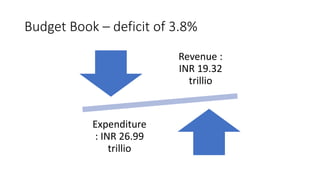

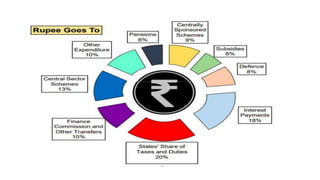

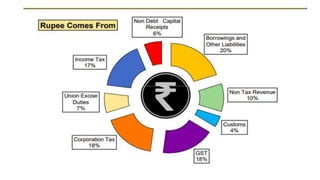

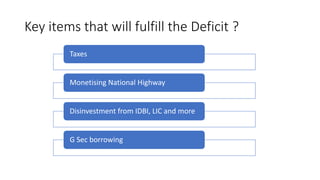

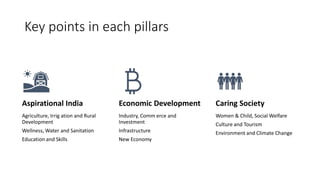

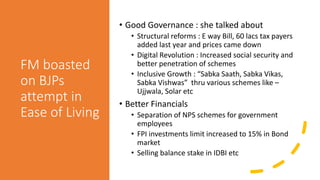

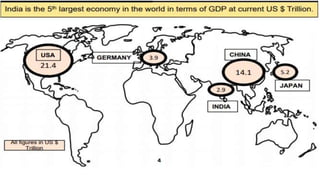

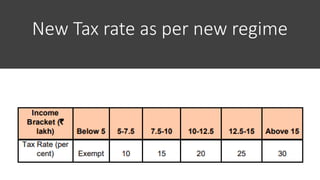

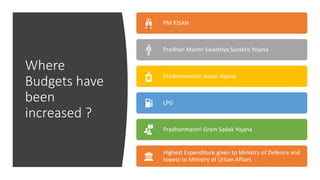

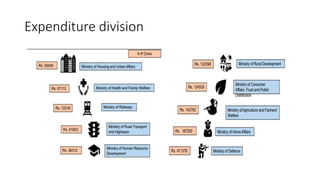

The budget aims to promote ease of living through initiatives focused on aspirational India, economic development, and a caring society. Key aspects include a fiscal deficit target of 3.8% for FY21, increased revenues of INR 19.32 trillion, and expenditures of INR 26.99 trillion. Deficit will be met through taxes, monetizing highways, and disinvestment. Sectors like agriculture, education, infrastructure, and healthcare will see increased focus. Tax reforms include lower corporate tax rates and a new simplified individual tax system without deductions. The budget emphasizes digital initiatives, increasing farmer incomes, expanding health and education infrastructure across India.