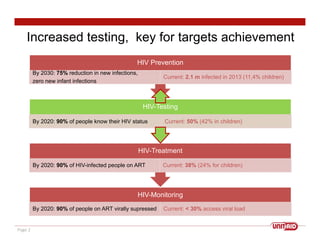

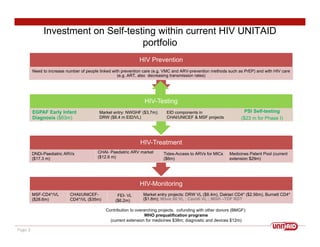

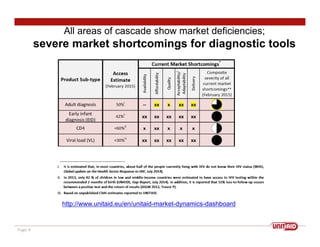

This document discusses UNITAID's strategy for HIV/AIDS testing, treatment, and prevention by 2020/2030. It outlines goals such as having 90% of people know their HIV status and 90% of infected people on antiretroviral therapy. The document then details UNITAID's current portfolio of projects supporting these goals, totaling over $300 million, which focus on early testing, treatment for children, and prevention. It argues that self-testing could help address market deficiencies and testing gaps, and that UNITAID funding now could stimulate the self-testing market and have public health impacts in low-and middle-income countries.