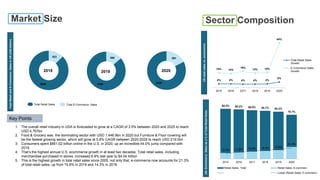

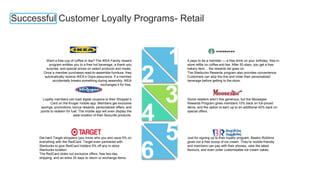

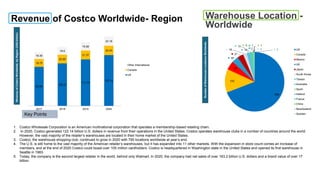

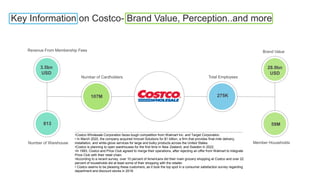

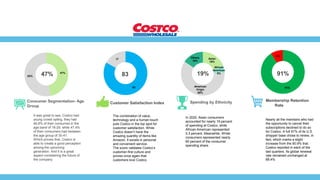

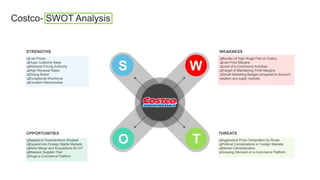

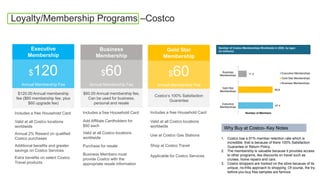

The U.S. retail market is projected to grow at a CAGR of 3.5% from 2020 to 2025, driven by evolving consumer expectations and the impact of COVID-19. Costco, as a major player, maintains a strong membership base with significant e-commerce sales and an extensive expansion plan, facing competition primarily from Walmart and Amazon. Successful loyalty programs and technological adaptations are crucial for retailers to capture and retain customers in this transforming landscape.