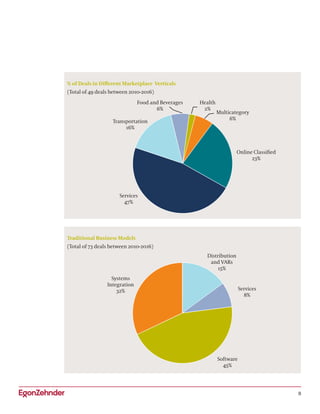

The report analyzes mergers and acquisitions in Turkey's technology and digital sectors from 2010 to 2016, highlighting a significant increase in transaction numbers despite political and economic challenges. The rise of angel investors and venture capitalists contrasts with limited private equity interest, particularly as e-commerce and marketplaces emerge as key areas of growth. It also addresses the brain drain of talent from Turkey's tech sector, which affects the ecosystem's future potential.