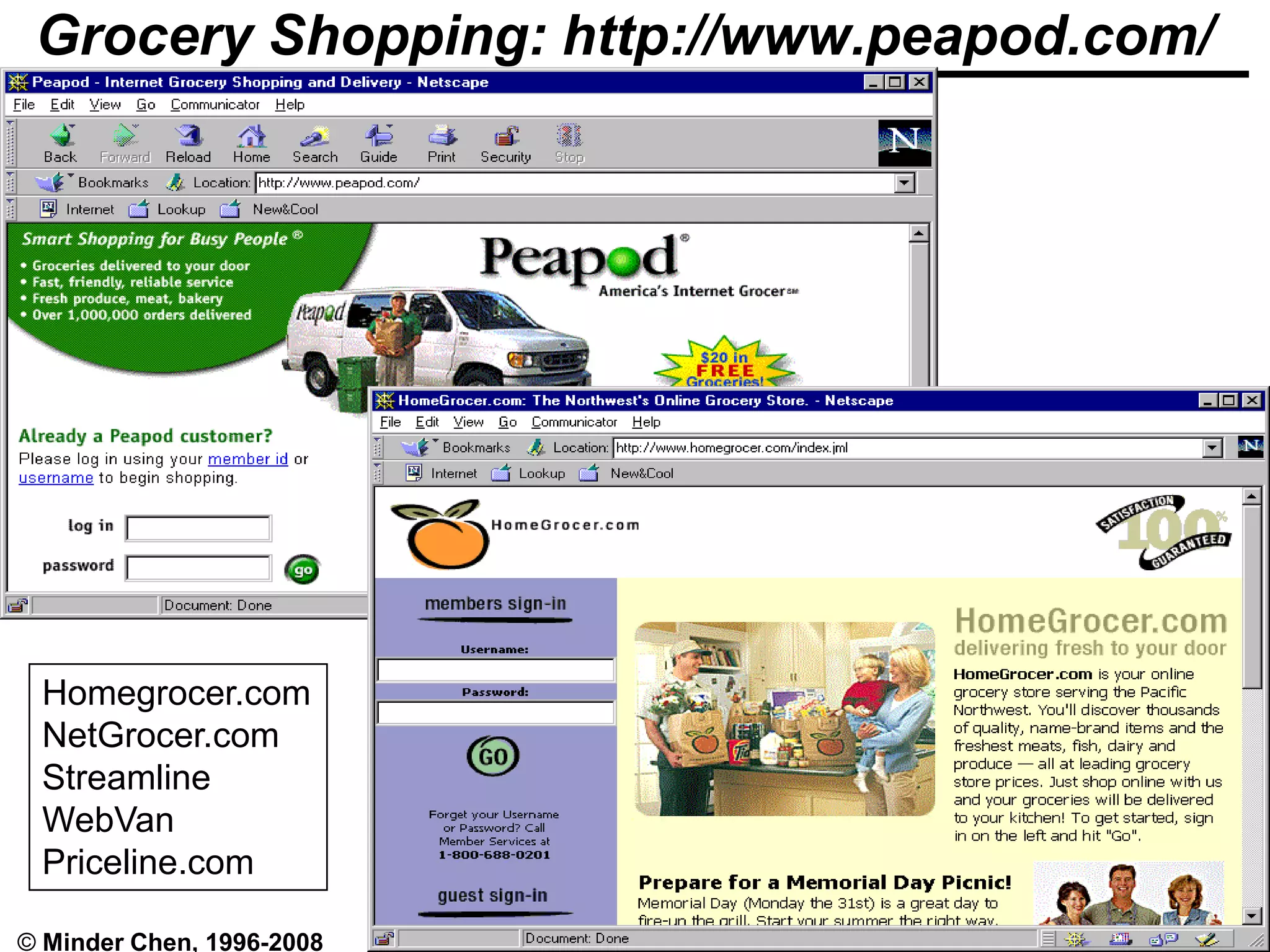

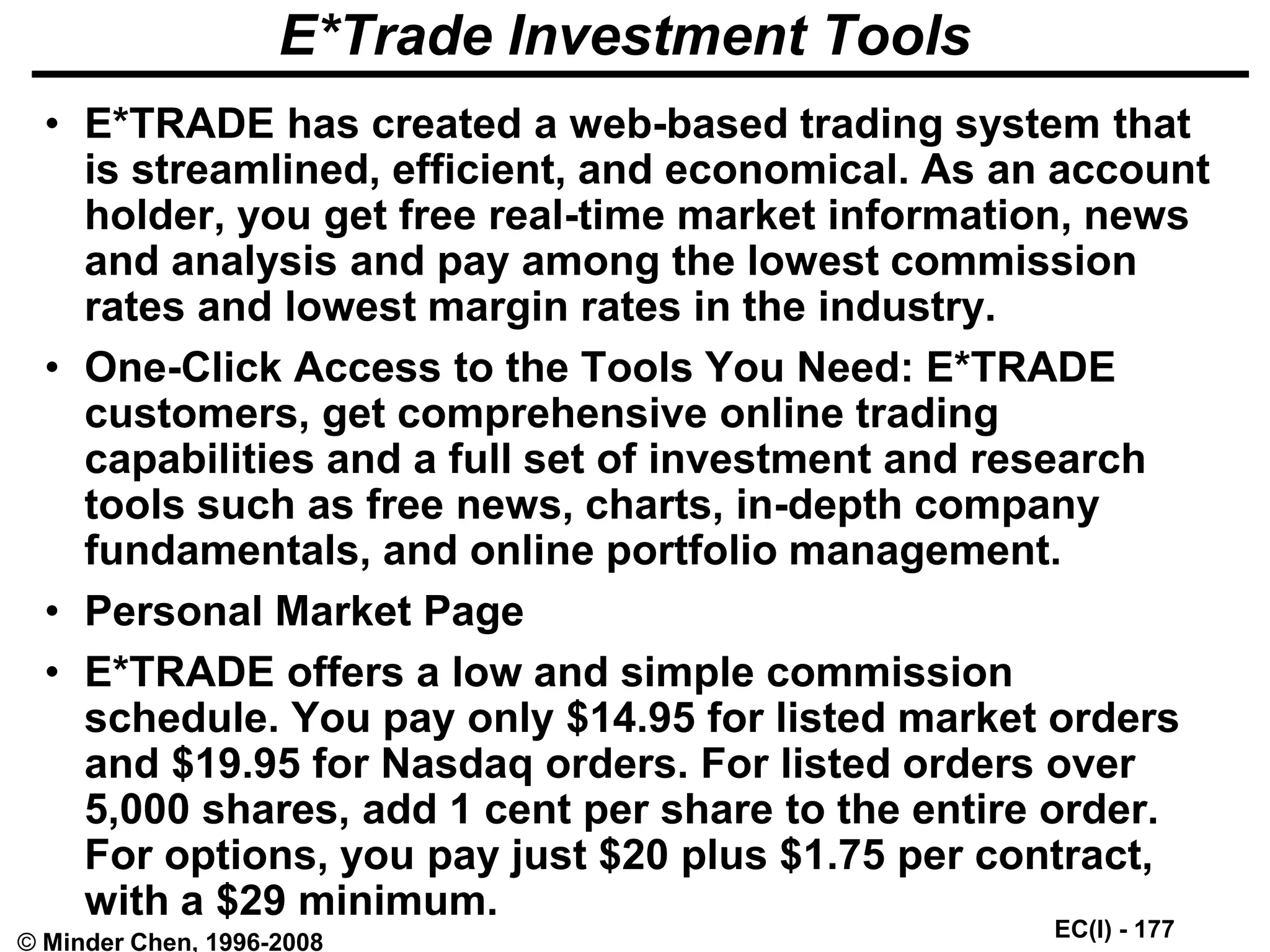

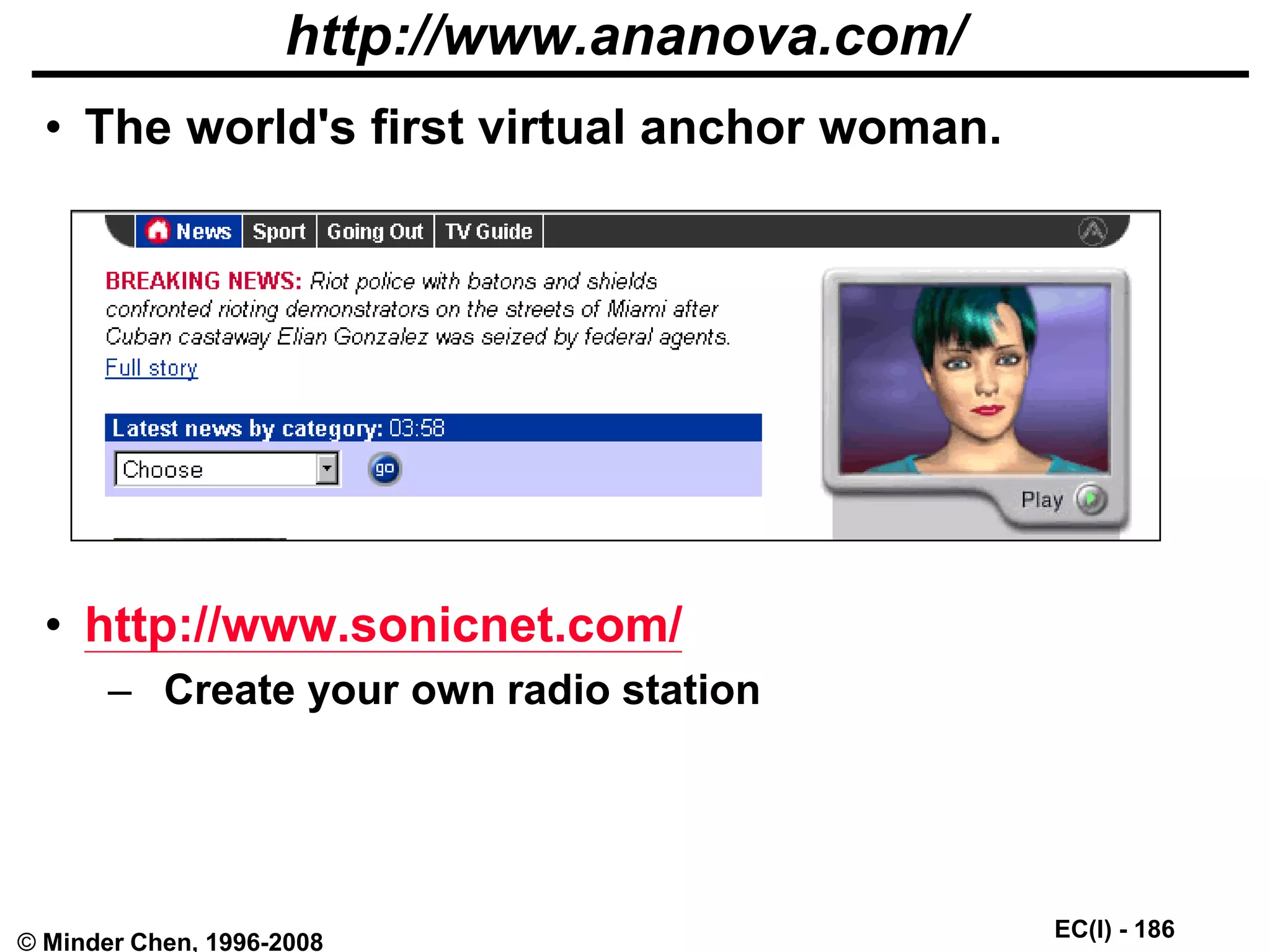

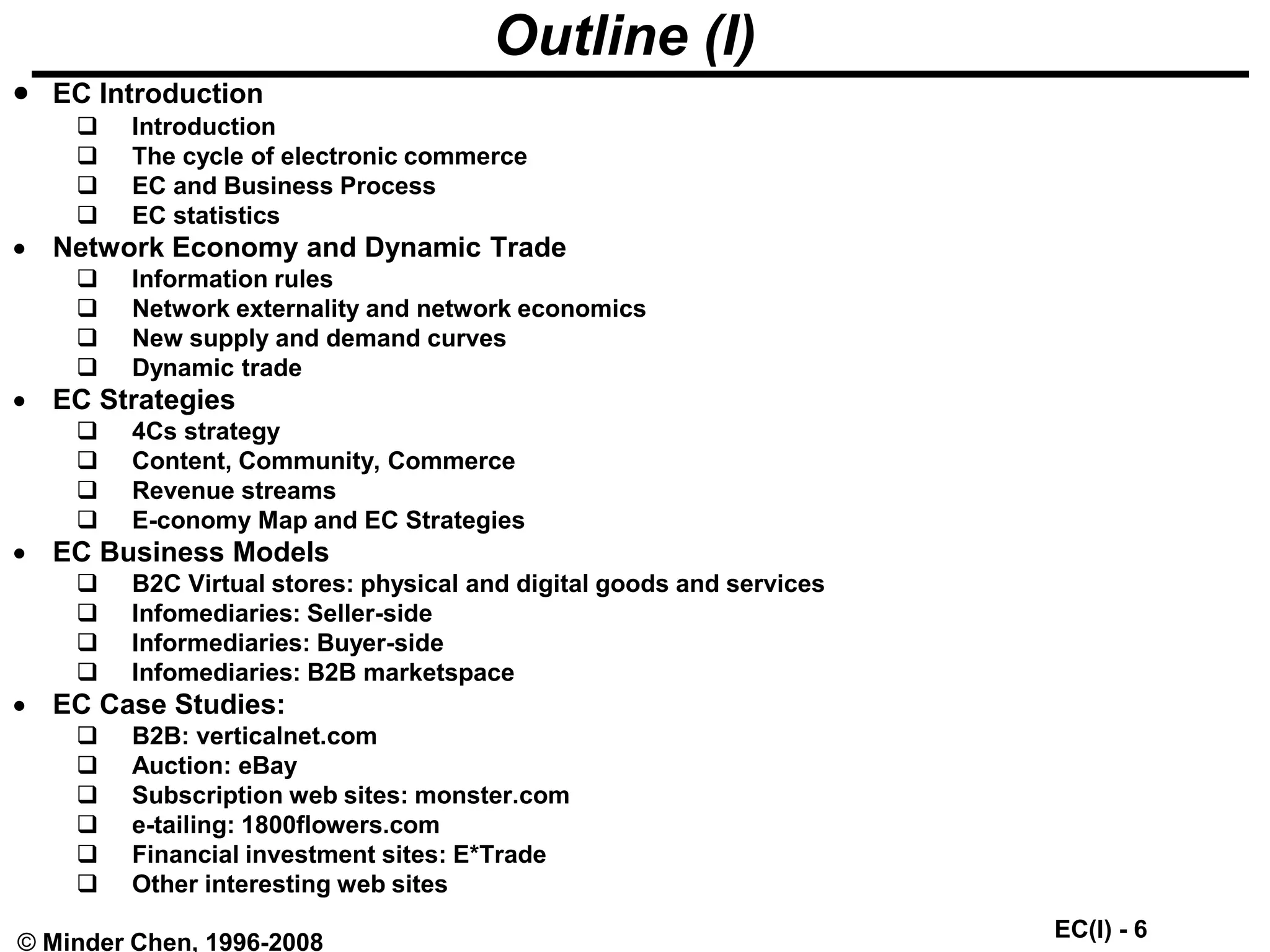

Direct-to-Customer (D-to-C)

• Large, global, e-energized corporations (e.g.,

Fortune 1000) begin to squeeze intermediary

companies.

• Stop & Shop [a large supermarket chain] is

launch its own delivery service and is expected

to end its partnership with Peapod [a dotcom

delivery service]. -- The Boston Globe, April 2000

• June 20, 2000. Peapod announced online shopping and

delivery services in Connecticut through grocery chain

Stop & Shop. Stop & Shop is owned by Royal Ahold,

which recently took a 51 percent interest in struggling

Peapod.

B-to-C B-to-B D-to-C](https://image.slidesharecdn.com/valuechainofe-commerce-230926061447-8e47566a/75/Value-Chain-of-e-commerce-ppt-108-2048.jpg)