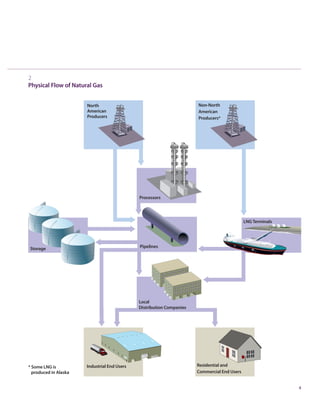

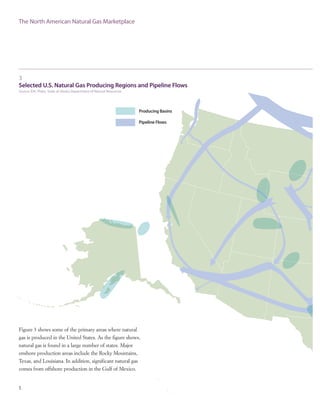

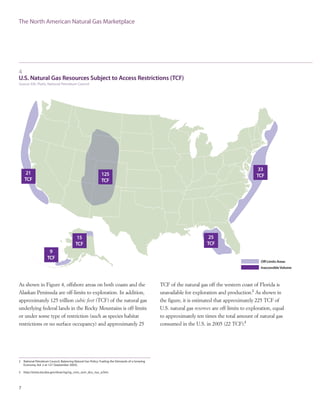

The document provides an overview of the North American natural gas market, including natural gas demand, supply, and pricing dynamics. It notes that natural gas demand in the US is driven by economic growth, weather, and relative fuel prices, while domestic supply has leveled off as existing fields mature. With demand and supply tightly balanced, prices have trended upward in recent years. The market is working to increase supply from unconventional resources and new areas, but significant gas resources remain restricted from development.