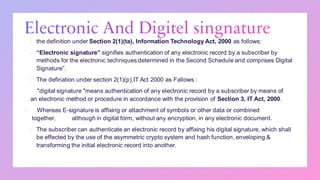

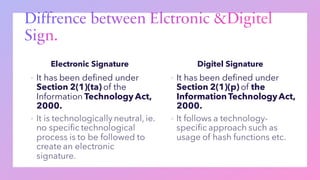

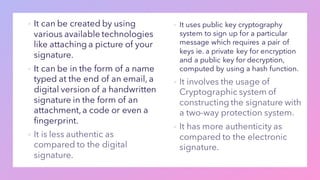

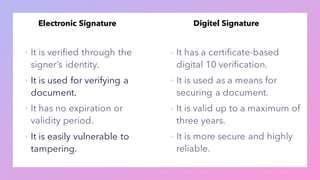

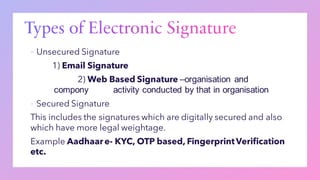

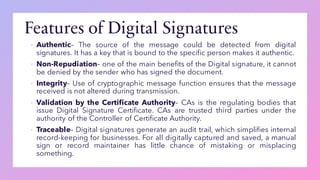

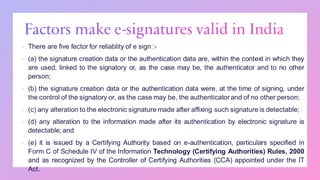

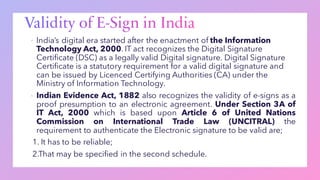

The document discusses the validity of electronic signatures in India, established under the Information Technology Act of 2000, which grants them the same legal status as handwritten signatures. It outlines different types of electronic and digital signatures, the legal framework for their use, and the factors that ensure their validity, including rules on authentication and certification. Additionally, the document highlights the integration of e-signatures in various legal agreements and documents, including the use of Aadhaar for electronic authentication.