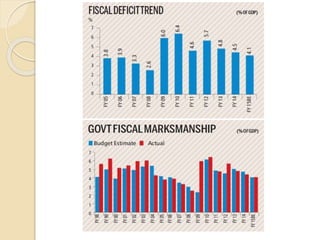

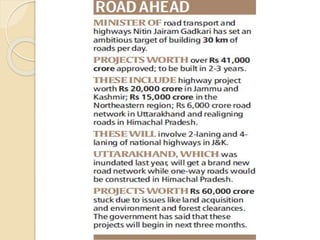

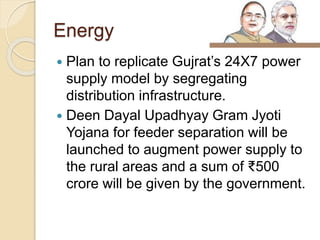

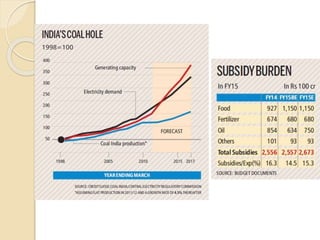

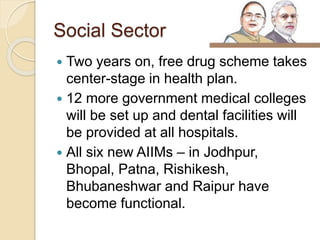

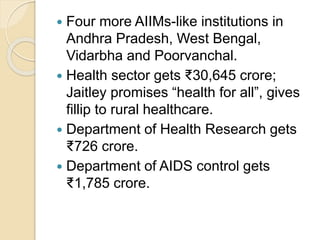

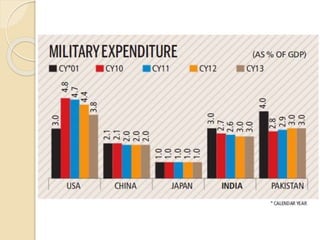

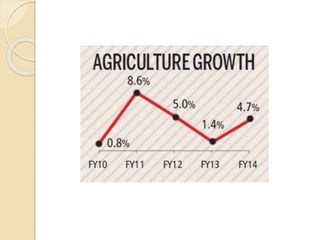

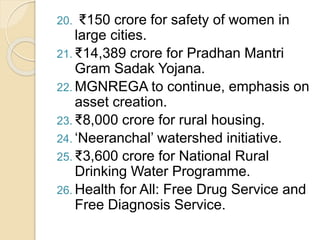

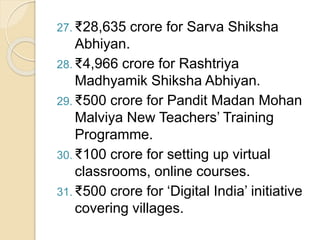

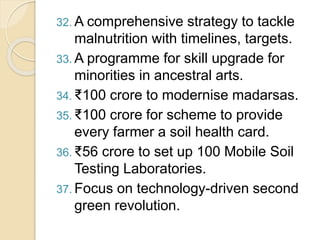

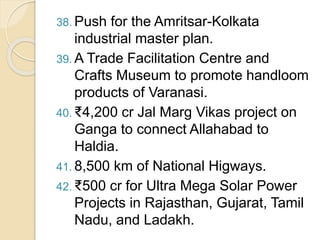

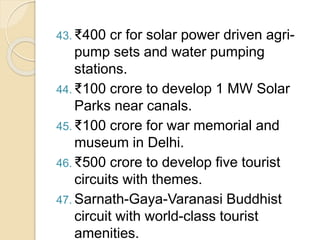

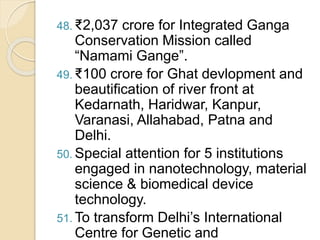

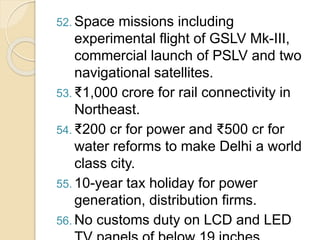

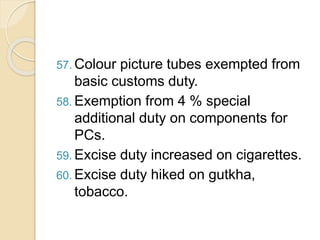

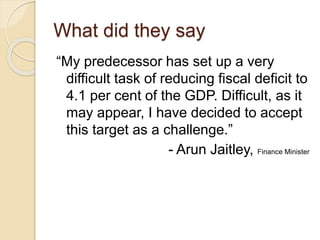

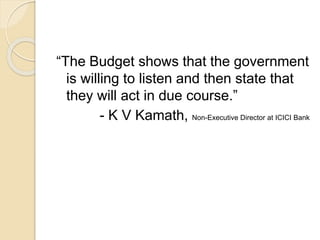

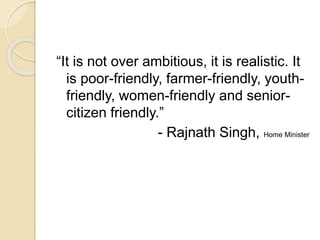

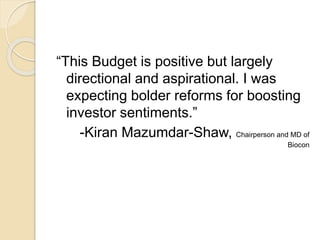

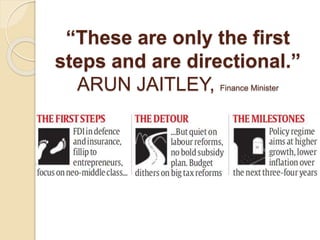

The budget document summarizes the key points of the Indian Union Budget for 2014-15 presented by Finance Minister Arun Jaitley. The budget aims to boost economic growth, bring down inflation, and reduce fiscal deficit. It focuses on fiscal consolidation, increasing investment in infrastructure, rural development, health and education. It also aims to promote manufacturing, ease business regulations, and increase foreign investment in defense and insurance. The budget received mixed reactions from political and business leaders.