Embed presentation

Download to read offline

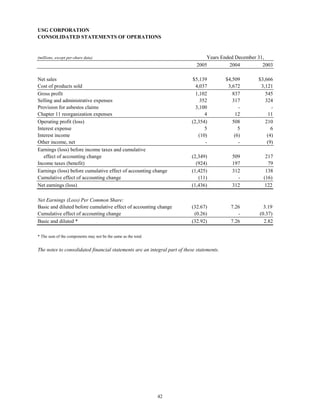

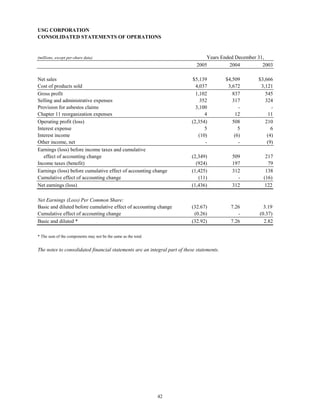

This document is a Form 10-K annual report filed by USG Corporation with the SEC for the fiscal year ending December 31, 2005. It provides information on USG Corporation's business, legal proceedings, risks, financial statements, executive compensation, and other required disclosures. Specifically, it discloses that USG Corporation is the parent company of United States Gypsum Company, which filed for bankruptcy in 2001 due to asbestos liability claims. It also provides details on USG Corporation's securities registered with the SEC and stock exchange listings.