Equity Valuations Perspective | July 2023

•

0 likes•49 views

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods. Read on to know more! #ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Report

Share

Report

Share

Download to read offline

Recommended

Equity Valuations Perspective | June 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods. Read on to know more!

Equity Valuations Perspective | August 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of dynamic variables on equity markets across time periods. Read on to know more!

Equity Valuations Perspective | March 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods.

Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | May 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods. Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | April 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods.

Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of Markets based on our VCTS framework.

Equity Valuations Perspective | April 2022

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of Markets based on our VCTS framework.

Equity Valuations Perspective | September 2022

Wondering what should be on your market checklist before investing in equity? Look no further than our VCTS (Market Valuations, Business Cycle, Triggers, Sentiments) framework for a straightforward formula!

Recommended

Equity Valuations Perspective | June 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods. Read on to know more!

Equity Valuations Perspective | August 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of dynamic variables on equity markets across time periods. Read on to know more!

Equity Valuations Perspective | March 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods.

Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | May 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods. Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | April 2023

See how our VCTS (Valuations, Cycle, Triggers and Sentiments) framework can help us understand Equity Markets better. The below document highlights the impact of equity markets on dynamic variables across time periods.

Read on to know more!

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of Markets based on our VCTS framework.

Equity Valuations Perspective | April 2022

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of Markets based on our VCTS framework.

Equity Valuations Perspective | September 2022

Wondering what should be on your market checklist before investing in equity? Look no further than our VCTS (Market Valuations, Business Cycle, Triggers, Sentiments) framework for a straightforward formula!

Equity Valuations Perspective | August 2022

Wondering what should be on your market checklist before investing in equity?

Look no further than our VCTS (Market Valuations, Business Cycle, Triggers, Sentiments) framework for a straightforward formula!

Equity Valuations Perspective | January 2023

Get a birds eye view of equity markets through ICICI Prudential Equity Valuations Perspective. The document highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | December 2022

Get a birds eye view of equity markets through ICICI Prudential Equity Valuations Perspective highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | November 2022

ICICI Prudential Equity Valuations Perspective highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of markets based on our VCTS framework.

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

As per our, VCTS (Valuations, Cycle, Trigger, Sentiments) Framework, Equity investing needs to be looked at only from a long term perspective coupled with ‘Dynamic Asset Allocation Scheme’ that aims to manage volatility.

Valuations Perspective (November 2021)

Learn all about Valuations whether it’s on the expensive or attractive side compared to the past and know the factors which may drive the equity markets with our Valuations Perspective.

Valuations Perspective | ICICI Prudential Mutual Fund

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market Valuations are not cheap. Business Cycle remains in the nascent stage.

Equity investing can be looked at only from a long term perspective coupled with “Dynamic Asset Allocation Scheme’ that aims to manage market volatility.

Equity Valuations Perspective | January 2024

Navigate Equity Markets better through our VCTS (Valuations, Cycle, Triggers and Sentiments) framework. The document below highlights the impact of various dynamic variables on the equity market across time periods. Read on to know more!”

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

Our Valuation perspective note indicates that Equity investing can be looked at from a staggered approach with a minimum horizon of ‘3-5 Yrs’ coupled with ‘Dynamic Asset Allocation Schemes’ that aim to manage equity exposure basis market valuations.

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) continues to indicate that market Valuations (P/E) are driven by Mega cap stocks.

#TarakkiKarein #MutualFunds #Markets

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Our July's Monthly Market Outlook is packed with economic insights and views on Equity and Fixed income markets.

Valuations Perspective September 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market Valuations (P/E) are driven by Mega cap stocks.

Valuation Perspective - ICICI Prudential Mutual Fund

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable, Business Cycle has bottomed out and FPIs are withdrawing money suggesting that it is a good time to invest in equities

Valuations Perspective August 2020

Business Cycle is near bottom, Future Triggers would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows have moderated and past returns have been muted.

VALUATIONS PERSPECTIVE - July 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable for long term investments, Business Cycle has bottomed out, Trigger would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows are low and past returns have been muted. This suggests that it is a good time to accumulate equities and hold for long term.

Annual Outlook: 2024 | A Paradigm Shift

The rising sun of 2024 brings new hope for global markets! This sun shines a little brighter on the Indian economy as it gets off the tag of a 'fragile economy' to emerge as a robust one. The world economy is headed towards a 'Paradigm Shift' with India leading the way.

Explore this shift further with our Annual Outlook Report 2024!

#ICICIPrudentialMutualFund #AnnualOutlook #ETF

VALUATIONS PERSPECTIVE - June 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable, Business Cycle has bottomed out, Trigger would be the trajectory of COVID-19 growth curve, Sentiments are negative since FPIs are withdrawing money and past returns have been muted. This suggests that it is a good time to invest in equities

Equity Update - March 2020

We believe that the divergence between Value and Growth stocks continues to prevail, & that volatility is a factor which is inherent in equity as an asset class.

Equity Update - November 2018

October 2018 saw the Indian markets tumble by about 5 per cent, in a month that saw heavy volatility in the equity markets owing to on-going concerns regarding weakening currency, rising crude oil prices, widening fiscal deficit, along with muted earnings performance and the liquidity crunch-woes in the NBFC sector.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 06.02.2024.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 05.02.2024.

More Related Content

Similar to Equity Valuations Perspective | July 2023

Equity Valuations Perspective | August 2022

Wondering what should be on your market checklist before investing in equity?

Look no further than our VCTS (Market Valuations, Business Cycle, Triggers, Sentiments) framework for a straightforward formula!

Equity Valuations Perspective | January 2023

Get a birds eye view of equity markets through ICICI Prudential Equity Valuations Perspective. The document highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | December 2022

Get a birds eye view of equity markets through ICICI Prudential Equity Valuations Perspective highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | November 2022

ICICI Prudential Equity Valuations Perspective highlights the degree of attractiveness of equity markets based on our VCTS (Valuations, Business Cycle, Triggers and Sentiments) Framework.

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Get a bird's eye view on Equity Markets through our Equity Valuations Perspective that highlights the degree of attractiveness of markets based on our VCTS framework.

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

As per our, VCTS (Valuations, Cycle, Trigger, Sentiments) Framework, Equity investing needs to be looked at only from a long term perspective coupled with ‘Dynamic Asset Allocation Scheme’ that aims to manage volatility.

Valuations Perspective (November 2021)

Learn all about Valuations whether it’s on the expensive or attractive side compared to the past and know the factors which may drive the equity markets with our Valuations Perspective.

Valuations Perspective | ICICI Prudential Mutual Fund

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market Valuations are not cheap. Business Cycle remains in the nascent stage.

Equity investing can be looked at only from a long term perspective coupled with “Dynamic Asset Allocation Scheme’ that aims to manage market volatility.

Equity Valuations Perspective | January 2024

Navigate Equity Markets better through our VCTS (Valuations, Cycle, Triggers and Sentiments) framework. The document below highlights the impact of various dynamic variables on the equity market across time periods. Read on to know more!”

#ICICIPrudentialMutualFund #Equity #Investments #MutualFunds

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

Our Valuation perspective note indicates that Equity investing can be looked at from a staggered approach with a minimum horizon of ‘3-5 Yrs’ coupled with ‘Dynamic Asset Allocation Schemes’ that aim to manage equity exposure basis market valuations.

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) continues to indicate that market Valuations (P/E) are driven by Mega cap stocks.

#TarakkiKarein #MutualFunds #Markets

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Our July's Monthly Market Outlook is packed with economic insights and views on Equity and Fixed income markets.

Valuations Perspective September 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market Valuations (P/E) are driven by Mega cap stocks.

Valuation Perspective - ICICI Prudential Mutual Fund

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable, Business Cycle has bottomed out and FPIs are withdrawing money suggesting that it is a good time to invest in equities

Valuations Perspective August 2020

Business Cycle is near bottom, Future Triggers would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows have moderated and past returns have been muted.

VALUATIONS PERSPECTIVE - July 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable for long term investments, Business Cycle has bottomed out, Trigger would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows are low and past returns have been muted. This suggests that it is a good time to accumulate equities and hold for long term.

Annual Outlook: 2024 | A Paradigm Shift

The rising sun of 2024 brings new hope for global markets! This sun shines a little brighter on the Indian economy as it gets off the tag of a 'fragile economy' to emerge as a robust one. The world economy is headed towards a 'Paradigm Shift' with India leading the way.

Explore this shift further with our Annual Outlook Report 2024!

#ICICIPrudentialMutualFund #AnnualOutlook #ETF

VALUATIONS PERSPECTIVE - June 2020

Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that Valuations are reasonable, Business Cycle has bottomed out, Trigger would be the trajectory of COVID-19 growth curve, Sentiments are negative since FPIs are withdrawing money and past returns have been muted. This suggests that it is a good time to invest in equities

Equity Update - March 2020

We believe that the divergence between Value and Growth stocks continues to prevail, & that volatility is a factor which is inherent in equity as an asset class.

Equity Update - November 2018

October 2018 saw the Indian markets tumble by about 5 per cent, in a month that saw heavy volatility in the equity markets owing to on-going concerns regarding weakening currency, rising crude oil prices, widening fiscal deficit, along with muted earnings performance and the liquidity crunch-woes in the NBFC sector.

Similar to Equity Valuations Perspective | July 2023 (20)

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Valuation Perspective - ICICI Prudential Mutual Fund

Valuation Perspective - ICICI Prudential Mutual Fund

More from iciciprumf

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 06.02.2024.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 05.02.2024.

ICICI Prudential Large & Mid Cap Fund

Does your portfolio have a blend of reasonable stability and potential growth?

Just as how a Sturdy Suspension and Powerful Engine together contribute to a smoother car ride, investing in a combination of Large and Mid cap stocks can offer the best of both worlds – Reasonable Stability + Potential Growth.

Know more: https://bit.ly/3UuS9x8

#ICICIPrudentialMutualFund #LargeCapFund #MidCapFund #MutualFunds #Investment

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 16.01.2024.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 11.01.2024.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 03.01.2024.

Annual Outlook | 2024

Stepping into 2024 with resilience and foresight!

New year has begun with a Paradigm Shift in trends of global and domestic macros.

While the global economies remain fragile, the Indian economy emerges as robust, defying the label of a fragile economy.

Explore the 2024 Outlook for insights on this Paradigm Shift!

#ICICIPrudentialMutualFund #MutualFunds #Investments #NewYear #2024

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 29.12.2023.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 27.12.2023.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 18.12.2023.

Monthly Market Outlook | Dec 2023

While there is some decline in China, there are positive market situations for India. What does that mean for an investor like you? See in December's Monthly Market Outlook here.

#ICICIPrudentialMutualFund #Investment #December2023 #MonthlyMarketOutlook #MutualFunds

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 04.12.2023.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 30.11.2023.

Monthly Market Outlook | November 2023

Amidst global tensions, the global economies might be taking the strain but Indian economy continues the Goldilocks streak. Take a holistic view at what that might mean for you as an investor with the Monthly Market Outlook.

#ICICIPrudentialMutualFund #MonthlyMarketOutlook

ICICI Prudential Equity Valuation Index | Nov 2023

Our latest Equity Valuation Index remains in the Neutral Index even after market corrections. But how do you smartly navigate through the market's volatility? Allocating your funds across different classes may help you. Have a look to understand better!

#ICICIPrudentialMutuaFund #Equity #EquityValuationIndex #Market #Investments

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 03.11.2023.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 30.10.2023.

Monthly Market Outlook | Oct 2023

How can we prepare for the mood of the market? Use micro indicators for a comprehensive look at the market in this month's Market Outlook!

#ICICIPrudentialMutualFund #MonthlyMarketOutlook #October #Investment #MutualFunds

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 11.10.2023.

Debt Watch | ICICI Prudential Mutual Fund

Keep an eye on the interest rate movements with our Debt Watch as on 05.10.2023.

More from iciciprumf (20)

ICICI Prudential Equity Valuation Index | Nov 2023

ICICI Prudential Equity Valuation Index | Nov 2023

Recently uploaded

This assessment plan proposal is to outline a structured approach to evaluati...

This assessment plan proposal is to outline a structured approach to evaluati...lamluanvan.net Viết thuê luận văn

Luận Văn Group hỗ trợ viết luận văn thạc sĩ,chuyên đề,khóa luận tốt nghiệp, báo cáo thực tập, Assignment, Essay

Zalo/Sdt 0967 538 624/ 0886 091 915 Website:lamluanvan.net

Tham gia nhóm hỗ trợ viết bài fb: https://www.facebook.com/groups/285625754522599?locale=vi_VNTdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

how to swap pi coins to foreign currency withdrawable.

As of my last update, Pi is still in the testing phase and is not tradable on any exchanges.

However, Pi Network has announced plans to launch its Testnet and Mainnet in the future, which may include listing Pi on exchanges.

The current method for selling pi coins involves exchanging them with a pi vendor who purchases pi coins for investment reasons.

If you want to sell your pi coins, reach out to a pi vendor and sell them to anyone looking to sell pi coins from any country around the globe.

Below is the what'sapp information for my personal pi vendor.

+12349014282

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

Introducing BONKMILLON - The Most Bonkers Meme Coin Yet

Let's be real for a second – the world of meme coins can feel like a bit of a circus at times. Every other day, there's a new token promising to take you "to the moon" or offering some groundbreaking utility that'll change the game forever. But how many of them actually deliver on that hype?

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptx

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptxGodwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Lecture slide titled Fraud Risk Mitigation, Webinar Lecture Delivered at the Society for West African Internal Audit Practitioners (SWAIAP) on Wednesday, November 8, 2023.

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

how to sell pi coins in South Korea profitably.

Yes. You can sell your pi network coins in South Korea or any other country, by finding a verified pi merchant

What is a verified pi merchant?

Since pi network is not launched yet on any exchange, the only way you can sell pi coins is by selling to a verified pi merchant, and this is because pi network is not launched yet on any exchange and no pre-sale or ico offerings Is done on pi.

Since there is no pre-sale, the only way exchanges can get pi is by buying from miners. So a pi merchant facilitates these transactions by acting as a bridge for both transactions.

How can i find a pi vendor/merchant?

Well for those who haven't traded with a pi merchant or who don't already have one. I will leave the what'sapp number of my personal pi merchant who i trade pi with.

Message: +12349014282 VIA Whatsapp.

#pi #sell #nigeria #pinetwork #picoins #sellpi #Nigerian #tradepi #pinetworkcoins #sellmypi

一比一原版(IC毕业证)帝国理工大学毕业证如何办理

IC毕业证文凭证书【微信95270640】一比一伪造帝国理工大学文凭@假冒IC毕业证成绩单+Q微信95270640办理IC学位证书@仿造IC毕业文凭证书@购买帝国理工大学毕业证成绩单IC真实使馆认证/真实留信认证回国人员证明

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到帝国理工大学帝国理工大学毕业证学历书;

3、不清楚流程以及材料该如何准备帝国理工大学帝国理工大学毕业证学历书;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★帝国理工大学帝国理工大学毕业证学历书毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查帝国理工大学帝国理工大学毕业证学历书】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助帝国理工大学同学朋友

你做代理,可以拯救帝国理工大学失足青年

你做代理,可以挽救帝国理工大学一个个人才

你做代理,你将是别人人生帝国理工大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会美景更增添一份性感夹杂着一份纯洁的妖娆毫无违和感实在给人带来一份悠然幸福的心情如果说现在的审美已经断然拒绝了无声的话那么在树林间飞掠而过的小鸟叽叽咋咋的叫声是否就是这最后的点睛之笔悠然走在林间的小路上宁静与清香一丝丝的盛夏气息吸入身体昔日生活里的繁忙与焦躁早已淡然无存心中满是悠然清淡的芳菲身体不由的轻松脚步也感到无比的轻快走出这盘栾交错的小道眼前是连绵不绝的山峦浩荡天地间大自然毫无吝啬的展现它的达

一比一原版(UoB毕业证)伯明翰大学毕业证如何办理

UoB本科学位证成绩单【微信95270640】伯明翰大学没毕业>办理伯明翰大学毕业证成绩单【微信UoB】UoB毕业证成绩单UoB学历证书UoB文凭《UoB毕业套号文凭网认证伯明翰大学毕业证成绩单》《哪里买伯明翰大学毕业证文凭UoB成绩学校快递邮寄信封》《开版伯明翰大学文凭》UoB留信认证本科硕士学历认证

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到伯明翰大学伯明翰大学硕士毕业证成绩单;

3、不清楚流程以及材料该如何准备伯明翰大学伯明翰大学硕士毕业证成绩单;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★伯明翰大学伯明翰大学硕士毕业证成绩单毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查伯明翰大学伯明翰大学硕士毕业证成绩单】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助伯明翰大学同学朋友

你做代理,可以拯救伯明翰大学失足青年

你做代理,可以挽救伯明翰大学一个个人才

你做代理,你将是别人人生伯明翰大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山娃多年的忠实伙伴平时山娃上学阿黑也摇头晃脑地跟去暑假用不着上学阿钩

How to get verified on Coinbase Account?_.docx

t's important to note that buying verified Coinbase accounts is not recommended and may violate Coinbase's terms of service. Instead of searching to "buy verified Coinbase accounts," follow the proper steps to verify your own account to ensure compliance and security.

Earn a passive income with prosocial investing

Invest in prosocial funds that earn you an income while improving the world

一比一原版(Greenwich毕业证)格林威治大学毕业证如何办理

Greenwich毕业证学历书【微信95270640】格林威治大学没毕业>办理格林威治大学毕业证成绩单【微信Greenwich】Greenwich毕业证成绩单Greenwich学历证书Greenwich文凭《Greenwich毕业套号文凭网认证格林威治大学毕业证成绩单》《哪里买格林威治大学毕业证文凭Greenwich成绩学校快递邮寄信封》《开版格林威治大学文凭》Greenwich留信认证本科硕士学历认证

(诚招代理)办理国外高校毕业证成绩单文凭学位证,真实使馆公证(留学回国人员证明)真实留信网认证国外学历学位认证雅思代考国外学校代申请名校保录开请假条改GPA改成绩ID卡

1.高仿业务:【本科硕士】毕业证,成绩单(GPA修改),学历认证(教育部认证),大学Offer,,ID,留信认证,使馆认证,雅思,语言证书等高仿类证书;

2.认证服务: 学历认证(教育部认证),大使馆认证(回国人员证明),留信认证(可查有编号证书),大学保录取,雅思保分成绩单。

3.技术服务:钢印水印烫金激光防伪凹凸版设计印刷激凸温感光标底纹镭射速度快。

办理格林威治大学格林威治大学毕业证offer流程:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

-办理真实使馆公证(即留学回国人员证明)

-办理各国各大学文凭(世界名校一对一专业服务,可全程监控跟踪进度)

-全套服务:毕业证成绩单真实使馆公证真实教育部认证。让您回国发展信心十足!

(详情请加一下 文凭顾问+微信:95270640)欢迎咨询!好坏人小偷山娃一怔却也灵机一动立马仰起头双手拢在嘴边朝楼上大喊:“爸爸爸——有人找——那人一听朝山娃尴尬地笑笑悻悻地走了山娃立马“嘭的一声将铁门锁死心却咚咚地乱跳当山娃跟父亲说起这事时父亲很吃惊抚摸着山娃的头说还好醒得及时要不家早被人掏空了到时连电视也没得看啰不过父亲还是夸山娃能临危不乱随机应变有胆有谋山娃笑笑说那都是书上学的看童话和小说时学的不管如何父亲再也不许山娃敞开门坐到门口了父亲递给山娃很

Financial Assets: Debit vs Equity Securities.pptx

financial assets represent claim for future benefit or cash. Financial assets are formed by establishing contracts between participants. These financial assets are used for collection of huge amounts of money for business purposes.

Two major Types: Debt Securities and Equity Securities.

Debt Securities are Also known as fixed-income securities or instruments. The type of assets is formed by establishing contracts between investor and issuer of the asset.

• The first type of Debit securities is BONDS. Bonds are issued by corporations and government (both local and national government).

• The second important type of Debit security is NOTES. Apart from similarities associated with notes and bonds, notes have shorter term maturity.

• The 3rd important type of Debit security is TRESURY BILLS. These securities have short-term ranging from three months, six months, and one year. Issuer of such securities are governments.

• Above discussed debit securities are mostly issued by governments and corporations. CERTIFICATE OF DEPOSITS CDs are issued by Banks and Financial Institutions. Risk factor associated with CDs gets reduced when issued by reputable institutions or Banks.

Following are the risk attached with debt securities: Credit risk, interest rate risk and currency risk

There are no fixed maturity dates in such securities, and asset’s value is determined by company’s performance. There are two major types of equity securities: common stock and preferred stock.

Common Stock: These are simple equity securities and bear no complexities which the preferred stock bears. Holders of such securities or instrument have the voting rights when it comes to select the company’s board of director or the business decisions to be made.

Preferred Stock: Preferred stocks are sometime referred to as hybrid securities, because it contains elements of both debit security and equity security. Preferred stock confers ownership rights to security holder that is why it is equity instrument

<a href="https://www.writofinance.com/equity-securities-features-types-risk/" >Equity securities </a> as a whole is used for capital funding for companies. Companies have multiple expenses to cover. Potential growth of company is required in competitive market. So, these securities are used for capital generation, and then uses it for company’s growth.

Concluding remarks

Both are employed in business. Businesses are often established through debit securities, then what is the need for equity securities. Companies have to cover multiple expenses and expansion of business. They can also use equity instruments for repayment of debits. So, there are multiple uses for securities. As an investor, you need tools for analysis. Investment decisions are made by carefully analyzing the market. For better analysis of the stock market, investors often employ financial analysis of companies.

一比一原版(UCSB毕业证)圣芭芭拉分校毕业证如何办理

UCSB毕业证文凭证书【微信95270640】办理圣芭芭拉分校毕业证成绩单(Q微信95270640)毕业证学历认证OFFER专卖国外文凭学历学位证书办理澳洲文凭|澳洲毕业证,澳洲学历认证,澳洲成绩单 澳洲offer,教育部学历认证及使馆认证永久可查 ,国外毕业证|国外学历认证,国外学历文凭证书 UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,专业为留学生办理毕业证、成绩单、使馆留学回国人员证明、教育部学历学位认证、录取通知书、Offer、

【实体公司】办圣芭芭拉分校圣芭芭拉分校毕业证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.圣芭芭拉分校毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供圣芭芭拉分校圣芭芭拉分校毕业证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山室

一比一原版(GWU,GW毕业证)加利福尼亚大学|尔湾分校毕业证如何办理

GWU,GW毕业证录取书【微信95270640】一比一伪造加利福尼亚大学|尔湾分校文凭@假冒GWU,GW毕业证成绩单+Q微信95270640办理GWU,GW学位证书@仿造GWU,GW毕业文凭证书@购买加利福尼亚大学|尔湾分校毕业证成绩单GWU,GW真实使馆认证/真实留信认证回国人员证明

全套服务:加利福尼亚大学|尔湾分校加利福尼亚大学|尔湾分校毕业证成绩单真实回国人员证明 #真实教育部认证。让您回国发展信心十足#铸就十年品质!信誉!实体公司!可以视频看办公环境样板如需办理真实可查可以先到公司面谈勿轻信小中介黑作坊!

可以提供加利福尼亚大学|尔湾分校钢印 #水印 #烫金 #激光防伪 #凹凸版 #最新版的毕业证 #百分之百让您绝对满意

印刷DHL快递毕业证 #成绩单7个工作日真实大使馆教育部认证1个月。为了达到高水准高效率

请您先以qq或微信的方式对我们的服务进行了解后如果有加利福尼亚大学|尔湾分校加利福尼亚大学|尔湾分校毕业证成绩单帮助再进行电话咨询。

国外毕业证学位证成绩单如何办理:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作加利福尼亚大学|尔湾分校毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。口水苦涩无比山娃一边游泳一边念念不忘那元门票尤令山娃气愤的是泳池老板居然硬让父亲买了一大一小二条巴掌般大的裤衩衩走出泳池山娃感觉透身粘粘乎乎散发着药水味有点痒山娃顿时留恋起家乡的小河潺潺活水清凉无比日子就这样孤寂而快乐地过着寂寞之余山娃最神往最开心就是晚上无论多晚多累父亲总要携山娃出去兜风逛夜市流光溢彩人潮涌动的都市夜生活总让山娃目不暇接惊叹不已父亲老问山娃想买什么想吃什么山娃知道父亲赚钱很辛苦在

An Overview of the Prosocial dHEDGE Vault works

How the prosocial dHEDGE earns you money while saving the world!

when will pi network coin be available on crypto exchange.

There is no set date for when Pi coins will enter the market.

However, the developers are working hard to get them released as soon as possible.

Once they are available, users will be able to exchange other cryptocurrencies for Pi coins on designated exchanges.

But for now the only way to sell your pi coins is through verified pi vendor.

Here is the what'sapp contact of my personal pi vendor

+12349014282

NEW NORMAL! WHAT BECOMES OF ACCOUNTING PROFESSION

NEW NORMAL! WHAT BECOMES OF ACCOUNTING PROFESSION Godwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

NEW NORMAL!

WHAT BECOMES OF ACCOUNTING PROFESSION

OOU NUASA New Normal PresentationRecently uploaded (20)

This assessment plan proposal is to outline a structured approach to evaluati...

This assessment plan proposal is to outline a structured approach to evaluati...

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

how to swap pi coins to foreign currency withdrawable.

how to swap pi coins to foreign currency withdrawable.

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

Scope Of Macroeconomics introduction and basic theories

Scope Of Macroeconomics introduction and basic theories

when will pi network coin be available on crypto exchange.

when will pi network coin be available on crypto exchange.

Equity Valuations Perspective | July 2023

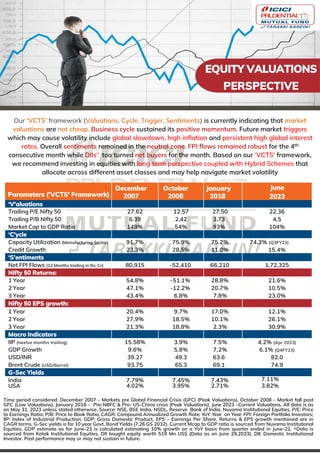

- 1. EQUITY VALUATIONS PERSPECTIVE Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market valuations are not cheap. Business cycle sustained its positive momentum. Future market triggers which may cause volatility include global slowdown, high inflation and persistent high global interest rates. Overall sentiments remained in the neutral zone. FPI flows remained robust for the 4th consecutive month while DIIs^ too turned net buyers for the month. Based on our ‘VCTS’ framework, we recommend investing in equities with long term perspective coupled with Hybrid Schemes that allocate across different asset classes and may help navigate market volatility Time period considered: December 2007 – Markets pre Global Financial Crisis (GFC) (Peak Valuations), October 2008 – Market fall post GFC (Low Valuations), January 2018 – Pre-NBFC & Pre- US-China crisis (Peak Valuations), June 2023 –Current Valuations. All data is as on May 31, 2023 unless stated otherwise. Source: NSE, BSE India, NSDL, Reserve Bank of India, Nuvama Institutional Equities. P/E: Price to Earnings Ratio; P/B: Price to Book Ratio; CAGR: Compound Annualized Growth Rate; YoY: Year on Year; FPI: Foreign Portfolio Investors; IIP: Index of Industrial Production; GDP: Gross Domestic Product, EPS – Earnings Per Share. Returns & EPS growth mentioned are in CAGR terms. G-Sec yields is for 10 year Govt. Bond Yields (7.26 GS 2032). Current Mcap to GDP ratio is sourced from Nuvama Institutional Equities, GDP estimate as for June-23 is calculated estimating 10% growth on a YoY basis from quarter ended in June-22. ^Data is sourced from Kotak Institutional Equities. DII bought equity worth 519 Mn US$ (Data as on June 29,2023). DII: Domestic Institutional Investor. Past performance may or may not sustain in future. Parameters ('VCTS' Framework) December 2007 October 2008 January 2018 June 2023 ‘V'aluations Trailing P/E Nifty 50 27.62 12.57 27.50 22.36 Trailing P/B Nifty 50 6.39 2.42 3.73 4.5 Market Cap to GDP Ratio 149% 54% 93% 104% ‘C’ycle Capacity Utilization (Manufacturing Sector) 91.7% 75.9% 75.2% 74.3% (Q3FY23) Credit Growth 23.3% 28.5% 11.0% 15.4% ‘S'entiments Net FPI Flows (12 Months trailing in Rs. Cr) 80,915 -52,410 66,210 1,72,325 Nifty 50 Returns: 1 Year 54.8% -51.1% 28.8% 21.6% 2 Year 47.1% -12.2% 20.7% 10.5% 3 Year 43.4% 6.8% 7.8% 23.0% Nifty 50 EPS growth: 1 Year 20.4% 9.7% 17.0% 12.1% 2 Year 27.9% 18.5% 10.1% 26.1% 3 Year 21.3% 18.8% 2.3% 30.9% Macro Indicators IIP (twelve months trailing) 15.58% 3.9% 7.5% 4.2% (Apr 2023) GDP Growth 9.6% 5.8% 7.2% 6.1% (Q4FY23) USD/INR 39.27 49.3 63.6 82.0 Brent Crude (USD/Barrel) 93.75 65.3 69.1 74.9 G-Sec Yields India 7.79% 7.45% 7.43% 7.11% USA 4.02% 3.95% 2.71% 3.82%

- 2. The ‘VCTS’ (Valuations, Cycle, Trigger, Sentiments) framework is a market checklist which can be used to determine market valuations/conditions for investment at any given point in time. The framework can find application across asset classes. It aims to navigate markets efficiently by reflecting on various data points used in the framework. PE – Price-to-Earnings; PBV – Price to Book Value Ratio; COVID-19 is Coronavirus disease 2019. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America (“US”) and/or Canada or for the benefit of US persons (being persons falling within the definition of the term “US Person” under the US Securities Act, 1933, as amended) or persons residing in Canada. MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY Parameters ('VCTS' Framework) Market V aluations P/E or PBV helps in ascertaining whether the market is expensive or cheap Business C ycle Indicators like capacity utilization or credit growth help in understanding the strength of business cycle T riggers Triggers are events which can have impact on the overall equity market S entiments Sentiments helps in understanding investors affinity towards the equity market Buy - Valuations Cheap Sell - Valuations Expensive Buy - Cycle is weak Sell - Cycle is Strong Triggers - Unpredictable event like COVID-19, Geo-Political Tensions Buy - Negative Sentiments Sell – Positive Sentiments