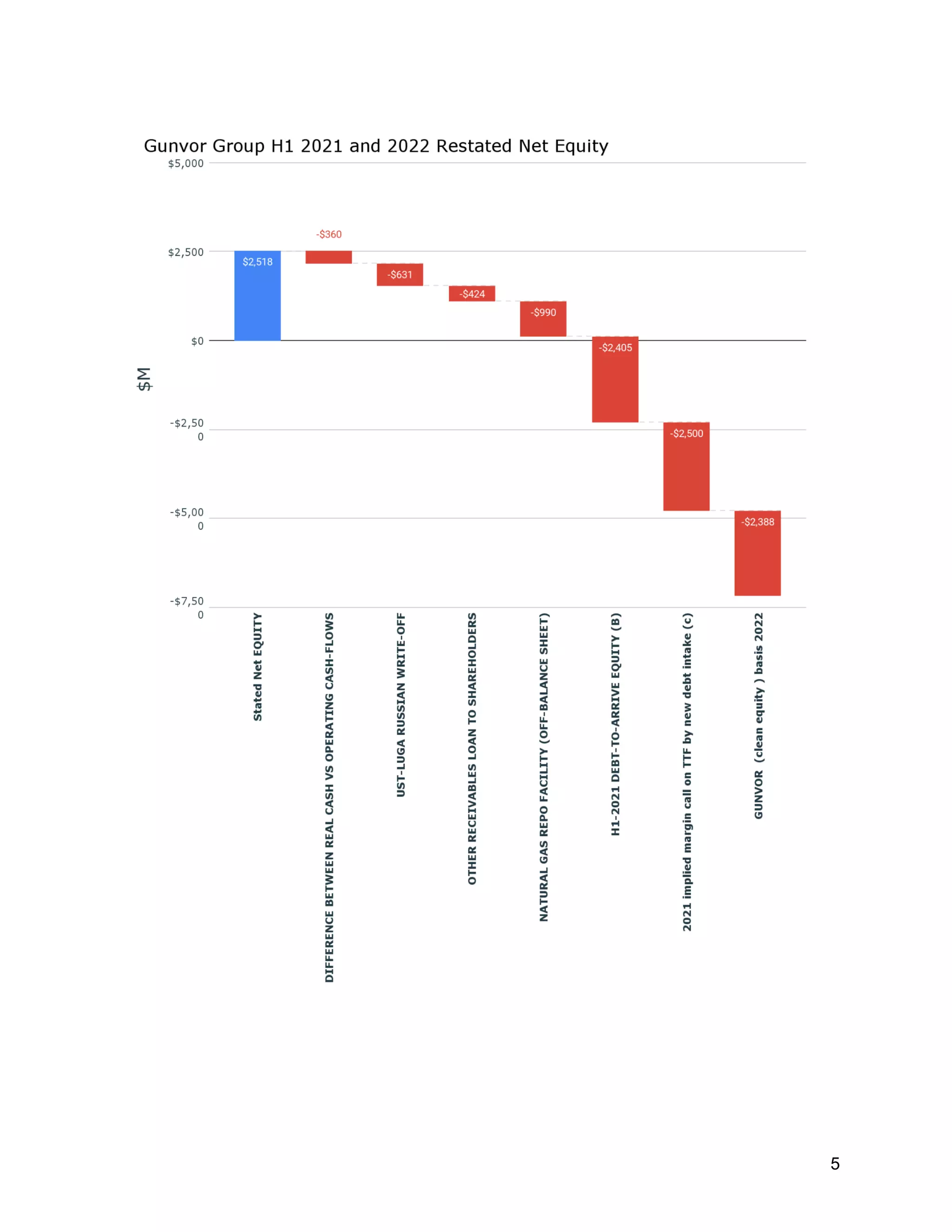

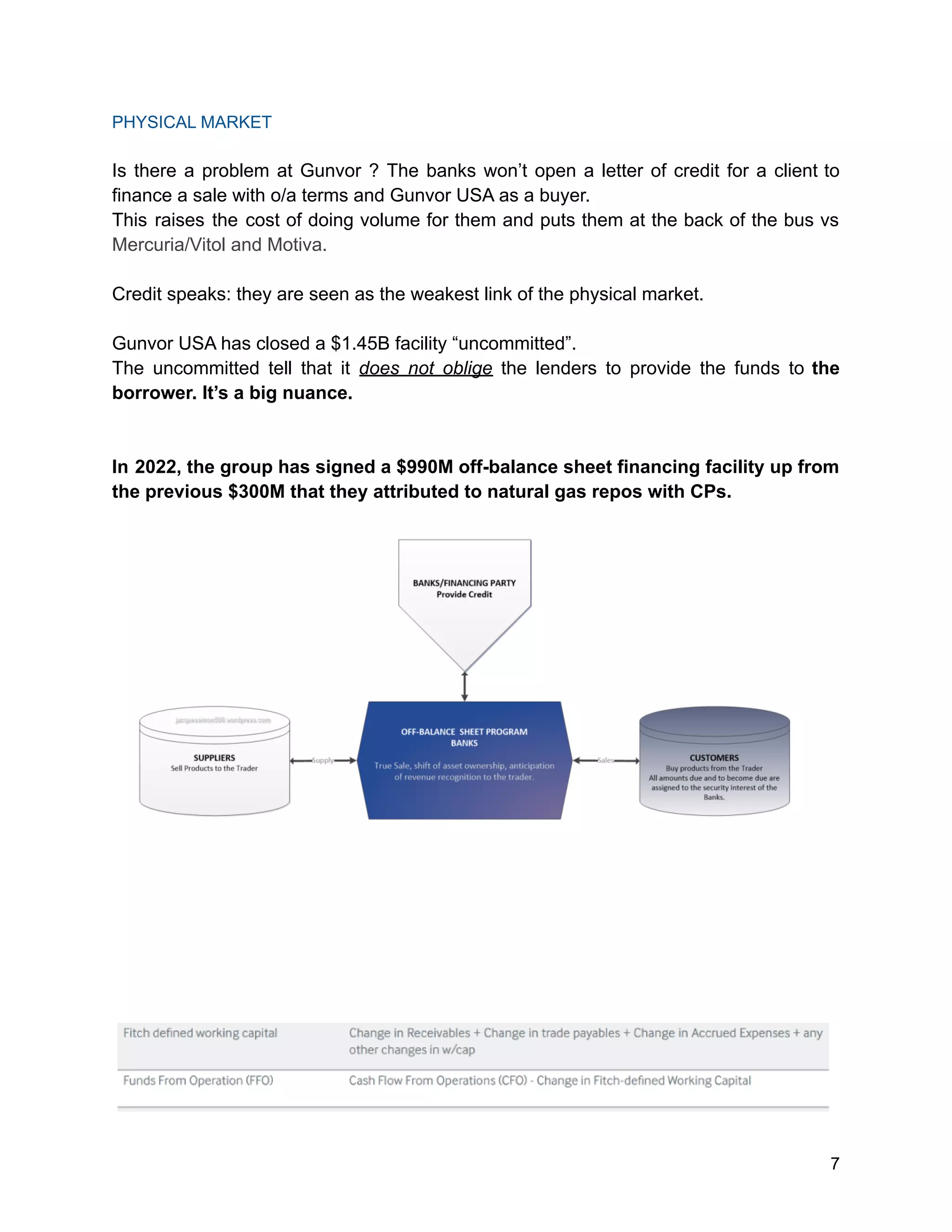

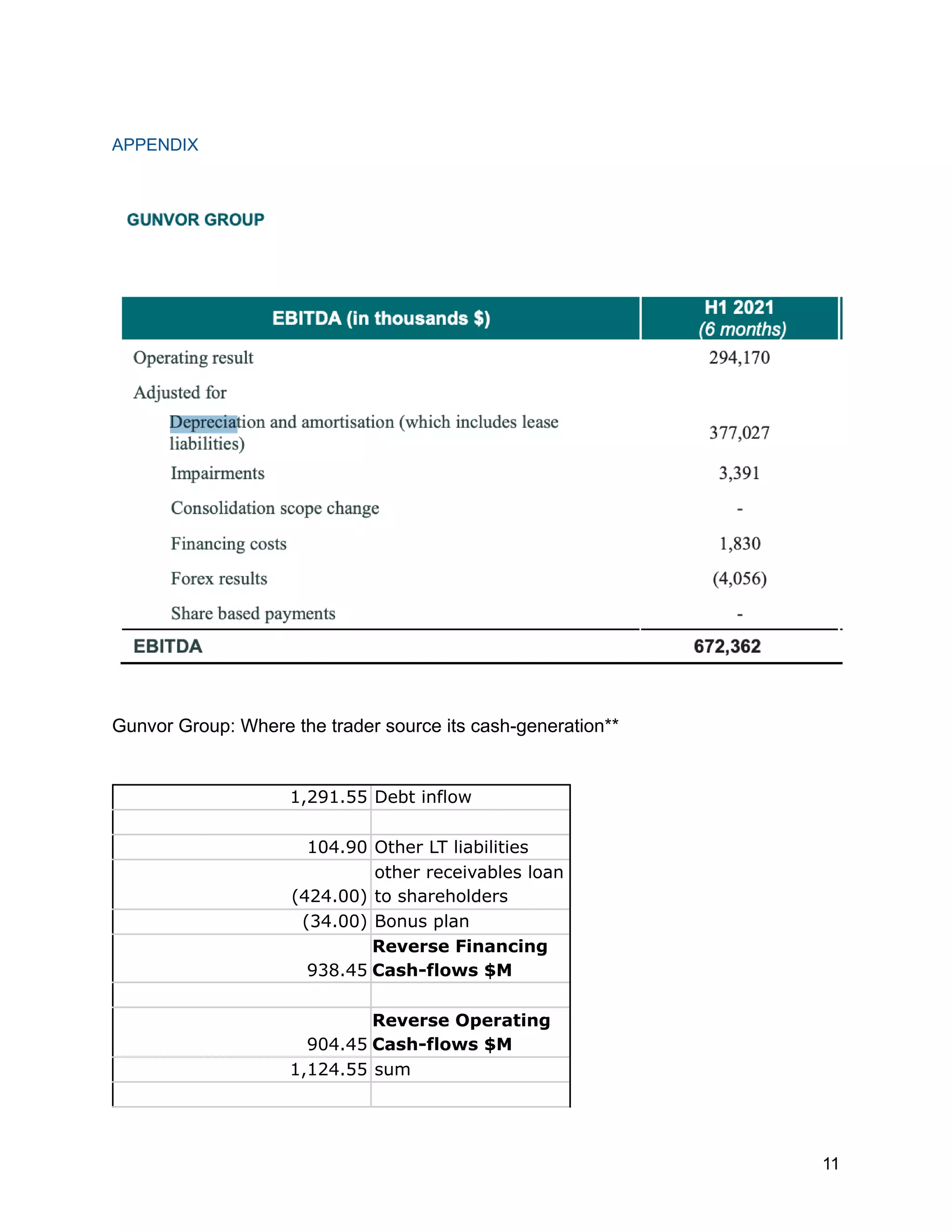

The Gunvor Group faces substantial financial challenges, including a debt-to-equity ratio of 11x and significant vulnerabilities in its operational and credit structure, caused by the lack of transparency with counterparties. In 2022, Gunvor closed a $1.45 billion uncommitted credit facility and a $990 million off-balance sheet financing deal, while consistently defaulting on LNG cargo deliveries. The company's financial disclosures have been inadequate, raising concerns about its creditworthiness and operational stability in the current market.