Embed presentation

Downloaded 13 times

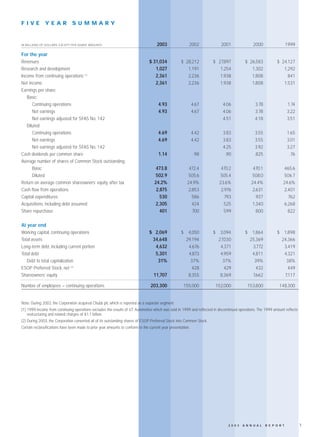

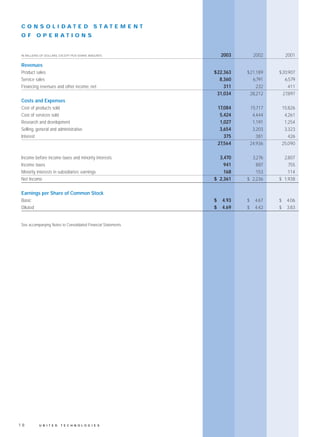

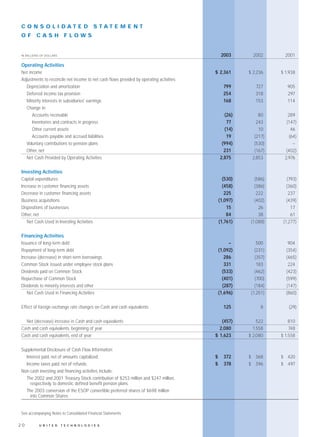

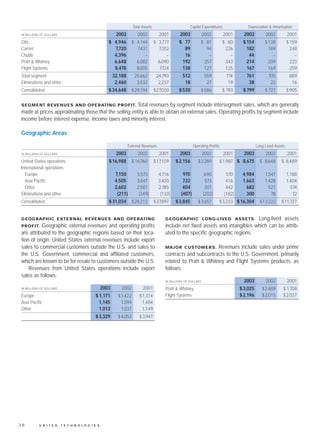

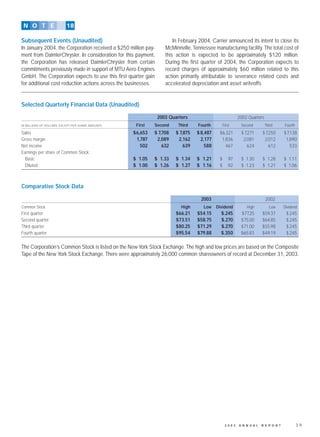

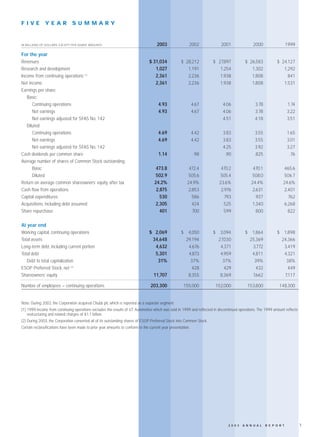

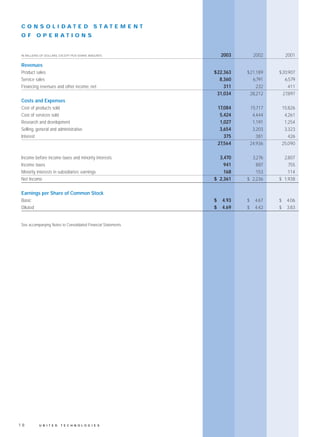

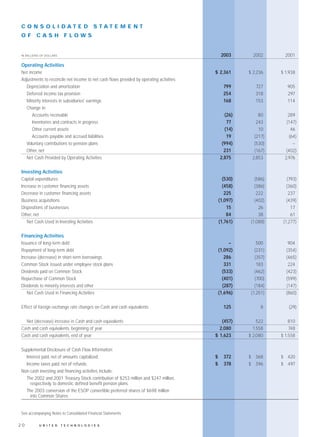

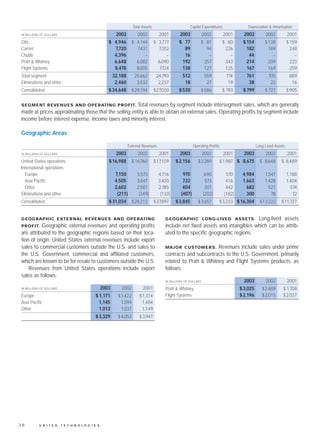

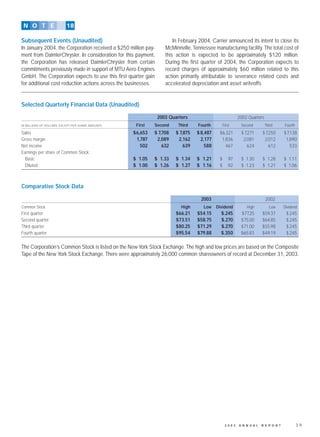

This 2003 annual report provides financial statements and discusses financial results for United Technologies Corporation. It includes a Management Discussion and Analysis section that reviews revenues, research and development expenses, income from continuing operations, and other financial details. The report also lists corporate leadership and shareholder information. United Technologies saw increased revenues but lower research spending compared to 2002, with higher income from continuing operations and net income. The company acquired Chubb plc in 2003.