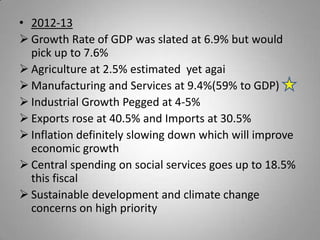

The document analyzes economic surveys and union budgets from 2010-2013, noting planned and non-planned expenditures that increased annually by 15-18% on average. Key sectors like infrastructure, capital goods, and pharmaceuticals saw positive impacts from budget allocations, while others like automobiles, FMCG and oil/gas saw neutral or negative impacts. The conclusion is that the 2012-2013 budget focused more on fiscal deficits than growth, but assumptions depend on world economic conditions and oil prices.