Equity Valuations Perspective | August 2022

•

0 likes•28 views

Wondering what should be on your market checklist before investing in equity? Look no further than our VCTS (Market Valuations, Business Cycle, Triggers, Sentiments) framework for a straightforward formula!

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Similar to Equity Valuations Perspective | August 2022

Similar to Equity Valuations Perspective | August 2022 (20)

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

Valuation Perspective - ICICI Prudential Mutual Fund

Valuation Perspective - ICICI Prudential Mutual Fund

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

More from iciciprumf

More from iciciprumf (20)

ICICI Prudential Equity Valuation Index | Nov 2023

ICICI Prudential Equity Valuation Index | Nov 2023

Recently uploaded

Resume

• Real GDP growth slowed down due to problems with access to electricity caused by the destruction of manoeuvrable electricity generation by Russian drones and missiles.

• Exports and imports continued growing due to better logistics through the Ukrainian sea corridor and road. Polish farmers and drivers stopped blocking borders at the end of April.

• In April, both the Tax and Customs Services over-executed the revenue plan. Moreover, the NBU transferred twice the planned profit to the budget.

• The European side approved the Ukraine Plan, which the government adopted to determine indicators for the Ukraine Facility. That approval will allow Ukraine to receive a EUR 1.9 bn loan from the EU in May. At the same time, the EU provided Ukraine with a EUR 1.5 bn loan in April, as the government fulfilled five indicators under the Ukraine Plan.

• The USA has finally approved an aid package for Ukraine, which includes USD 7.8 bn of budget support; however, the conditions and timing of the assistance are still unknown.

• As in March, annual consumer inflation amounted to 3.2% yoy in April.

• At the April monetary policy meeting, the NBU again reduced the key policy rate from 14.5% to 13.5% per annum.

• Over the past four weeks, the hryvnia exchange rate has stabilized in the UAH 39-40 per USD range.

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024Інститут економічних досліджень та політичних консультацій

Recently uploaded (20)

how can i use my minded pi coins I need some funds.

how can i use my minded pi coins I need some funds.

The new type of smart, sustainable entrepreneurship and the next day | Europe...

The new type of smart, sustainable entrepreneurship and the next day | Europe...

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Jio Financial service Multibagger 2024 from India stock Market

Jio Financial service Multibagger 2024 from India stock Market

Can a Pi network coin ever be sold out: I am ready to sell mine.

Can a Pi network coin ever be sold out: I am ready to sell mine.

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

Empowering the Unbanked: The Vital Role of NBFCs in Promoting Financial Inclu...

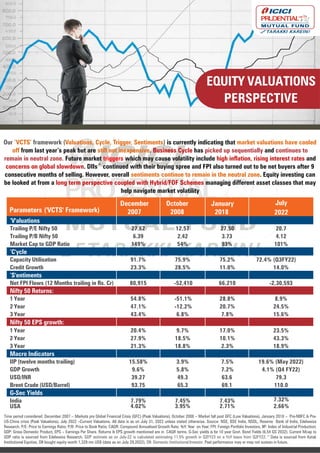

Equity Valuations Perspective | August 2022

- 1. EQUITY VALUATIONS PERSPECTIVE Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market valuations have cooled off from last year’s peak but are still not inexpensive. Business Cycle has picked up sequentially and continues to remain in neutral zone. Future market triggers which may cause volatility include high inflation, rising interest rates and concerns on global slowdown. DIIs^ continued with their buying spree and FPI also turned out to be net buyers after 9 consecutive months of selling. However, overall sentiments continue to remain in the neutral zone. Equity investing can be looked at from a long term perspective coupled with Hybrid/FOF Schemes managing different asset classes that may help navigate market volatility Time period considered: December 2007 – Markets pre Global Financial Crisis (GFC) (Peak Valuations), October 2008 – Market fall post GFC (Low Valuations), January 2018 – Pre-NBFC & Pre- US-China crisis (Peak Valuations), July 2022 –Current Valuations. All data is as on July 31, 2022 unless stated otherwise. Source: NSE, BSE India, NSDL, Reserve Bank of India, Edelweiss Research. P/E: Price to Earnings Ratio; P/B: Price to Book Ratio; CAGR: Compound Annualised Growth Rate; YoY: Year on Year; FPI: Foreign Portfolio Investors; IIP: Index of Industrial Production; GDP: Gross Domestic Product, EPS – Earnings Per Share. Returns & EPS growth mentioned are in CAGR terms. G-Sec yields is for 10 year Govt. Bond Yields (6.54 GS 2032). Current Mcap to GDP ratio is sourced from Edelweiss Research, GDP estimate as on July-22 is calculated estimating 11.5% growth in Q2FY23 on a YoY basis from Q2FY22.^Data is sourced from Kotak Institutional Equities. DII bought equity worth 1,329 mn US$ (data as on July 29,2022), DII: Domestic Institutional Investor. Past performance may or may not sustain in future. Parameters ('VCTS' Framework) December 2007 October 2008 January 2018 July 2022 ‘V'aluations Trailing P/E Nifty 50 27.62 12.57 27.50 20.7 Trailing P/B Nifty 50 6.39 2.42 3.73 4.12 Market Cap to GDP Ratio 149% 54% 93% 101% ‘C'ycle Capacity Utilisation 91.7% 75.9% 75.2% 72.4% (Q3FY22) Credit Growth 23.3% 28.5% 11.0% 14.0% ‘S'entiments Net FPI Flows (12 Months trailing in Rs. Cr) 80,915 -52,410 66,210 -2,30,593 Nifty 50 Returns: 1 Year 54.8% -51.1% 28.8% 8.9% 2 Year 47.1% -12.2% 20.7% 24.5% 3 Year 43.4% 6.8% 7.8% 15.6% Nifty 50 EPS growth: 1 Year 20.4% 9.7% 17.0% 23.5% 2 Year 27.9% 18.5% 10.1% 43.3% 3 Year 21.3% 18.8% 2.3% 18.9% Macro Indicators IIP (twelve months trailing) 15.58% 3.9% 7.5% 19.6% (May 2022) GDP Growth 9.6% 5.8% 7.2% 4.1% (Q4 FY22) USD/INR 39.27 49.3 63.6 79.3 Brent Crude (USD/Barrel) 93.75 65.3 69.1 110.0 G-Sec Yields India 7.79% 7.45% 7.43% 7.32% USA 4.02% 3.95% 2.71% 2.66%

- 2. The ‘VCTS’ (Valuations, Cycle, Trigger, Sentiments) framework is a market checklist which can be used to determine market valuations/conditions for investment at any given point in time. The framework can find application across asset classes. It aims to navigate markets efficiently by reflecting on various data points used in the framework. PE – Price-to-Earnings; PBV – Price to Book Value Ratio; COVID-19 is Coronavirus disease 2019. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America (“US”) and/or Canada or for the benefit of US persons (being persons falling within the definition of the term “US Person” under the US Securities Act, 1933, as amended) or persons residing in Canada. MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY Parameters ('VCTS' Framework) Market V aluations P/E or PBV helps in ascertaining whether the market is expensive or cheap Business C ycle Indicators like capacity utilization or credit growth help in understanding the strength of business cycle T riggers Triggers are events which can have impact on the overall equity market S entiments Sentiments helps in understanding investors affinity towards the equity market Buy - Valuations Cheap Sell - Valuations Expensive Buy - Cycle is weak Sell - Cycle is Strong Triggers - Unpredictable event like COVID-19, Geo- Political Tensions Buy - Negative Sentiments Sell - Positive Sentiments