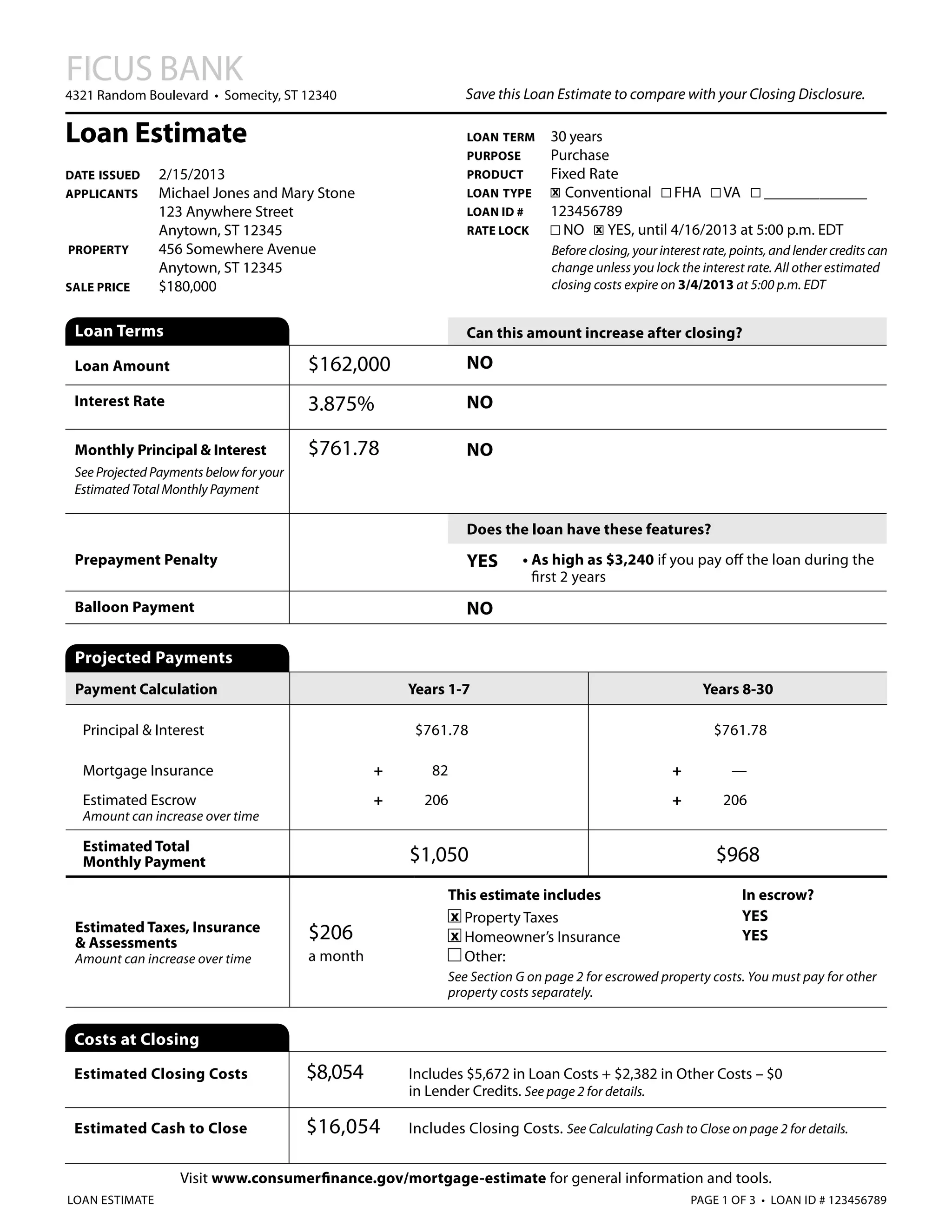

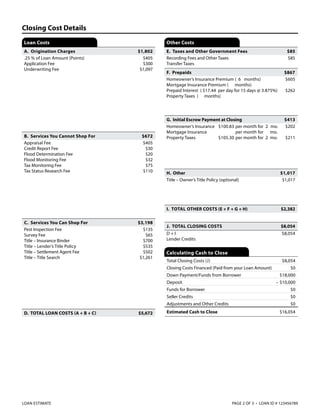

This loan estimate from Ficus Bank outlines a $180,000 mortgage for Michael Jones and Mary Stone, featuring a 30-year term at a 3.875% interest rate with closing costs totaling $8,054. The estimated monthly payment is $1,050, which includes principal, interest, taxes, and insurance, and the total cash to close is $16,054. Additional terms include a prepayment penalty and required homeowner’s insurance, with an APR of 4.274% and a total interest percentage of 69.45% over the loan's duration.