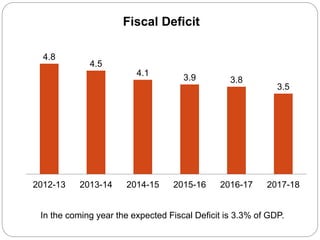

The Union Budget 2018 document highlights that the Indian economy has grown 7.5% annually for the past 3 years. The budget sets the GDP growth target for 2018-19 at 7.4% and targets a fiscal deficit of 3.3% of GDP. It allocates increased funds to key sectors like infrastructure, agriculture, healthcare, and education. It also provides tax benefits to small businesses and senior citizens, aims to expand rural development and social programs, and allocates additional funds for initiatives like rural electrification, sanitation, and digital connectivity across India.