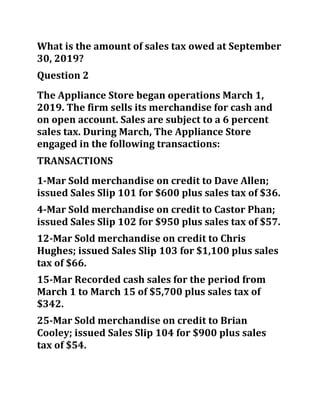

- Exceptional Electronics began operations on September 1, 2019 and engaged in various credit sales and cash transactions throughout the month, including accepting returns and issuing credits.

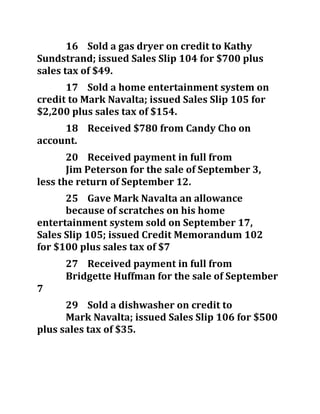

- Transactions included credit sales to Candy Cho, Jim Peterson, Bridgette Huffman, Kathy Sundstrand, and Mark Navalta, as well as cash sales, payments received, and a return/credit.

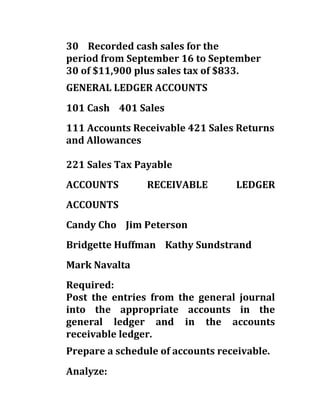

- The document provides the general ledger accounts and details of the transactions to post journal entries to the appropriate general ledger and accounts receivable accounts. It asks to prepare a schedule of accounts receivable and calculate the sales tax owed at September 30, 2019.