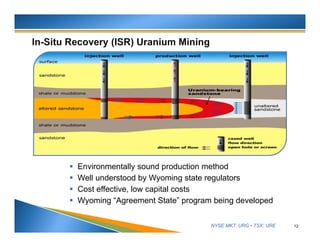

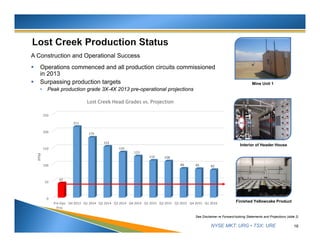

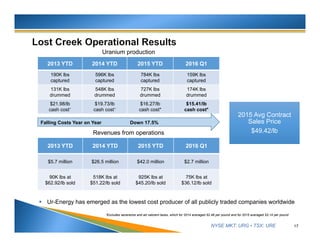

- Lost Creek ISR uranium facility in Wyoming has been in steady-state production since 2013, producing over 1.73M lbs of U3O8 to date at low costs.

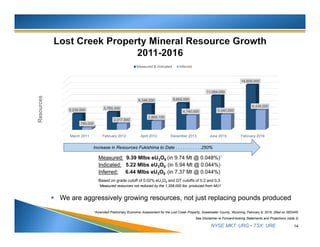

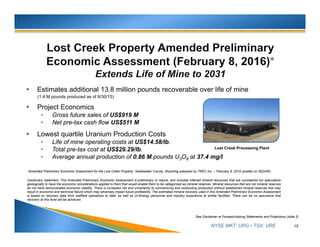

- Resources at the Lost Creek property have increased significantly since 2011 through exploration, totaling over 14.6M lbs of measured and indicated resources currently.

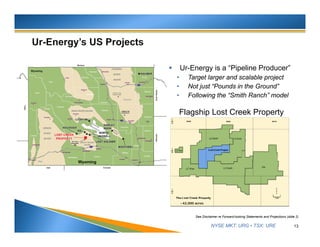

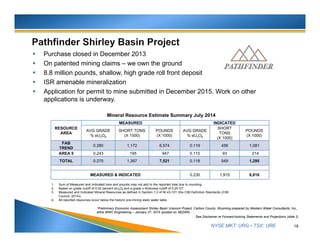

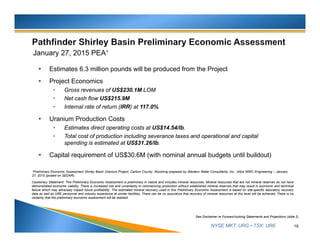

- The Shirley Basin project in Wyoming is the company's next development project, with a positive preliminary economic assessment completed in 2015 and permitting applications underway.