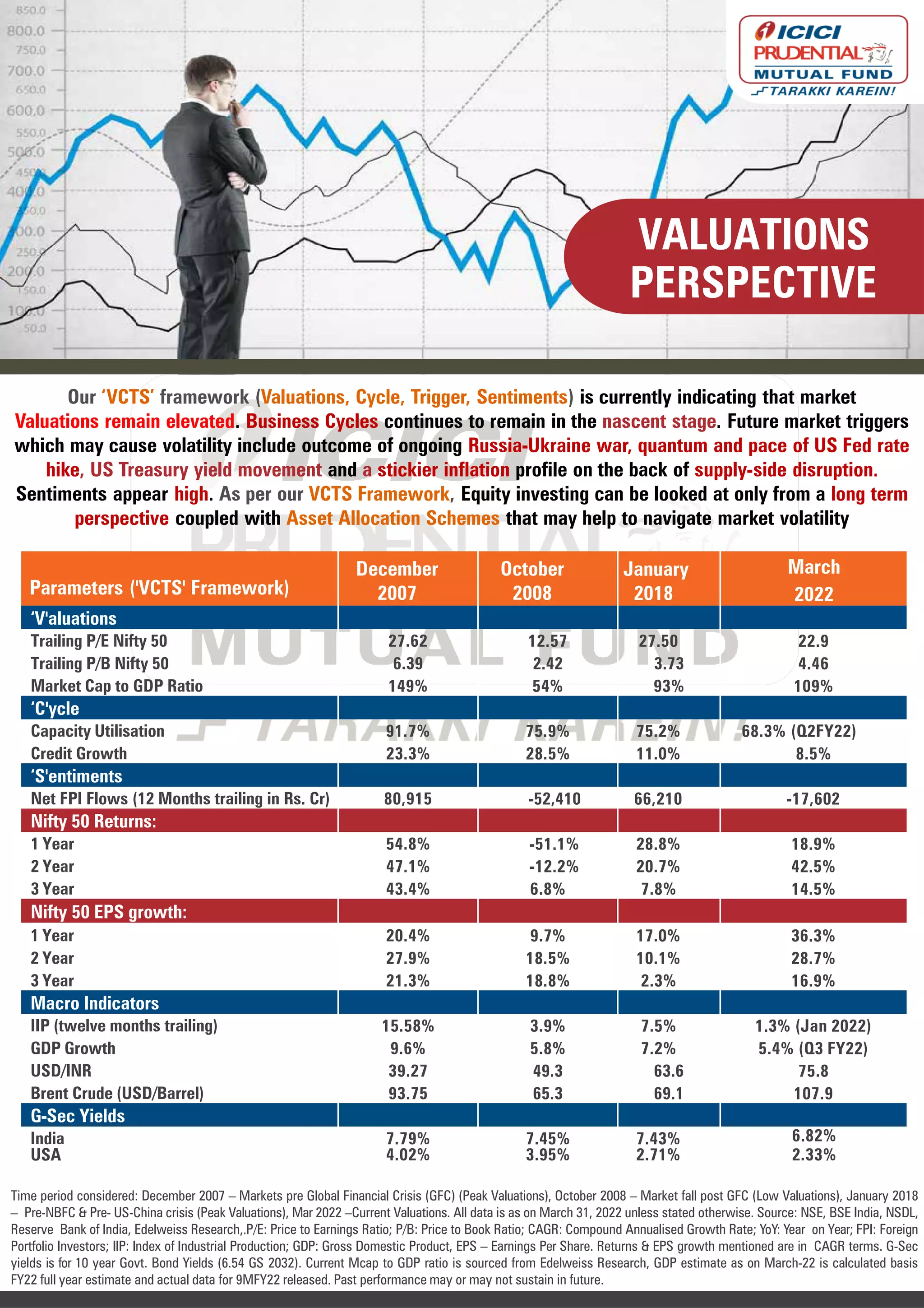

The 'VCTS' framework indicates that current market valuations are elevated while the business cycle is nascent, with future volatility potentially arising from geopolitical tensions, interest rate changes, and inflation. The framework provides a comprehensive checklist for evaluating market conditions through various indicators including valuations, cycle metrics, triggers, and sentiment analysis. Equity investing should be approached with a long-term perspective and an emphasis on asset allocation to manage market volatility.