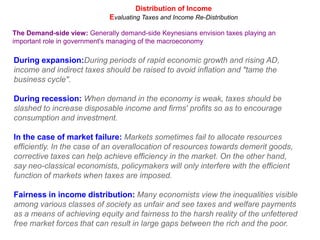

This document summarizes different types of taxes and their impact on the distribution of income. It discusses direct and indirect taxes, and how taxes can be progressive, proportional, or regressive depending on whether the tax rate increases, stays the same, or decreases as income rises. It also describes different views on the role of taxes, with supply-side economists favoring low taxes to encourage growth while demand-side economists see taxes as a tool to manage the economy and achieve fairness.