The Union Budget for 2011-12 had mixed impacts across various sectors:

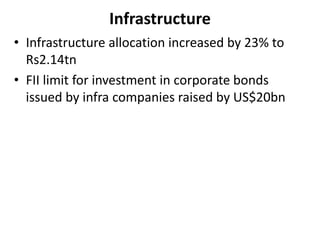

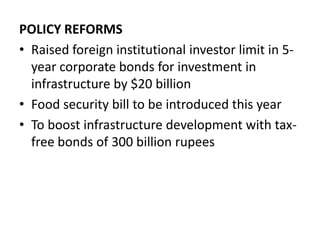

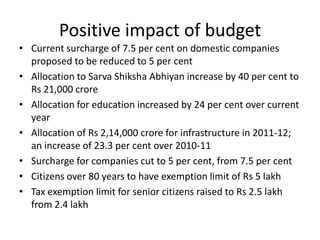

- Infrastructure allocation increased substantially while real estate saw some positive measures for affordable housing.

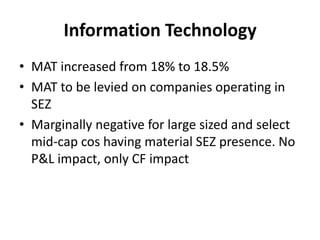

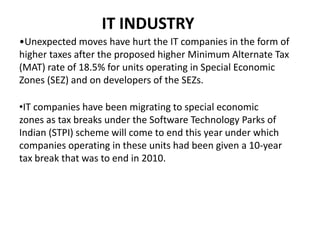

- The IT industry was negatively impacted by an increased MAT rate and its application to SEZ units.

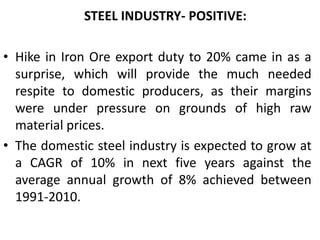

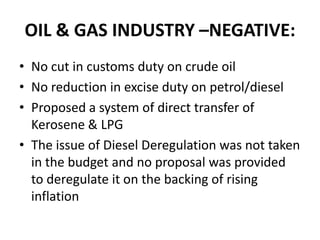

- Steel saw higher export duties as a boost while oil and gas faced no tax reliefs.

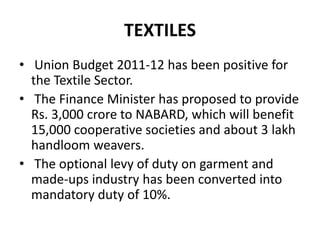

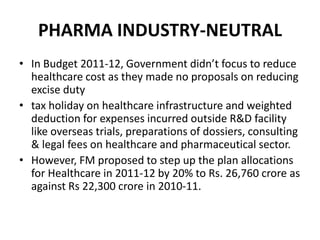

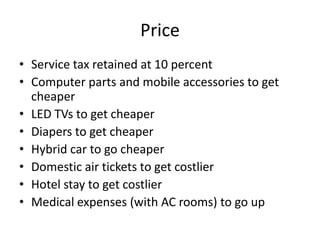

- Textiles, fertilizers, and banking received support but aviation and healthcare saw some cost increases.