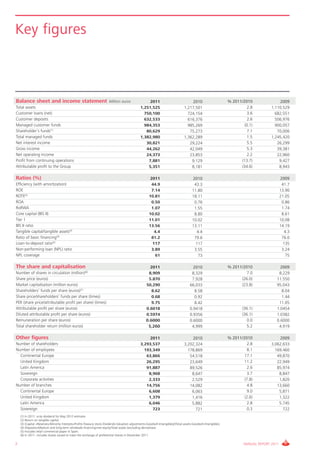

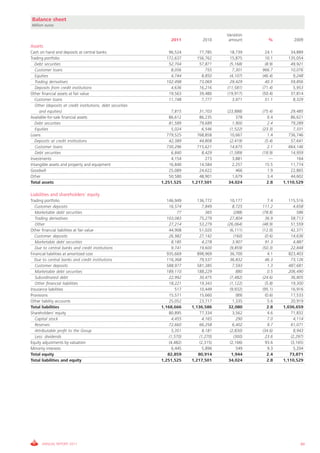

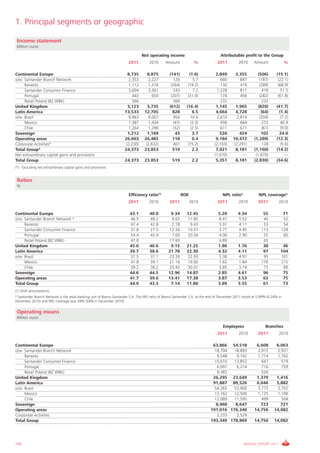

This annual report provides key figures and financial information for Grupo Santander for 2011. Some highlights include:

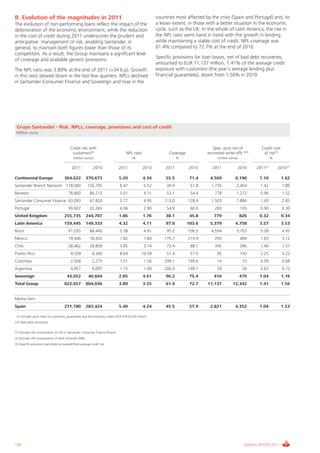

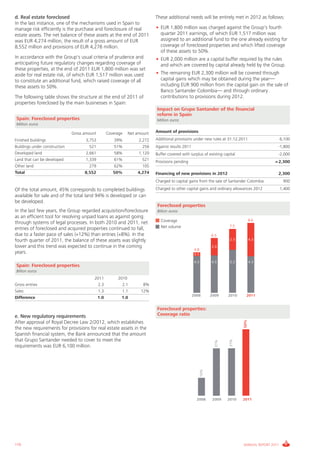

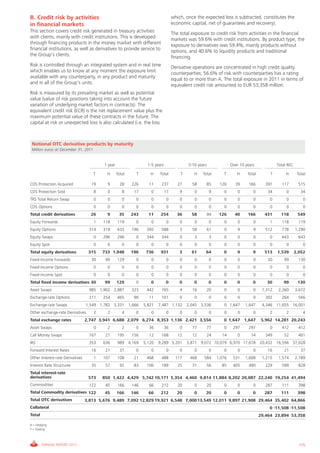

- Total assets increased 2.8% to €1,251,525 million

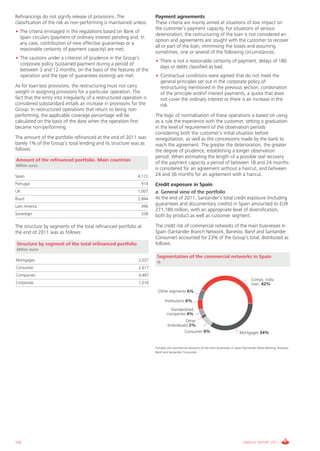

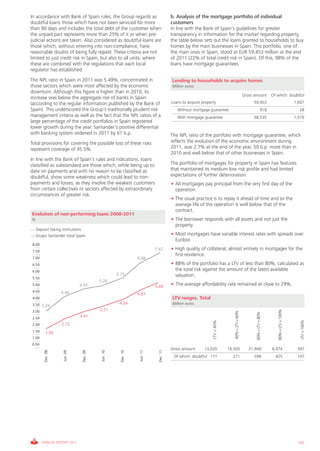

- Customer loans grew 3.6% to €750,100 million

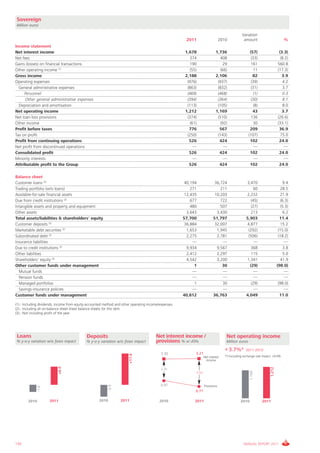

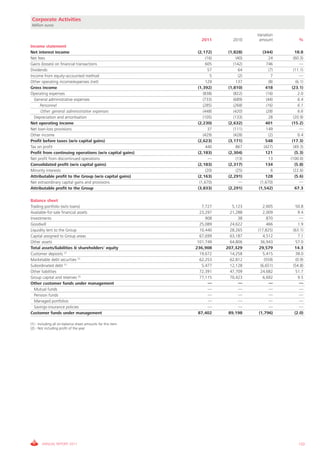

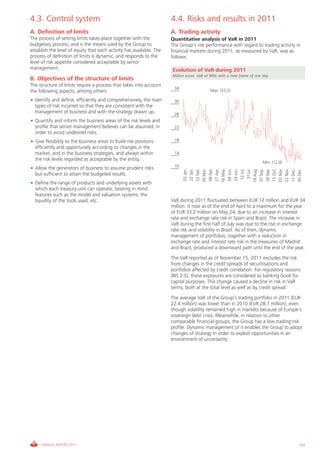

- Attributable profit to the Group decreased 34.6% to €5,351 million

- The efficiency ratio improved to 44.9% from 43.3% the prior year

- Capital ratios like Core capital and Tier 1 both increased, with Core capital at 10.02%