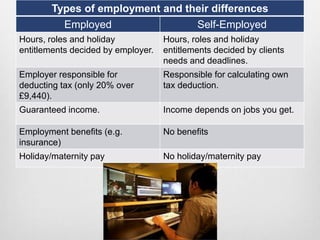

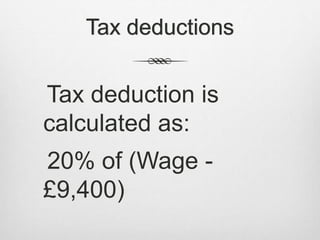

The document compares types of employment and differences between employed and self-employed workers. Employed workers have their hours, roles, and holiday entitlements set by their employer. Their employer also deducts taxes and they receive guaranteed income and potential employment benefits. Self-employed workers set their own hours and roles based on client needs and have responsibility for managing their own taxes and do not receive benefits or paid holiday/maternity leave. Their income depends on how many jobs they obtain.