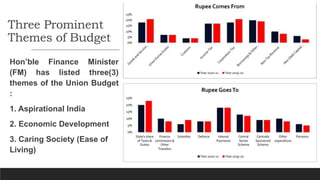

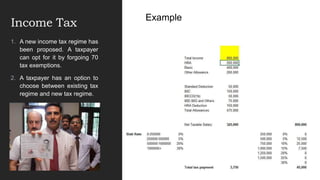

The document analyzes India's Union Budget 2020-21, highlighting key themes of aspirational India, economic development, and a caring society. Major changes include a new income tax regime, increased bank deposit insurance, and an emphasis on agricultural development alongside corporate tax cuts. It also expresses disappointment with the budget's lack of substantial direction and reduced allocations for critical sectors like employment and skill development.