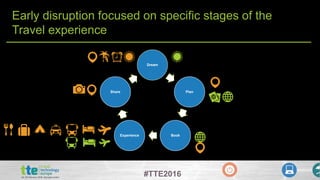

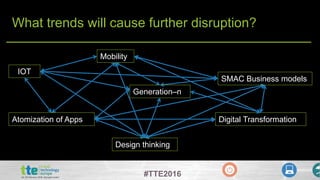

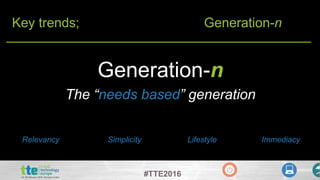

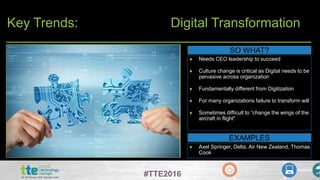

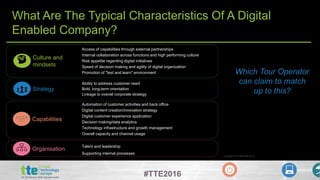

The document discusses the disruption facing traditional tour operators and the imperative for them to adapt to changing customer needs through digital transformation, data utilization, and innovative partnerships. Key trends such as the rise of the Internet of Things, mobility, and design thinking are highlighted as essential components for survival in a competitive landscape. Tour operators are urged to evolve from legacy systems to fully connected, customer-centric organizations or risk being left behind.