Updated Economic and Treasury Market Review

•Download as PPTX, PDF•

0 likes•67 views

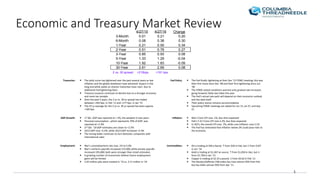

The document summarizes economic trends and market indicators in the United States. Treasury yields have generally decreased across maturity dates over the past year. The Federal Reserve raised interest rates in December 2015 and expects further gradual rate increases. First quarter GDP growth was modest at 0.5% but is estimated to rise to 2.5% in the second quarter. Core inflation remains below the Fed's 2% target. The unemployment rate rose slightly to 5% in March while payroll jobs increased more than expected. Commodity prices have risen from lows earlier this year but remain well below historic highs.

Report

Share

Report

Share

Recommended

Obama Administration vs CBO fiscal forecast

This presentation reviews the fiscal forecast from the Obama Administration released within the "A New Era of Responsibility" in February of 2009 and the related CBO analysis released in March of 2009.

Real Time Market Advice In Forex Market

We are providing Intraday Forex Tips. Just Look Up Quick Results now!

Weekly Currency Round up – 16th February 2018

The pound was off to a poor start at the beginning of this week, particularly given the Bank of England’s guidance last week that the UK interest rates would rise sooner and further than previously suggested.

special Forex (Currency ) trading tips

Get Free Trial for Intraday Forex Tips by Trifid Research. Our Forex Tips are available on Mobile and Web. Get Your 2 days Free Trial Now!

Recommended

Obama Administration vs CBO fiscal forecast

This presentation reviews the fiscal forecast from the Obama Administration released within the "A New Era of Responsibility" in February of 2009 and the related CBO analysis released in March of 2009.

Real Time Market Advice In Forex Market

We are providing Intraday Forex Tips. Just Look Up Quick Results now!

Weekly Currency Round up – 16th February 2018

The pound was off to a poor start at the beginning of this week, particularly given the Bank of England’s guidance last week that the UK interest rates would rise sooner and further than previously suggested.

special Forex (Currency ) trading tips

Get Free Trial for Intraday Forex Tips by Trifid Research. Our Forex Tips are available on Mobile and Web. Get Your 2 days Free Trial Now!

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...Investments Network marcus evans

For more information contact: emailus@marcusevans.com

Mike PeQueen from HighTower Advisors and a Speaker at the marcus evans Private Wealth Management Summit held in Las Vegas, NV Dec 8-10, delivered his presentation entitled "What to Expect in the Year Ahead: The Global Market Outlook for 2014".

Join the 2014 Private Wealth Management Summit along with leading regional investors in an intimate environment for a highly focused discussion on the latest investment strategies in the market.

For more information contact: emailus@marcusevans.com011117 boe base rate rise

A look at the potential consequences of a rise in the Bank of England Base Rate

Bank of Canada maintains overnight rate target at 1/2 per cent

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

The global economy is evolving largely as the Bank projected in its April Monetary Policy Report (MPR). In the United States, despite weakness in the first quarter, a number of indicators, including employment, point to a return to solid growth in 2016. Financial conditions remain accommodative, with ongoing geopolitical factors contributing to fragile market sentiment. Oil prices are higher, in part because of short-term supply disruptions.

In Canada, the economy’s structural adjustment to the oil price shock continues, but is proving to be uneven. Growth in the first quarter of 2016 appears to be in line with the Bank’s April projection, although business investment and intentions remain disappointing. The second quarter will be much weaker than predicted because of the devastating Alberta wildfires. The Bank’s preliminary assessment is that fire-related destruction and the associated halt to oil production will cut about 1 1/4 percentage points off real GDP growth in the second quarter. The economy is expected to rebound in the third quarter, as oil production resumes and reconstruction begins. While the Canadian dollar has been fluctuating in response to shifting expectations of US monetary policy and higher oil prices, it is now close to the level assumed in April.

Inflation is roughly in line with the Bank’s expectations. Total CPI inflation has risen recently, largely due to movements in gasoline prices, but remains slightly below the 2 per cent target. Measures of core inflation remain close to 2 per cent, reflecting the offsetting influences of past exchange rate depreciation and excess capacity.

Canada’s housing market continues to display strong regional divergences, reinforced by the complex adjustment underway in the economy. In this context, household vulnerabilities have moved higher. Meanwhile, the risks to the Bank’s inflation projection remain roughly balanced. Therefore, the Bank’s Governing Council judges that the current stance of monetary policy is still appropriate, and the target for the overnight rate remains at 1/2 per cent.

The Economy Ahead in 2015

Jevin Sackett does an in-depth look at various economic factors that leads him to believe that the United States will have a strong economic year in 2015.

Public Sector in Rural Oregon

A brief overview of the public sector in rural Oregon. Presentation given to the Oregon House Committee on Economic Development and Trade on May 31st, 2017.

The Powerful Currency Market Tips & News

Trifid Research are providing the better clients 24x7 assistance and support for excellent trading tips. We are providing 2 days free trial for Currency Tips and Forex Tips etc.

Investment & Trading Tips in Forex Market

Trifid Research Pvt Ltd. is a leading stock advisory firm offering services in Forex and Currency market Tips all over India. Try our 2 days free trial.

Daily Currency Tips and News

Trifid Research had provided a daily and weekly report on the stock market, commodity market and currency market. This is very useful for all traders and investors, according to long term and short term trading.

Market Month: July 2018

Market growth has come despite trade wars between the United States and other trade partners, particularly China. Stocks propelled forward in July due to favorable economic indicators and encouraging corporate earnings reports.

2015 Economic Outlook Briefing

SunTrust Chief Economist Gregory Miller Briefs Chamber Members on Economic Trends

Gregory Miller, chief economist at SunTrust Bank, gave the keynote address at the 2015 Economic Outlook Briefing presented by Town of Chapel Hill Economic Development, describing trends and the latest economic issues facing the nation and the region.

As SunTrust’s chief economist, Gregory Miller analyzes the U.S. and global economies and forecasts the U.S. national economy. He advises corporate and bank boards of directors, as well as making frequent presentations to SunTrust business and wealth management clients. He sits on committees charged with interest rate setting, corporate investment, and benefits policy. He is a policy advisor for Private Wealth and Corporate Investment Banking groups.

Mr. Miller comments frequently in business media, including CNBC News, Bloomberg News, Fox Business, Reuters, USA Today, Wall Street Journal, Financial Times, Blue Chip Financial Forecast, and other local news media platforms.

In addition to Miller’s economic forecast, Chamber President & CEO Aaron Nelson presented the results of the Chamber’s annual Economic Conditions Survey, an online survey that gauges our community’s thoughts on the current economy based on Chamber member response.

For more information, visit carolinachamber.org or contact Kristen Smith at (919) 357-9988.

###

The Chapel Hill-Carrboro (NC) Chamber of Commerce is a business leadership organization serving the greater Chapel Hill, NC community. The Chamber serves and supports the business interests of its more than 1,200 members and helps create a sustainable community where they can thrive. Chamber members employ more than 80,000 in the Research Triangle region.

201812-FOMC

Fed must relent. Our expectations now is for a state dependent (global financial conditions to stabilise, cushion rising debt repayment burden and allowing domestic leverage to level off, coupled with still moderate economic growth/inflation, policy options to widen positively globally, especially in China) Fed relent with scope for a final 25-50bps, if any (pause otherwise), in late 2019/2020, should the cycle extents, with the FFR hitting cycle terminal at 2.75-3.00%.

More Related Content

What's hot

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...Investments Network marcus evans

For more information contact: emailus@marcusevans.com

Mike PeQueen from HighTower Advisors and a Speaker at the marcus evans Private Wealth Management Summit held in Las Vegas, NV Dec 8-10, delivered his presentation entitled "What to Expect in the Year Ahead: The Global Market Outlook for 2014".

Join the 2014 Private Wealth Management Summit along with leading regional investors in an intimate environment for a highly focused discussion on the latest investment strategies in the market.

For more information contact: emailus@marcusevans.com011117 boe base rate rise

A look at the potential consequences of a rise in the Bank of England Base Rate

Bank of Canada maintains overnight rate target at 1/2 per cent

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

The global economy is evolving largely as the Bank projected in its April Monetary Policy Report (MPR). In the United States, despite weakness in the first quarter, a number of indicators, including employment, point to a return to solid growth in 2016. Financial conditions remain accommodative, with ongoing geopolitical factors contributing to fragile market sentiment. Oil prices are higher, in part because of short-term supply disruptions.

In Canada, the economy’s structural adjustment to the oil price shock continues, but is proving to be uneven. Growth in the first quarter of 2016 appears to be in line with the Bank’s April projection, although business investment and intentions remain disappointing. The second quarter will be much weaker than predicted because of the devastating Alberta wildfires. The Bank’s preliminary assessment is that fire-related destruction and the associated halt to oil production will cut about 1 1/4 percentage points off real GDP growth in the second quarter. The economy is expected to rebound in the third quarter, as oil production resumes and reconstruction begins. While the Canadian dollar has been fluctuating in response to shifting expectations of US monetary policy and higher oil prices, it is now close to the level assumed in April.

Inflation is roughly in line with the Bank’s expectations. Total CPI inflation has risen recently, largely due to movements in gasoline prices, but remains slightly below the 2 per cent target. Measures of core inflation remain close to 2 per cent, reflecting the offsetting influences of past exchange rate depreciation and excess capacity.

Canada’s housing market continues to display strong regional divergences, reinforced by the complex adjustment underway in the economy. In this context, household vulnerabilities have moved higher. Meanwhile, the risks to the Bank’s inflation projection remain roughly balanced. Therefore, the Bank’s Governing Council judges that the current stance of monetary policy is still appropriate, and the target for the overnight rate remains at 1/2 per cent.

The Economy Ahead in 2015

Jevin Sackett does an in-depth look at various economic factors that leads him to believe that the United States will have a strong economic year in 2015.

Public Sector in Rural Oregon

A brief overview of the public sector in rural Oregon. Presentation given to the Oregon House Committee on Economic Development and Trade on May 31st, 2017.

The Powerful Currency Market Tips & News

Trifid Research are providing the better clients 24x7 assistance and support for excellent trading tips. We are providing 2 days free trial for Currency Tips and Forex Tips etc.

Investment & Trading Tips in Forex Market

Trifid Research Pvt Ltd. is a leading stock advisory firm offering services in Forex and Currency market Tips all over India. Try our 2 days free trial.

Daily Currency Tips and News

Trifid Research had provided a daily and weekly report on the stock market, commodity market and currency market. This is very useful for all traders and investors, according to long term and short term trading.

What's hot (16)

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...

What to Expect in the Year Ahead - Presentation: Mike PeQueen, HighTower Advi...

Bank of Canada maintains overnight rate target at 1/2 per cent

Bank of Canada maintains overnight rate target at 1/2 per cent

Agri 2312 chapter 15 macroeconomic policy and agriculture

Agri 2312 chapter 15 macroeconomic policy and agriculture

Similar to Updated Economic and Treasury Market Review

Market Month: July 2018

Market growth has come despite trade wars between the United States and other trade partners, particularly China. Stocks propelled forward in July due to favorable economic indicators and encouraging corporate earnings reports.

2015 Economic Outlook Briefing

SunTrust Chief Economist Gregory Miller Briefs Chamber Members on Economic Trends

Gregory Miller, chief economist at SunTrust Bank, gave the keynote address at the 2015 Economic Outlook Briefing presented by Town of Chapel Hill Economic Development, describing trends and the latest economic issues facing the nation and the region.

As SunTrust’s chief economist, Gregory Miller analyzes the U.S. and global economies and forecasts the U.S. national economy. He advises corporate and bank boards of directors, as well as making frequent presentations to SunTrust business and wealth management clients. He sits on committees charged with interest rate setting, corporate investment, and benefits policy. He is a policy advisor for Private Wealth and Corporate Investment Banking groups.

Mr. Miller comments frequently in business media, including CNBC News, Bloomberg News, Fox Business, Reuters, USA Today, Wall Street Journal, Financial Times, Blue Chip Financial Forecast, and other local news media platforms.

In addition to Miller’s economic forecast, Chamber President & CEO Aaron Nelson presented the results of the Chamber’s annual Economic Conditions Survey, an online survey that gauges our community’s thoughts on the current economy based on Chamber member response.

For more information, visit carolinachamber.org or contact Kristen Smith at (919) 357-9988.

###

The Chapel Hill-Carrboro (NC) Chamber of Commerce is a business leadership organization serving the greater Chapel Hill, NC community. The Chamber serves and supports the business interests of its more than 1,200 members and helps create a sustainable community where they can thrive. Chamber members employ more than 80,000 in the Research Triangle region.

201812-FOMC

Fed must relent. Our expectations now is for a state dependent (global financial conditions to stabilise, cushion rising debt repayment burden and allowing domestic leverage to level off, coupled with still moderate economic growth/inflation, policy options to widen positively globally, especially in China) Fed relent with scope for a final 25-50bps, if any (pause otherwise), in late 2019/2020, should the cycle extents, with the FFR hitting cycle terminal at 2.75-3.00%.

2020 Vancouver Strategic Outlook Presentation

Following an introductory by President David Sung, CEO John Nicola and CIO Rob Edel cover investment strategies for an uncertain future.

Executive Breakfast Monthly Economic Review - August 2015: LOOT RECOVERY???- ...

Executive Breakfast Monthly Economic Review - August 2015: LOOT RECOVERY???- ...Financial Derivatives Company Limited (FDC)

The CBN has come out with a rash of new regulations to defend the naira, the latest being the suspension of dollar cash deposits into domiciliary accounts in Nigeria. The naira has swung like a pendulum in the parallel market between N208 and N245. Most investors are deferring any decisions until there is some clarity, as to the Buhari economic direction.

Federal and state government officials have cut back on international travels and reckless expenditure, which has resulted in airline summer load factors dropping to 65%. Power supply from the grid is up at 4,800MW while airport immigration and customs officers are behaving themselves professionally.

In the meantime there has been a sharp lull in economic activity with retail sales of garments and electronics down to 30%. There is also the problem of 55% of flats in Lekki being vacant and rents likely to fall.

The impact of the uncertainty and slowdown on investment, output and profit margins is discussed in this edition of the August LBS Executive Breakfast session with B.J. Rewane and the FDC team.

Enjoy your read....India Economic Outlook - 2014

A more simplified and reader-friendly version of P.K Basu's - India Economic Outlook - 2014. It deduces from past trends and outlines the current economic scenario around the world and its implications on the Indian economy.

CRFB_Fiscal Policy in High Inflation.pptx

This slide deck was used by Marc Goldwein, Senior Vice President and Senior Policy Director for the Committee for a Responsible Federal Budget, during a recent presentation on inflation and fiscal policy

Swedbank's Global Economic Outlook, 2011 March

Swedbank's Global Economic Outlook, 2011 March: The global recovery has gained a footing –

but the risk of a backlash remains.

Swedbank Economic Outlook January 2010

Swedbank was founded in 1820, as Sweden’s first savings bank was established. Today, our heritage is visible in that we truly are a bank for each and every one and in that we still strive to contribute to a sustainable development of society and our environment. We are strongly committed to society as a whole and keen to help bring about a sustainable form of societal development. Our Swedish operations hold an ISO 14001 environmental certification, and environmental work is an integral part of our business activities.

Similar to Updated Economic and Treasury Market Review (20)

Executive Breakfast Monthly Economic Review - August 2015: LOOT RECOVERY???- ...

Executive Breakfast Monthly Economic Review - August 2015: LOOT RECOVERY???- ...

603fafc95abf73a62ea02cf6_e-rossi_global_24nov2015.ppt

603fafc95abf73a62ea02cf6_e-rossi_global_24nov2015.ppt

Updated Economic and Treasury Market Review

- 1. Economic and Treasury Market Review 1 Change 3-Month 0.01 0.21 0.20 6-Month 0.08 0.38 0.30 1-Year 0.21 0.55 0.34 2-Year 0.51 0.78 0.27 3-Year 0.85 0.93 0.08 5-Year 1.33 1.29 -0.04 10-Year 1.92 1.83 -0.09 30-Year 2.61 2.69 0.08 4/27/15 4/27/16 2 vs. 30 spread: +210bps. +191 bps. Treasuries: The yield curve has tightened over the past several years as low inflation and the global slowdown have attracted buyers in the long end while yields on shorter maturities have risen due to additional Fed tightening fears Treasury issuance continues to decline due to a stronger economy and more tax receipts Over the past 5 years, the 2-yr vs. 30-yr spread has traded between +402 bps. in Feb ‘11 and +177 bps. in Jan ‘15 The 25-yr average for the 2-yr vs. 30-yr spread has been approx. +185 bps. Fed Policy: The Fed finally tightening at their Dec ‘15 FOMC meeting; this was their first move since Dec ‘08 and their first tightening since Jun ’06 The FOMC stated conditions warrant only gradual rate increases going forward; likely two hikes this year The Fed’s actual rate path will depend on their economic outlook and the data itself Their policy stance remains accommodative Upcoming FOMC meetings are slated for Jun 15, Jul 27, and Sep 21 GDP Growth: 1st Qtr. GDP was reported at +.5%, the weakest in two years Personal consumption , which represents 70% of GDP, was reported at +1.9% 2nd Qtr. ‘16 GDP estimates are closer to +2.5% 2015 GDP rose +2.4%, while 2014 GDP increased +2.4% The strong dollar continues to hurt domestic companies with international sales Inflation: Mar’s Core-CPI rose .1%, less than expected Feb’s Y-O-Y Core-CPI rose 2.2%, less than expected In 2015, the overall CPI rose .7%, while core inflation rose 2.1% The Fed has reiterated that inflation below 2% could pose risks to the economy Employment: Mar’s unemployment rate rose .1% to 5.0% Mar’s nonfarm payrolls increased 215,000, while private payrolls increased 195,000; both were stronger than street estimates A growing number of economists believe future employment gains will be limited 2.65 million jobs were created in ’15 vs. 3.11 million in ‘14 Commodities: Oil is trading at $46 a barrel, h from $26 in Feb, but i from $107 in Jun ‘14 Gold is trading at $1,267 an ounce, h from $1,050 in Dec, but i from $1,700 in Jan ’13 Copper is trading at $2.22 a pound, i from $4.62 in Feb ‘11 The Reuters/Jefferies CRB Index has risen almost 20% from Feb but has fallen almost 50% from Apr ’11