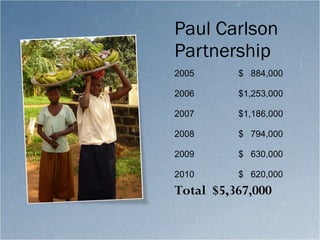

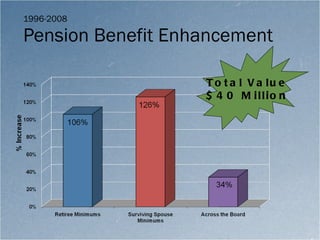

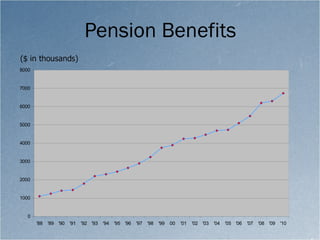

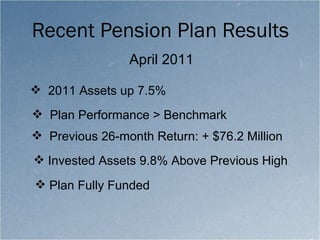

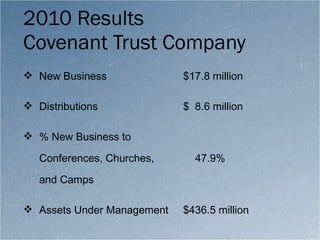

The document summarizes the 2010 financial reports of several Evangelical Covenant Church organizations. It shows that in 2010, Covenant World Relief distributed $981,000 and the Paul Carlson Partnership distributed $620,000 totaling $5.37 million since 2005. It also provides details on the budgets, funding levels, growth and performance of the Covenant Pension Plan, Bethany Benefit Service, National Covenant Properties, and Covenant Trust Company. An audit report gives positive ratings to the organizations for having balanced budgets, fully funded pension plans, enrollment growth, and exceeding financial benchmarks.