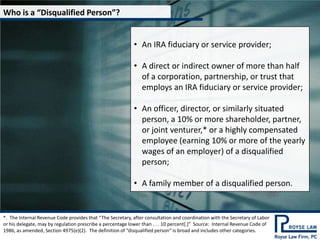

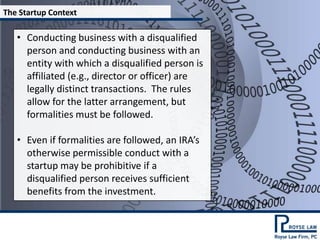

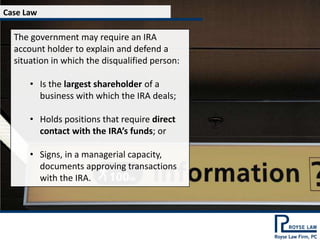

Many entrepreneurs and investors use Individual Retirement Accounts (IRAs) to fund startups. While IRAs have traditionally been used to purchase passive assets, some now use them to actively fund and conduct business with startups. However, IRAs must adhere to specific rules to avoid penalties. Conducting prohibited transactions like self-dealing with disqualified persons like the IRA holder can trigger taxes and loss of the IRA. While funding startups is allowed if formalities are followed, the arrangement cannot improperly benefit a disqualified person. Legal advice can help structure compliant deals.