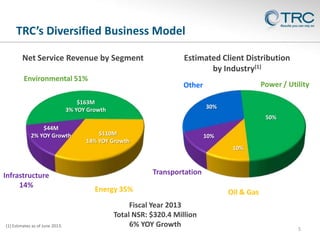

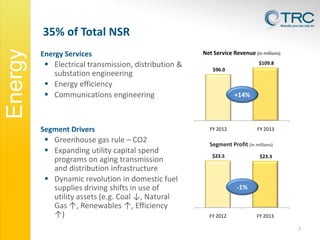

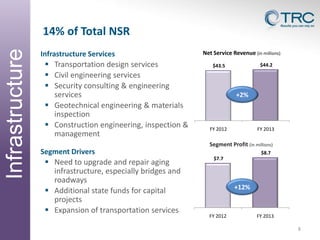

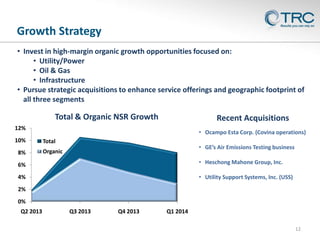

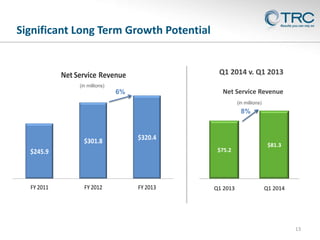

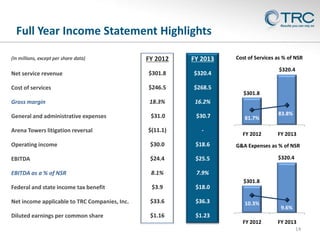

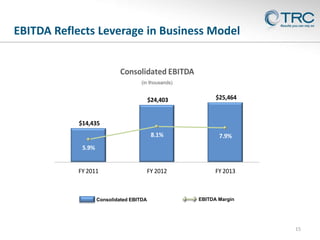

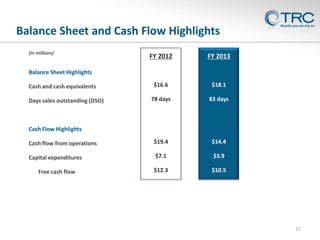

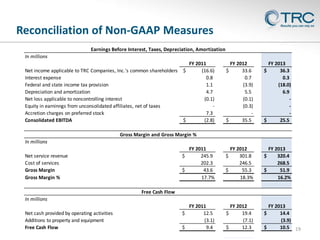

TRC reported financial results for the first quarter of fiscal year 2014. Net service revenue increased 6% year-over-year to $81.3 million. Backlog remained stable at $247 million. TRC continues executing its growth strategy focused on high-margin organic growth in utility/power, oil and gas, and infrastructure markets. The company also pursues strategic acquisitions to enhance its service offerings and geographic footprint. TRC is well positioned in markets with solid medium- to long-term growth opportunities and maintains a strong balance sheet and cash position.