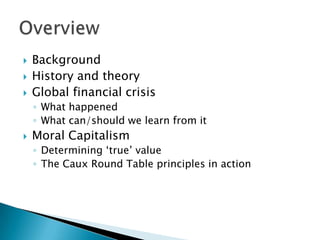

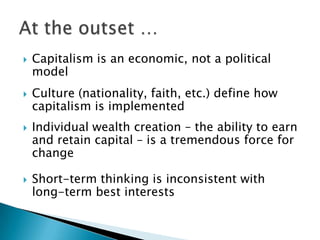

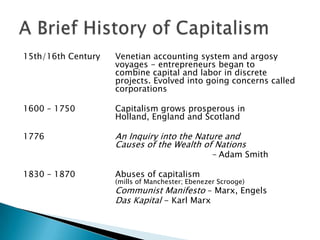

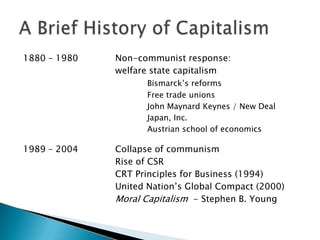

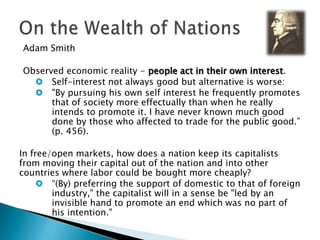

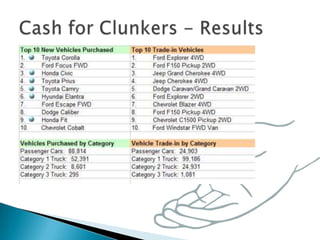

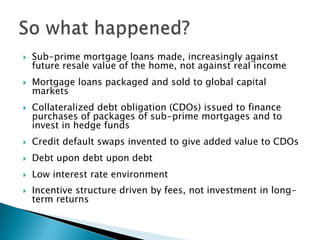

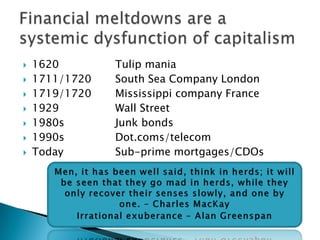

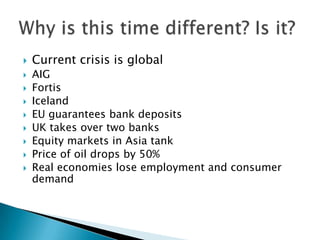

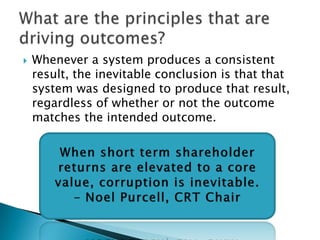

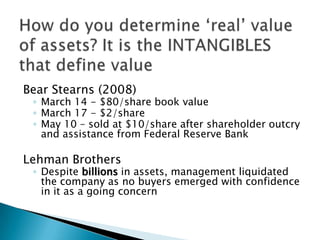

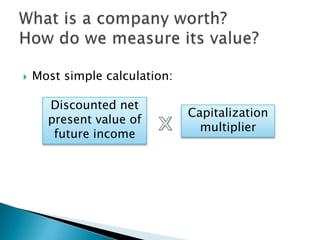

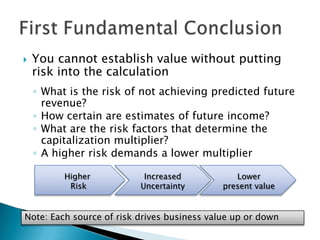

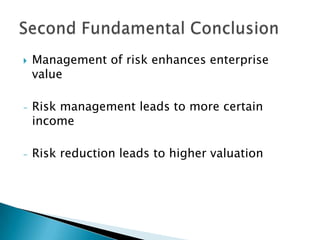

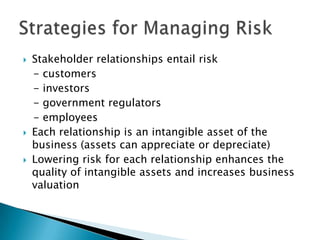

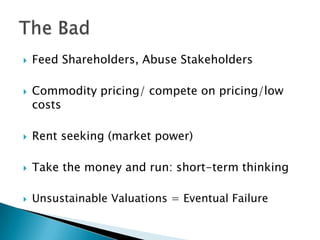

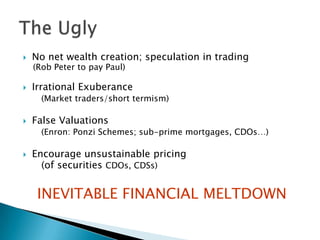

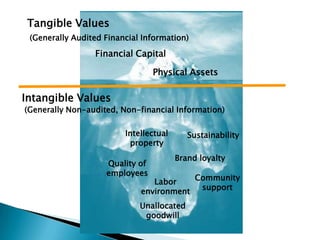

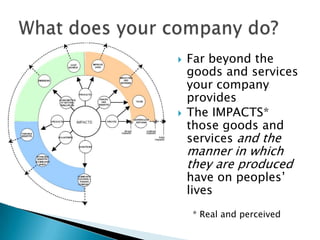

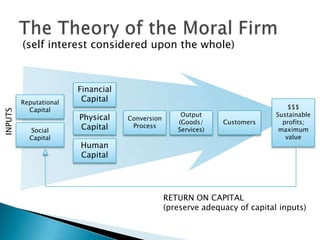

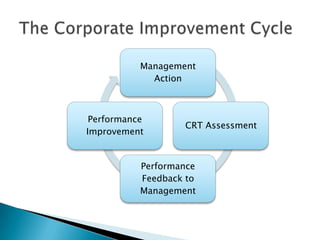

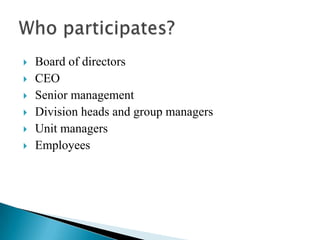

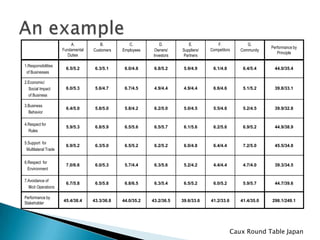

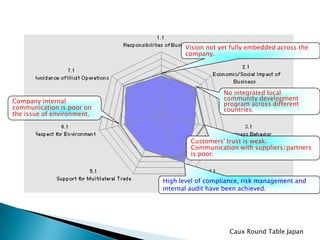

The Caux Round Table is an international network that promotes moral capitalism through implementing principles for responsible business. These principles aim to allow principled capitalism to flourish in a way that leads to sustainable prosperity and a just global society. John Friedman discussed the history of capitalism and financial crises. He explained that the Caux Round Table principles seek to determine true value by managing risk, optimizing stakeholder benefits, and creating sustainable corporations through strong stakeholder relationships and attention to intangible assets like reputation.