Embed presentation

Download to read offline

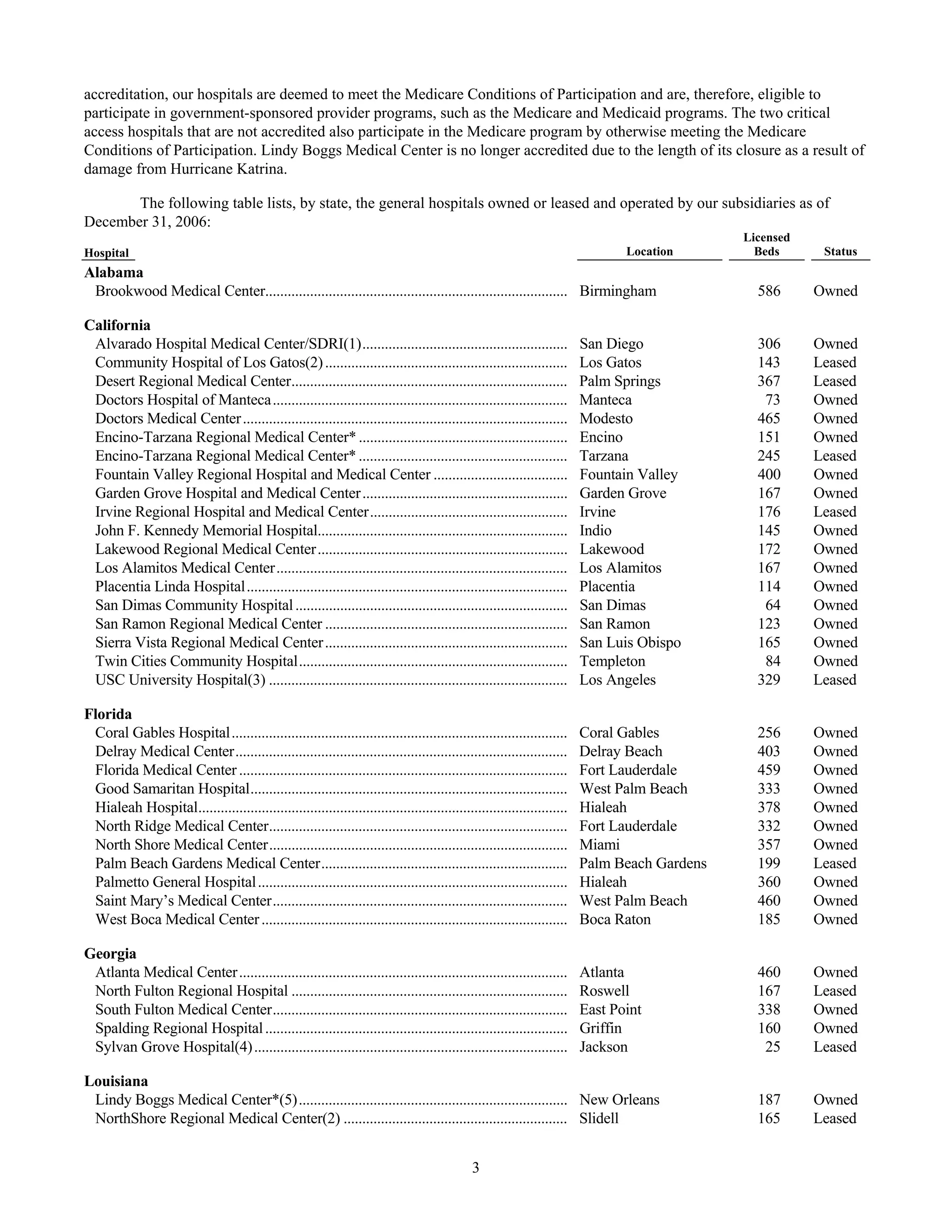

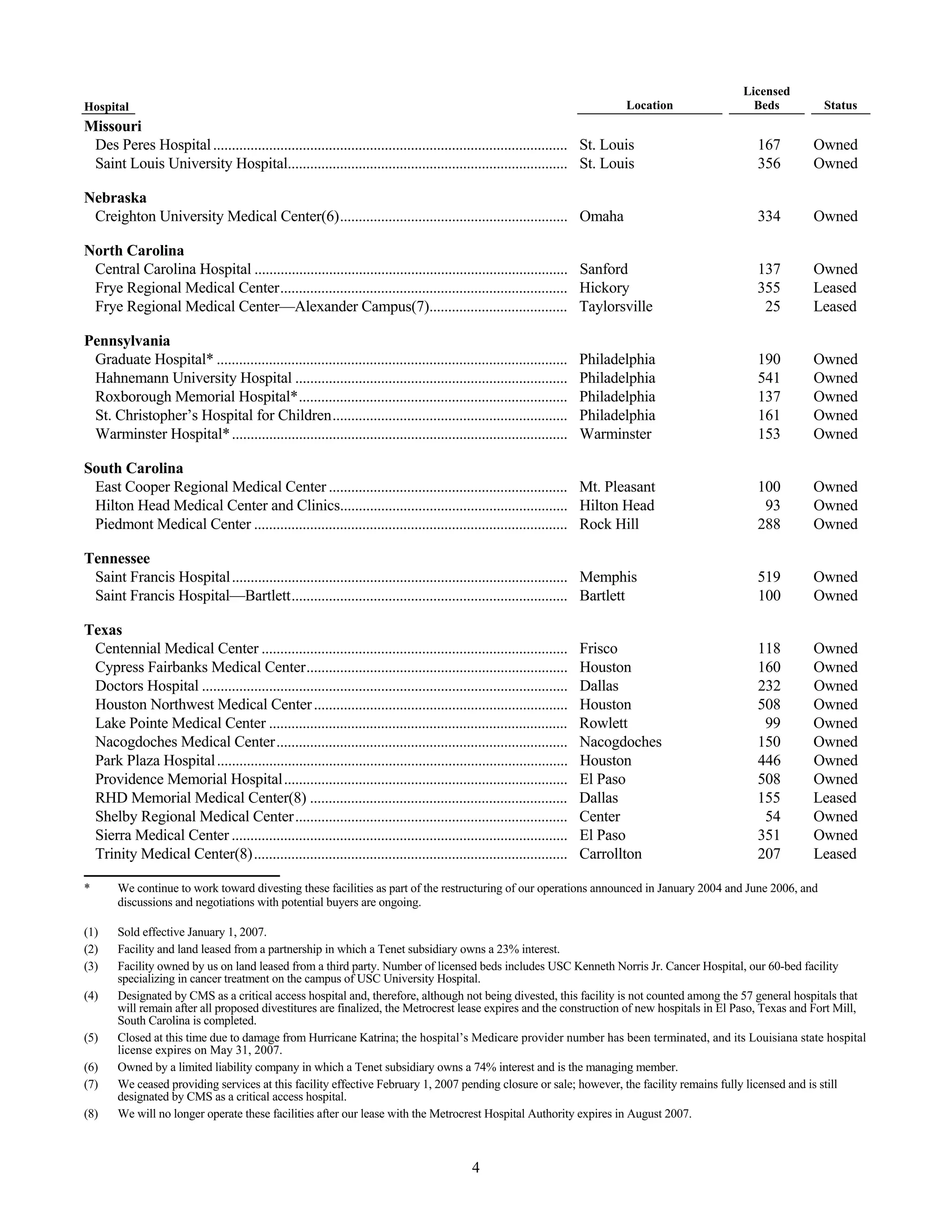

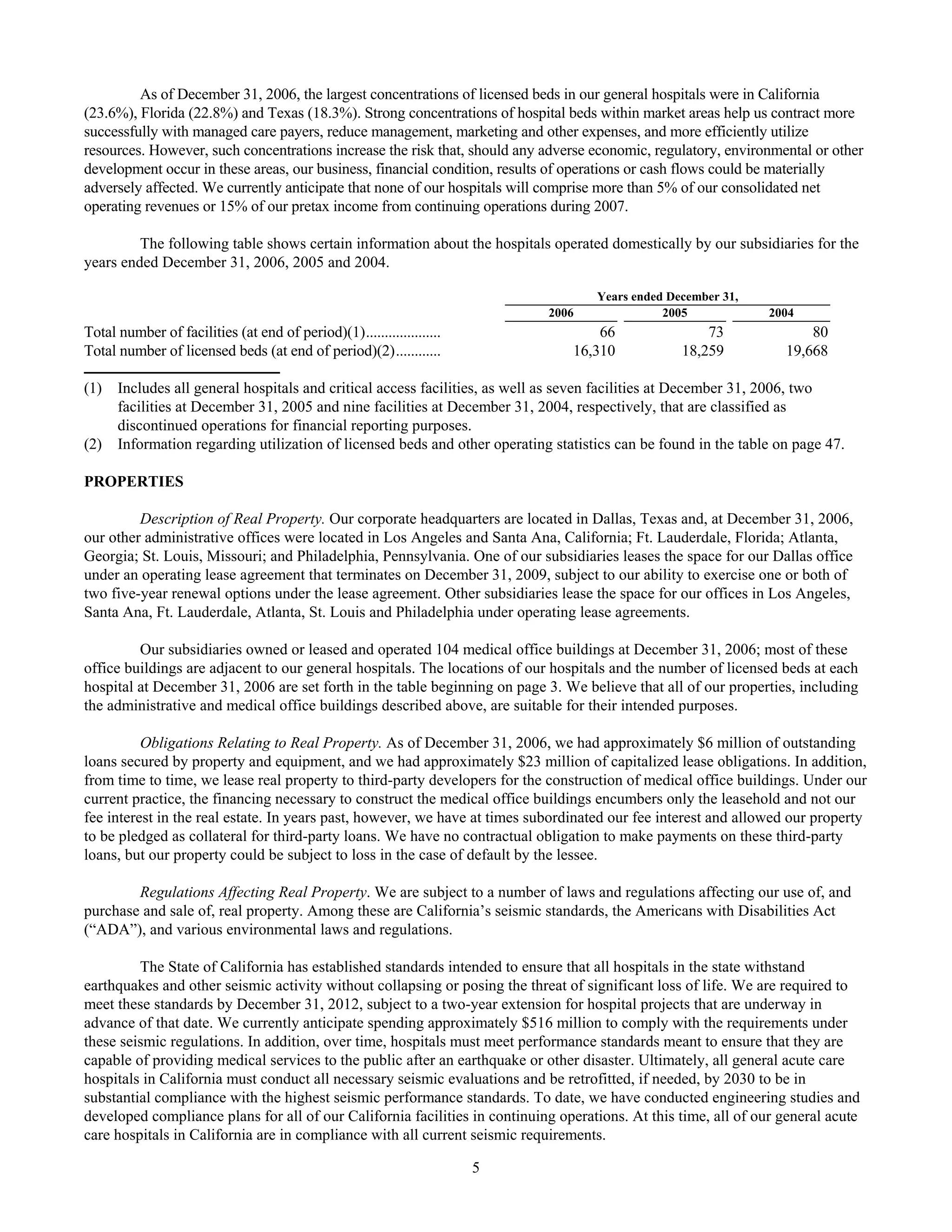

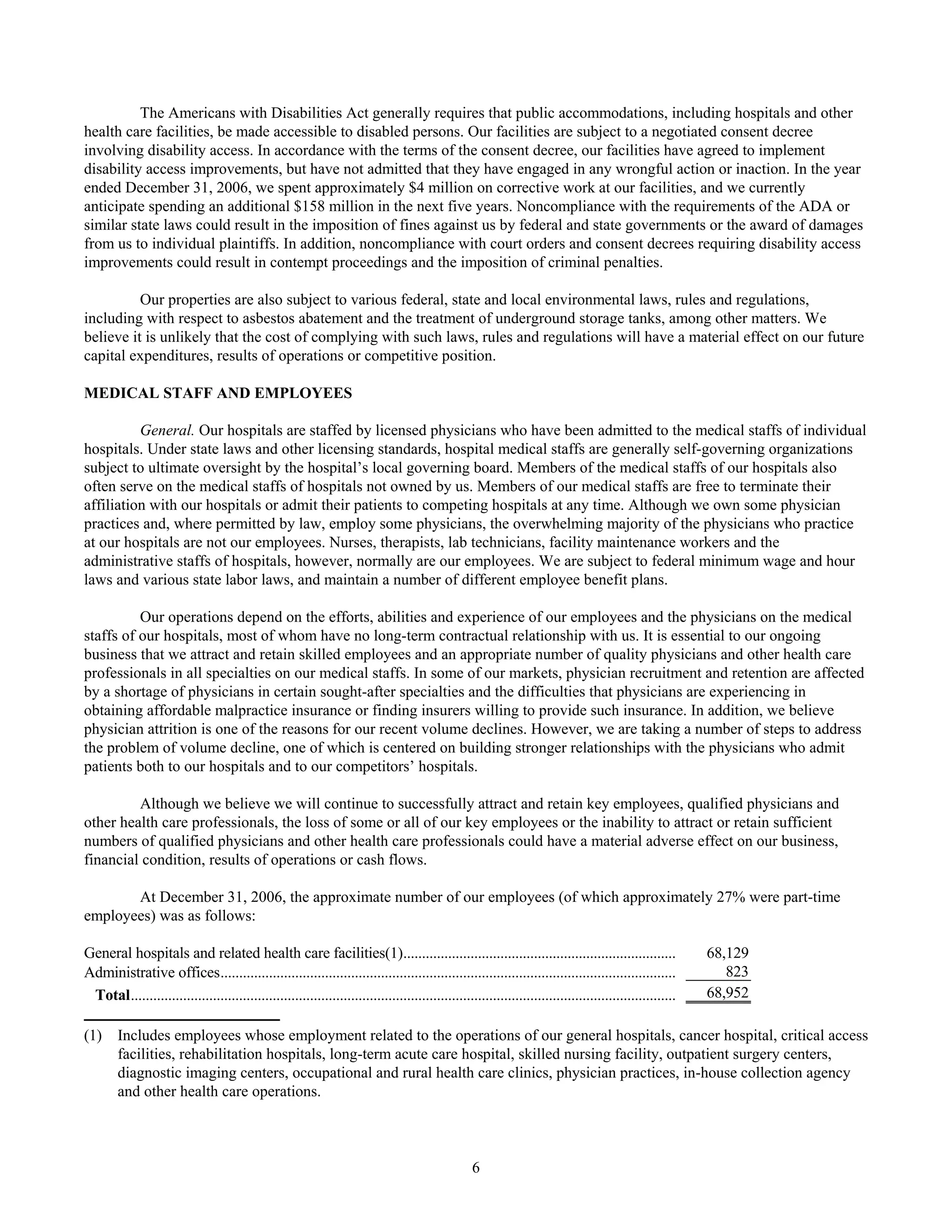

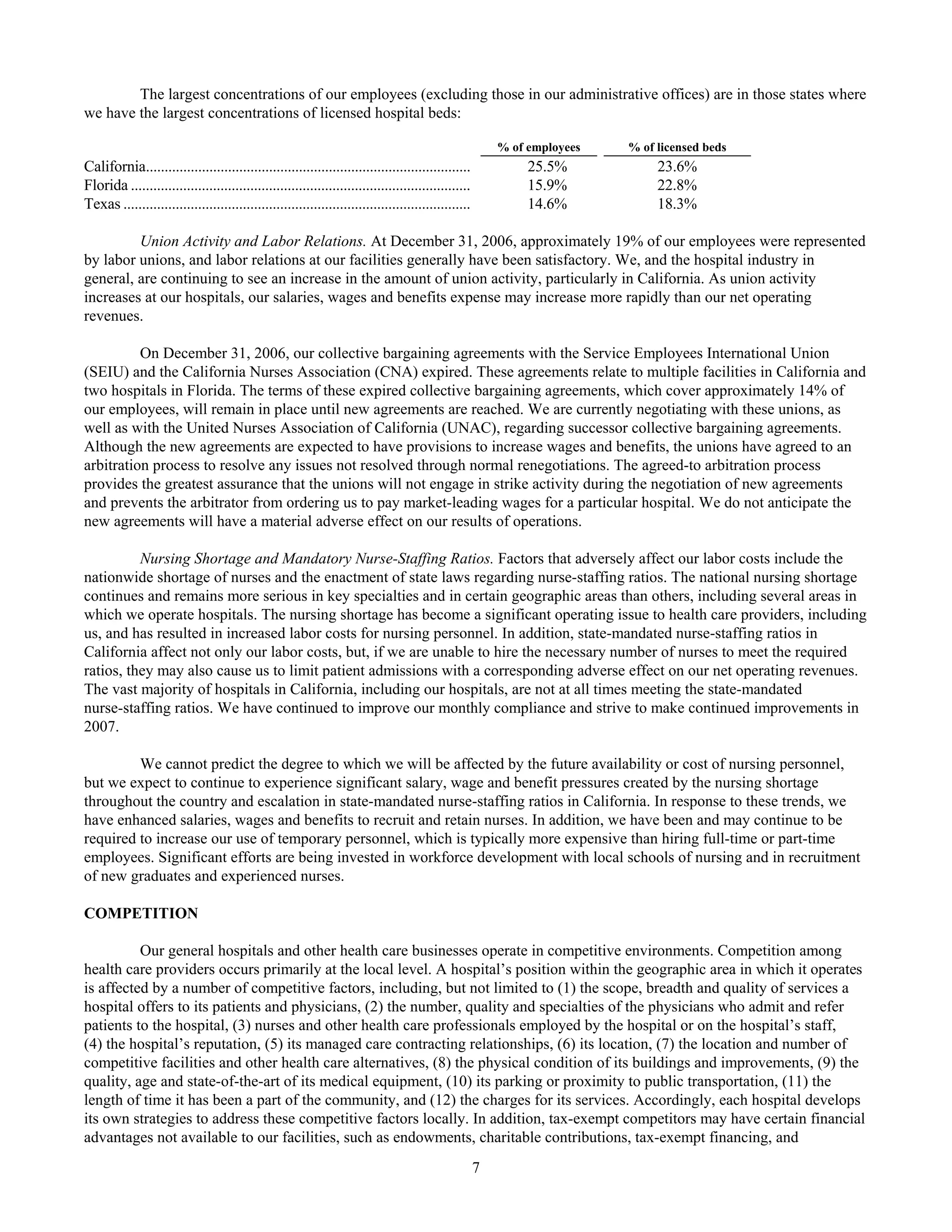

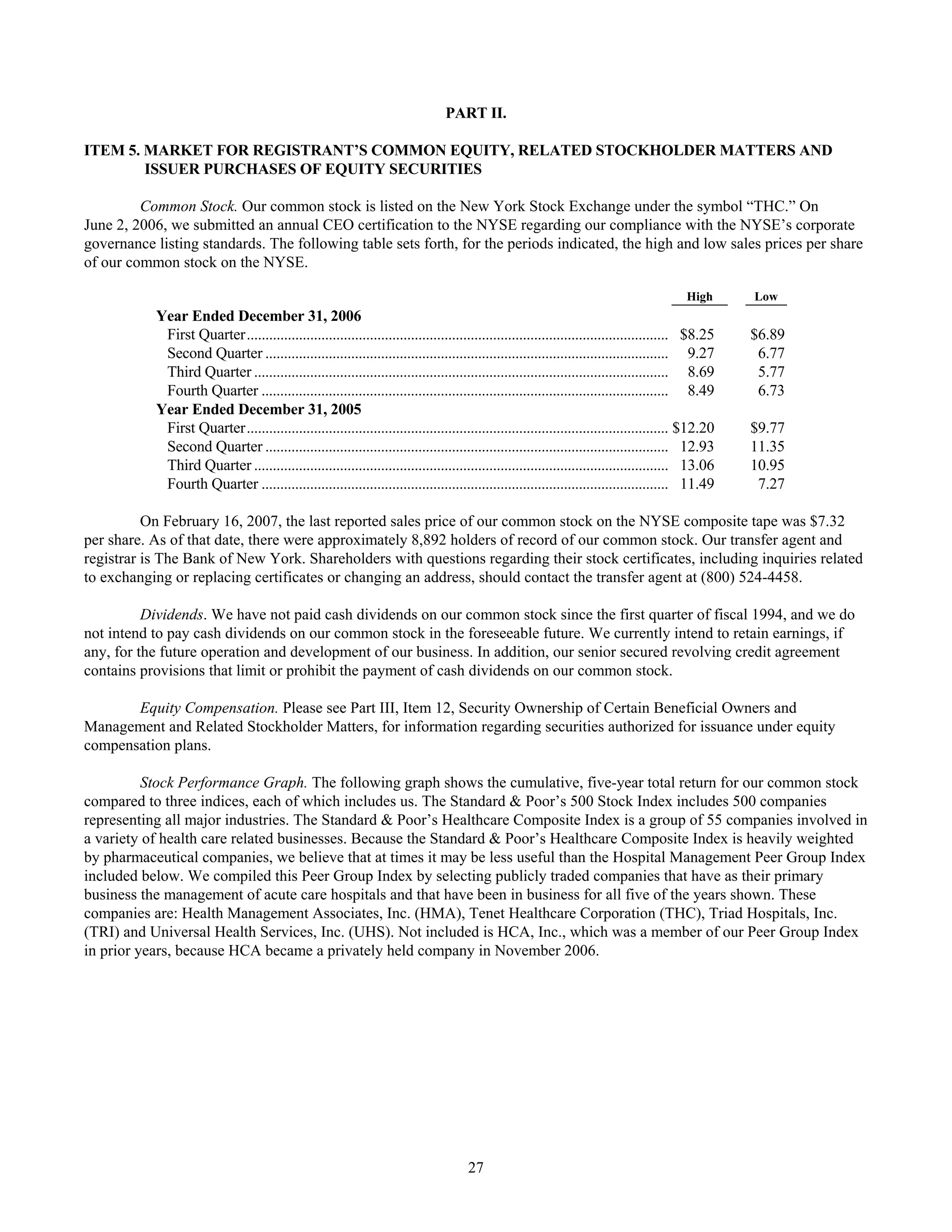

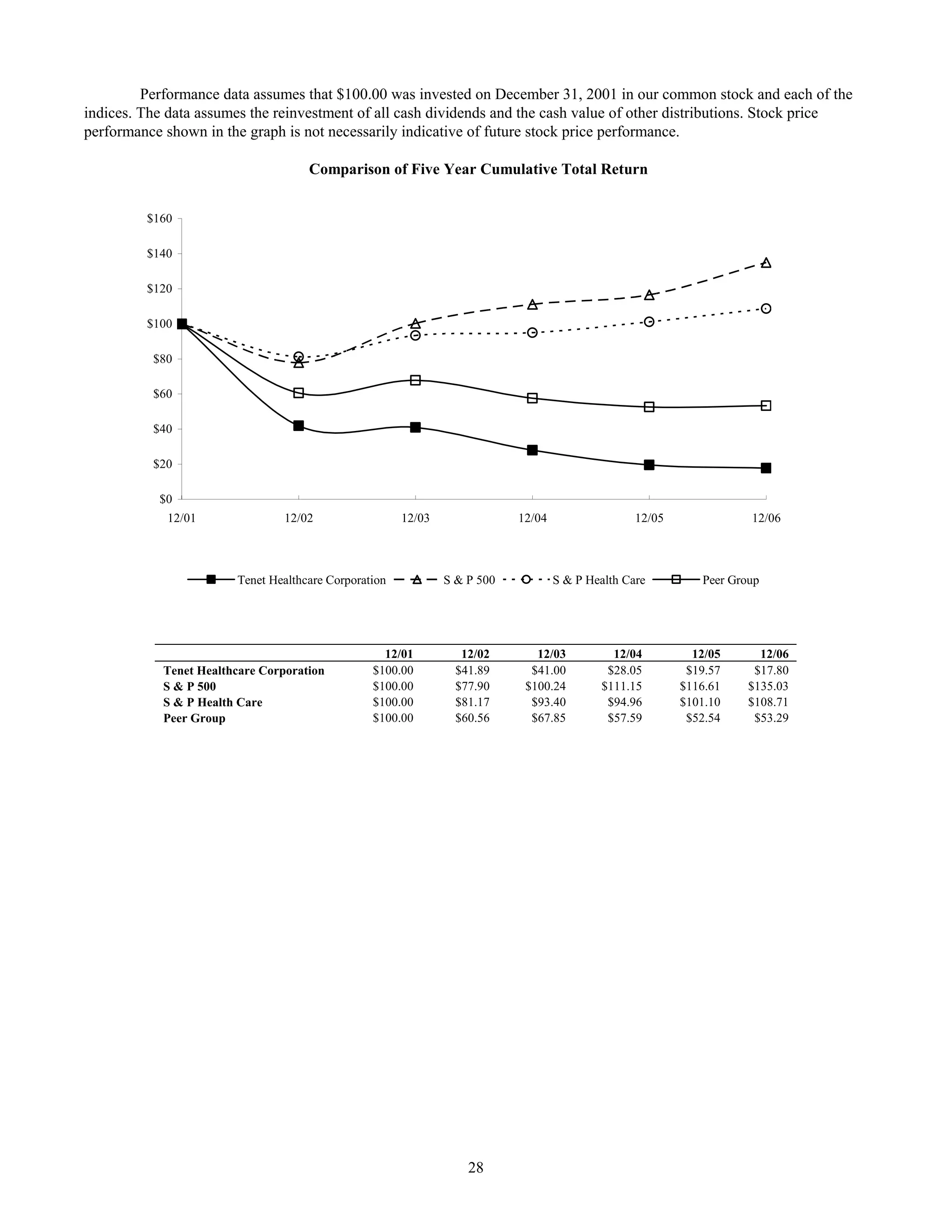

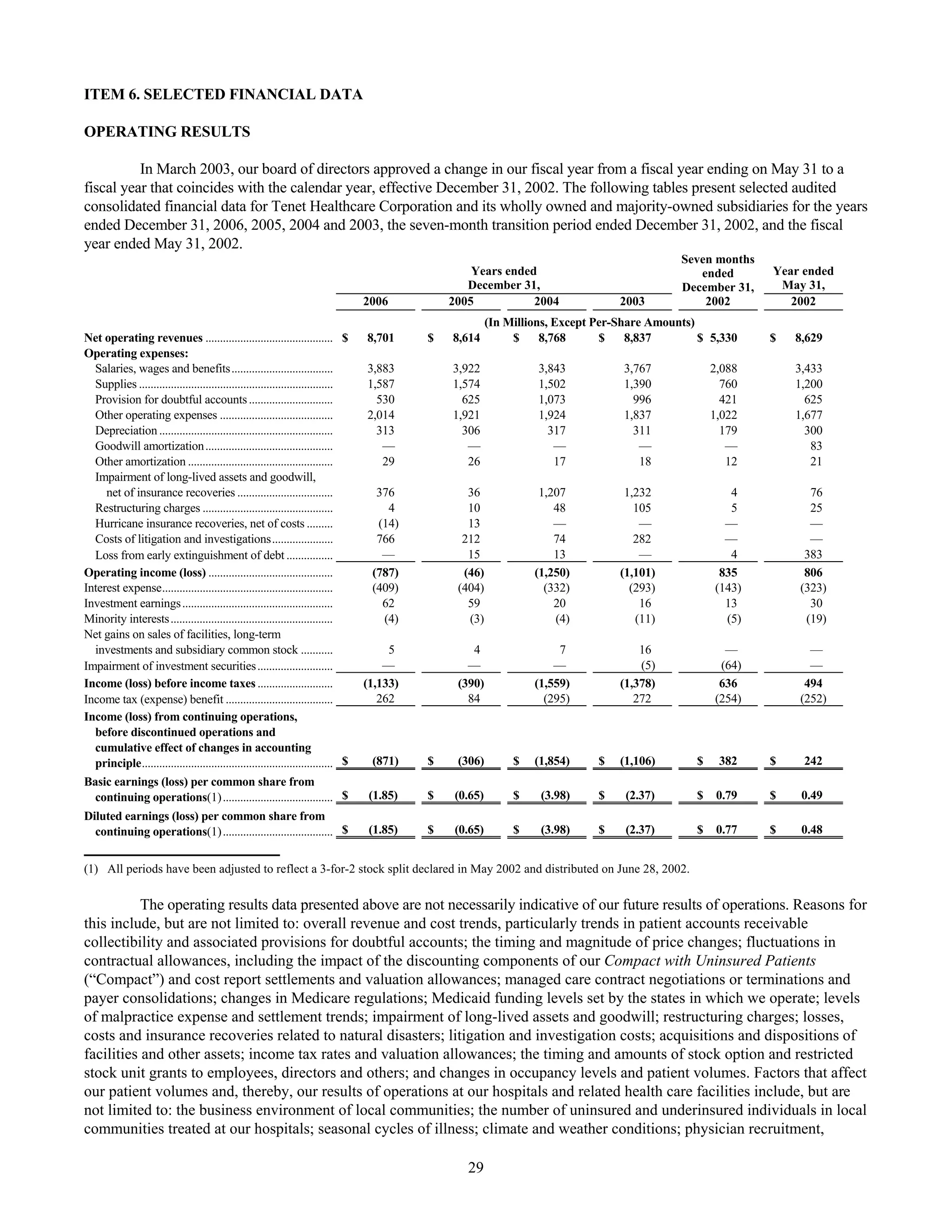

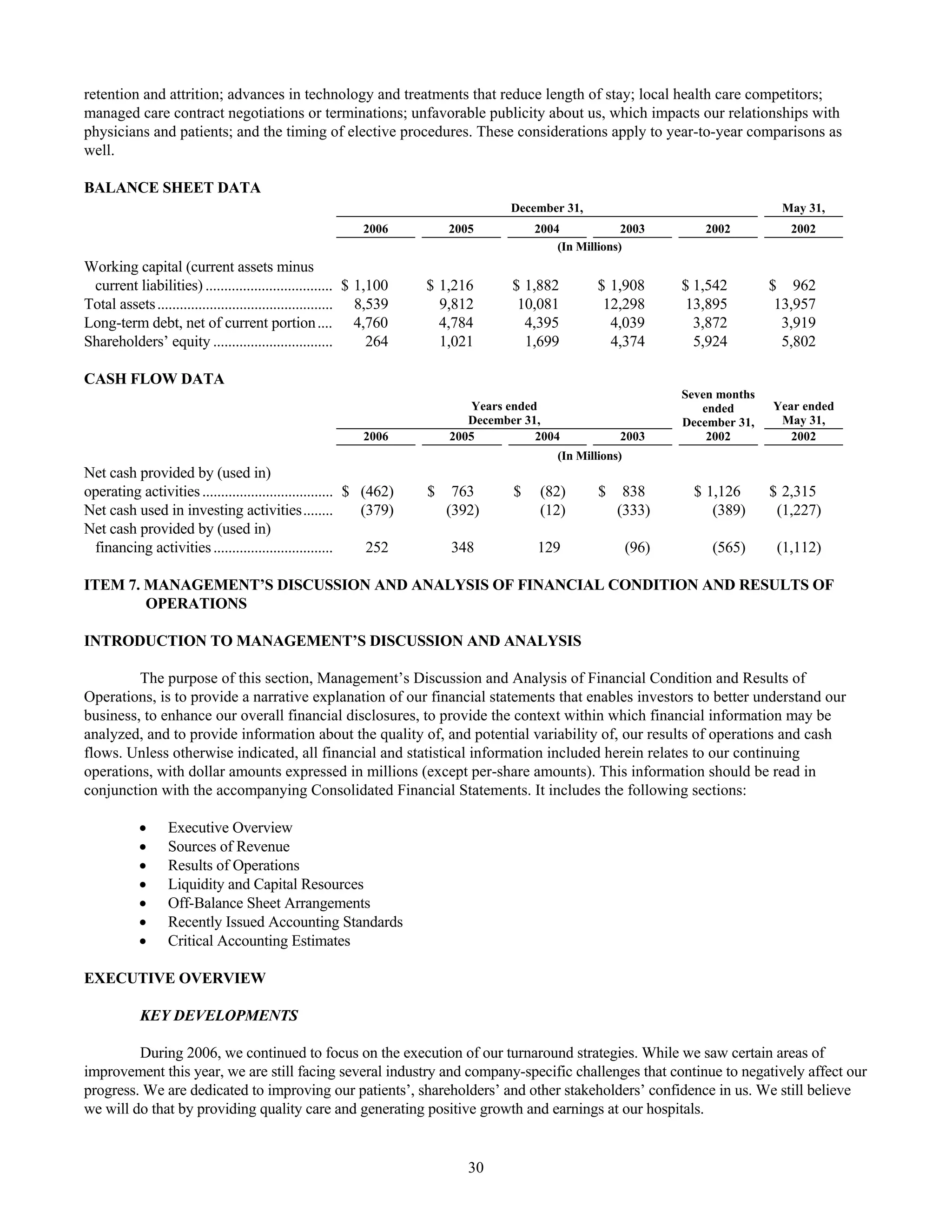

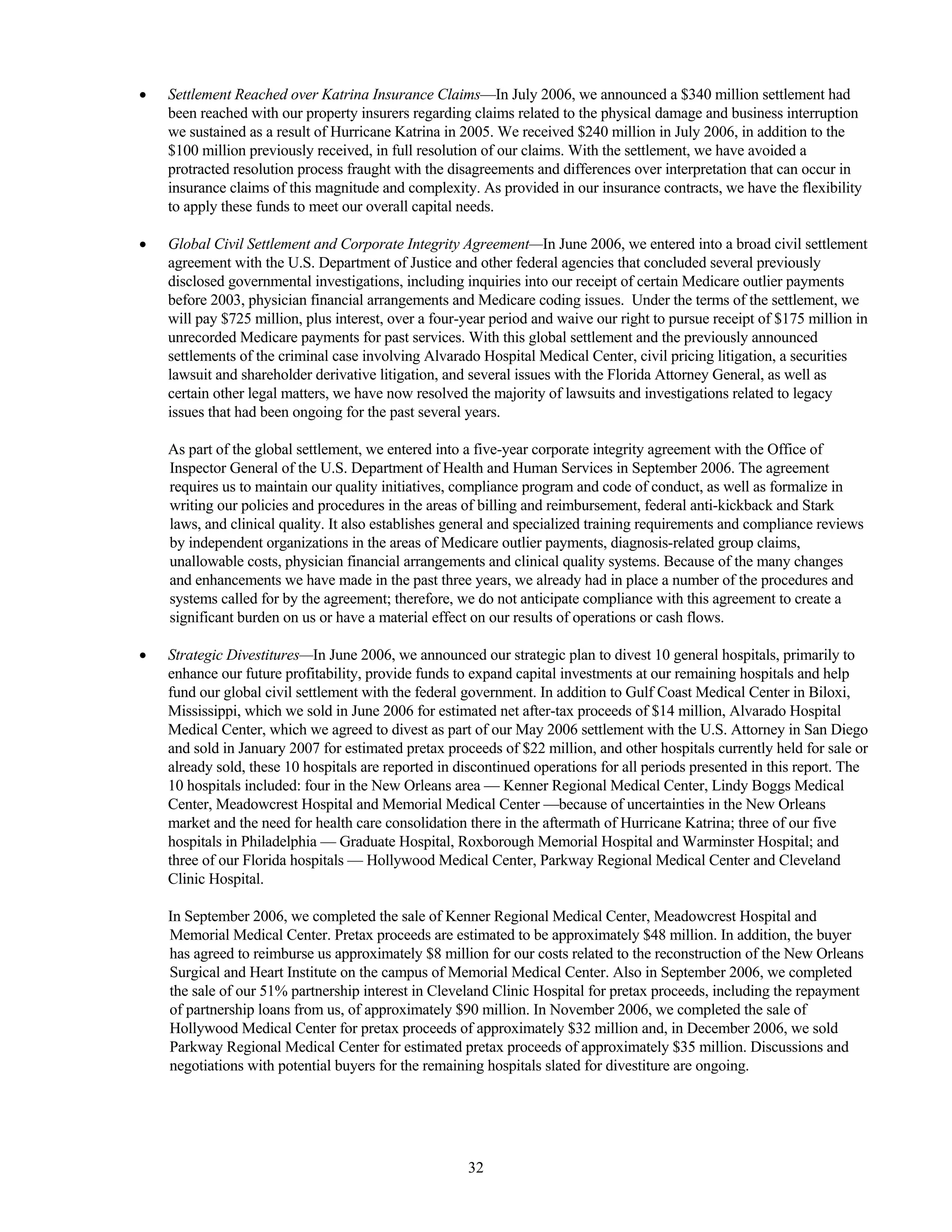

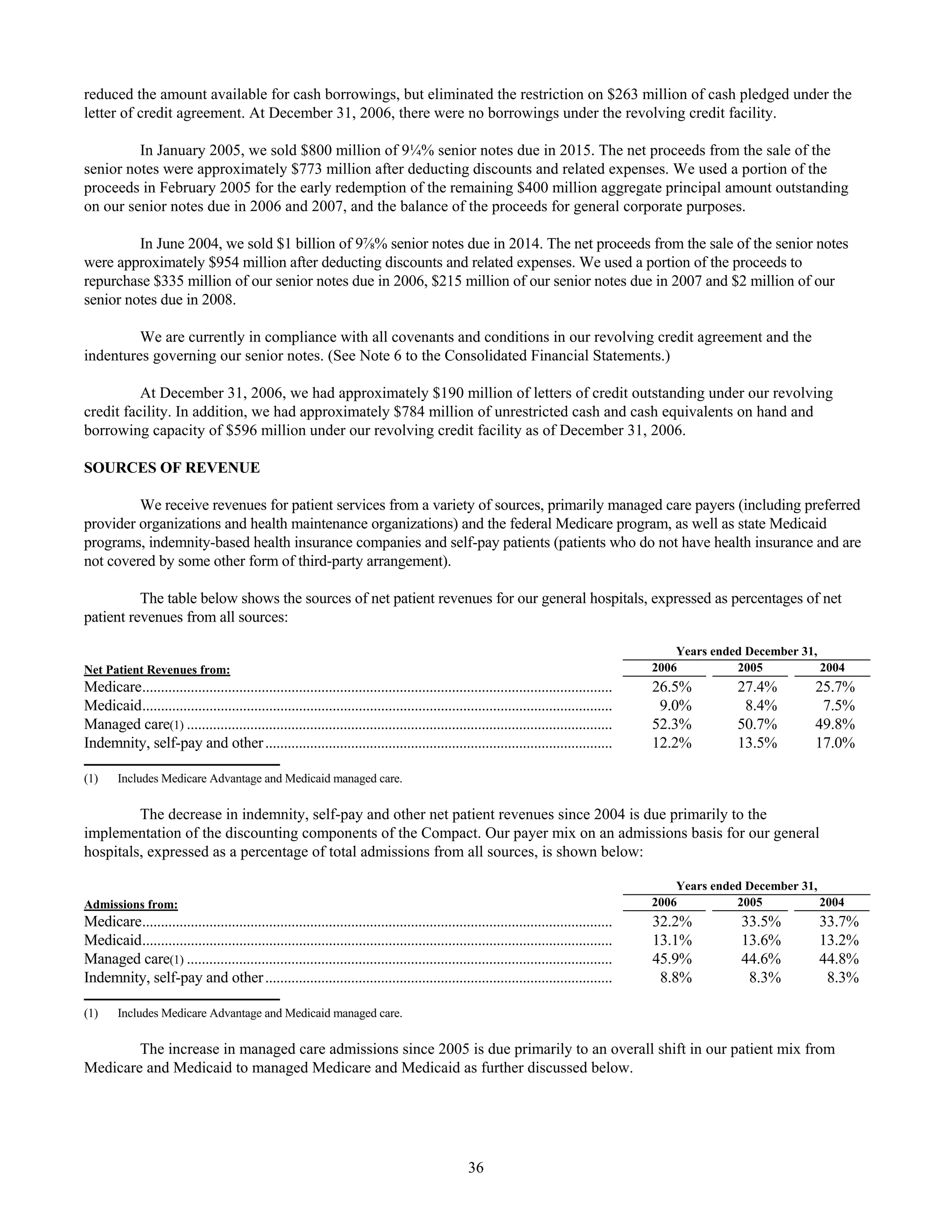

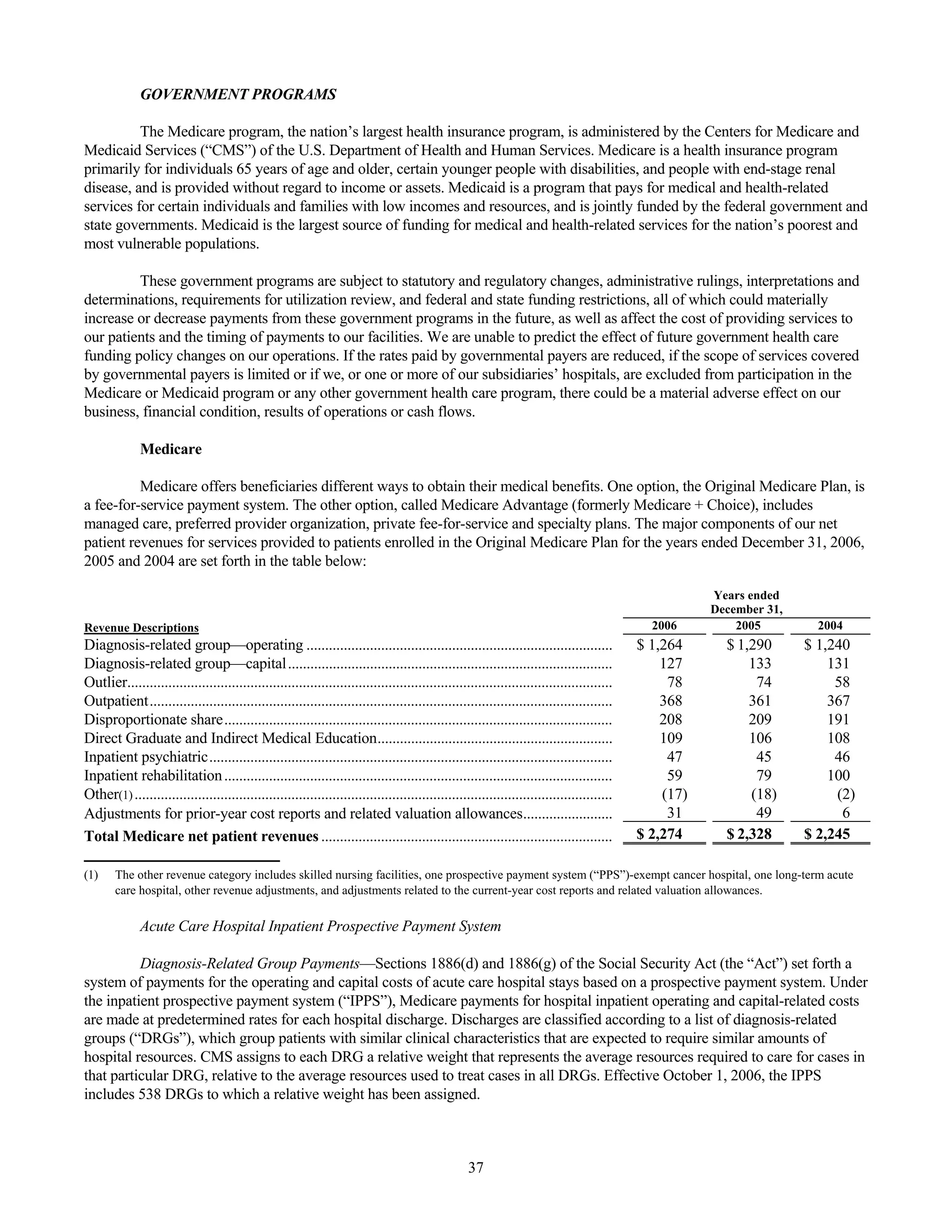

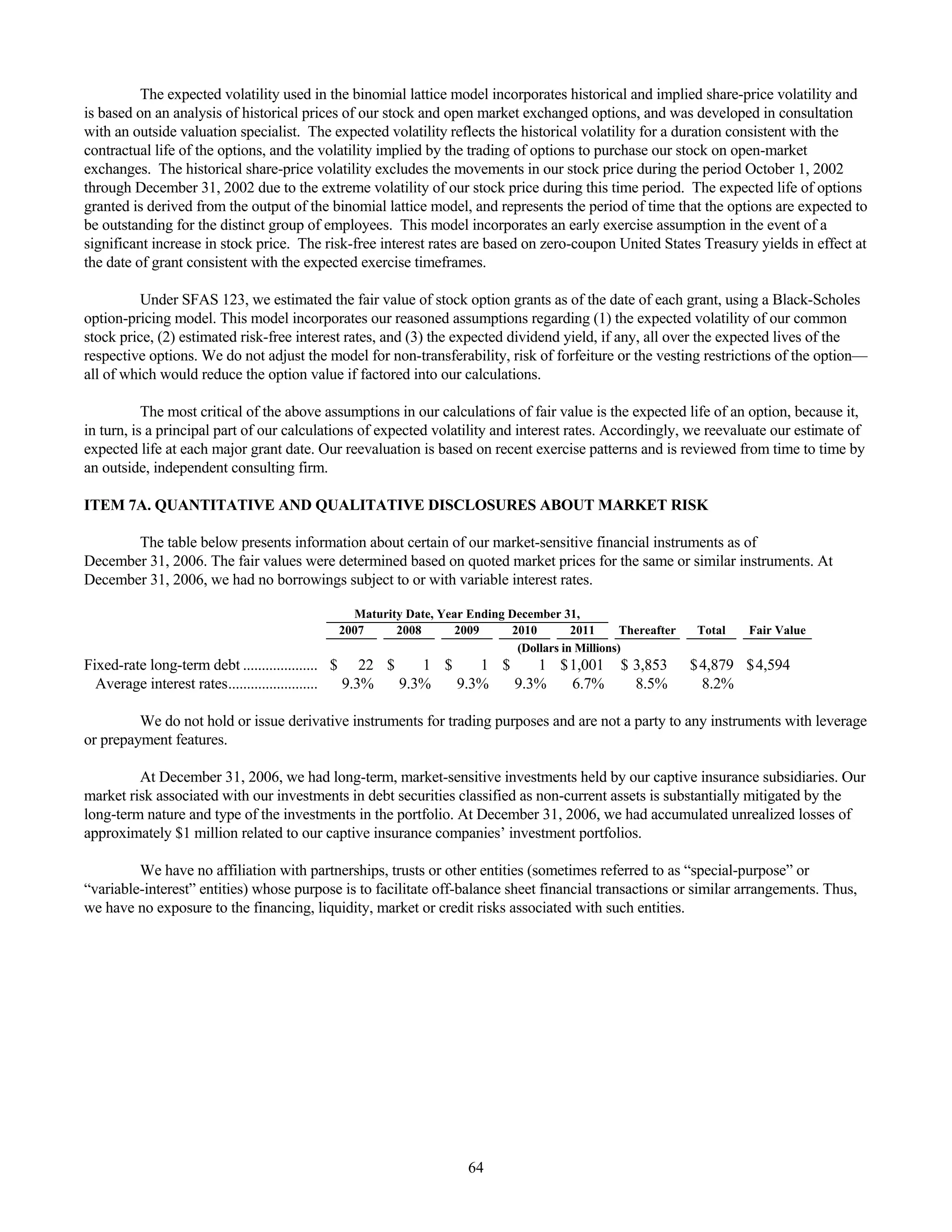

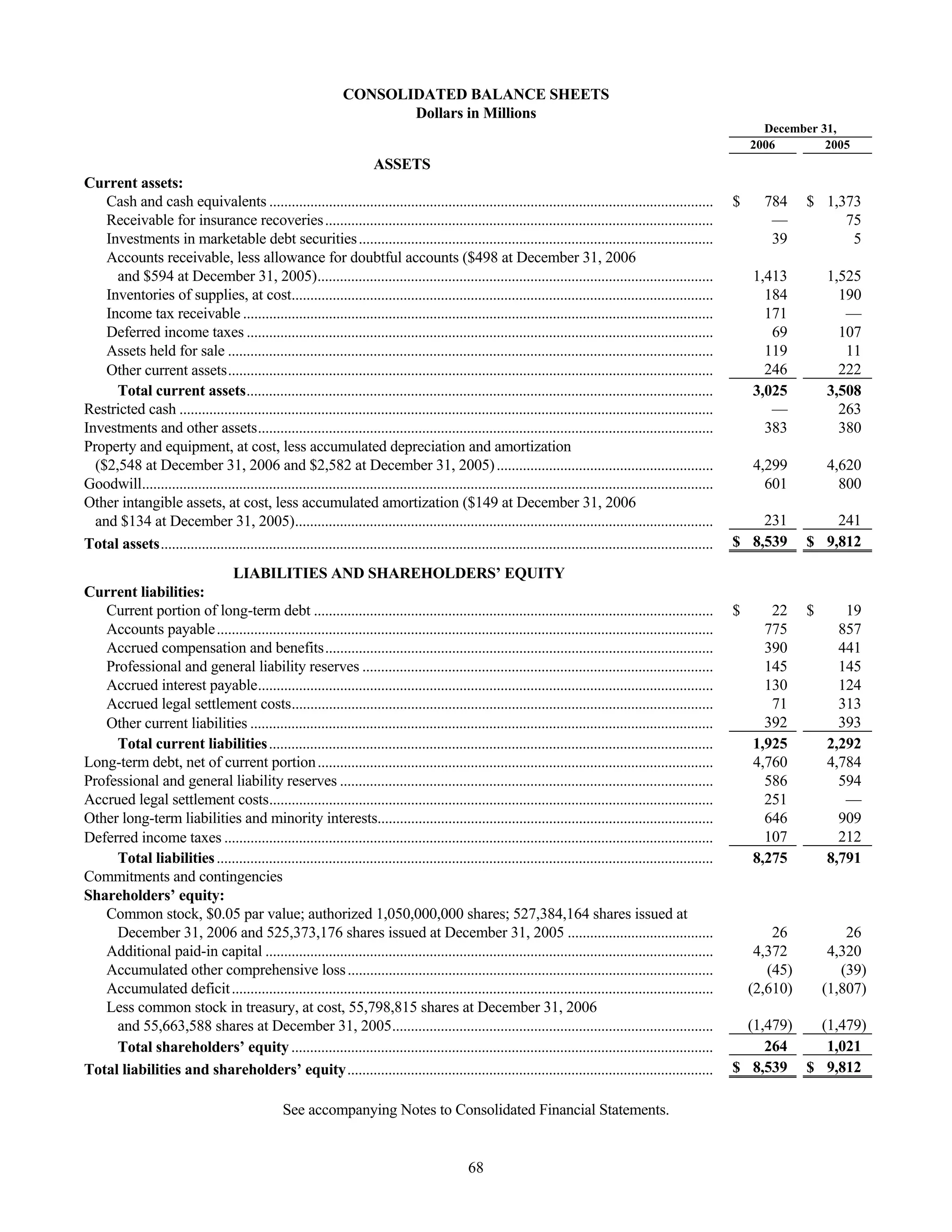

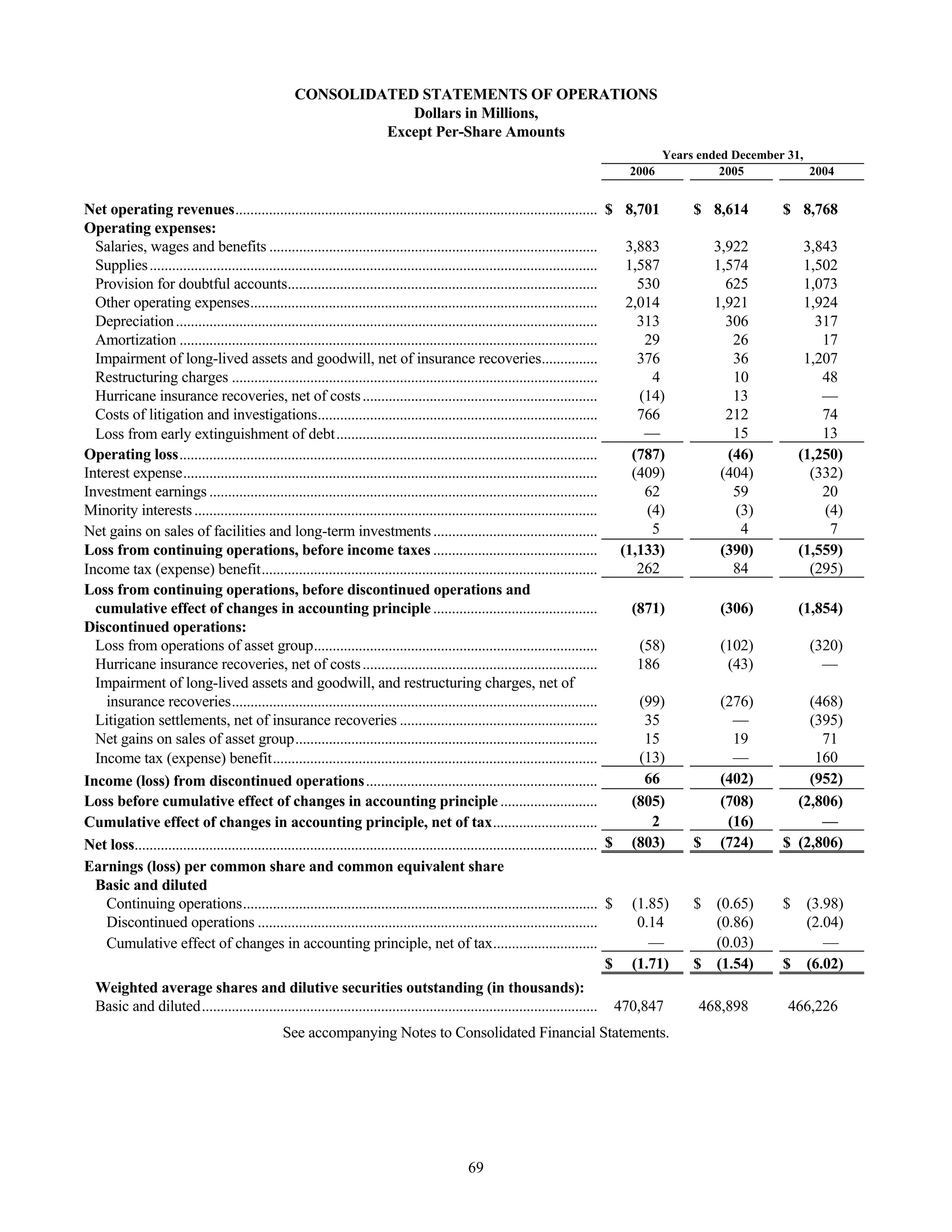

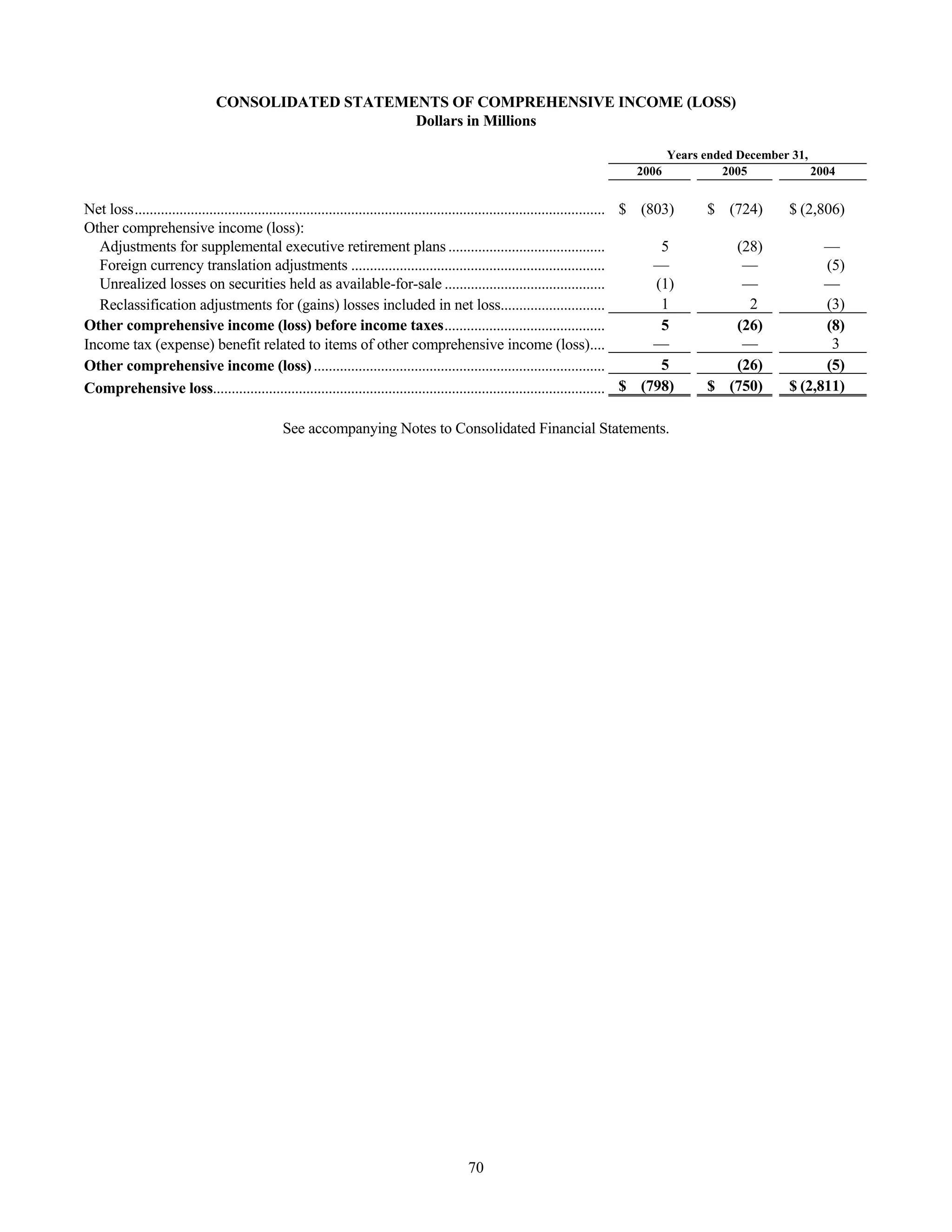

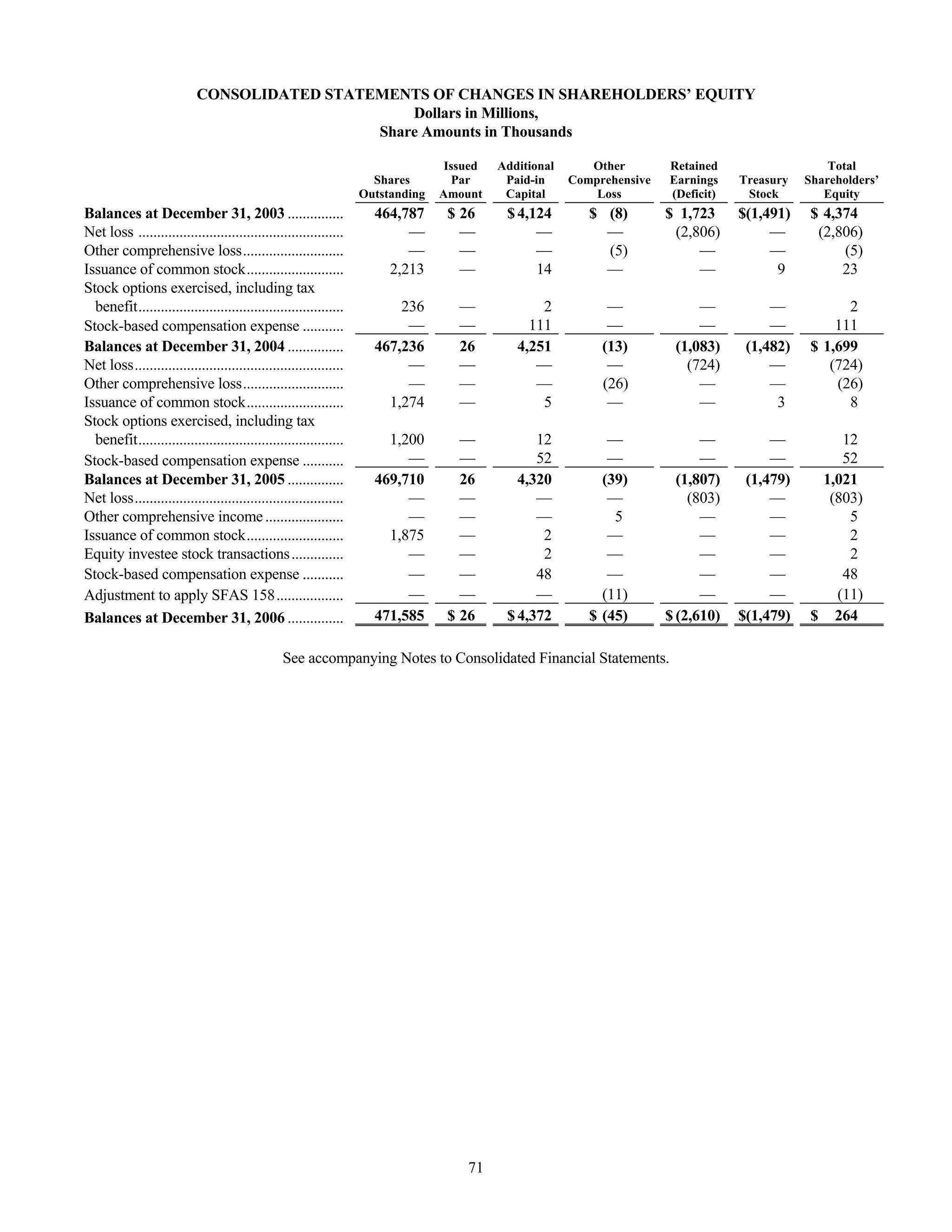

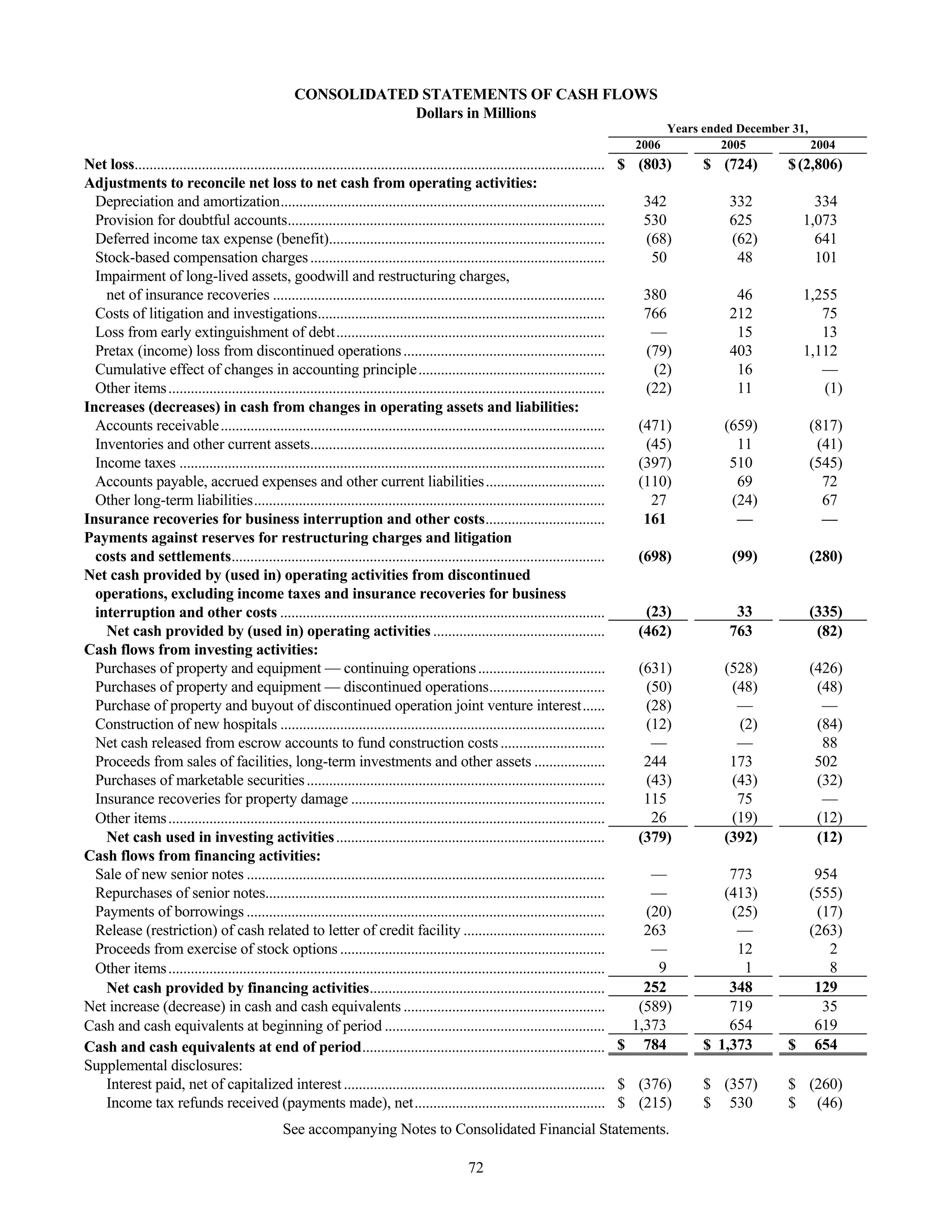

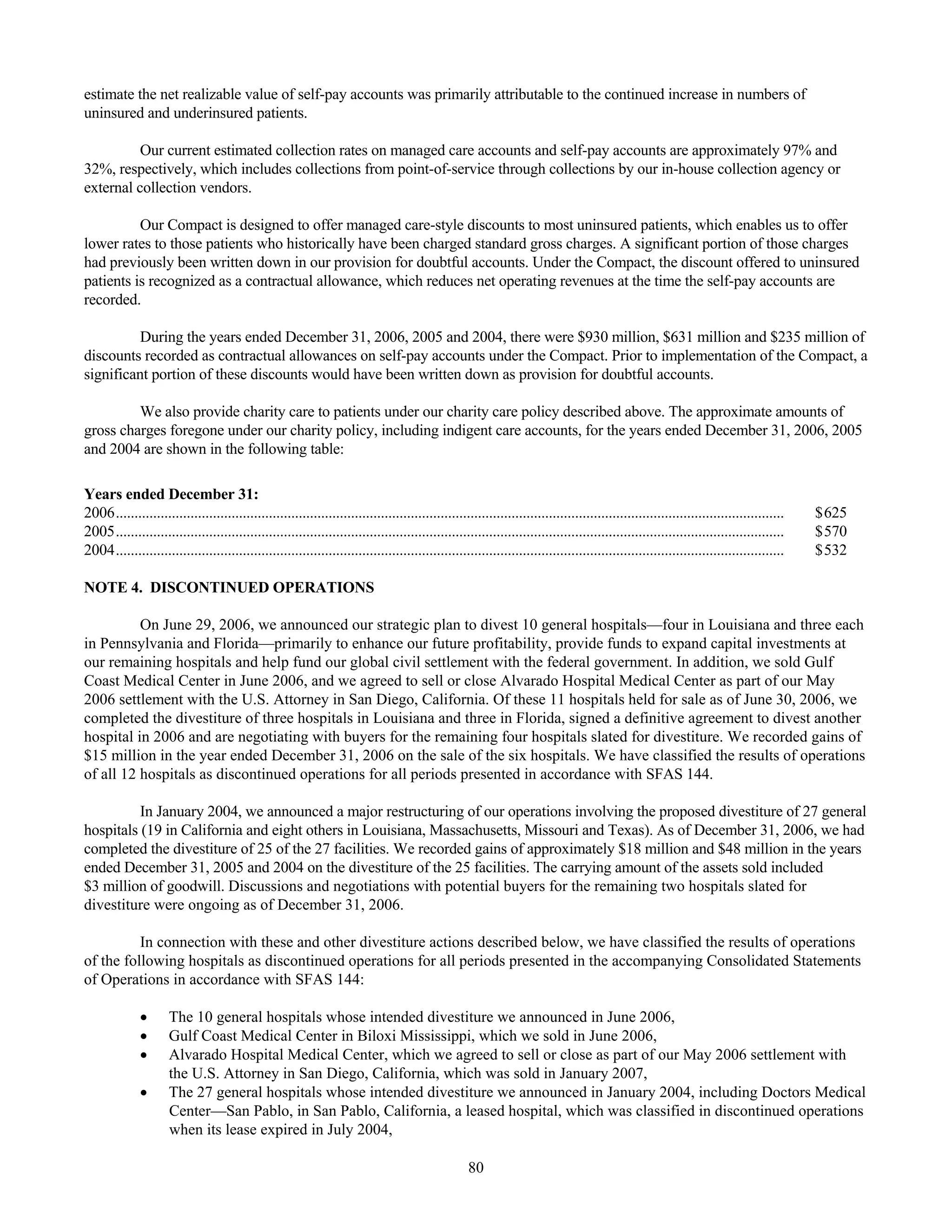

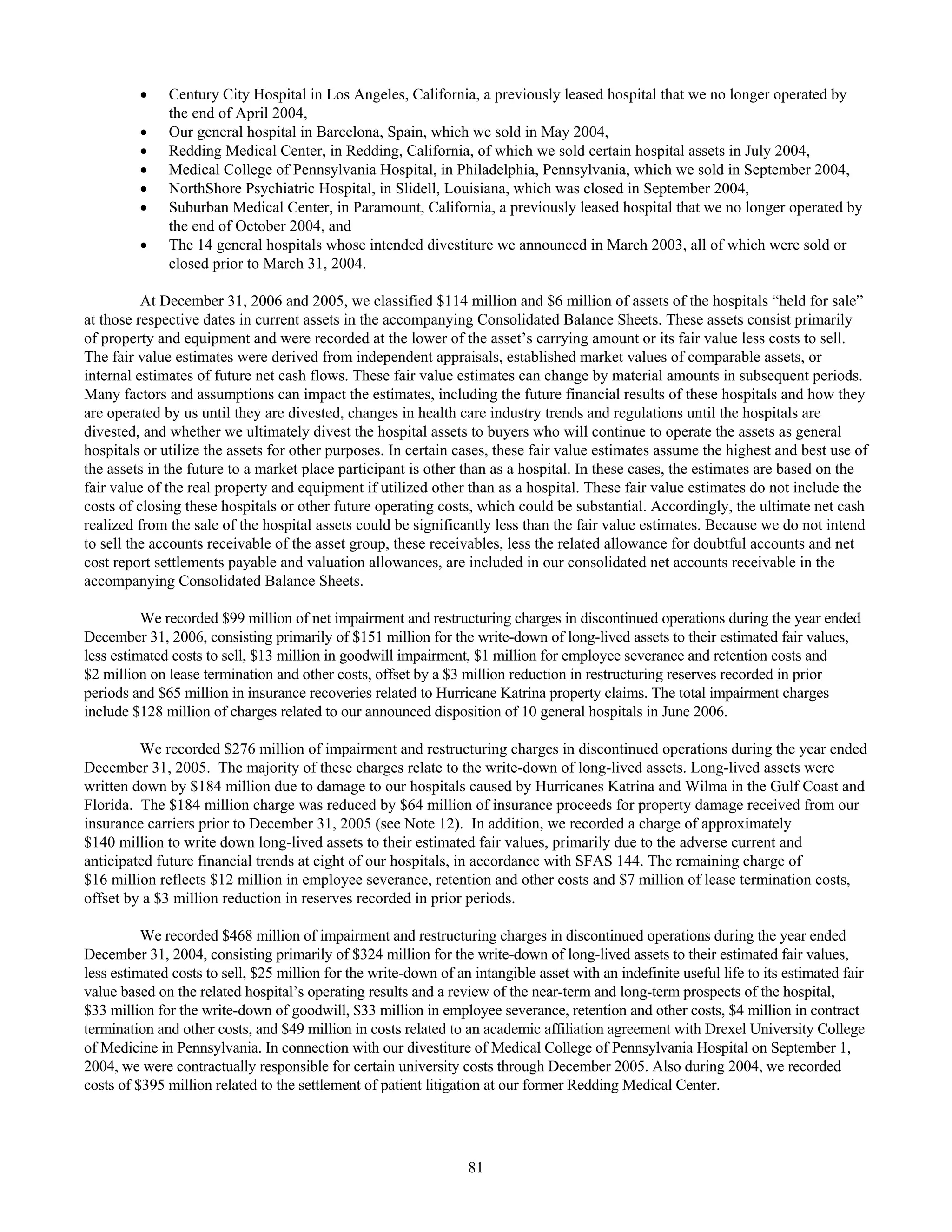

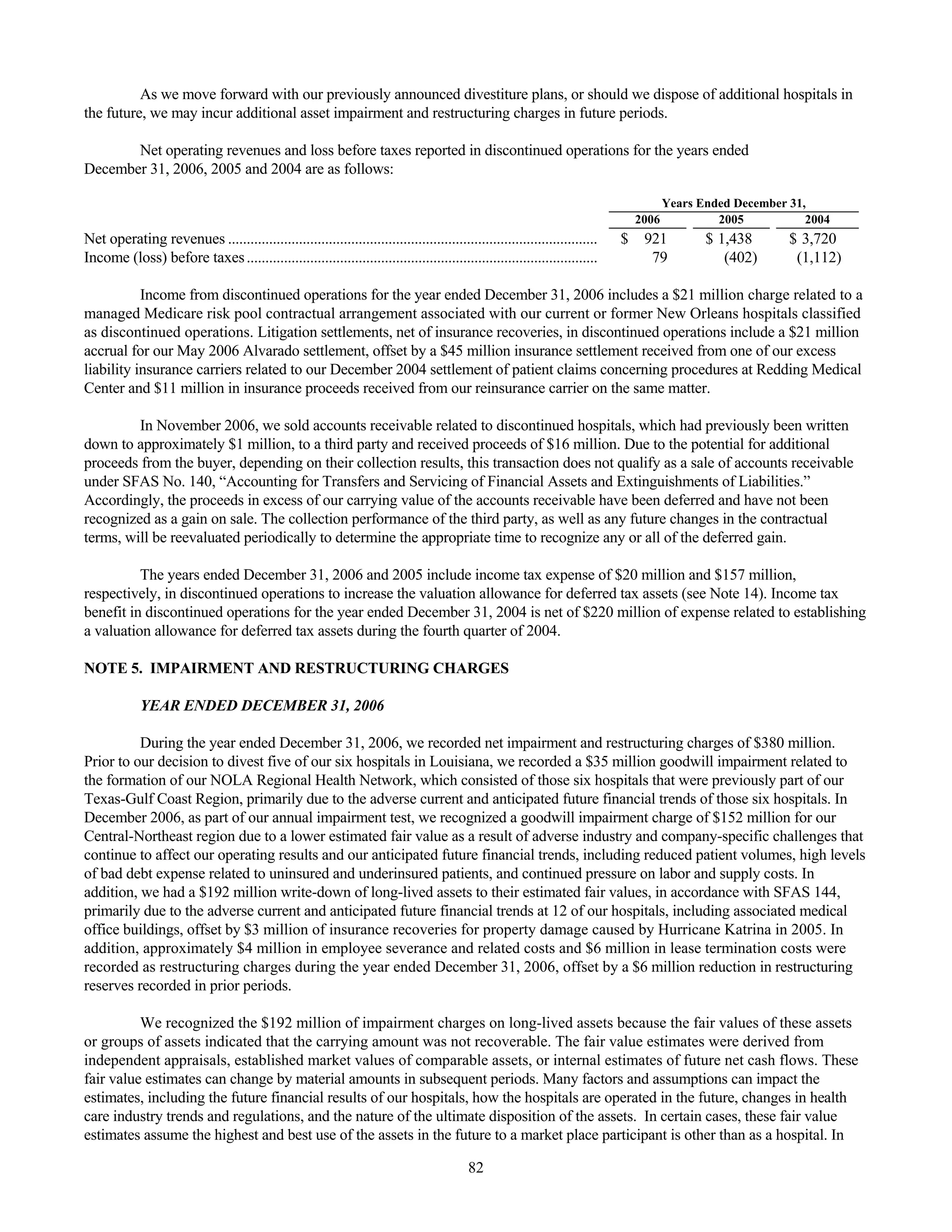

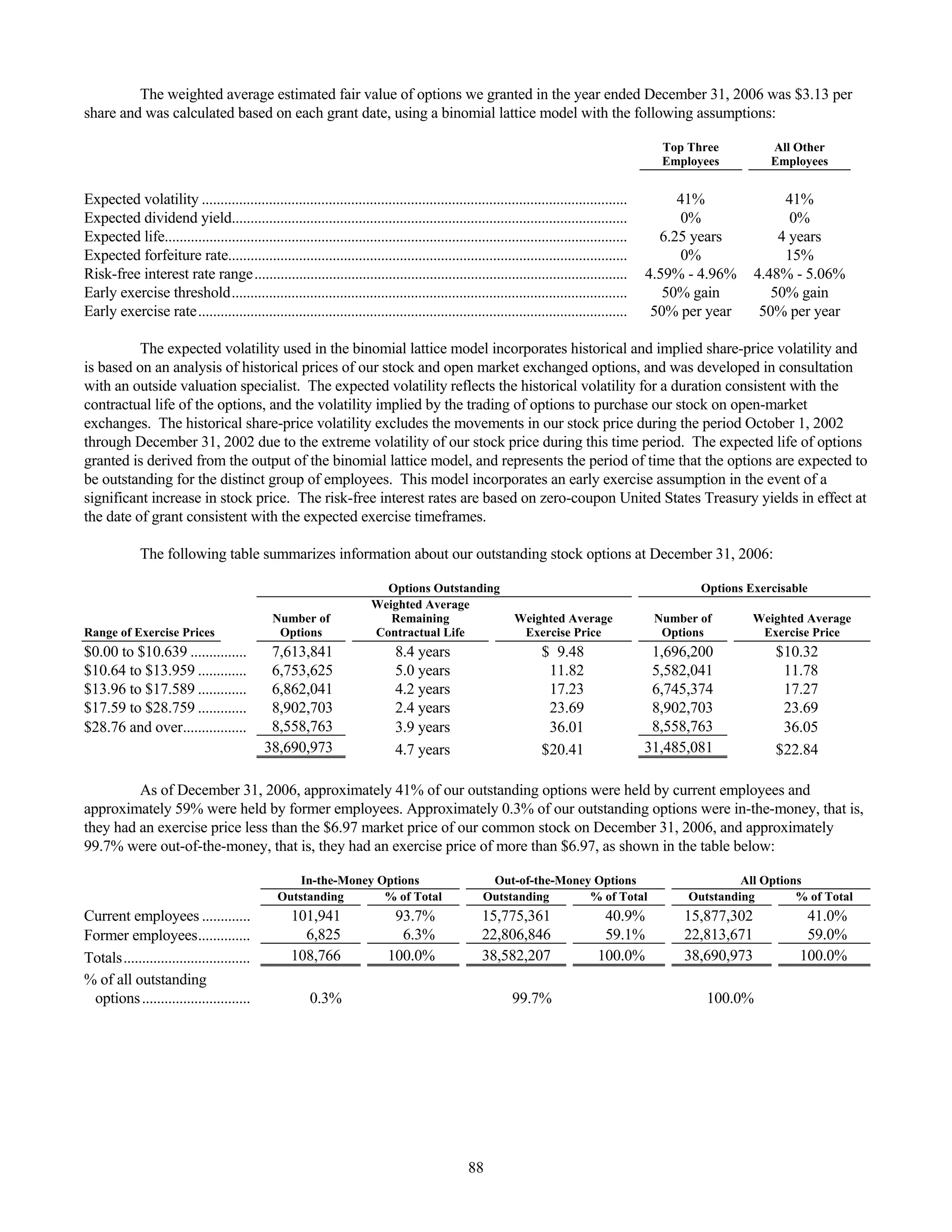

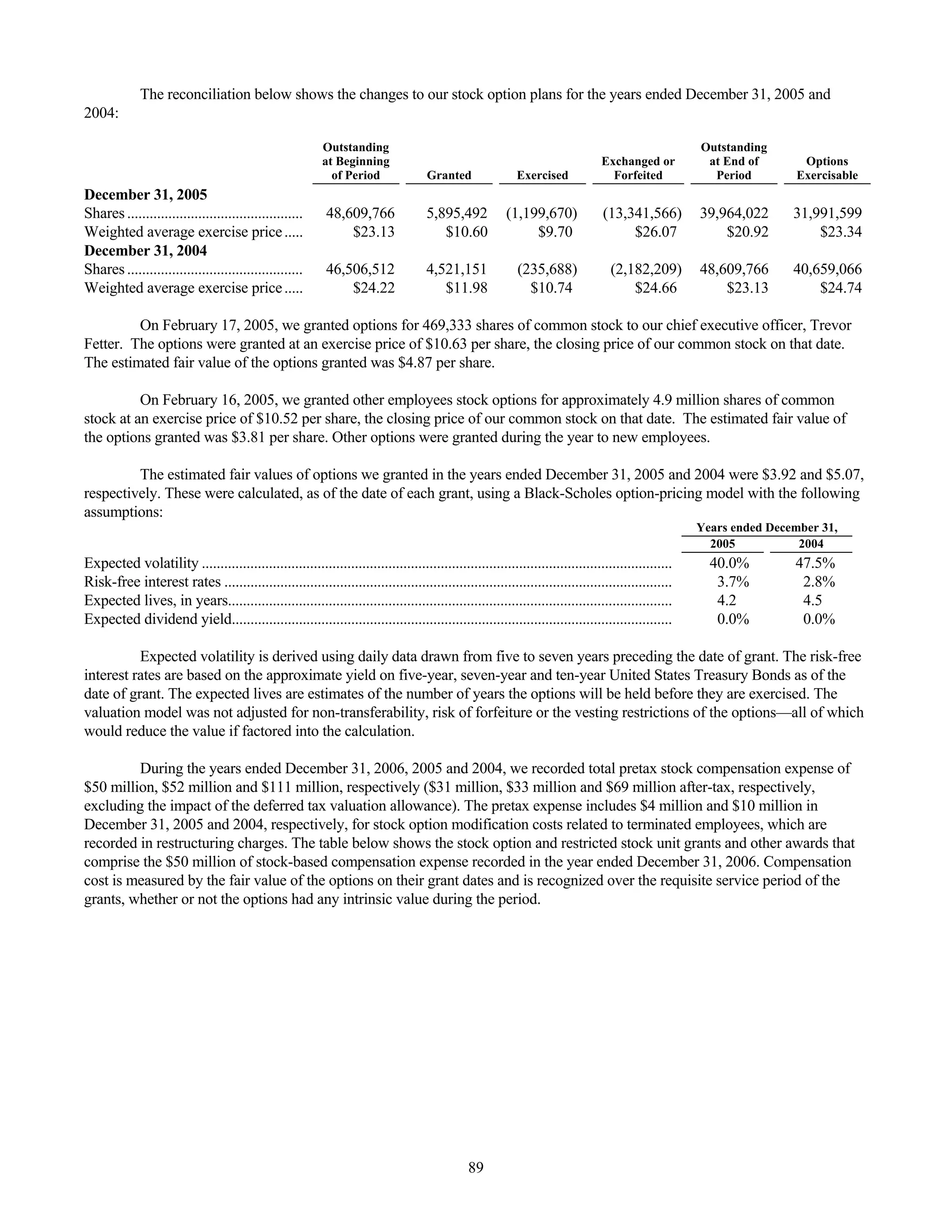

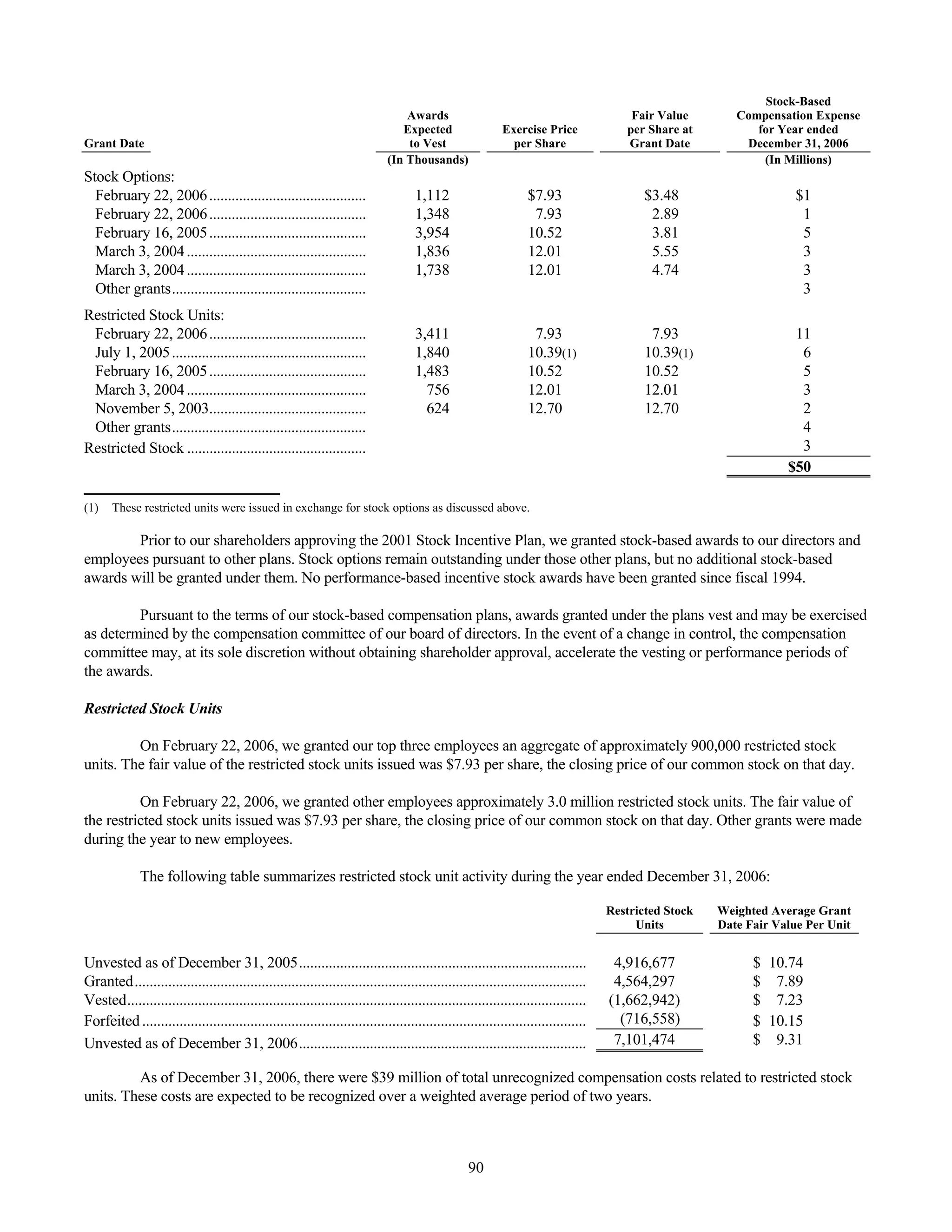

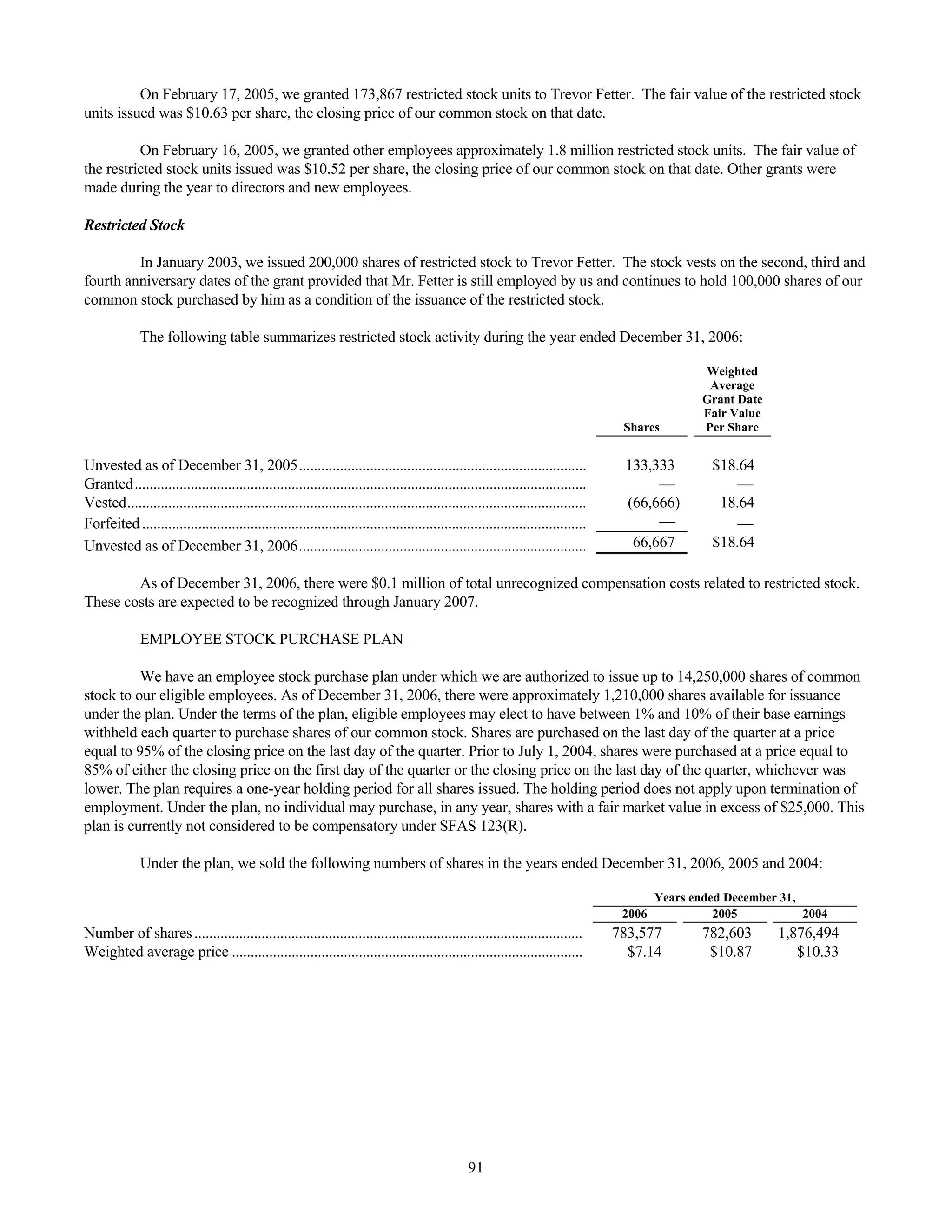

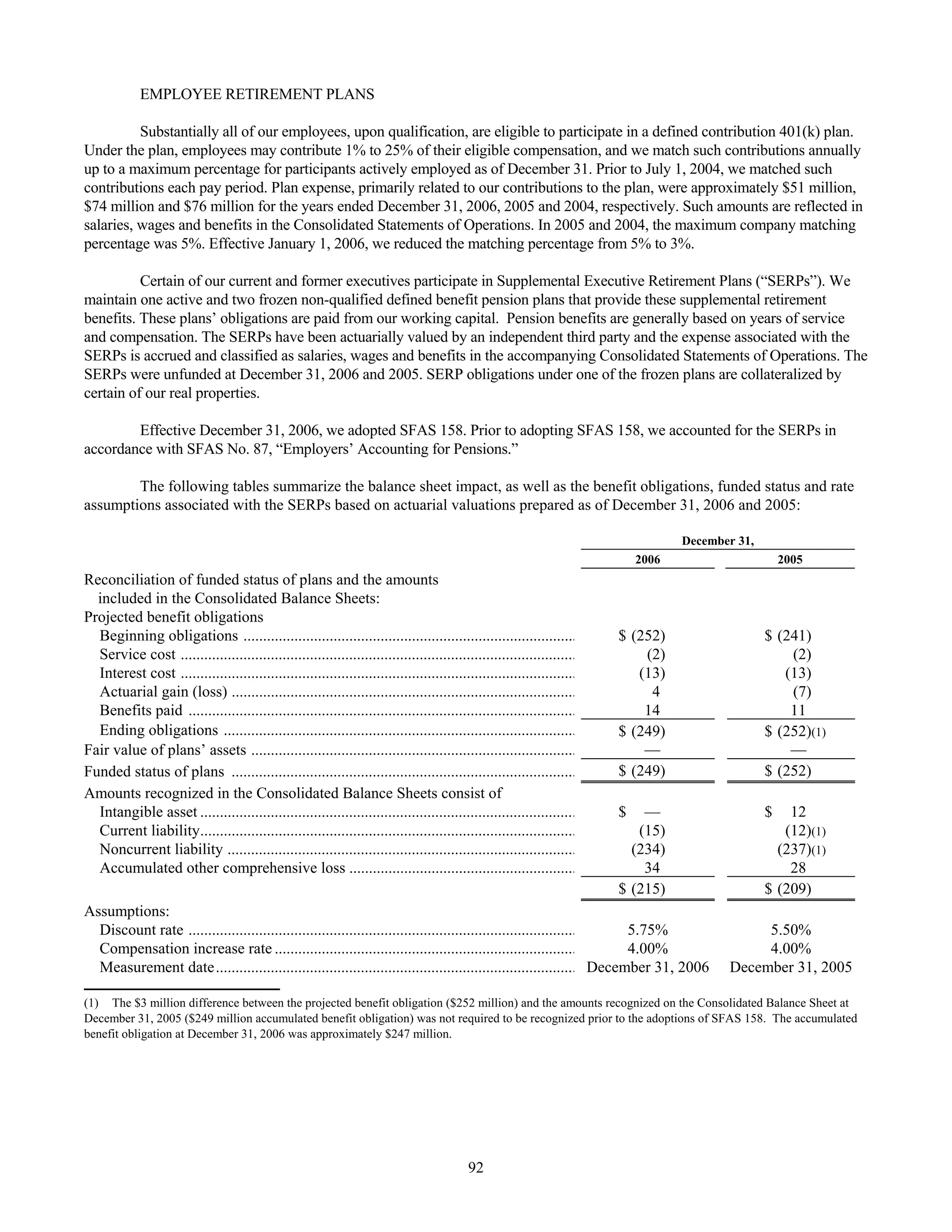

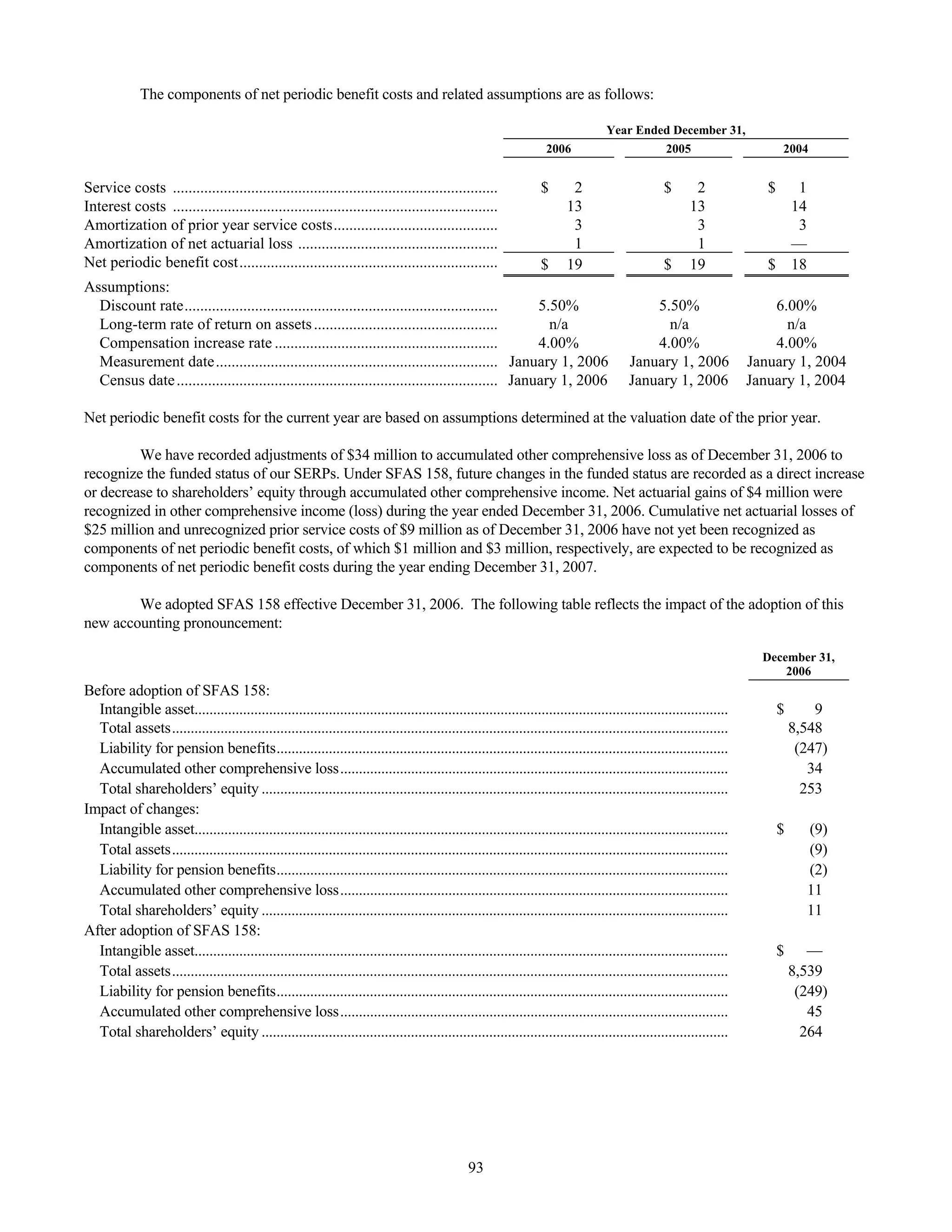

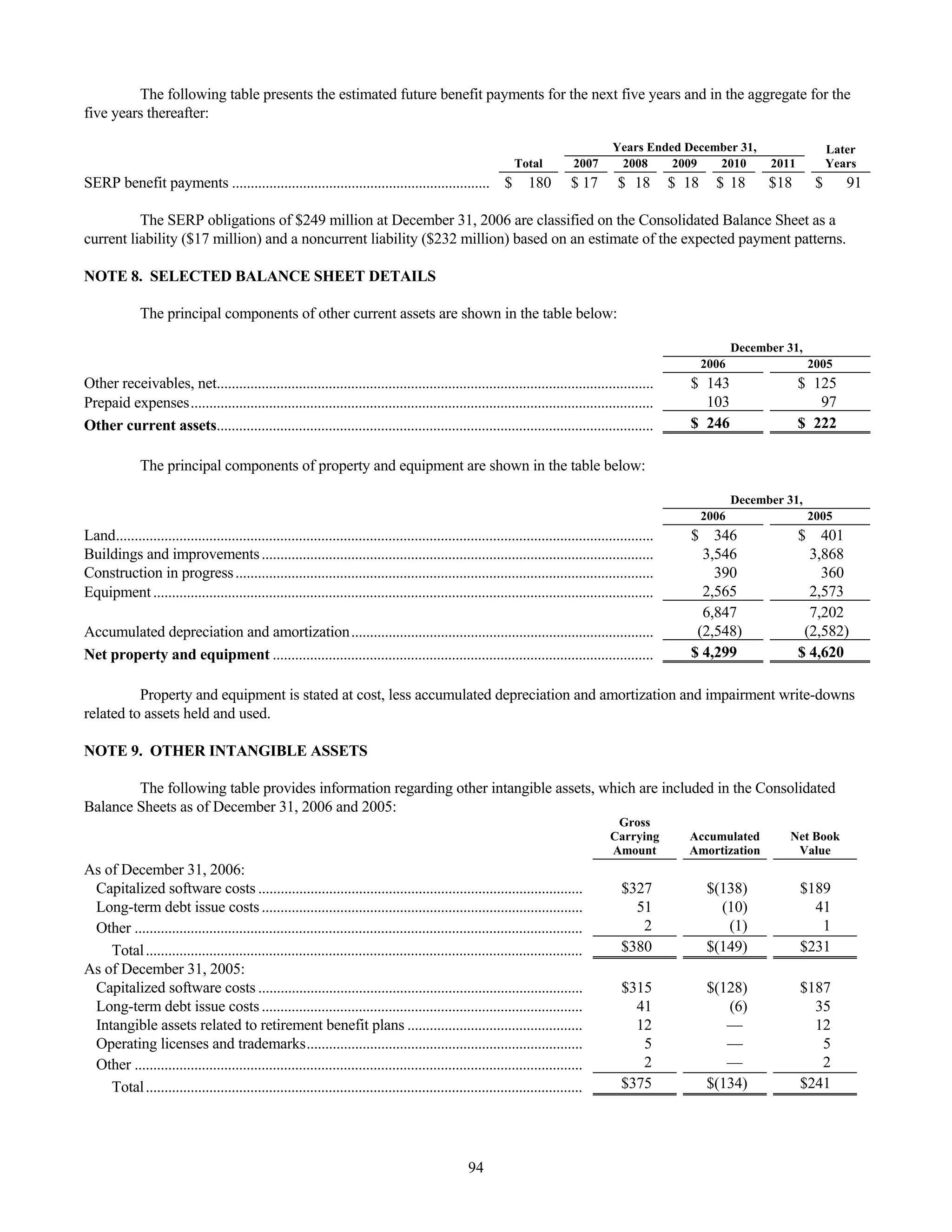

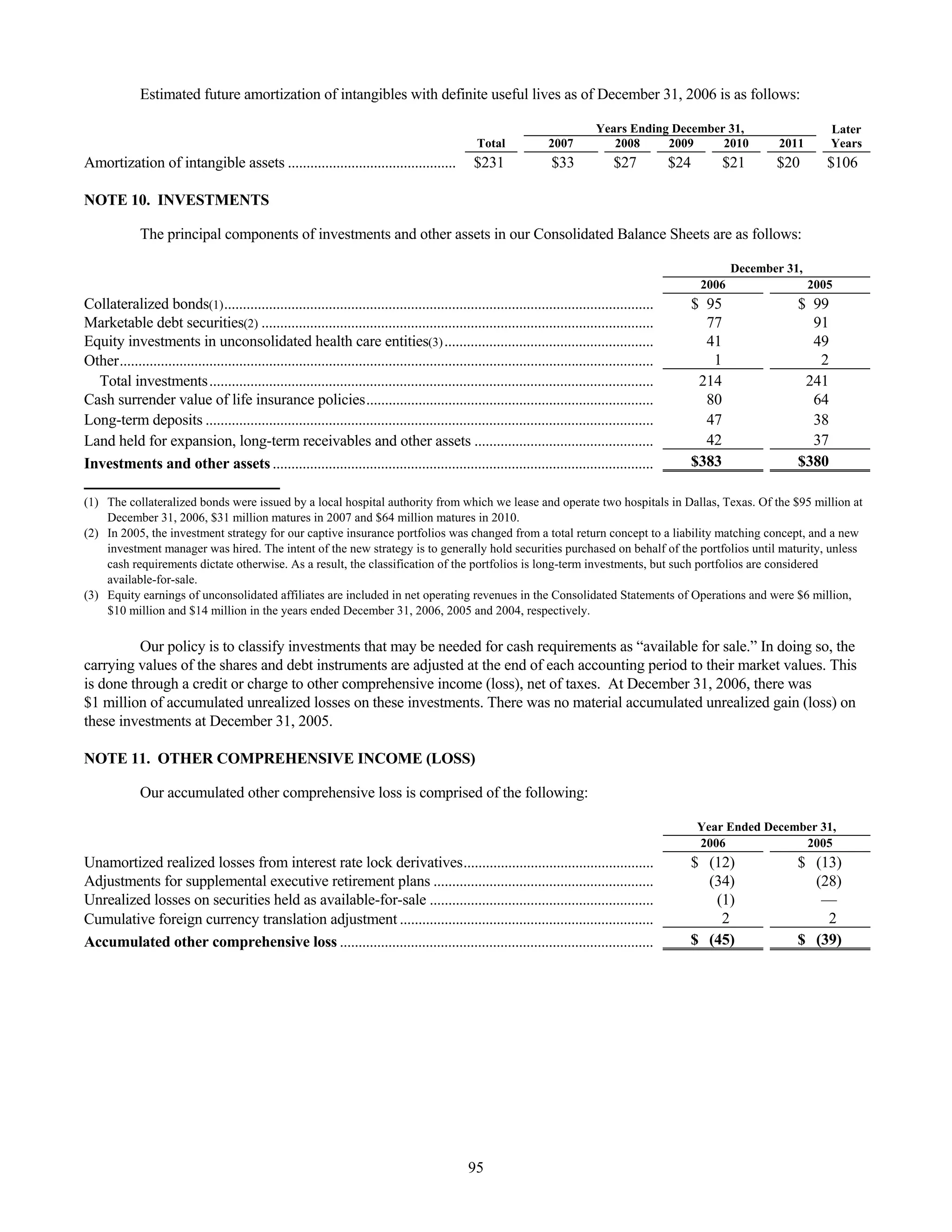

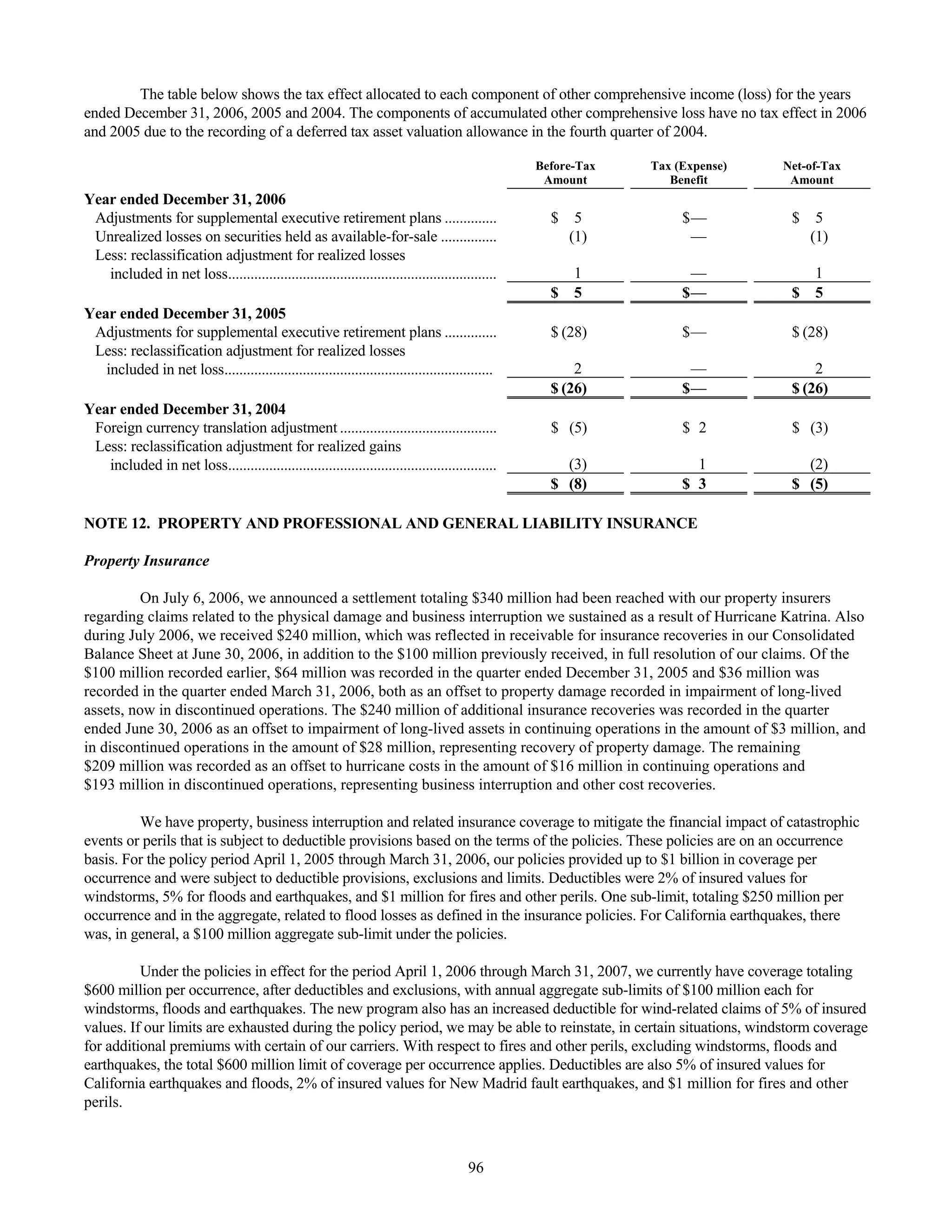

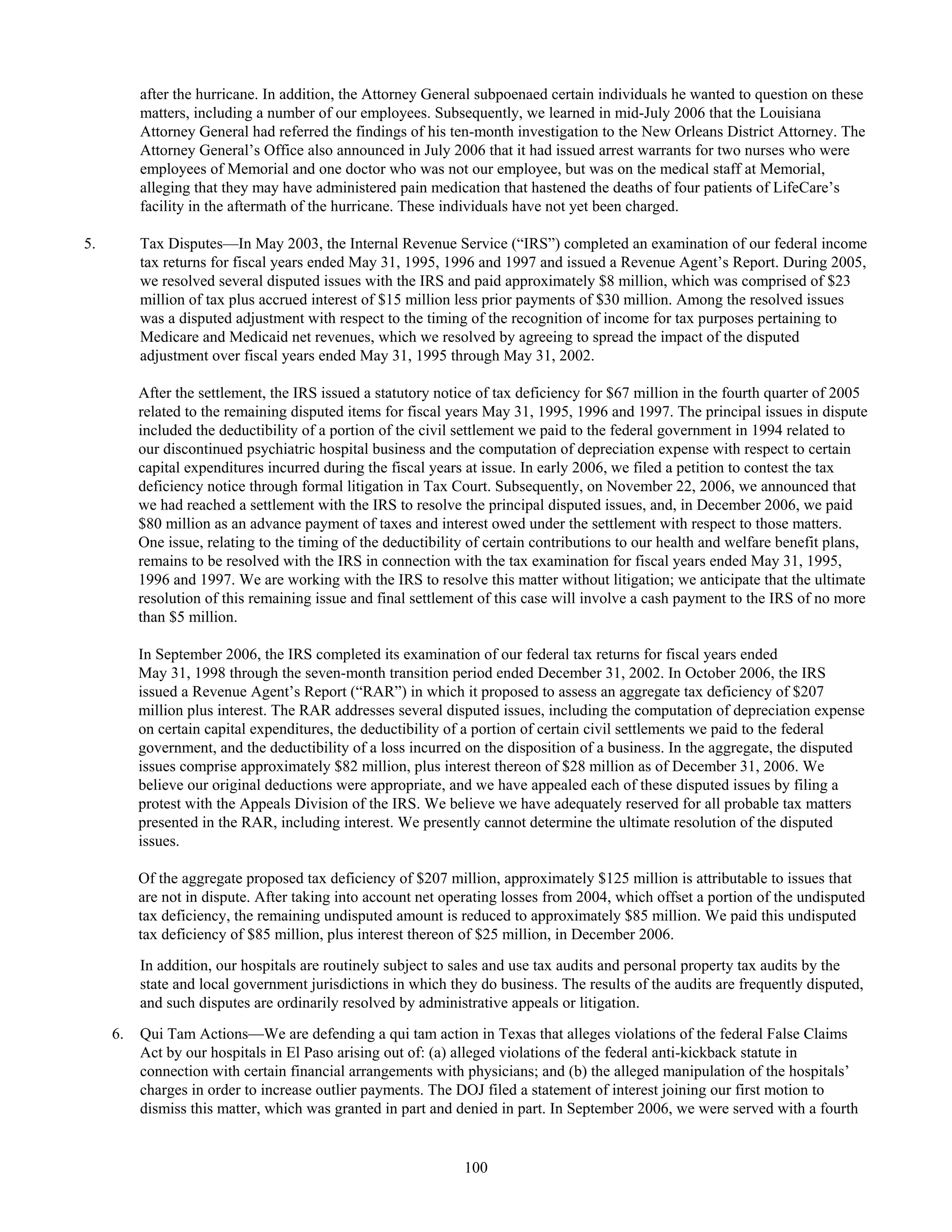

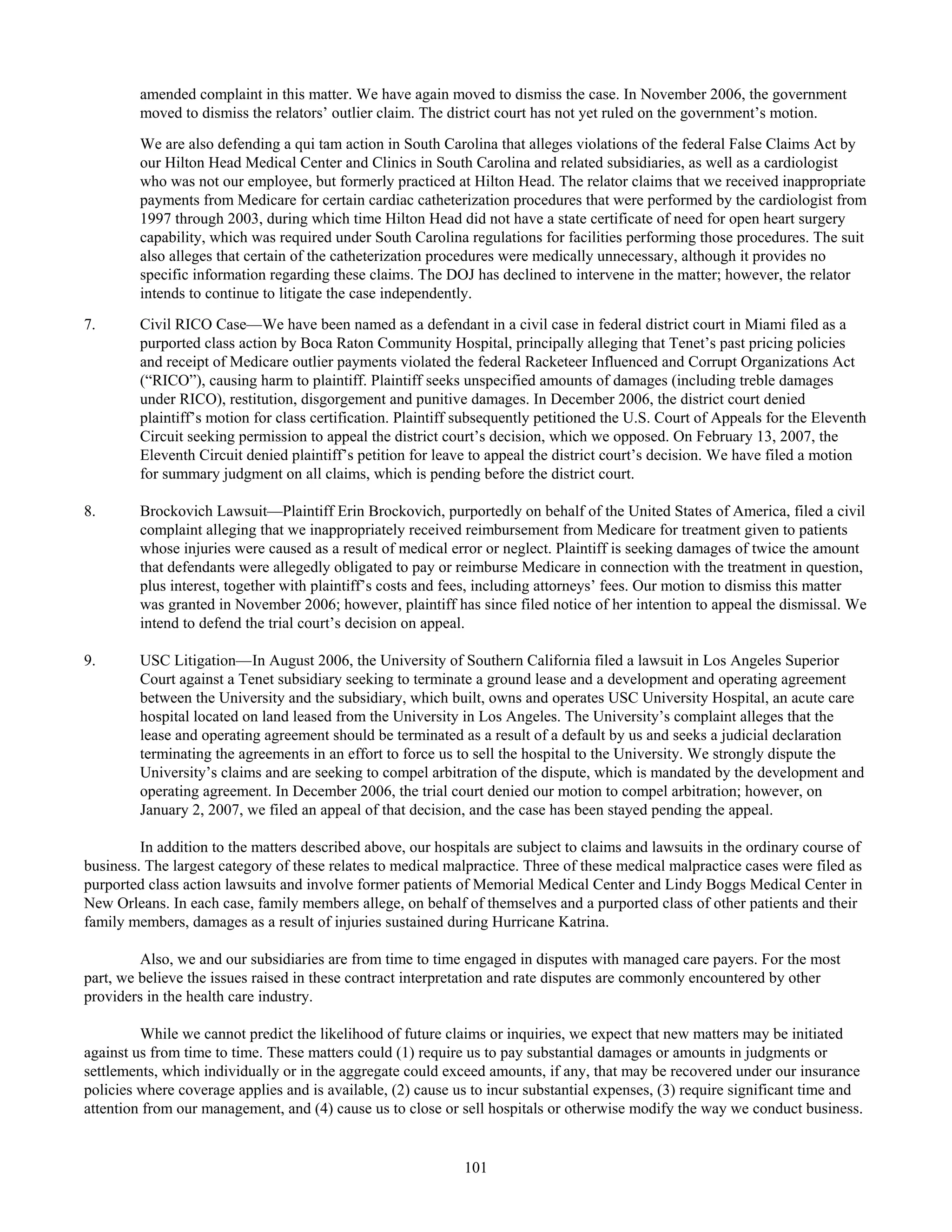

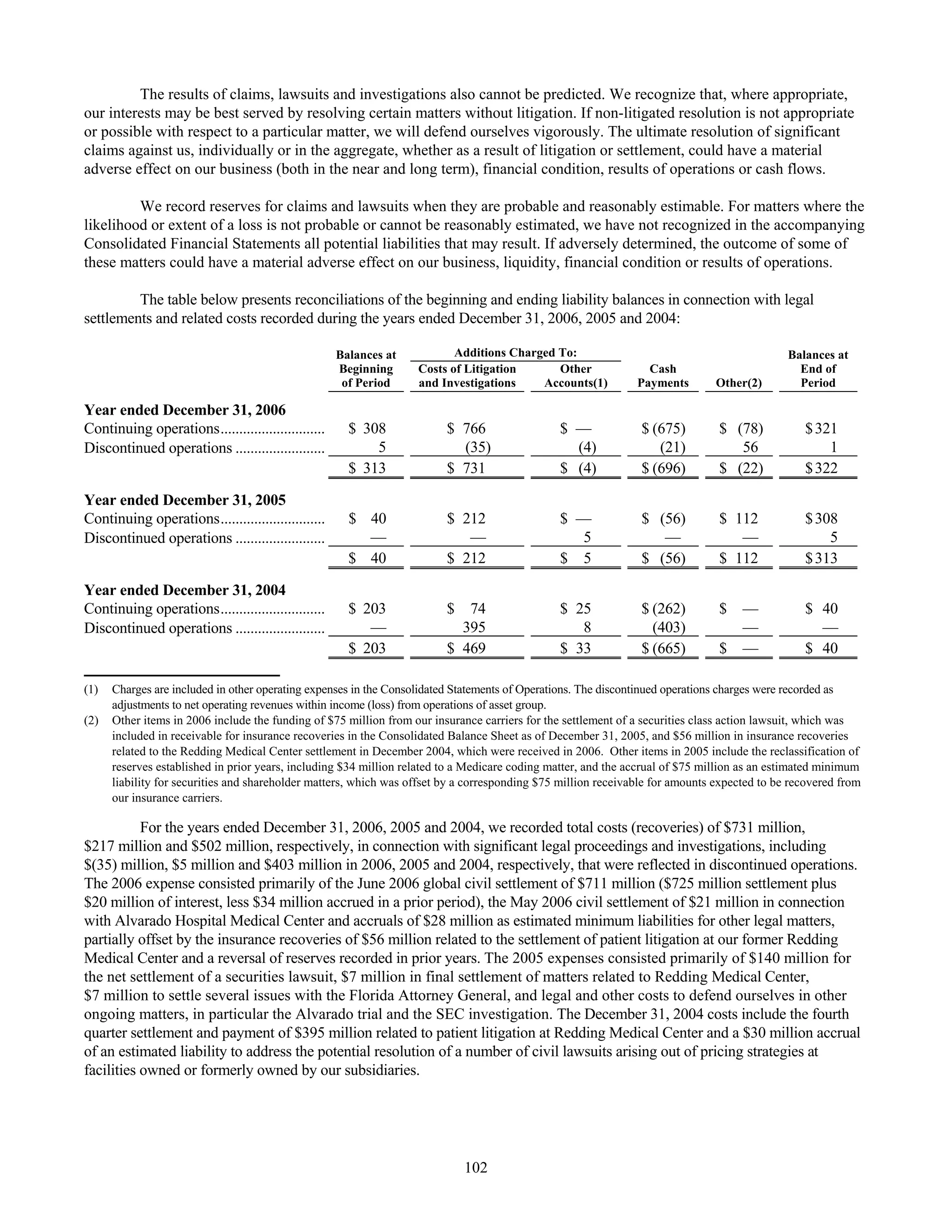

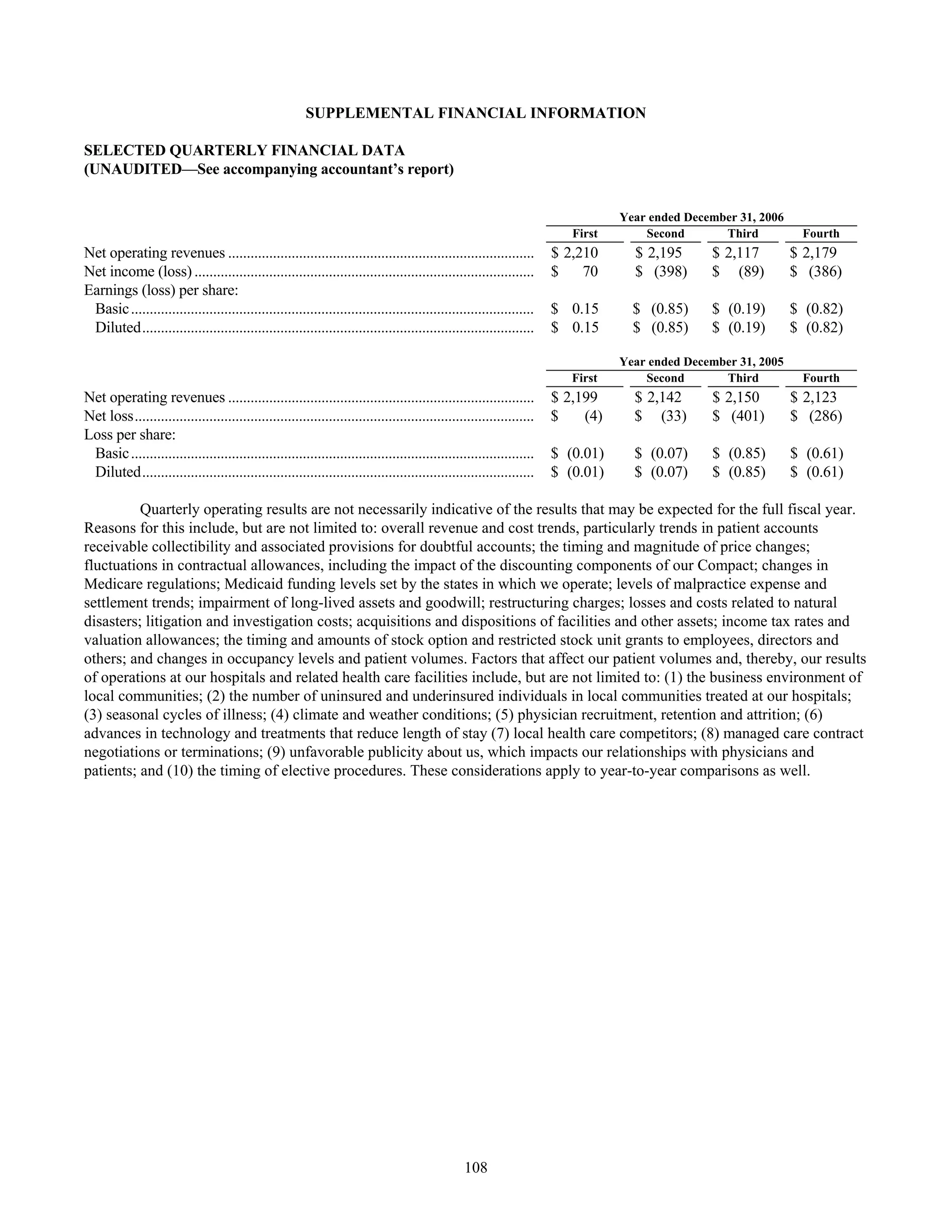

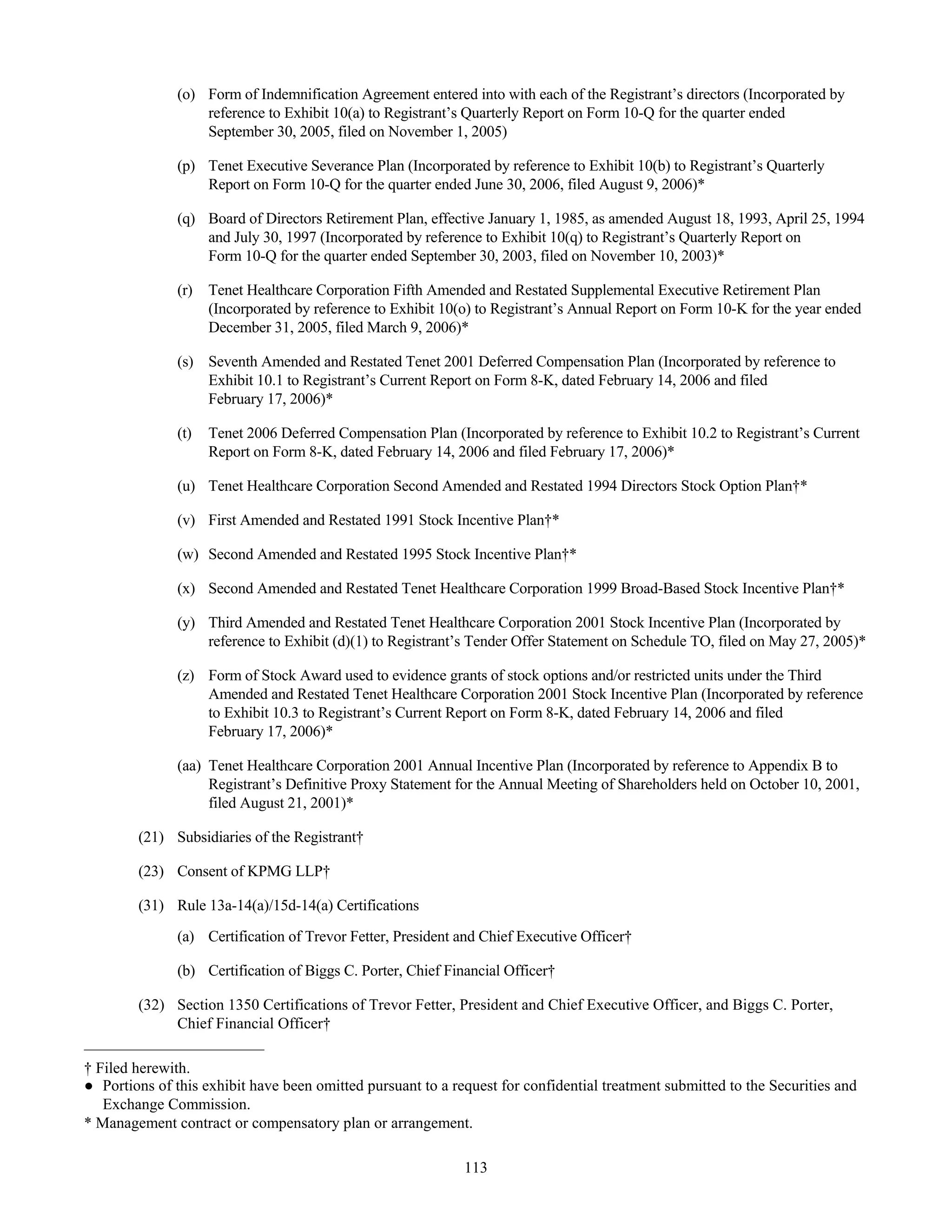

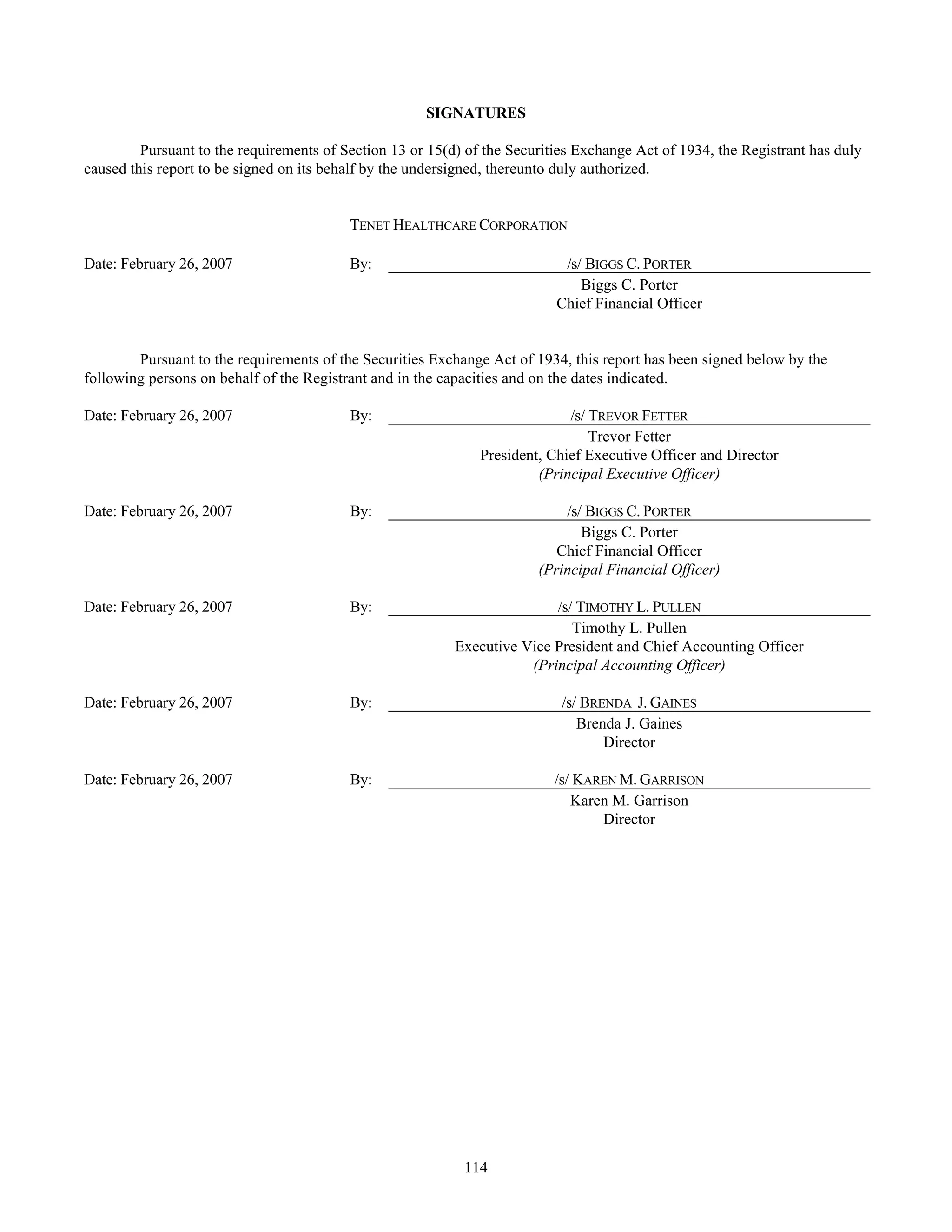

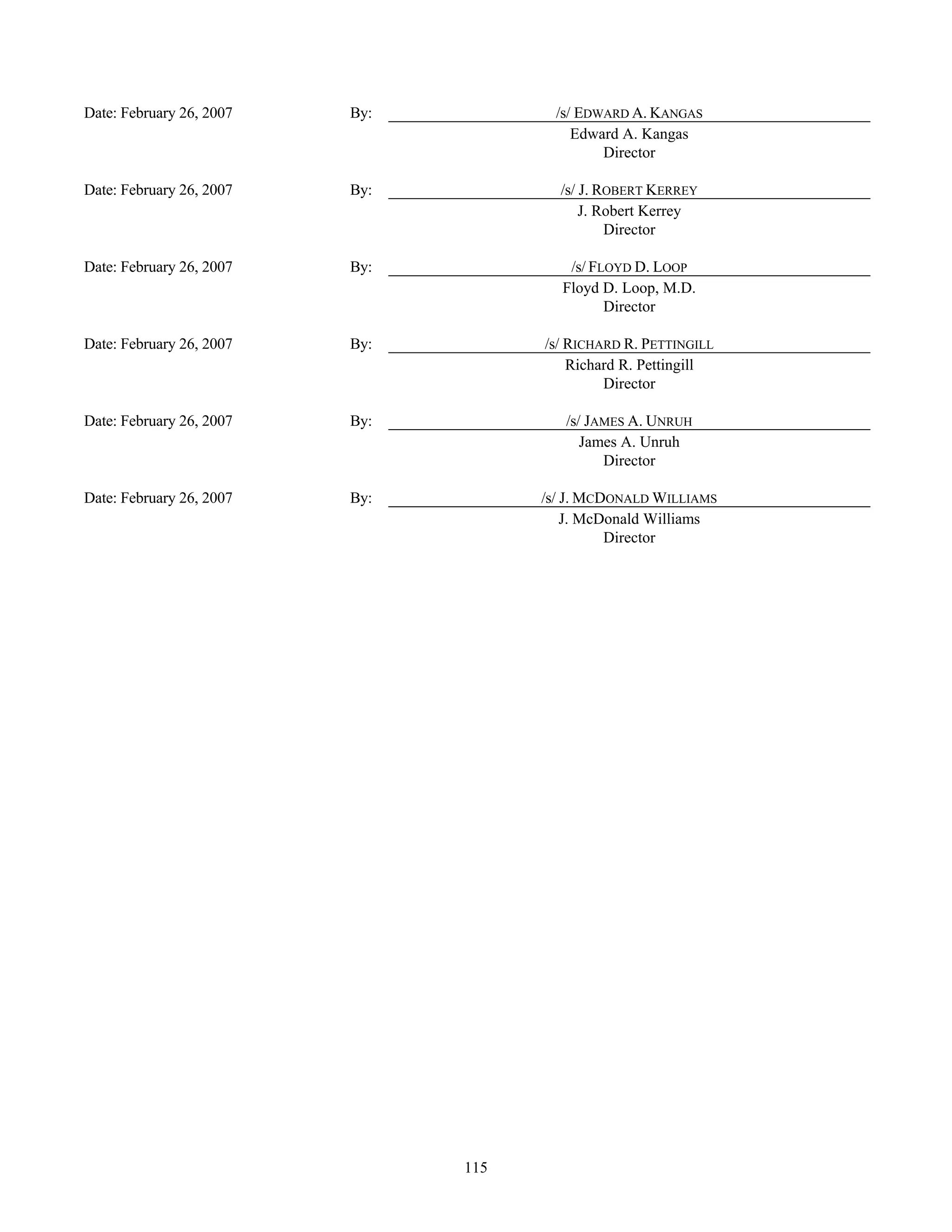

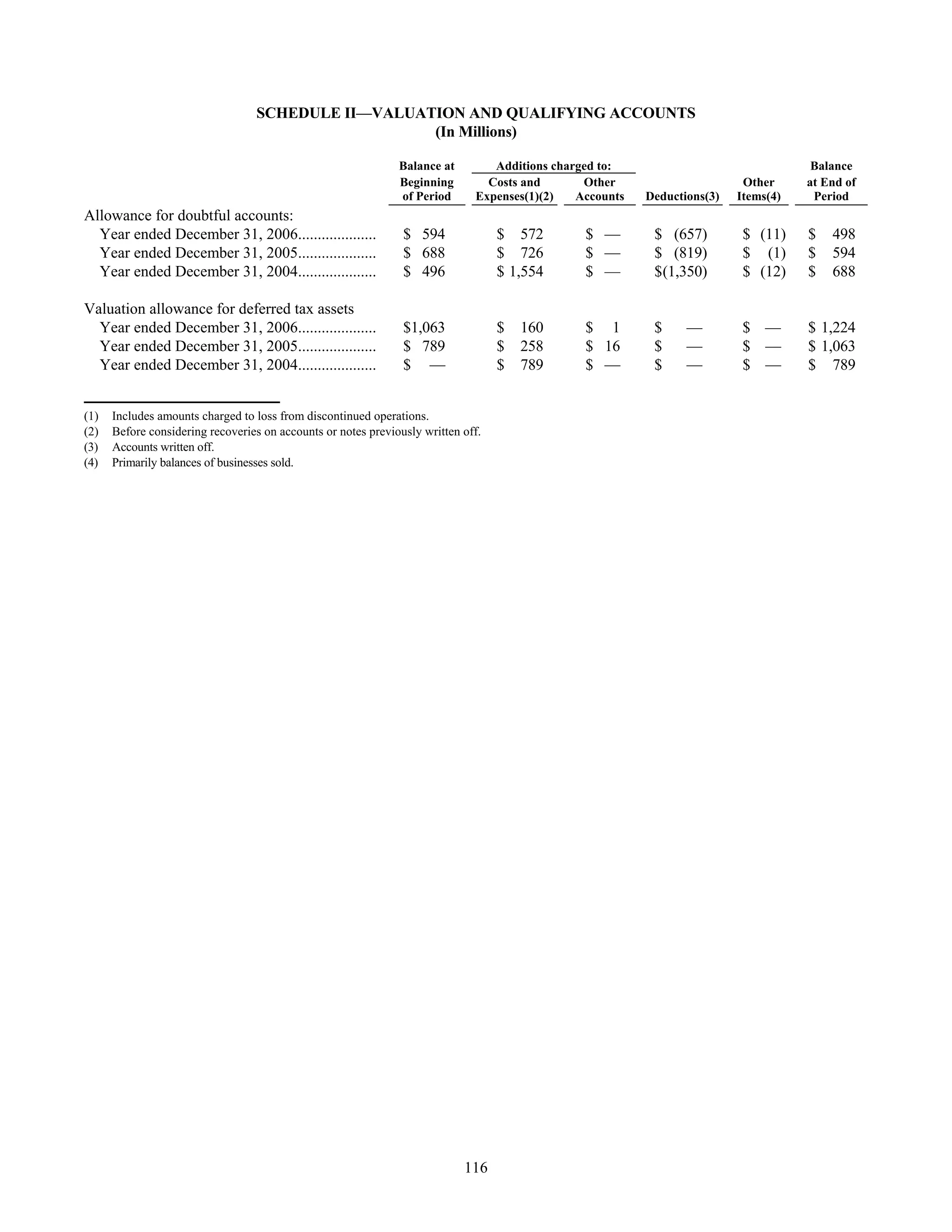

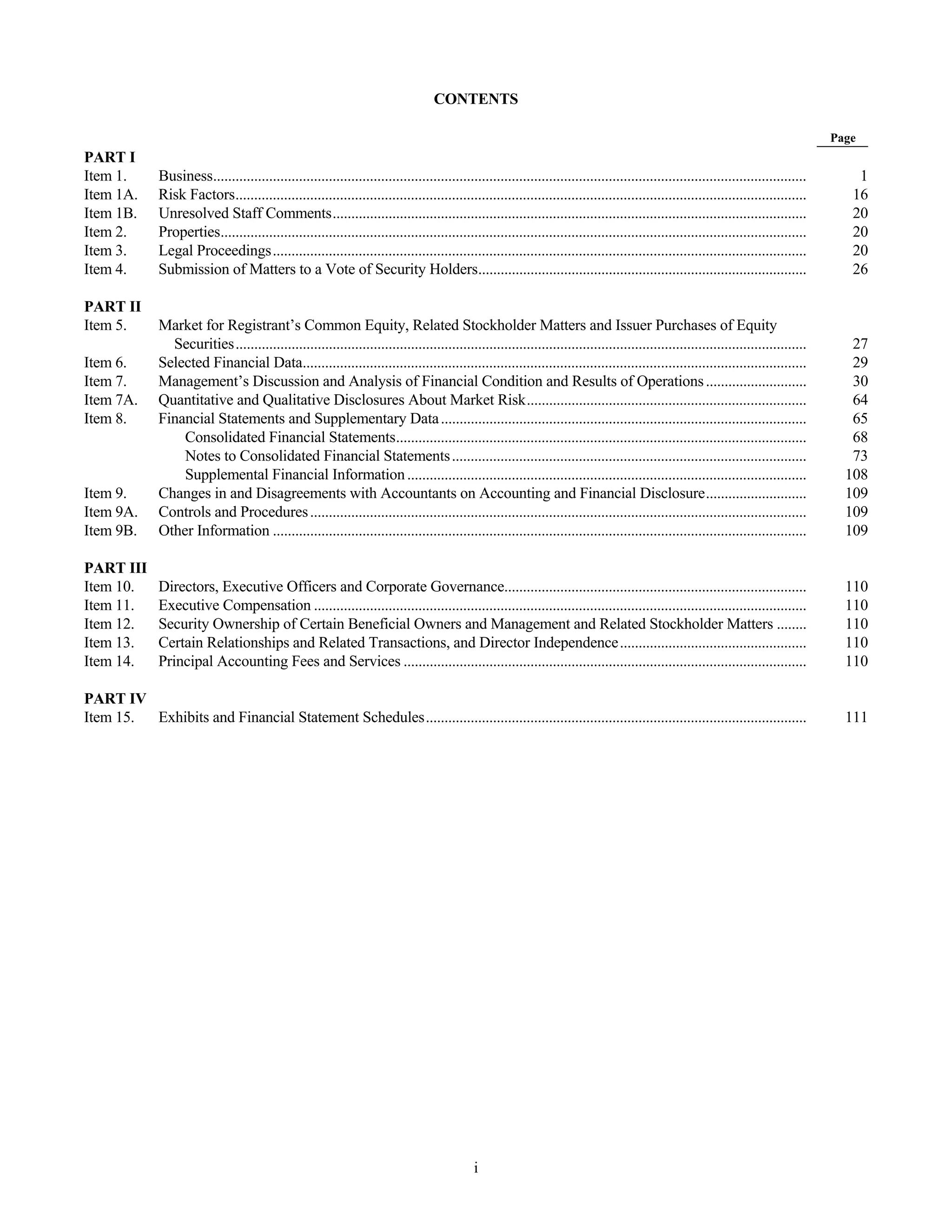

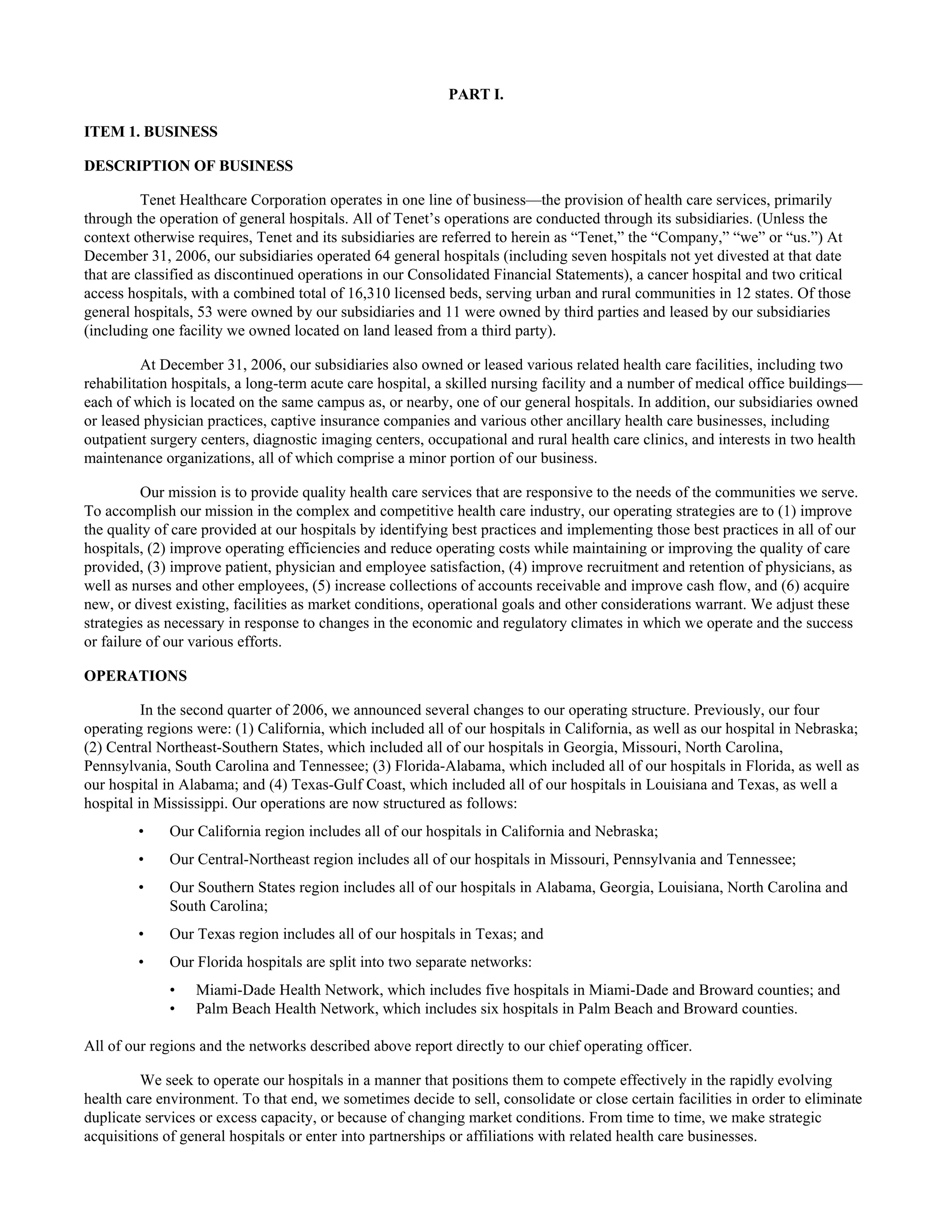

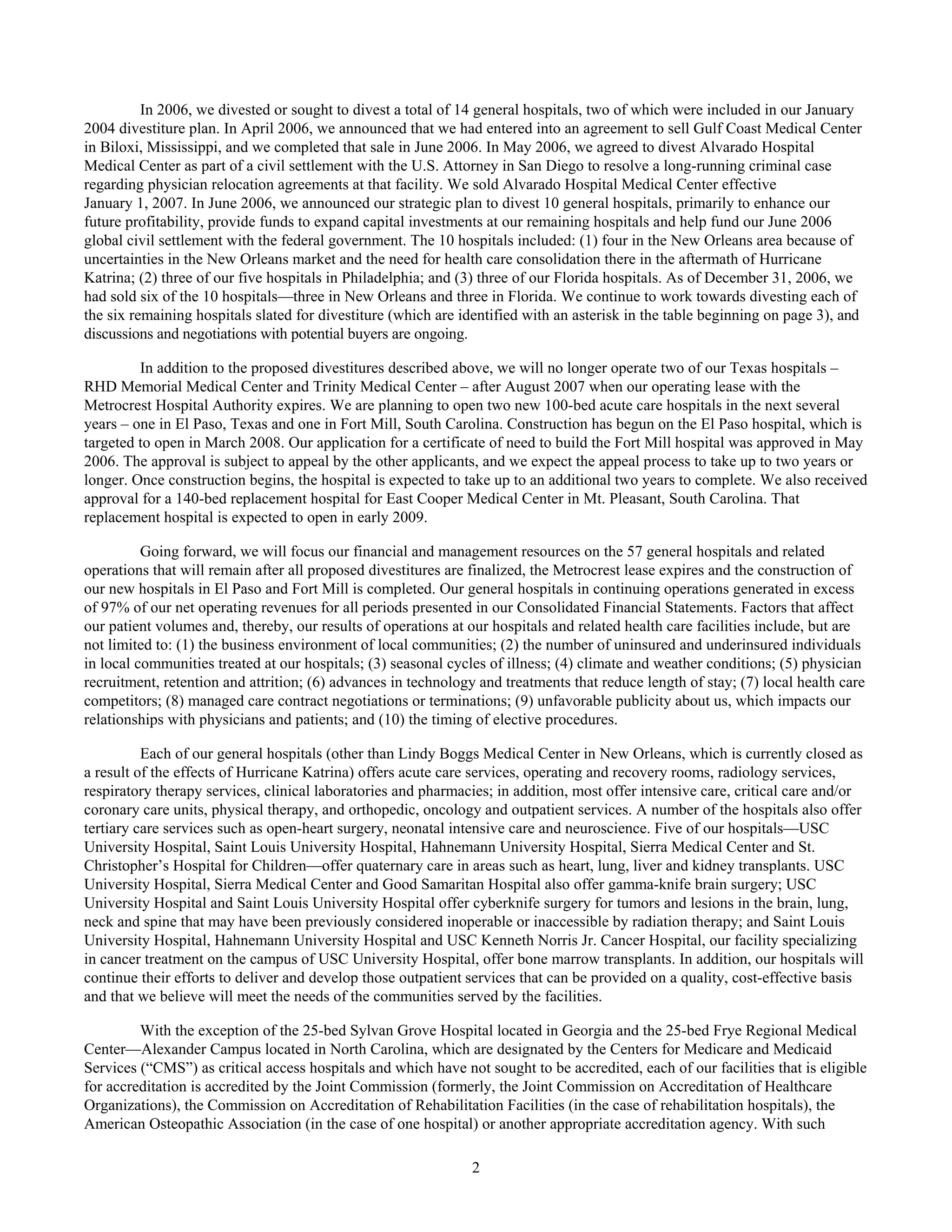

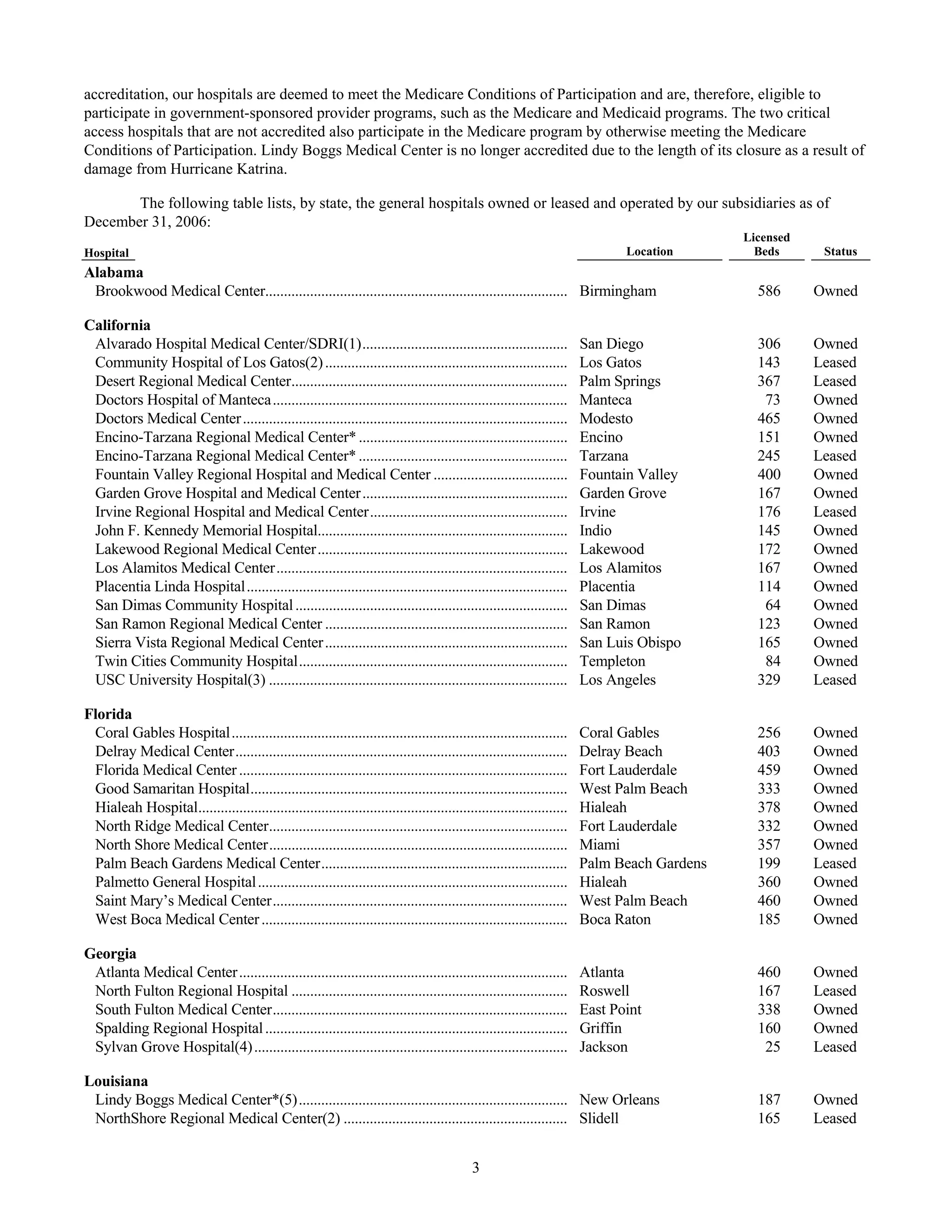

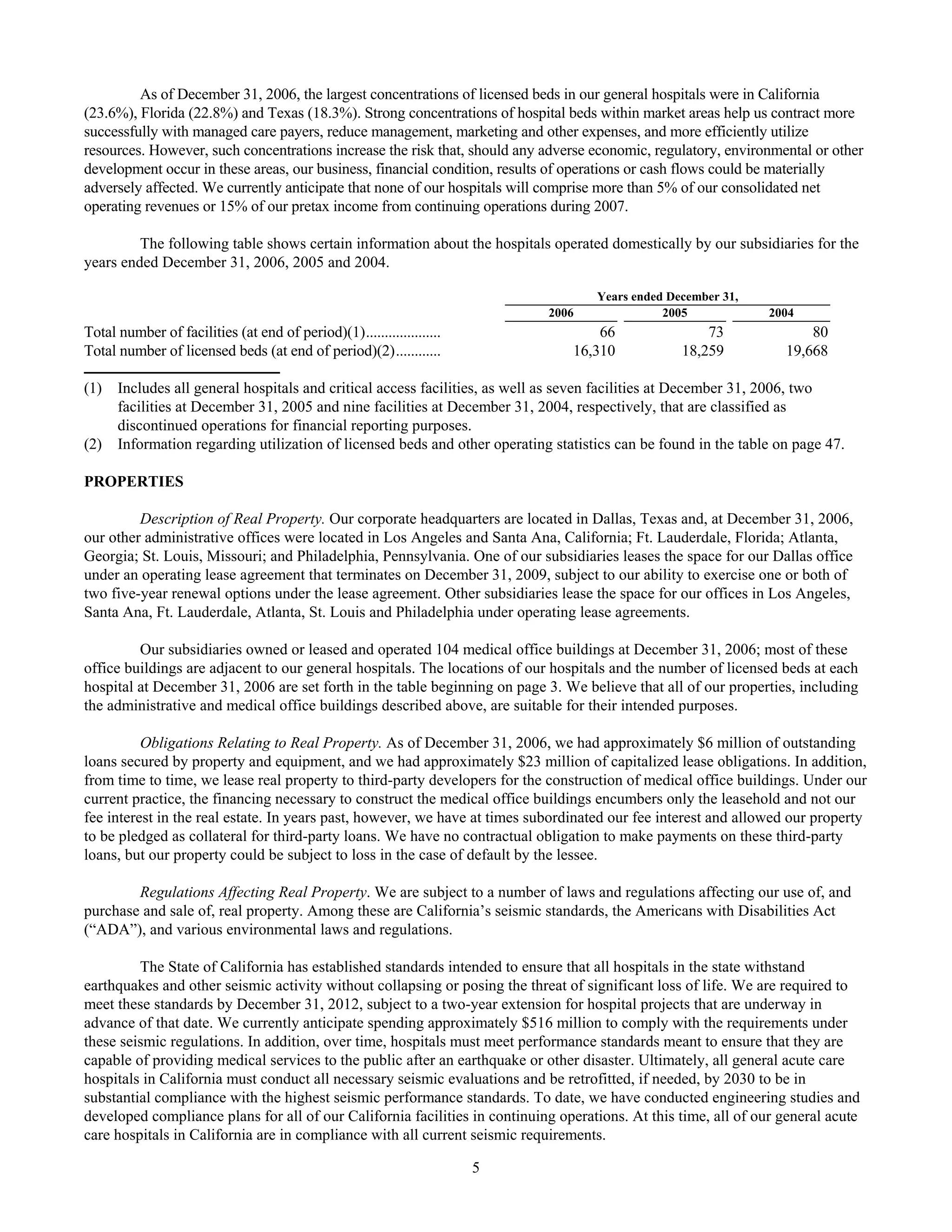

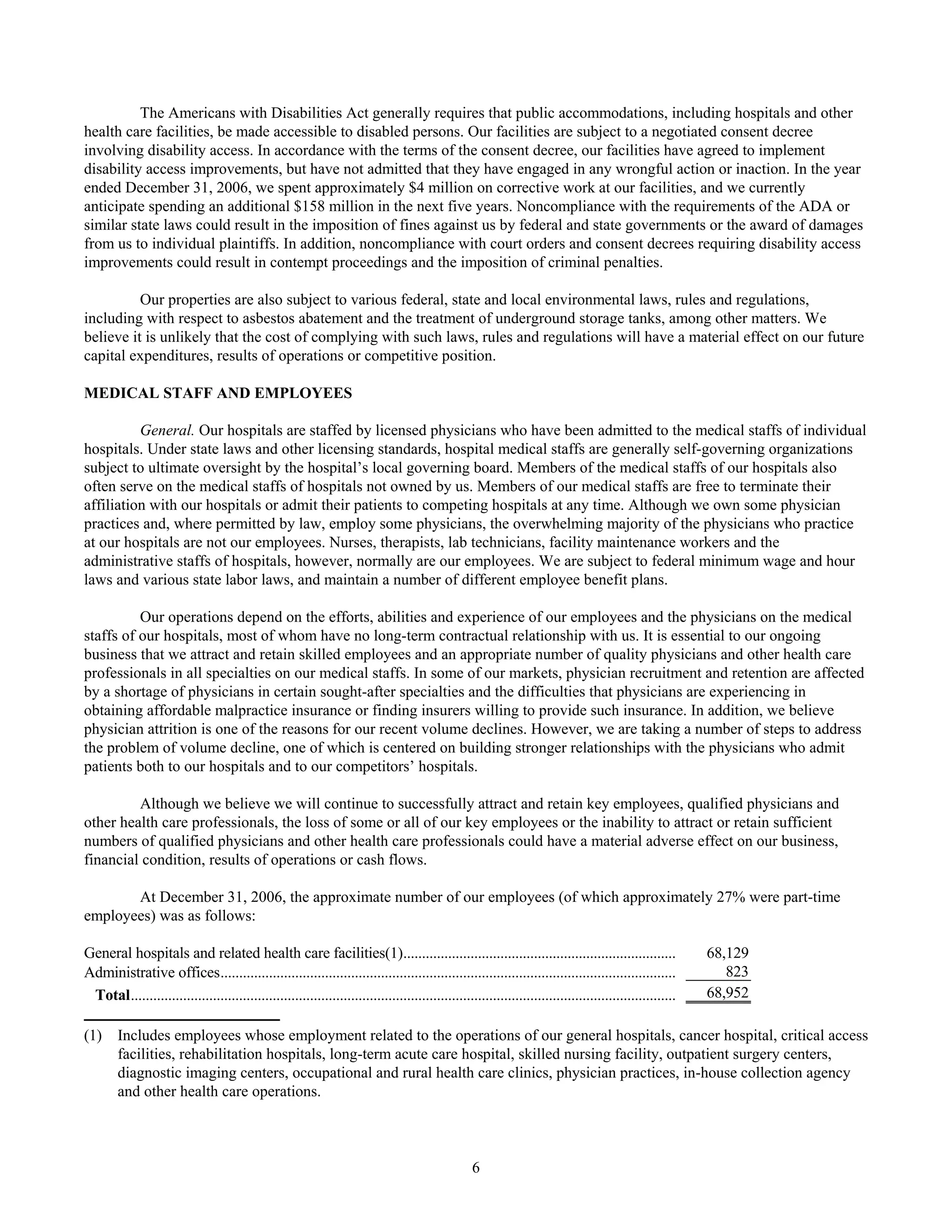

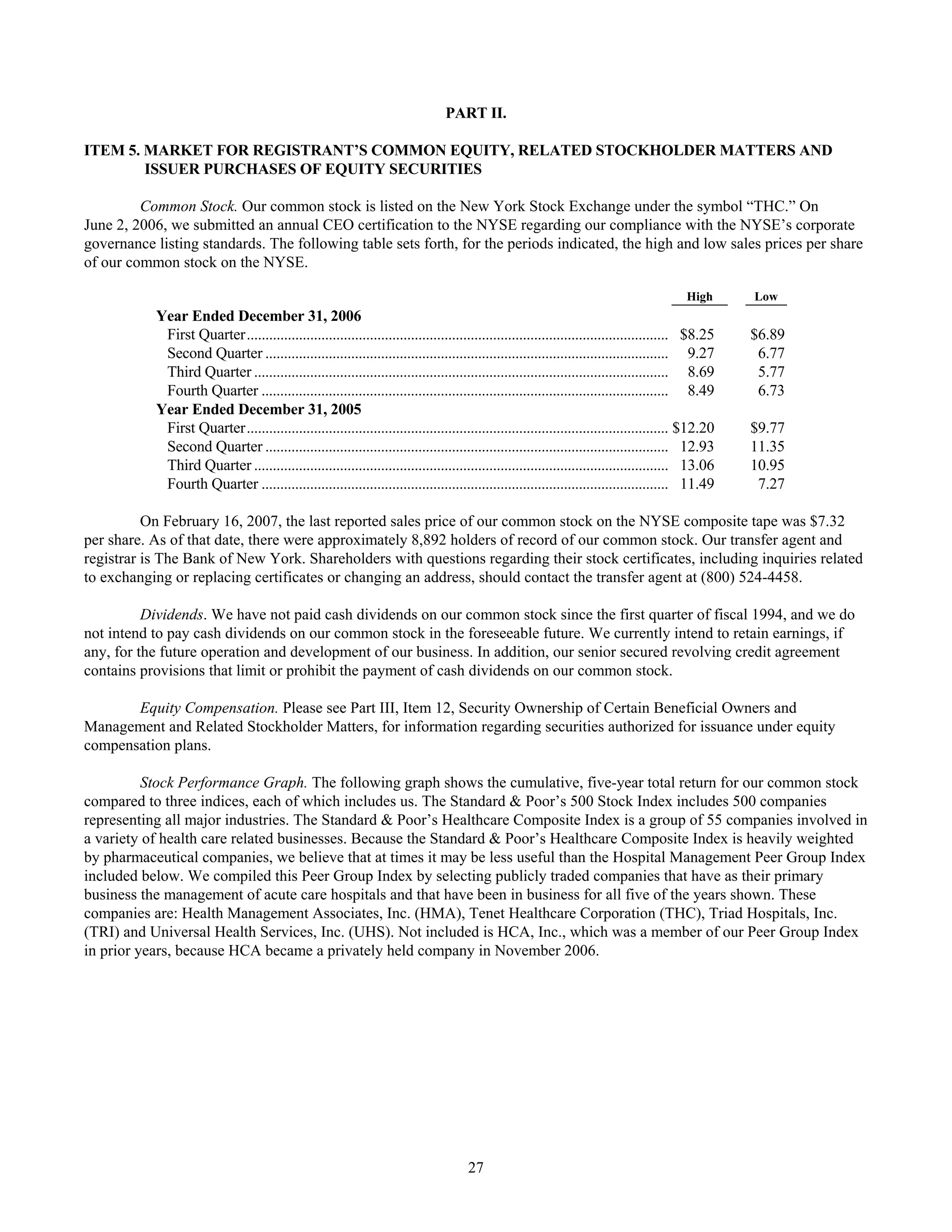

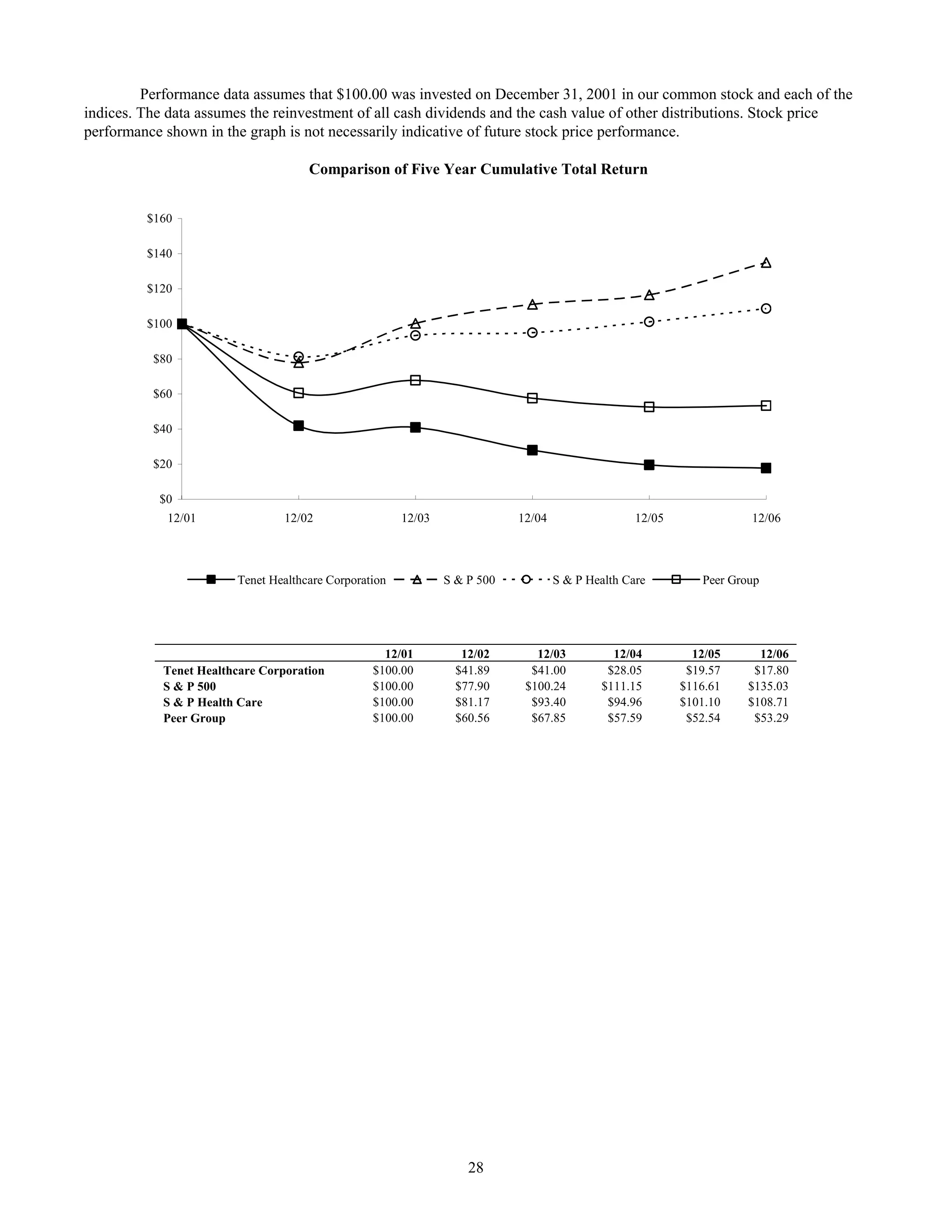

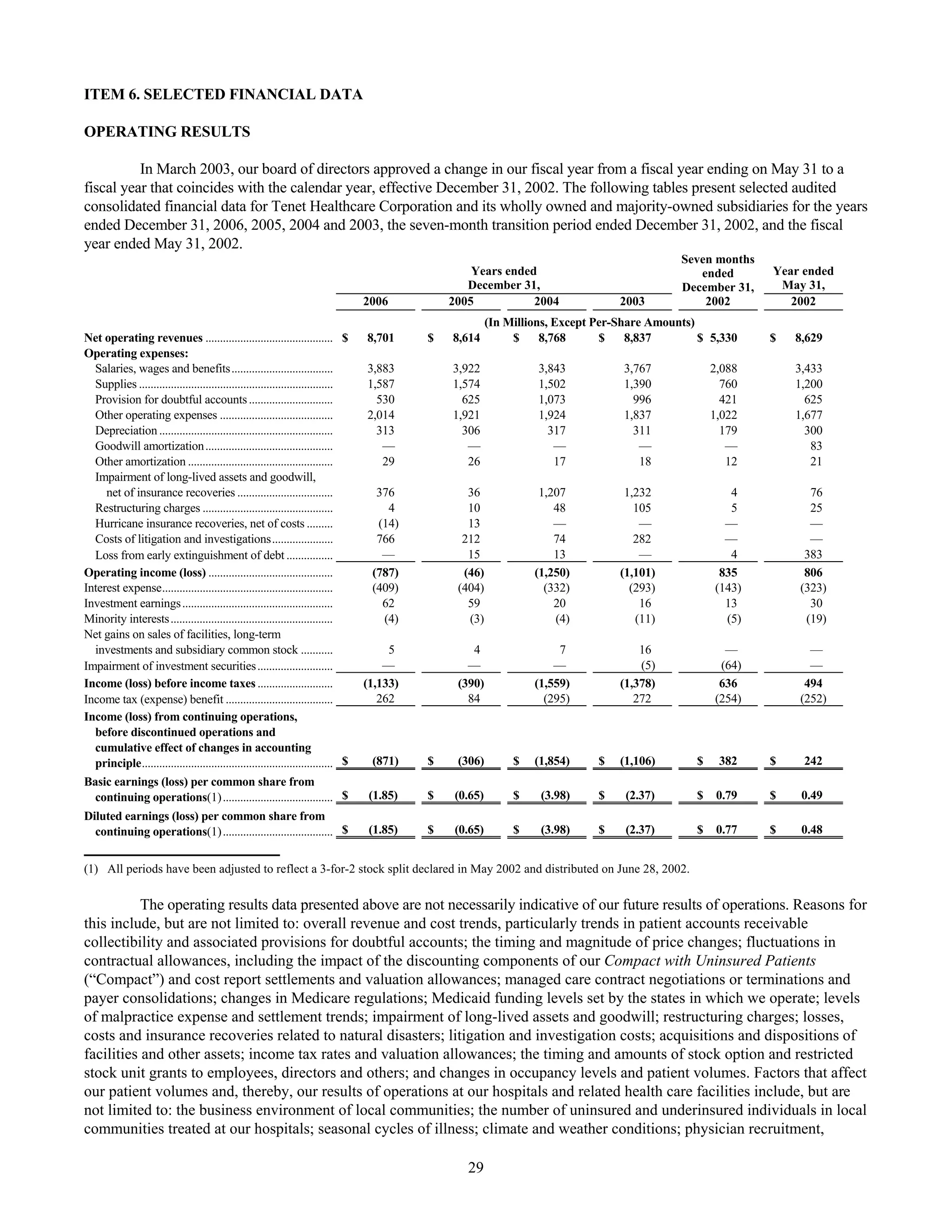

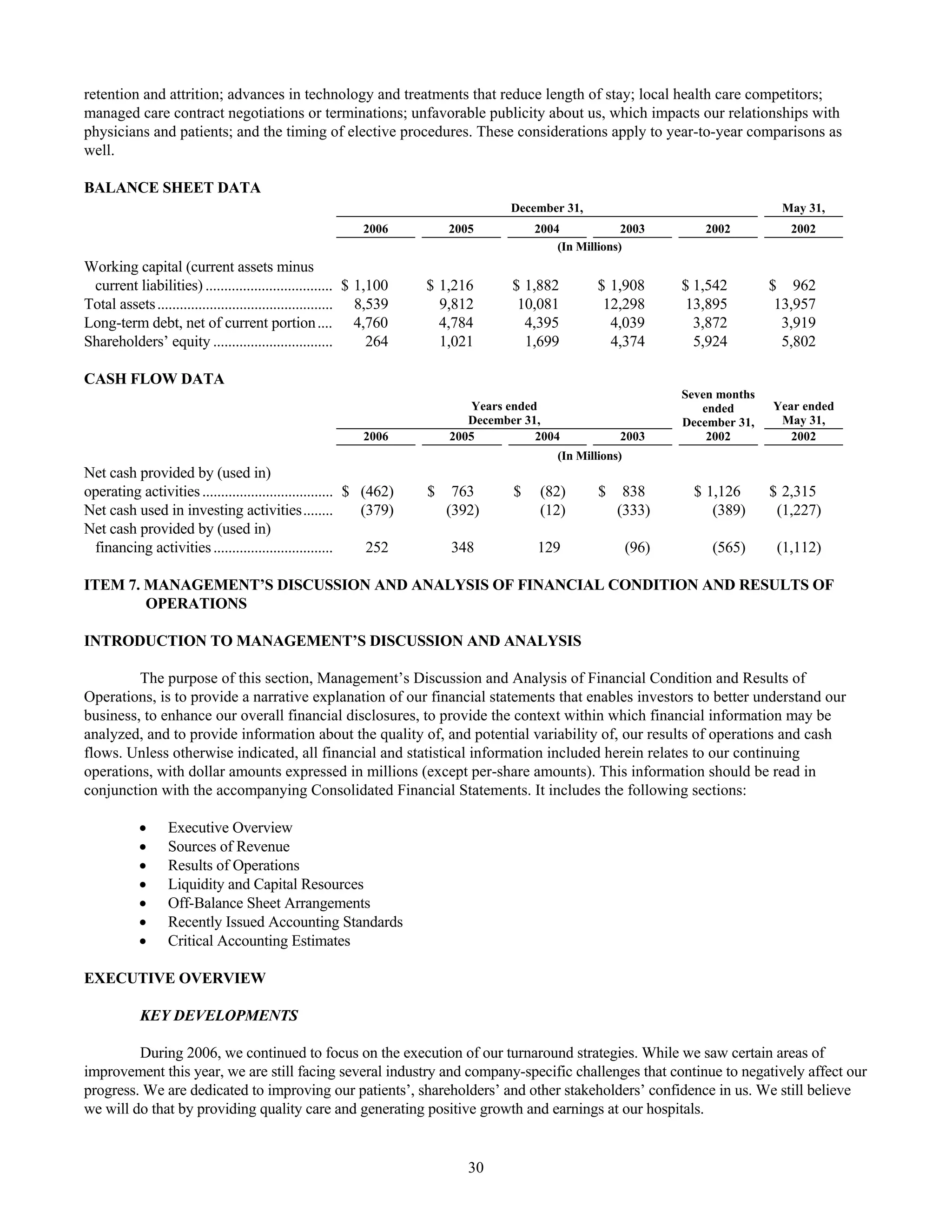

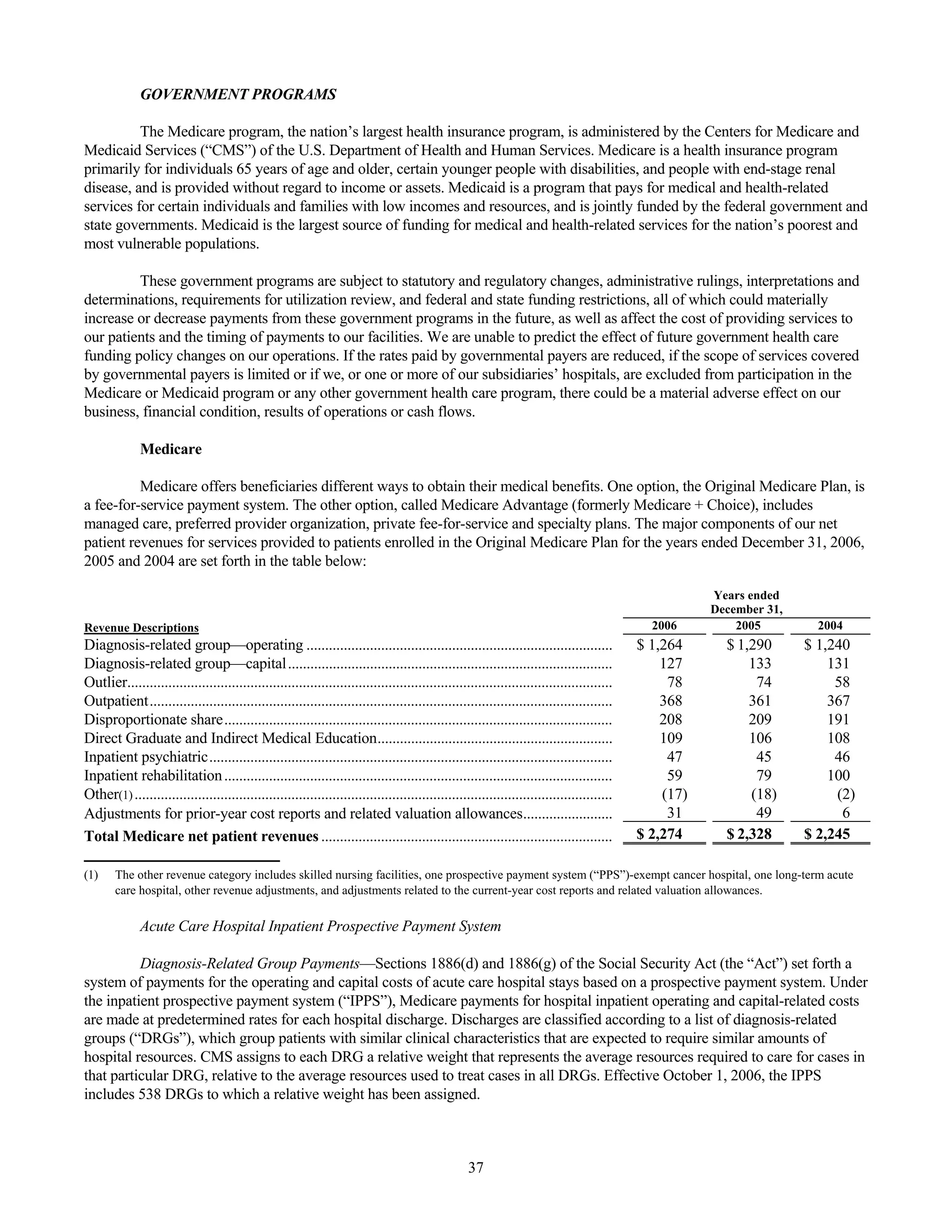

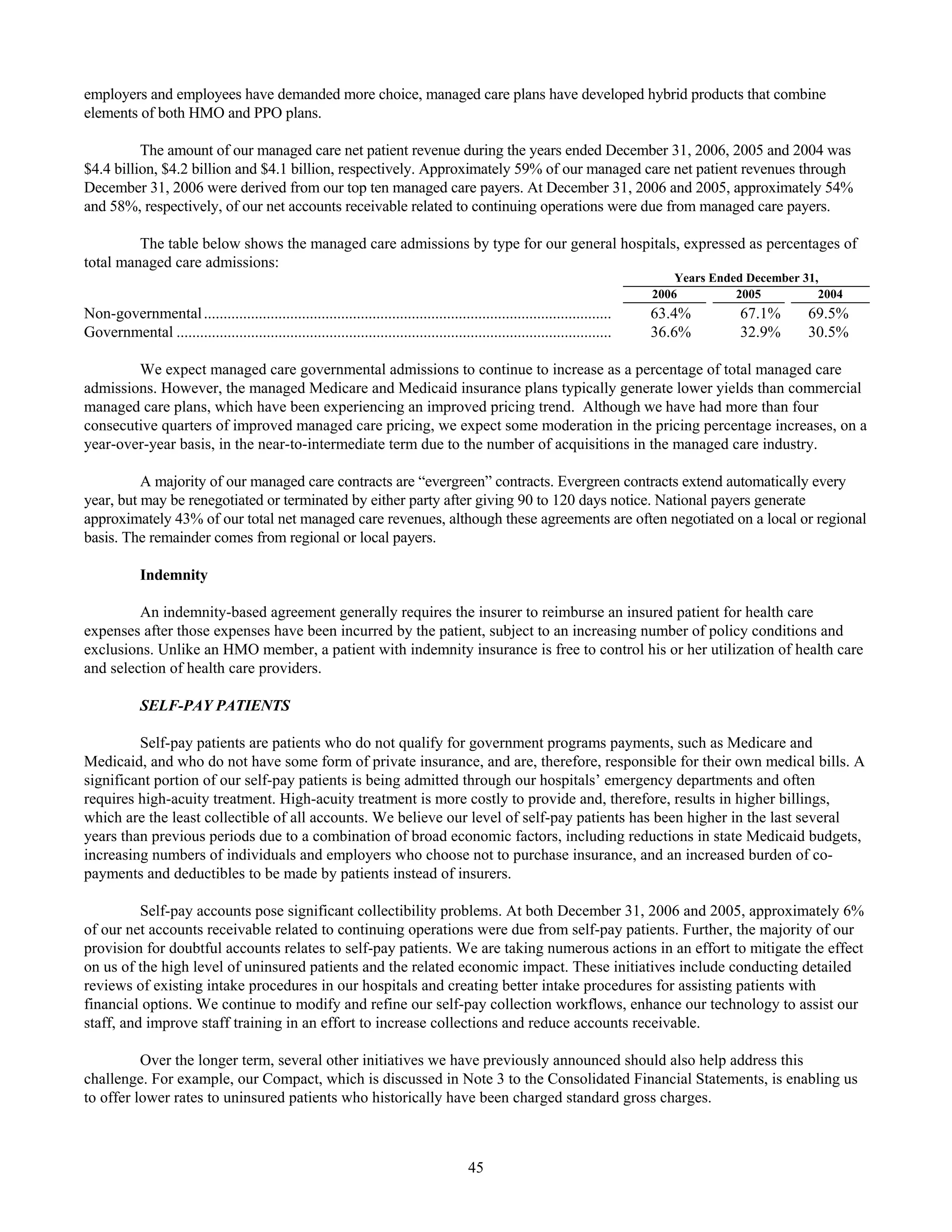

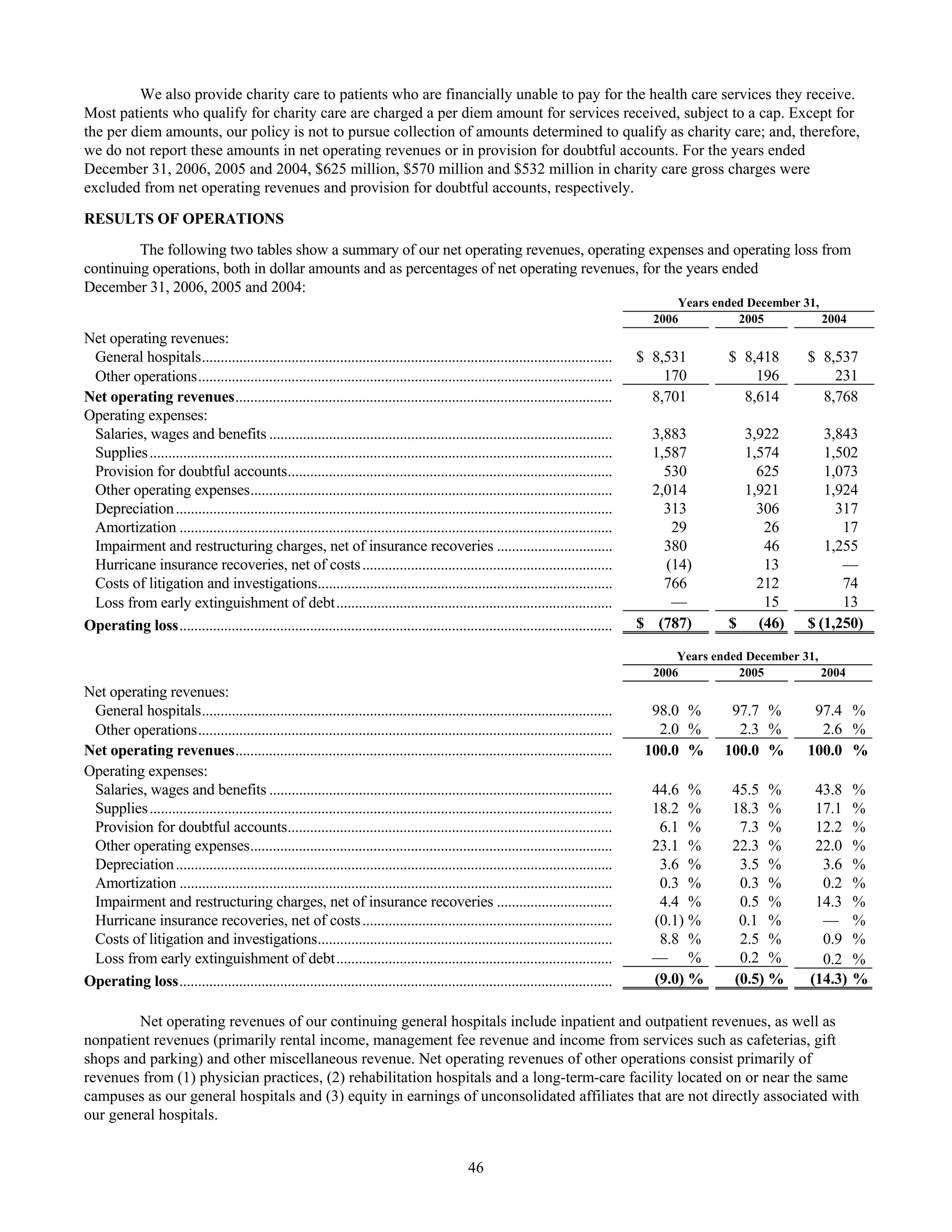

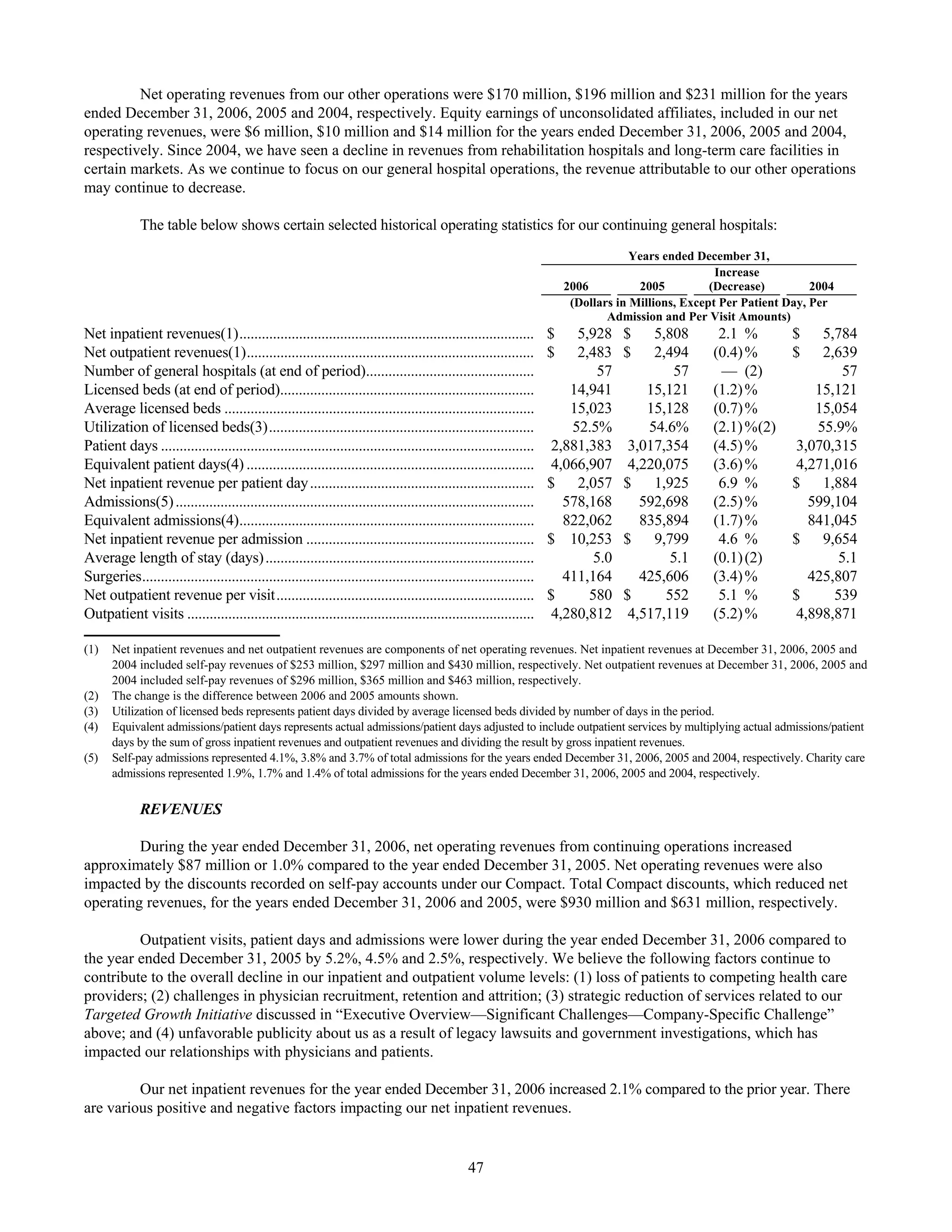

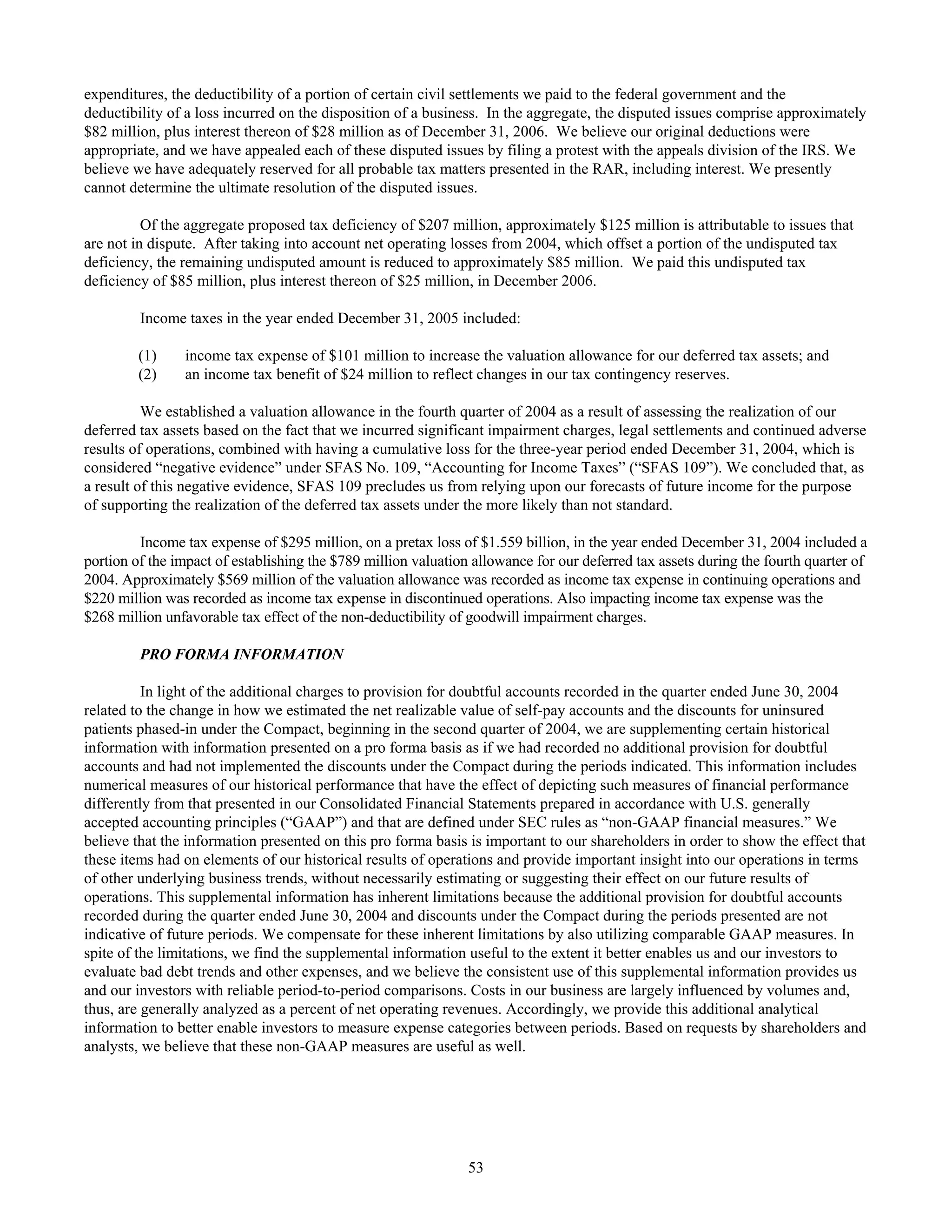

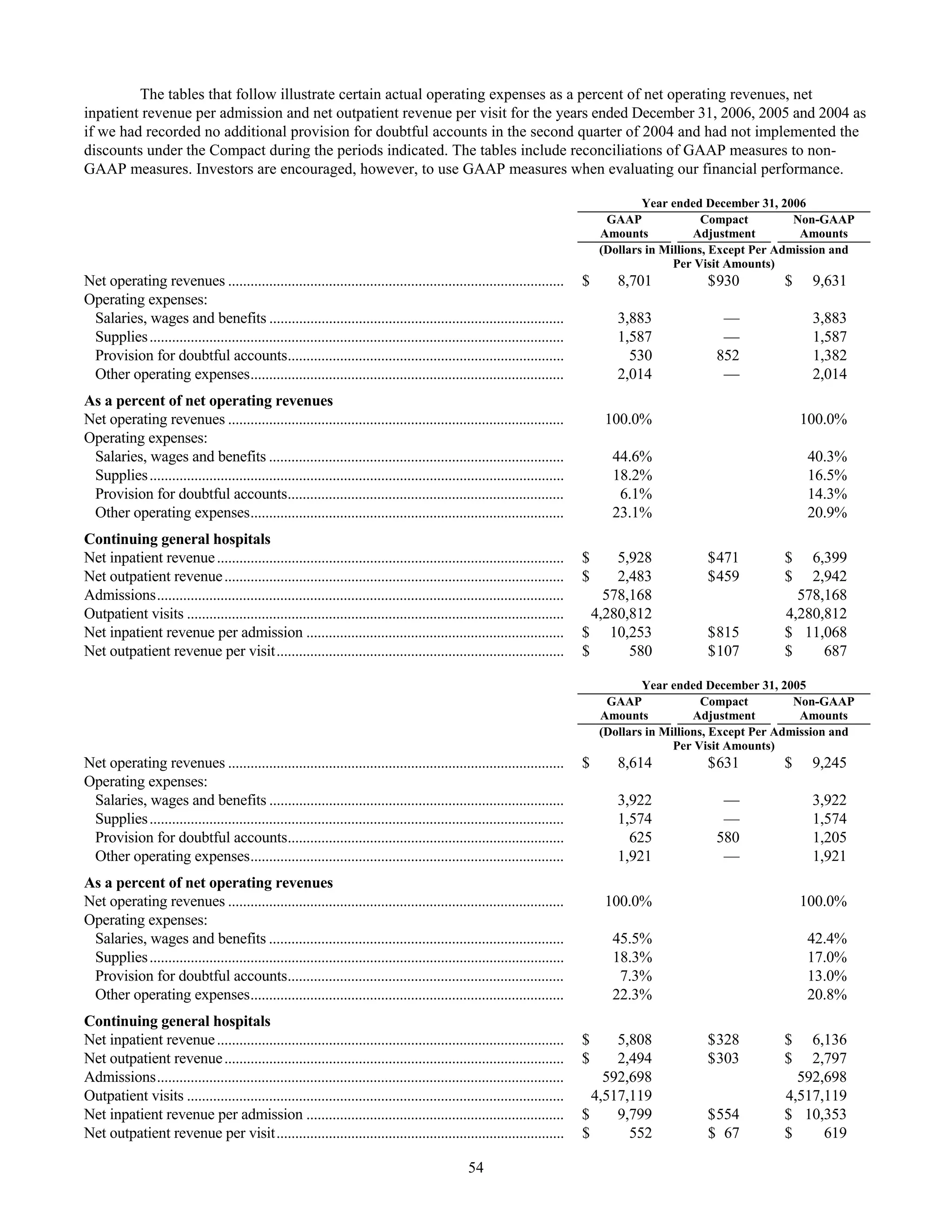

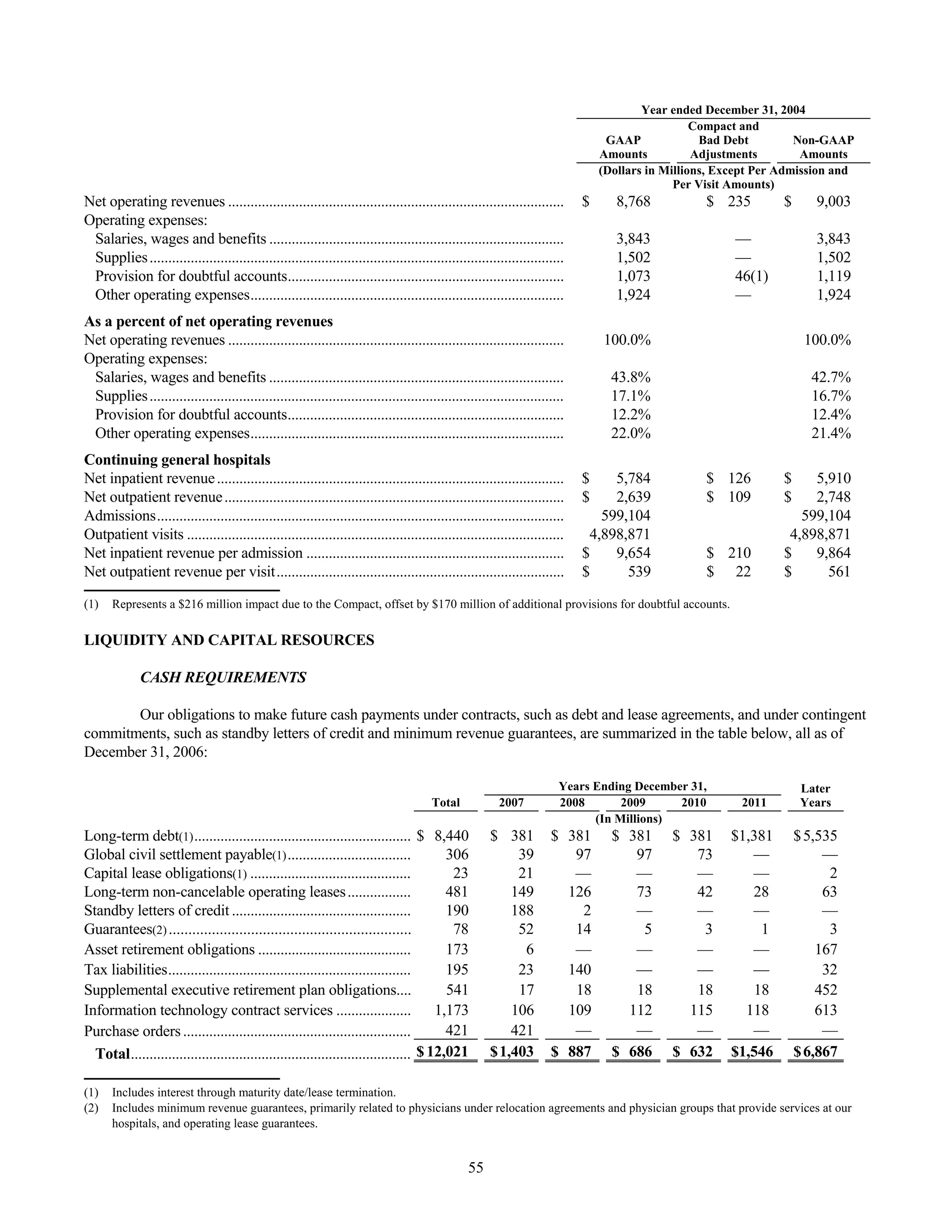

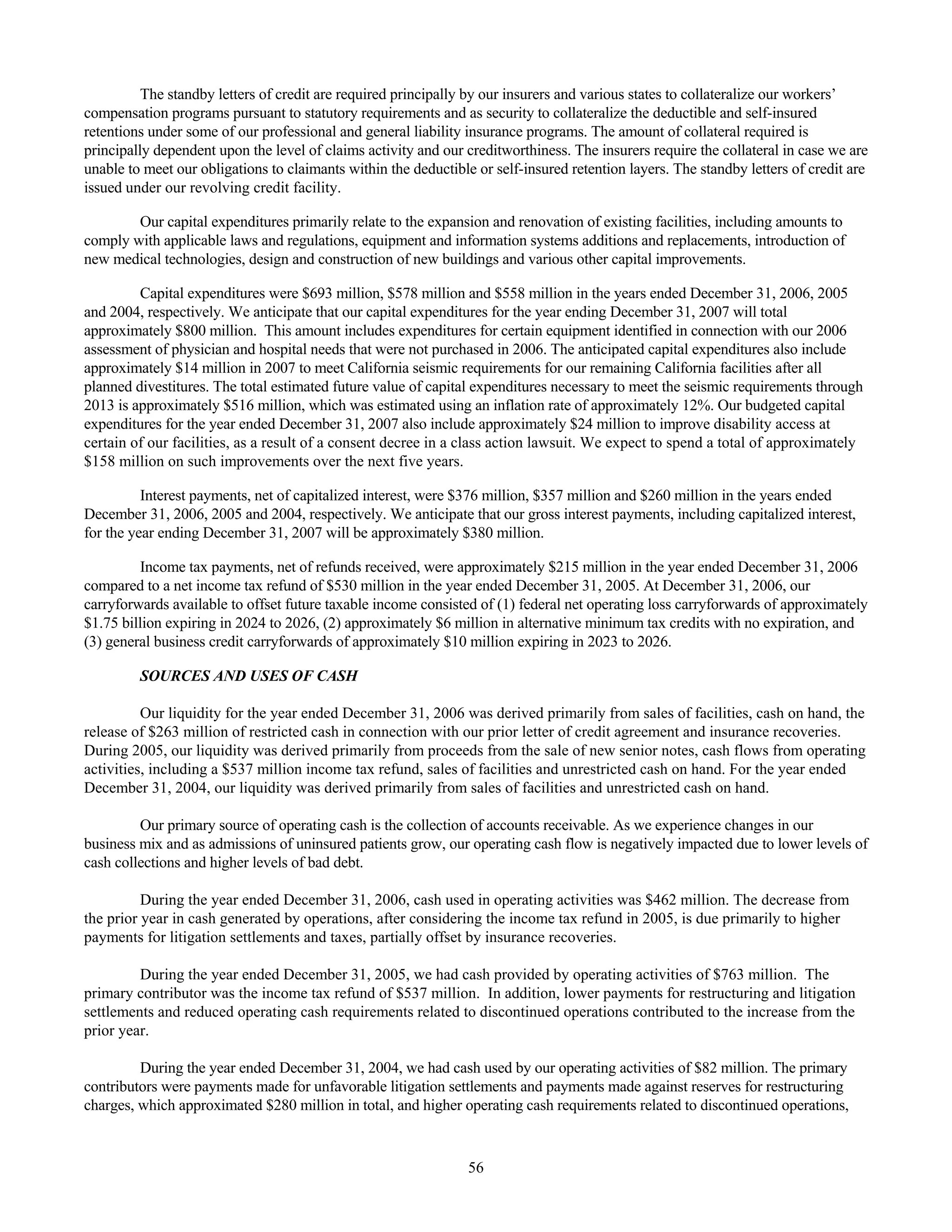

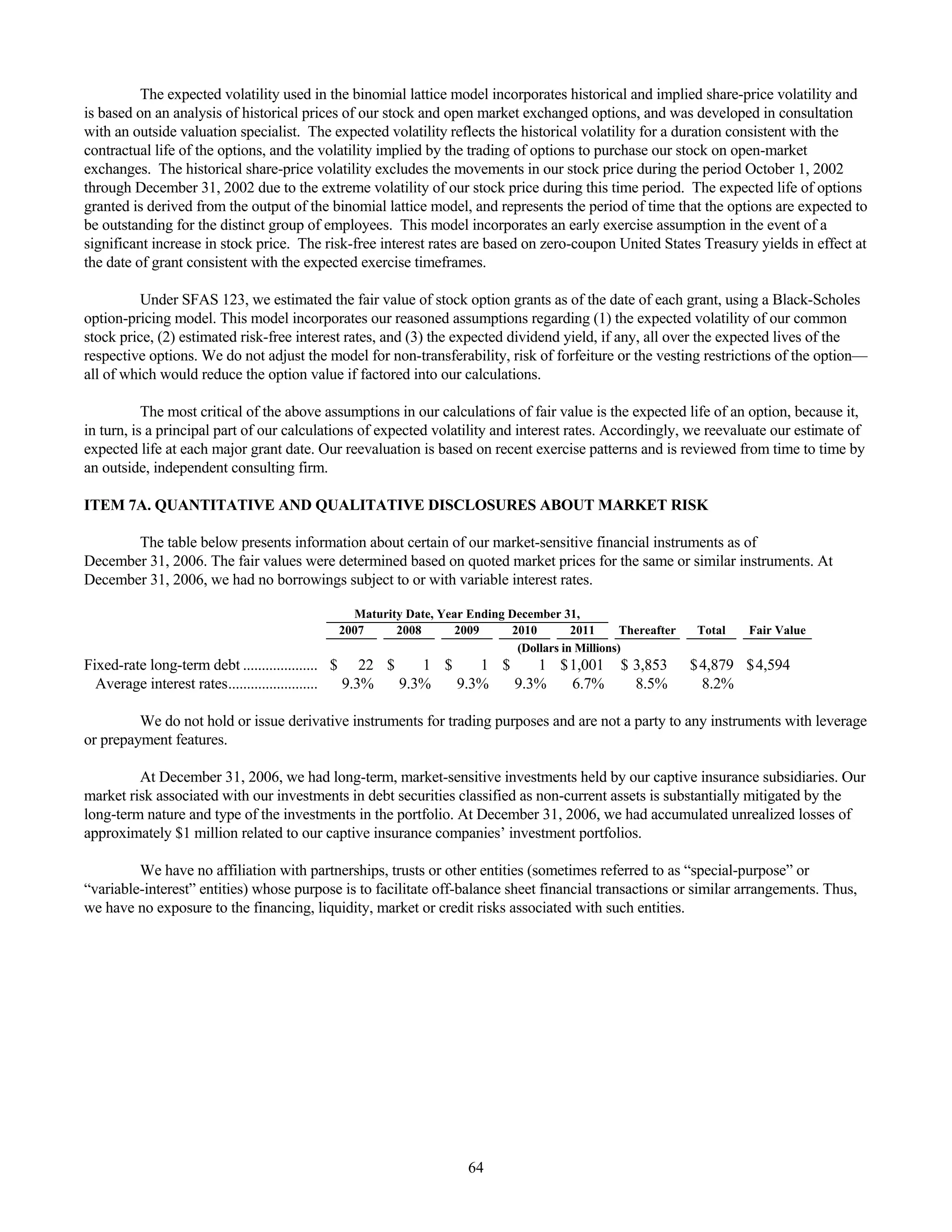

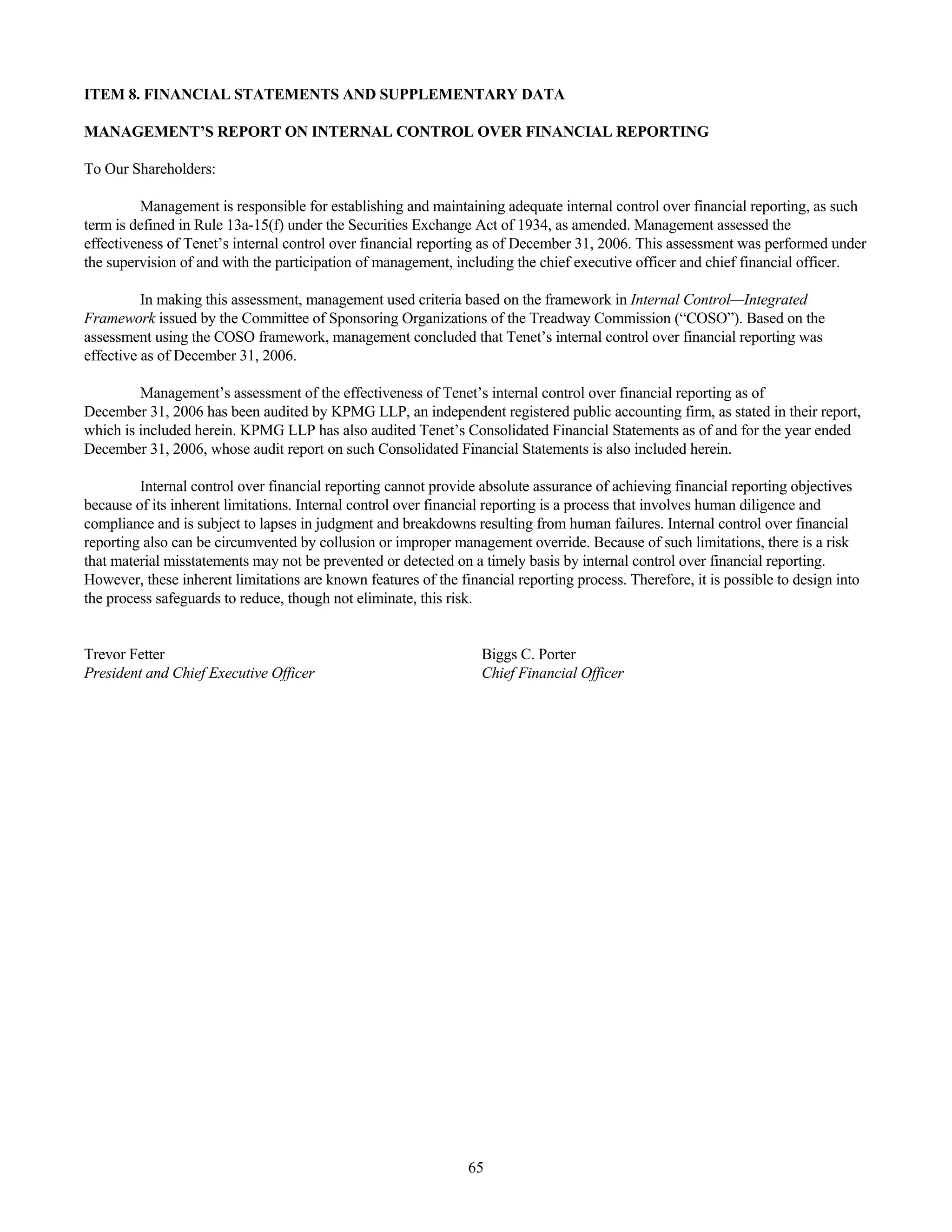

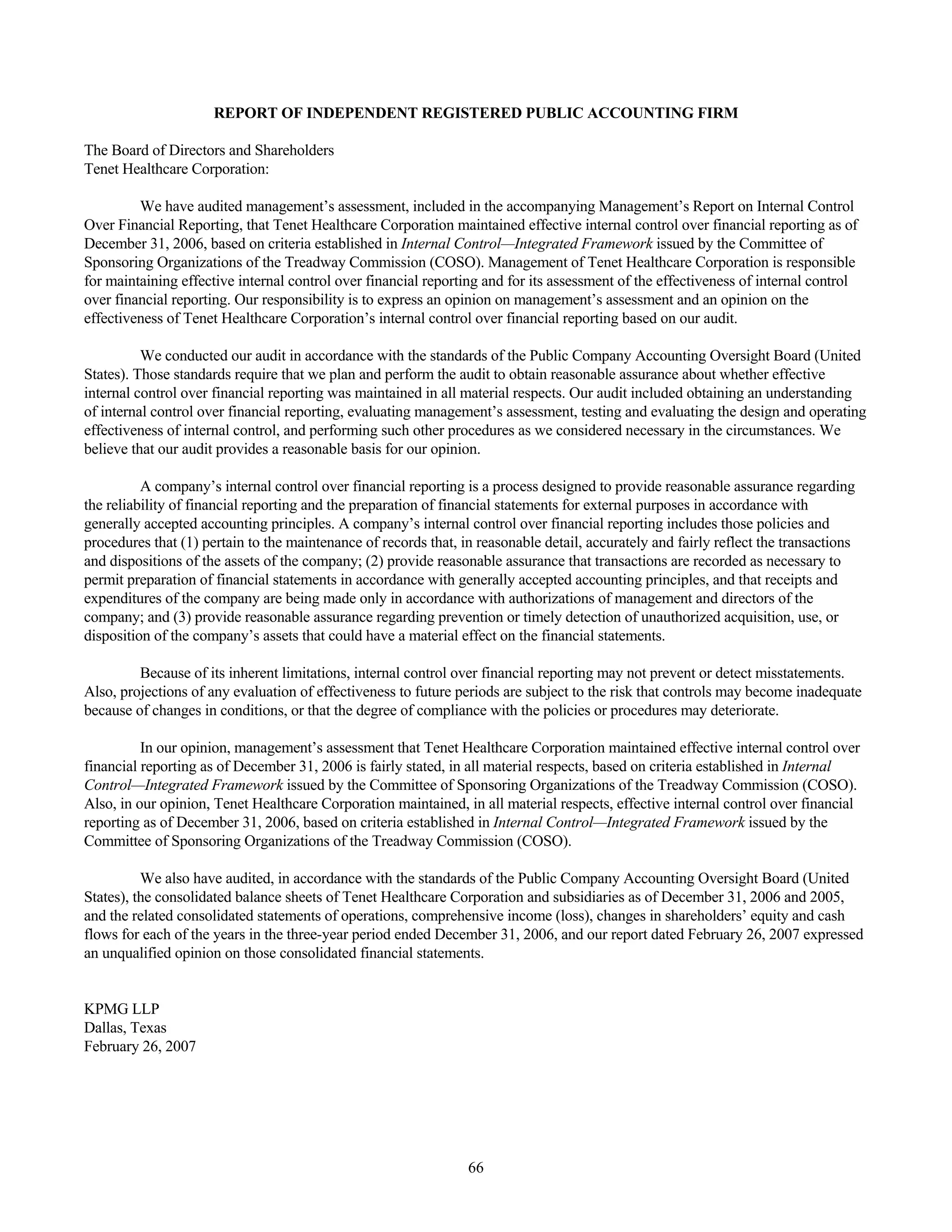

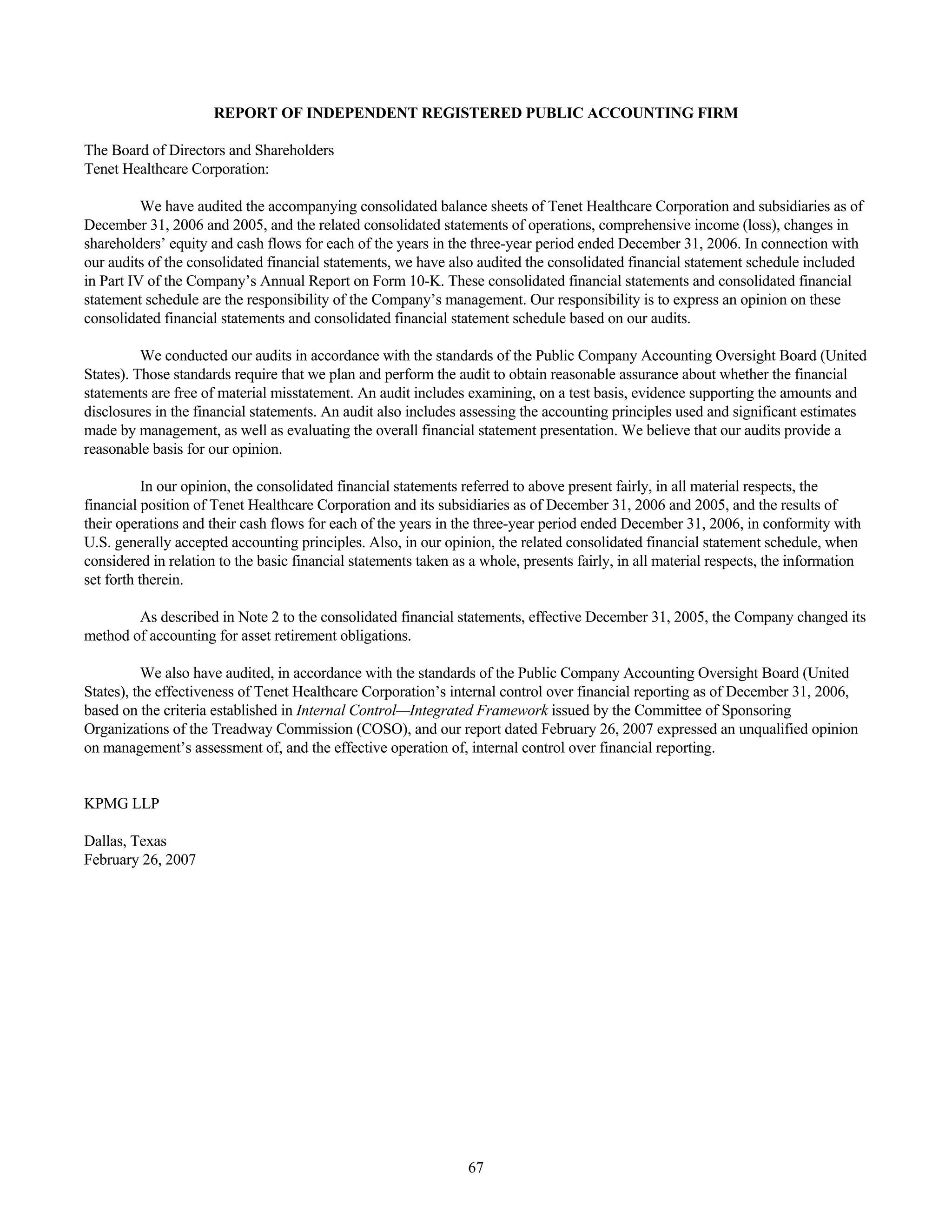

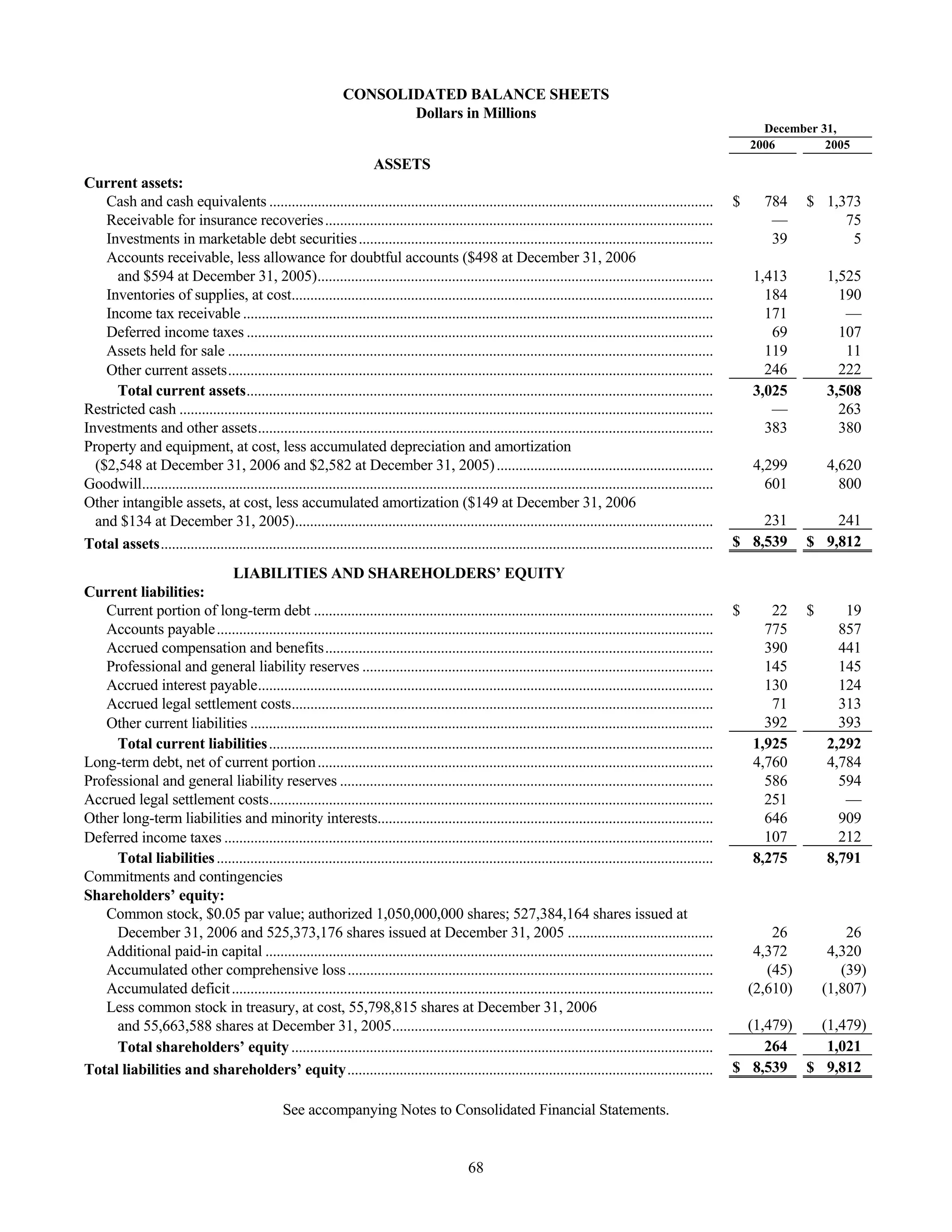

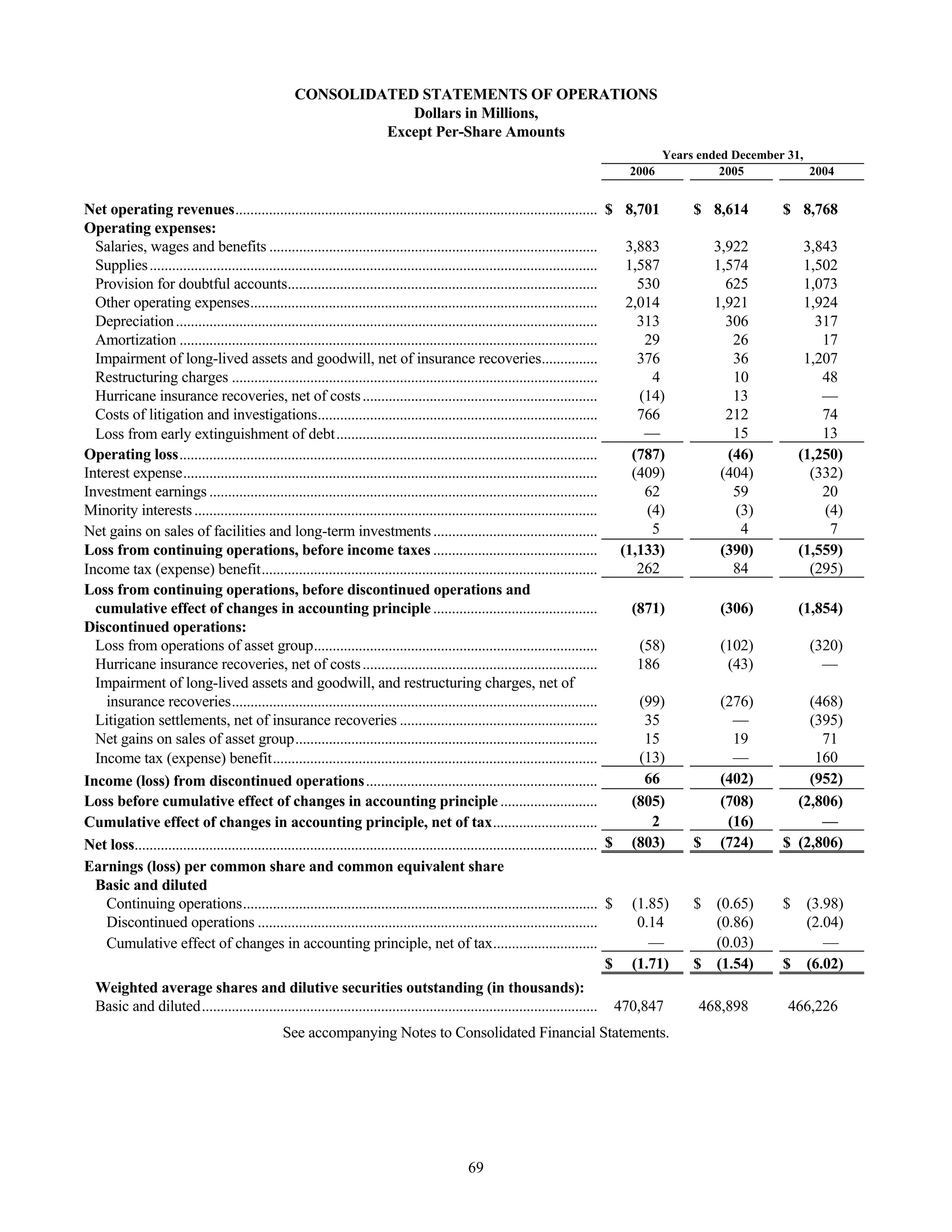

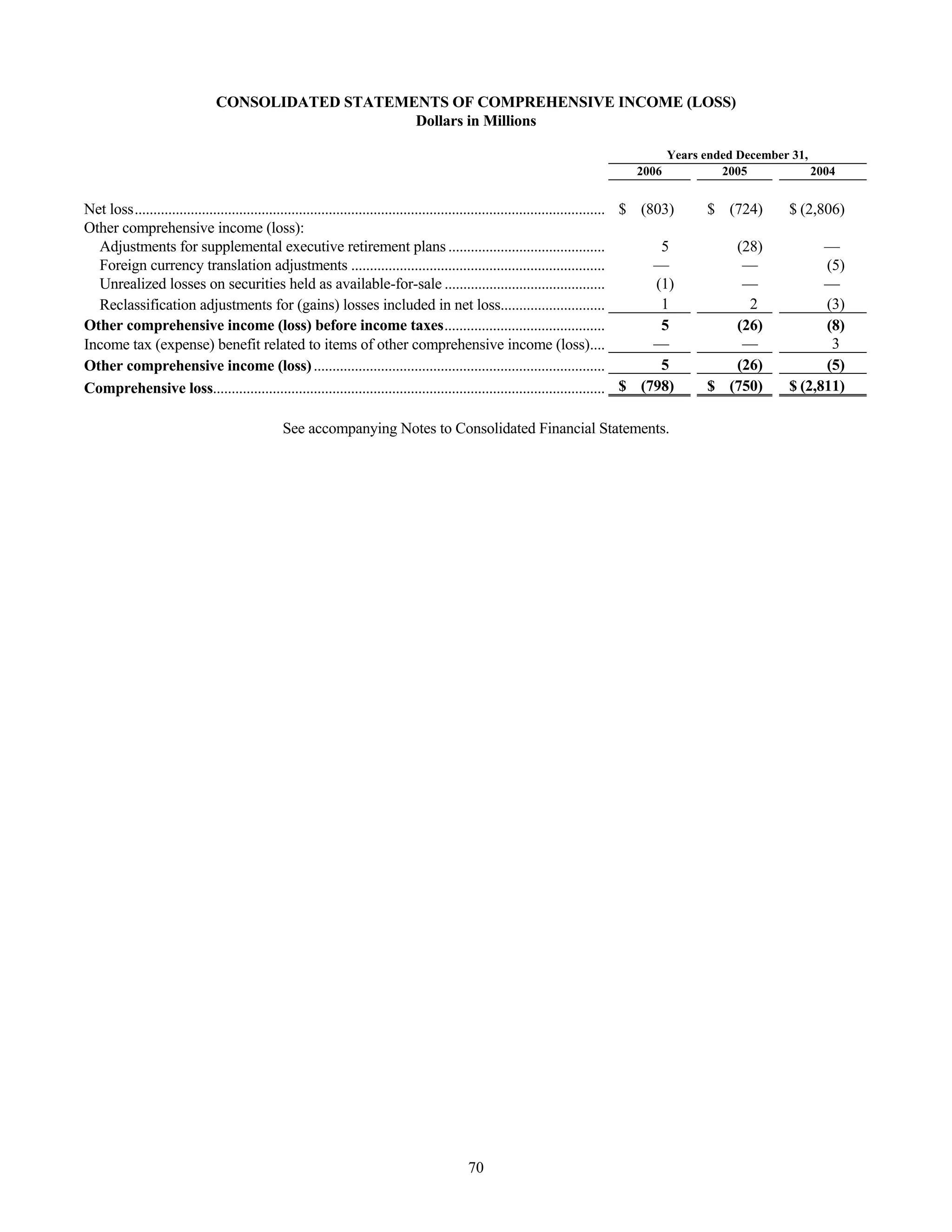

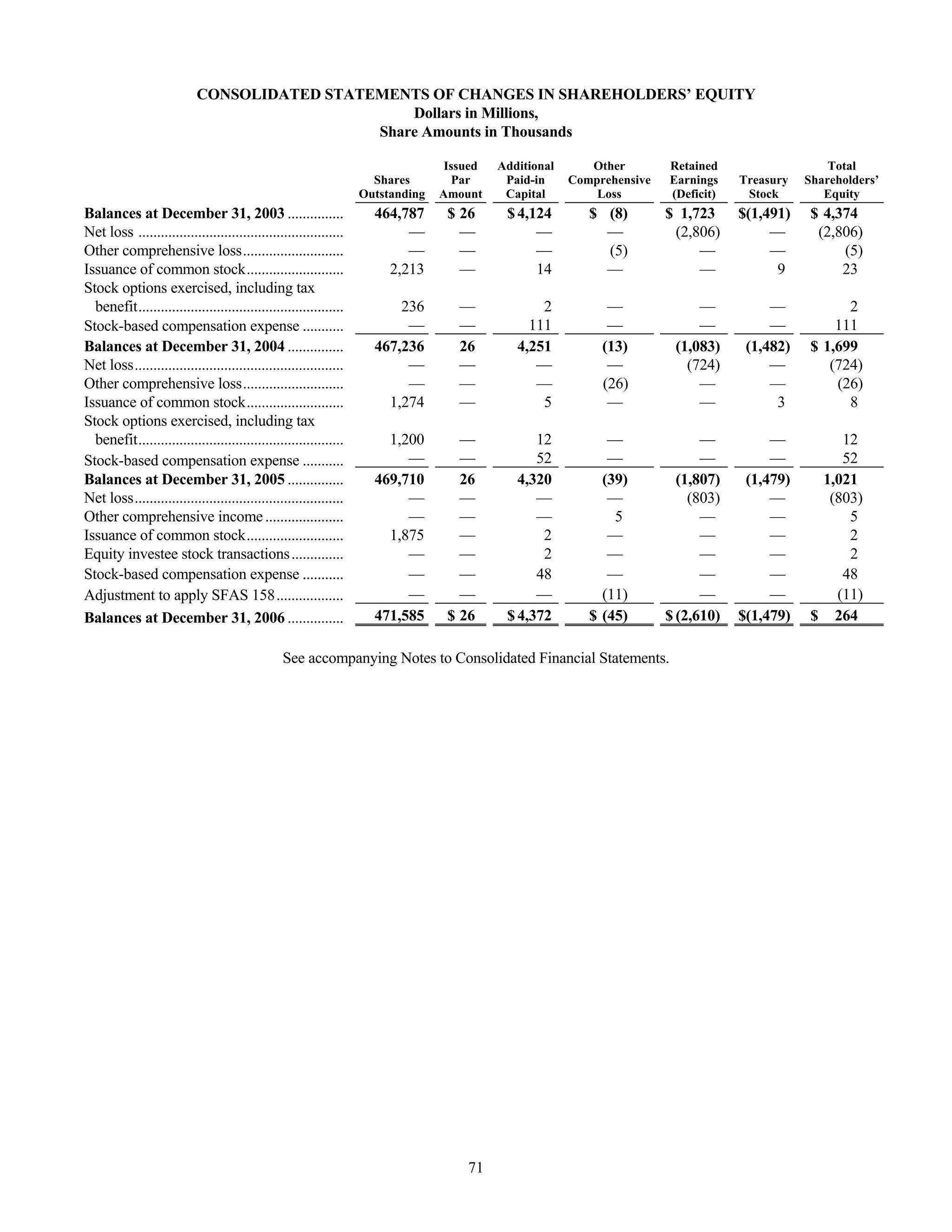

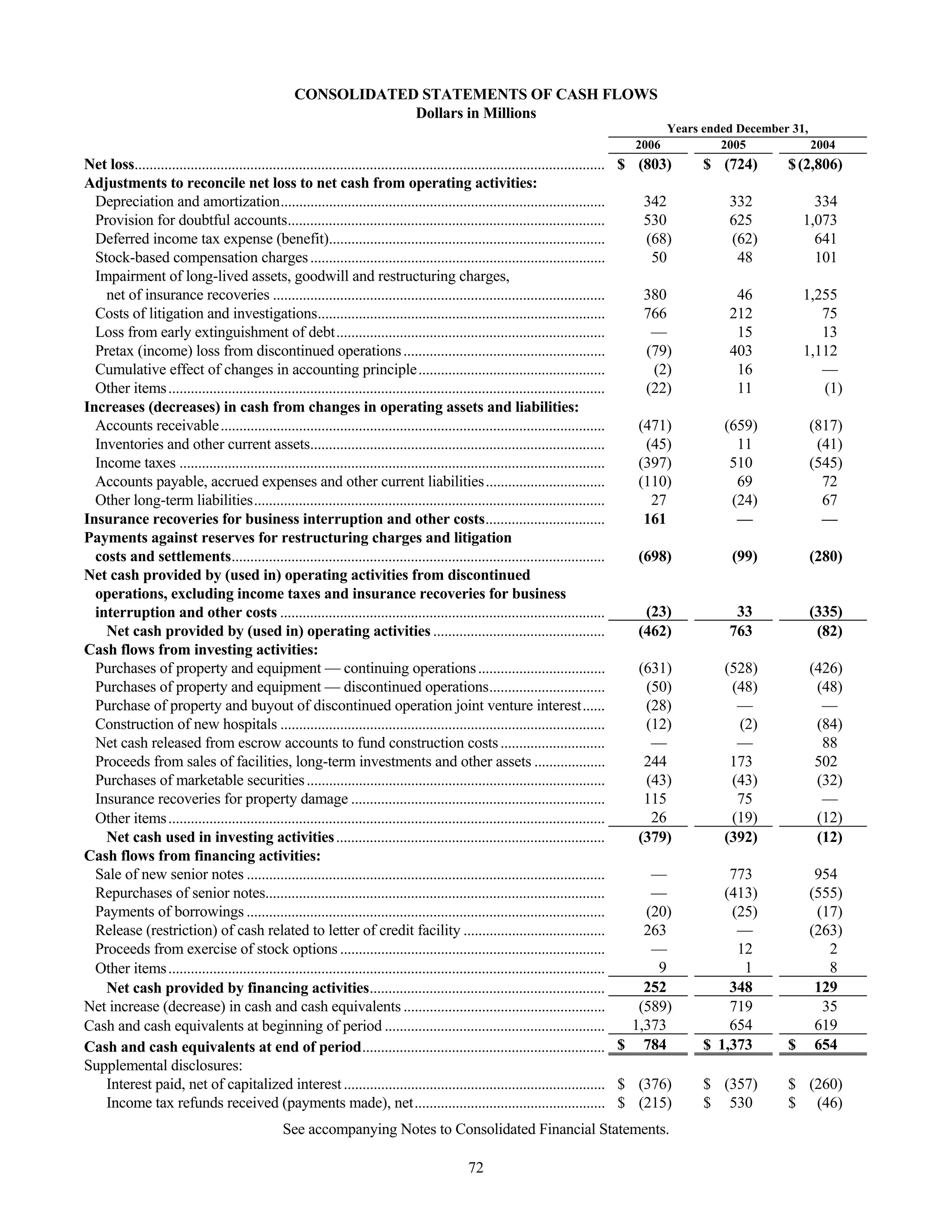

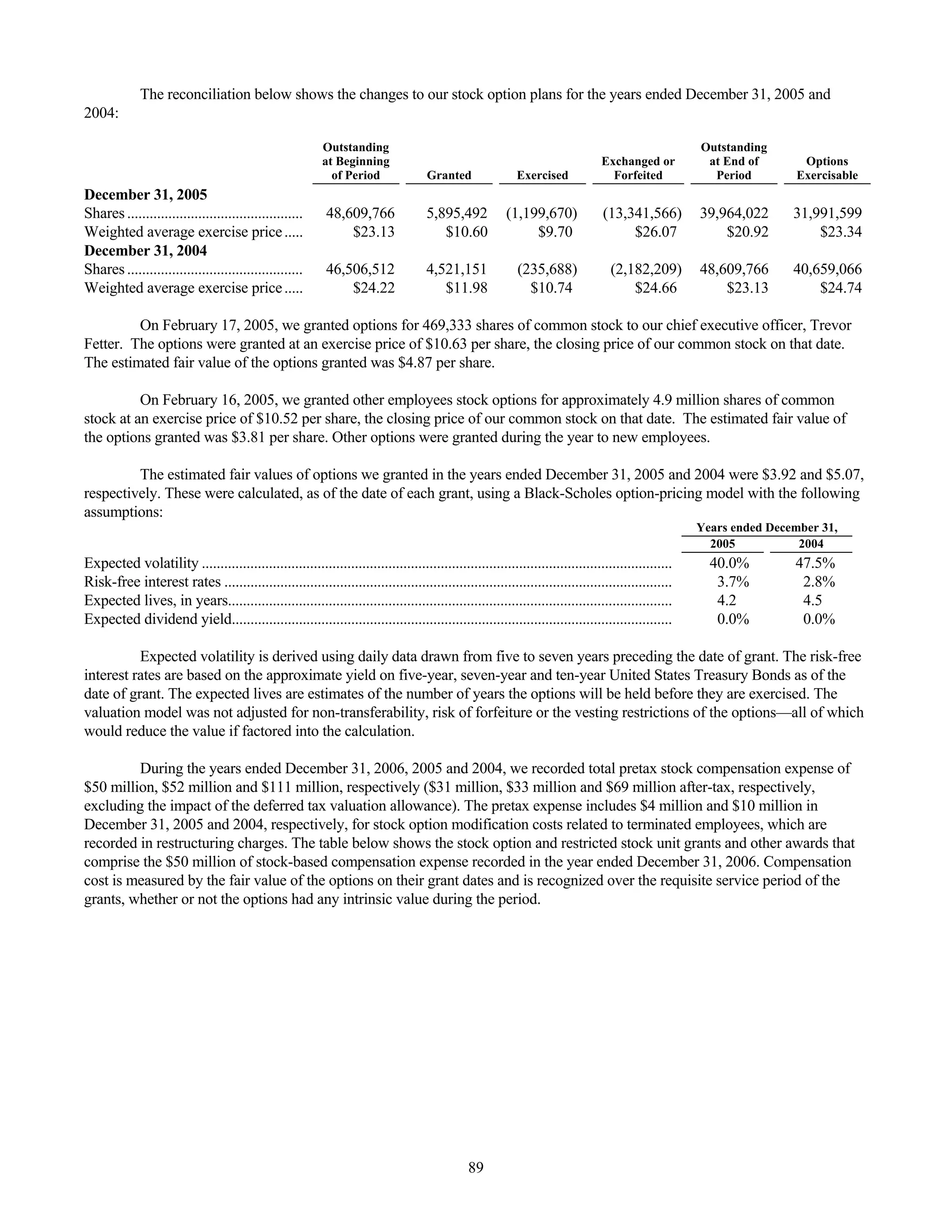

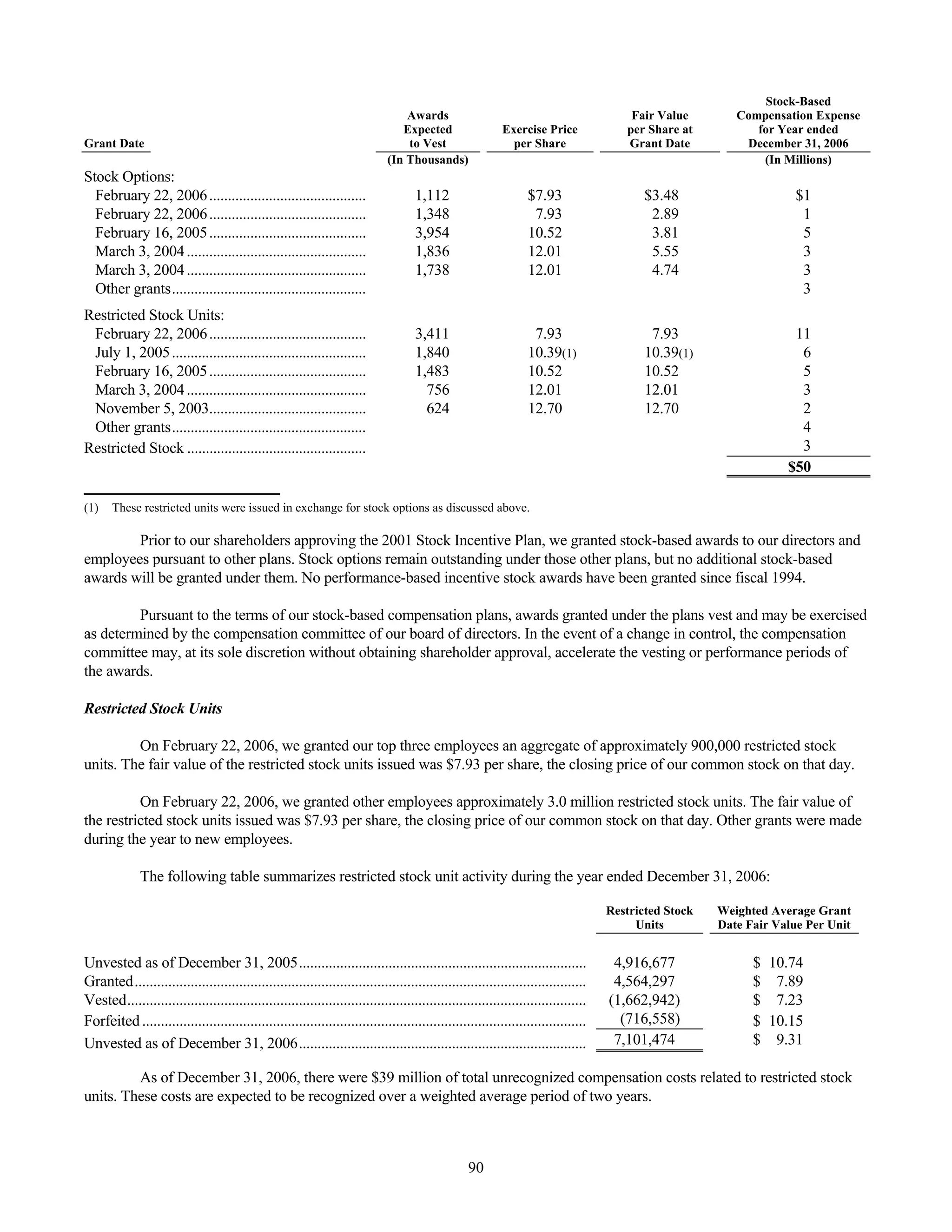

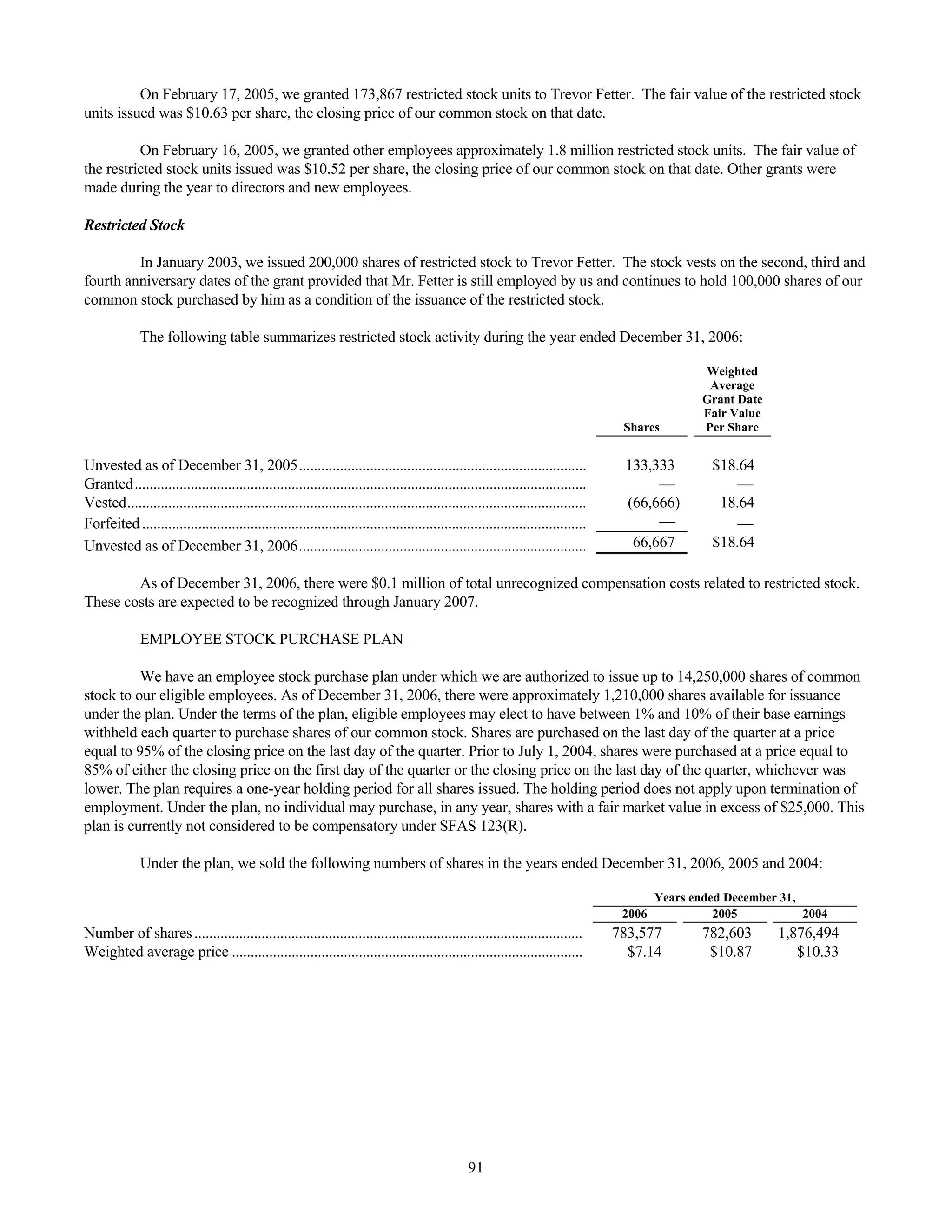

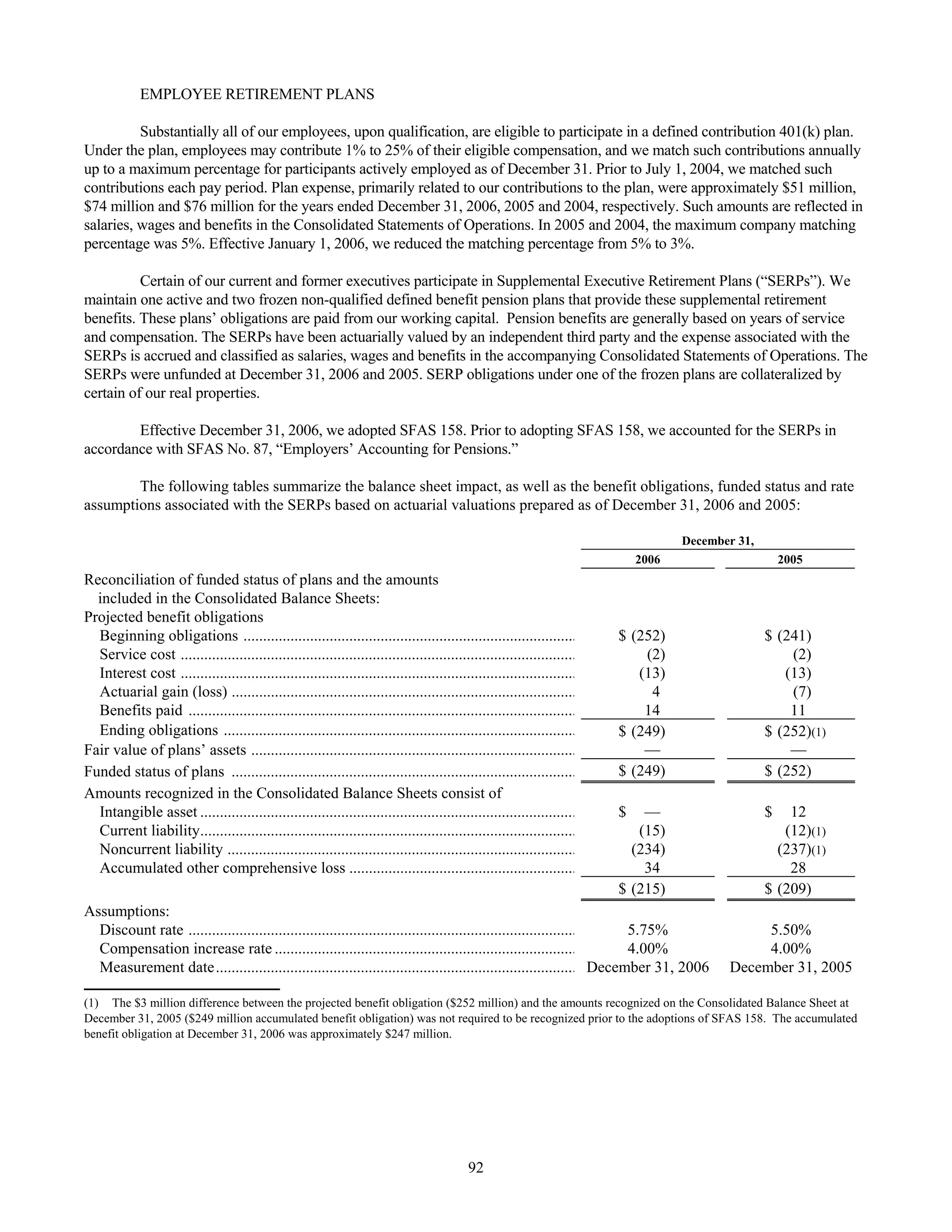

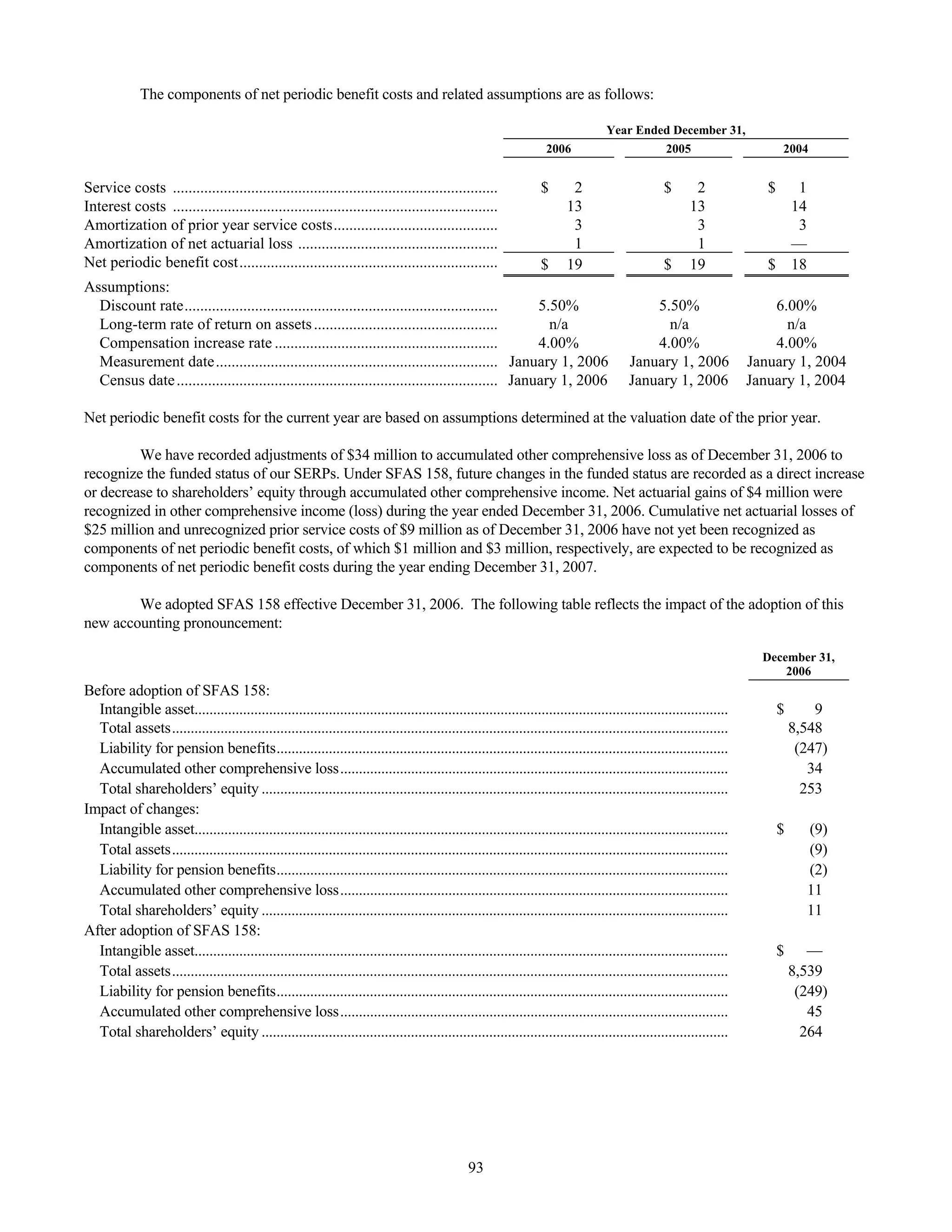

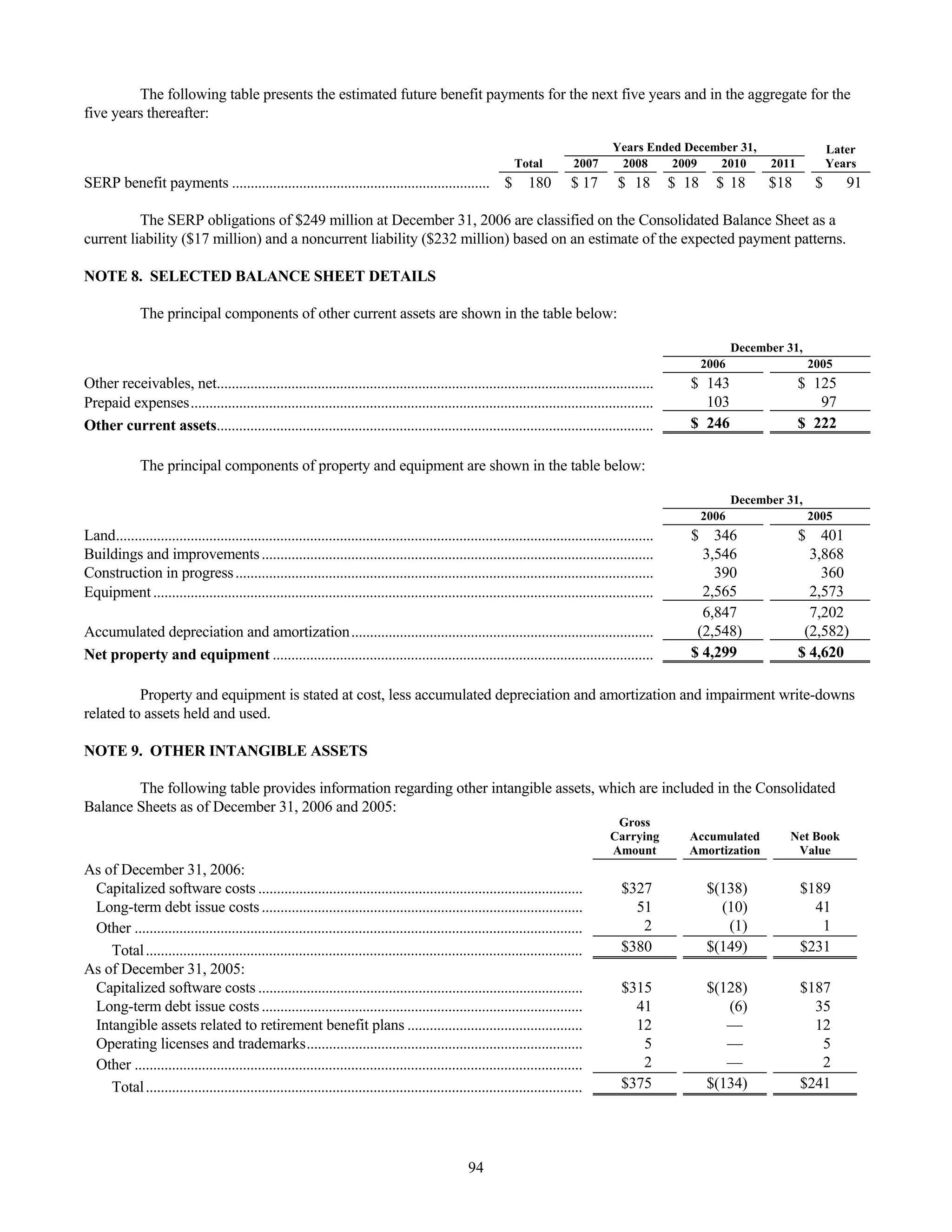

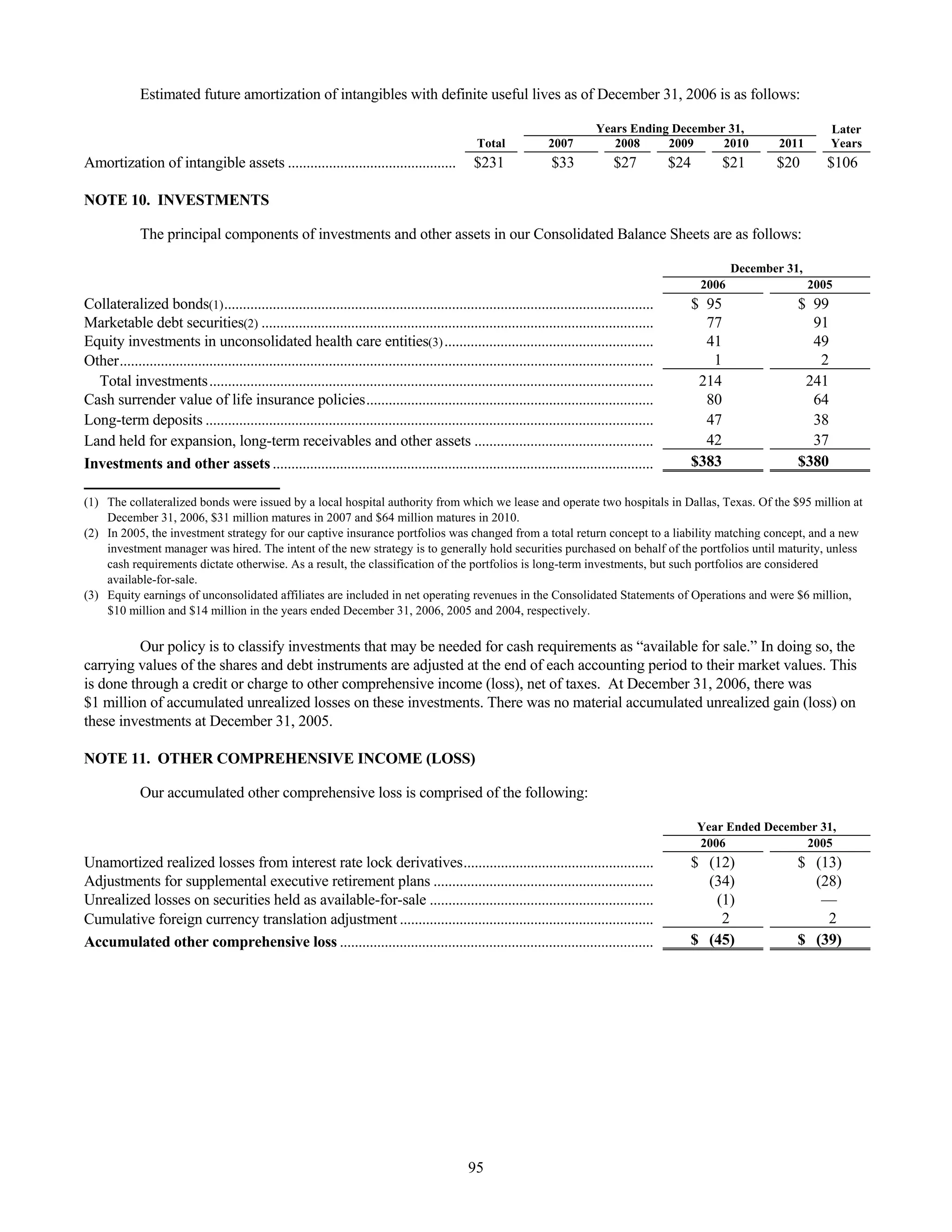

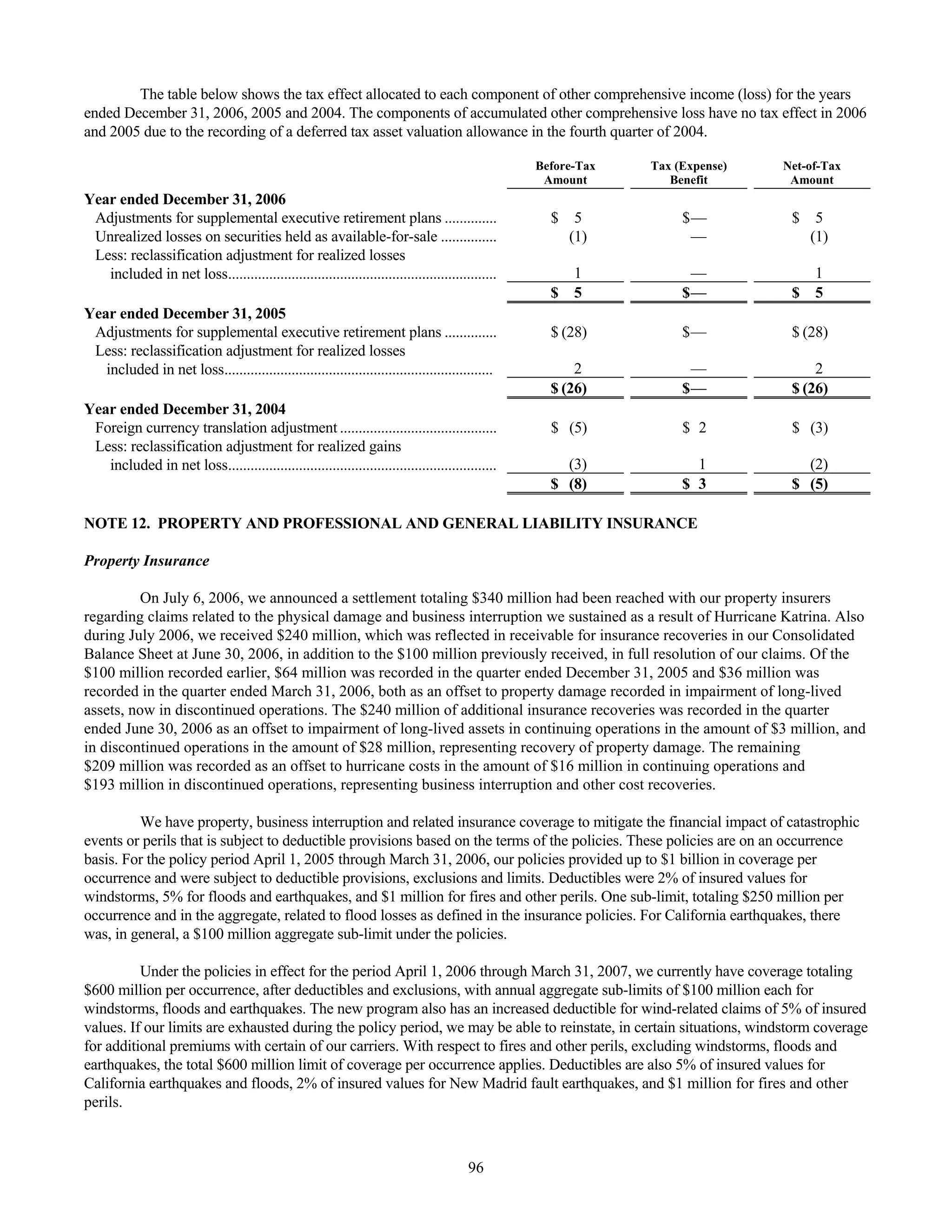

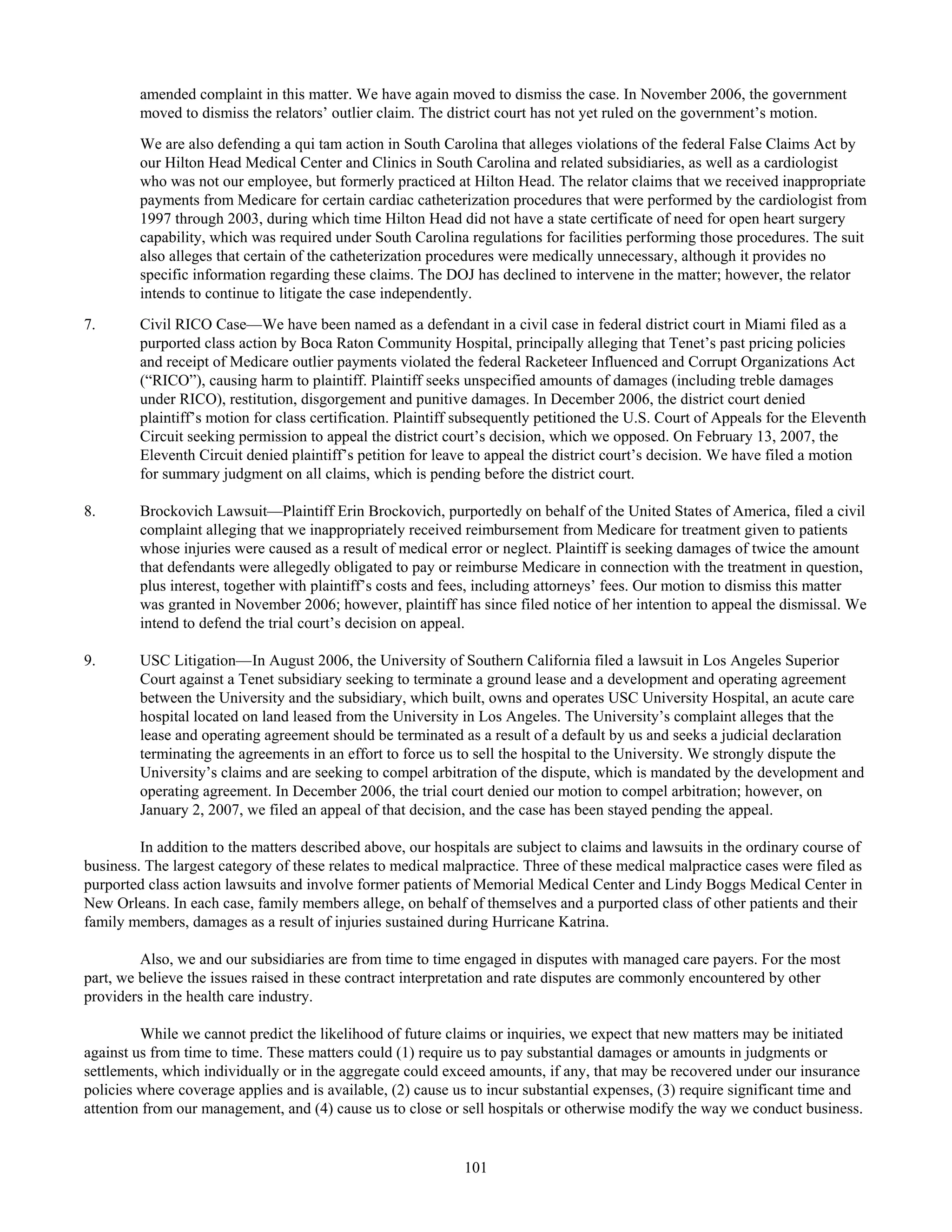

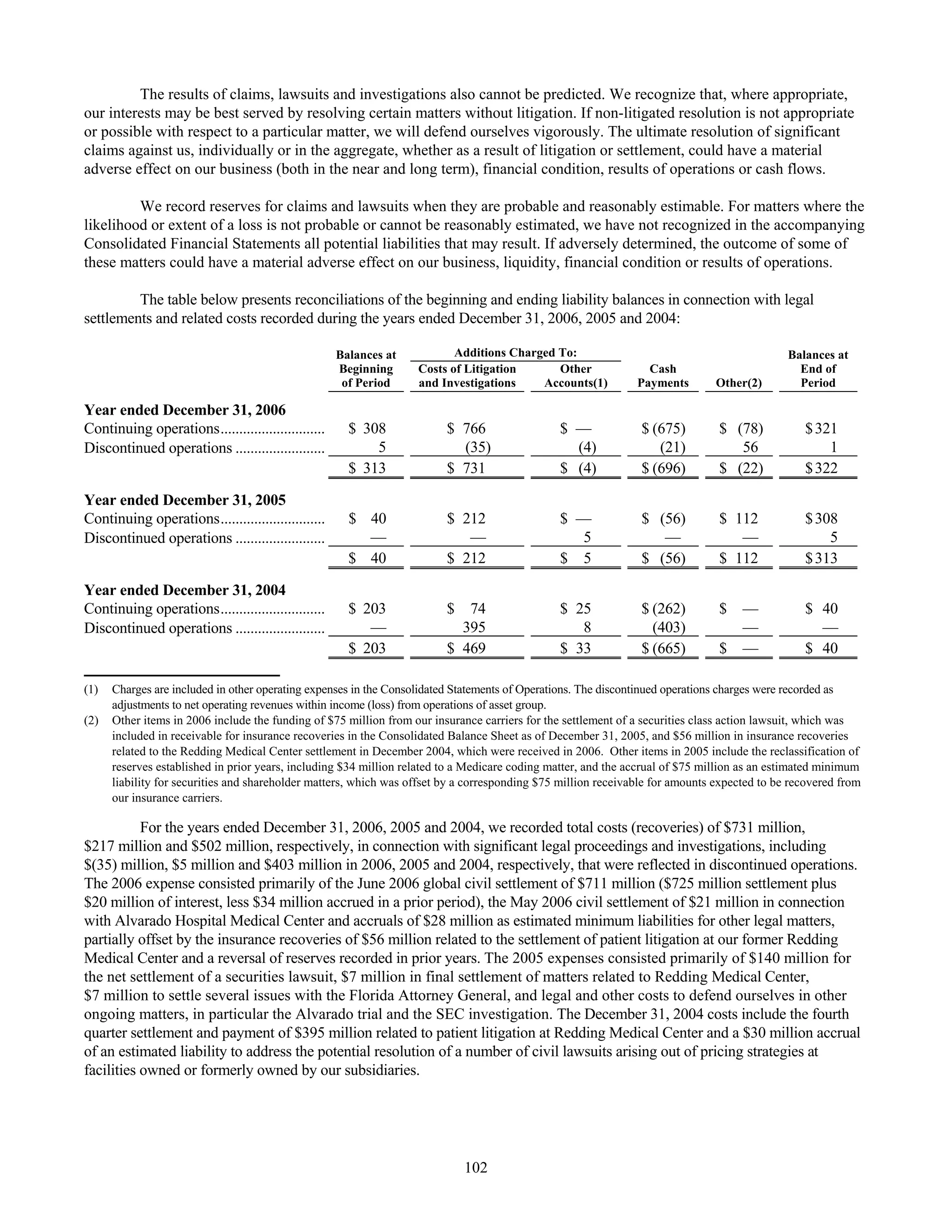

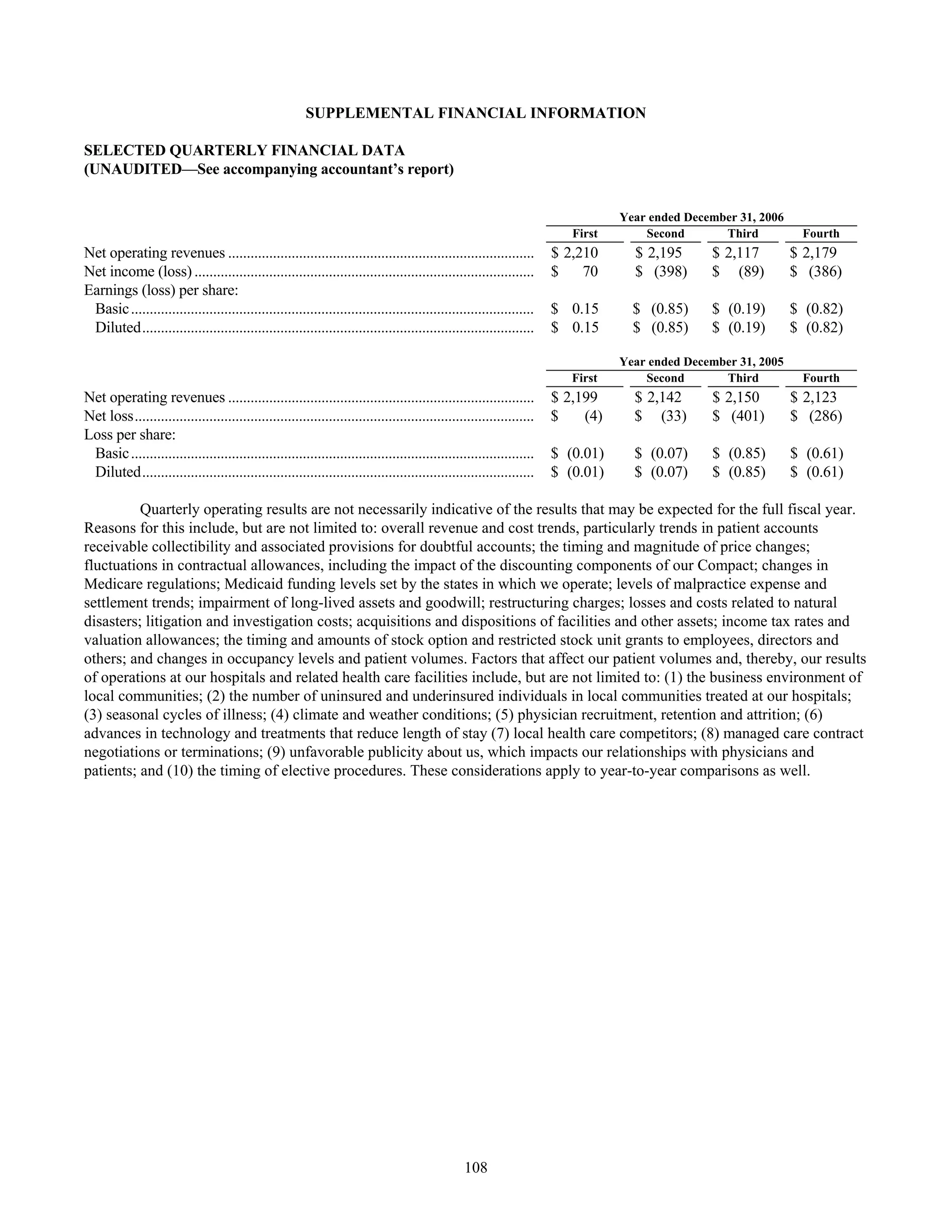

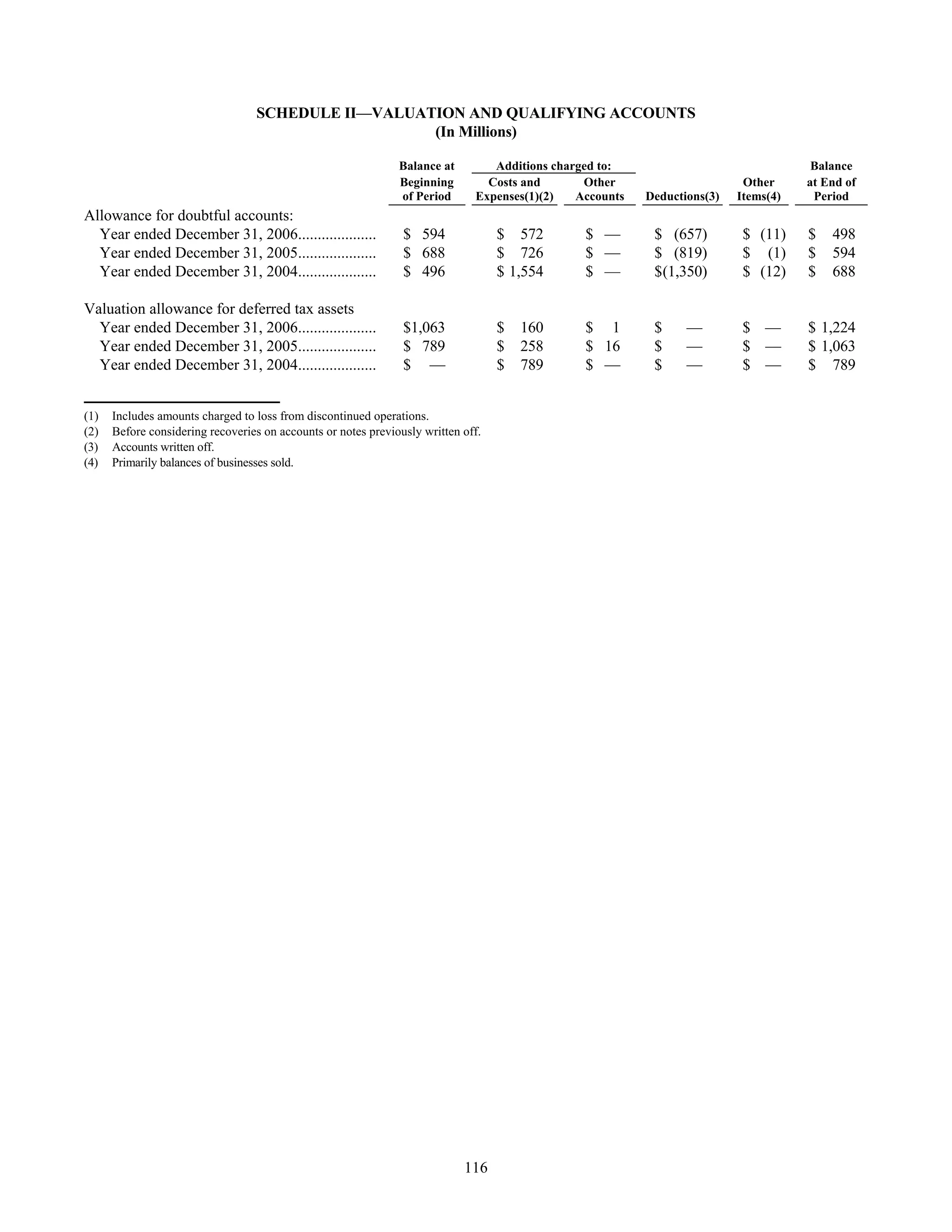

This document is Tenet Healthcare Corporation's annual report on Form 10-K for the fiscal year ended December 31, 2006 filed with the US Securities and Exchange Commission. It provides an overview of Tenet's business operations, legal proceedings, risk factors, financial statements and other required disclosures. Tenet operates general hospitals and related healthcare facilities across the United States.