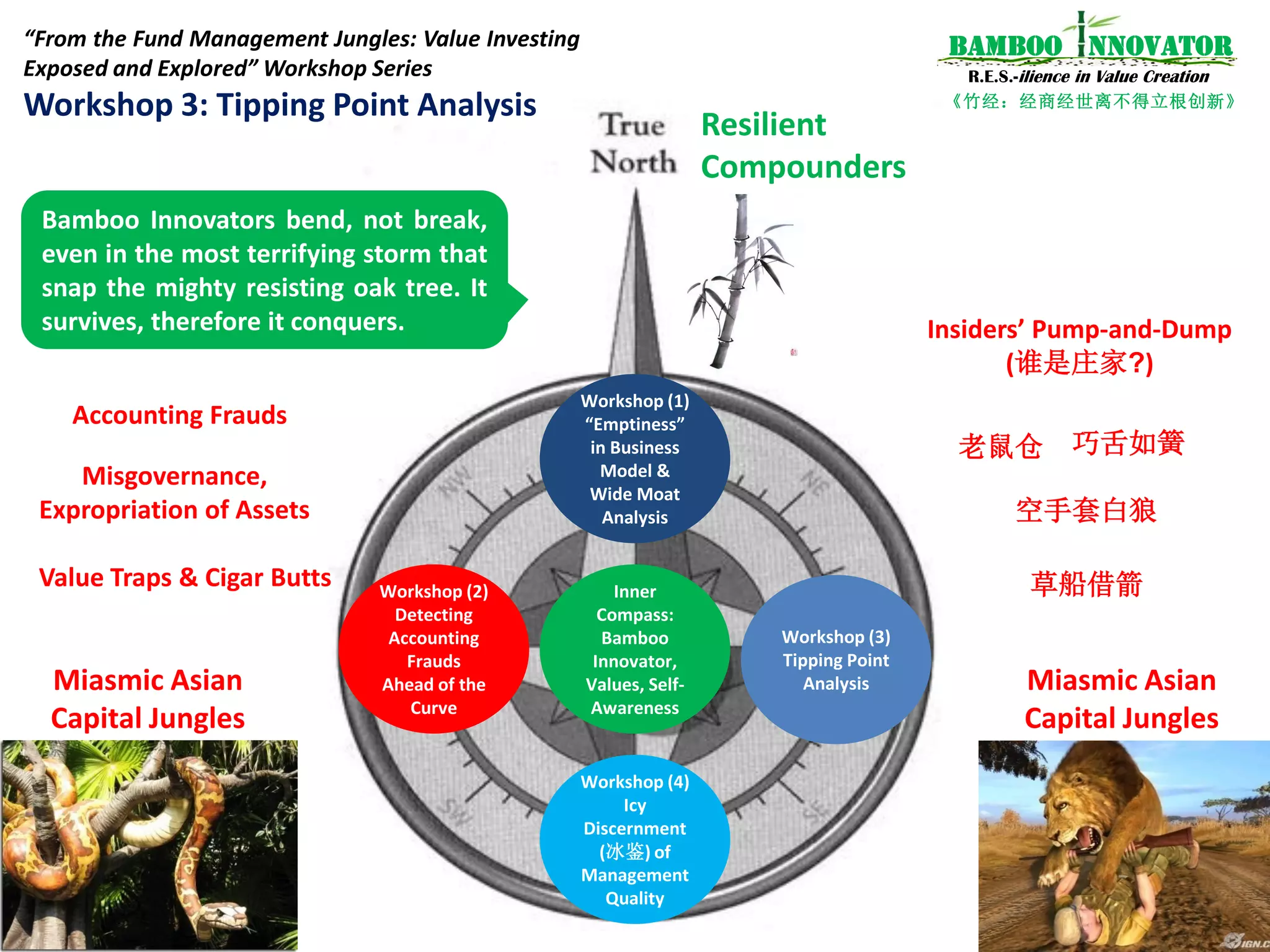

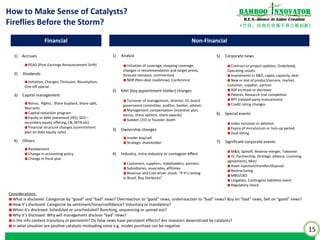

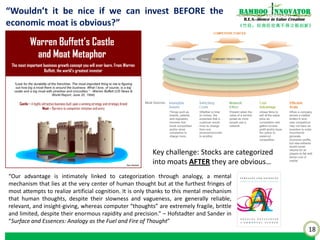

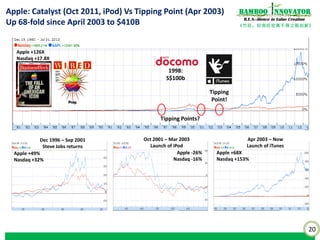

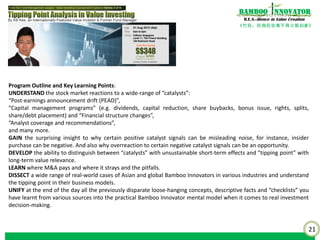

1) The document discusses the concept of "catalysts" and "tipping points" in investing, and argues that waiting for catalysts can be risky as many purported catalysts are actually false signals created by insiders to manipulate stock prices.

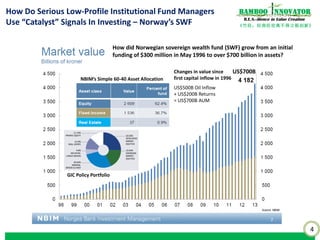

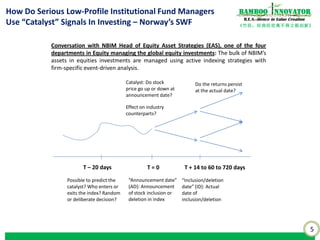

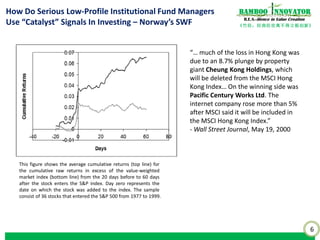

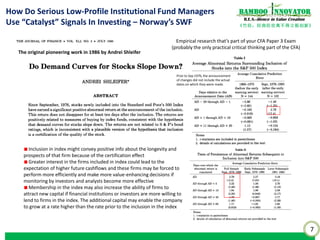

2) It provides examples of how serious institutional investors like Norway's sovereign wealth fund analyze business model dynamics and tipping points, rather than focusing on short-term catalysts.

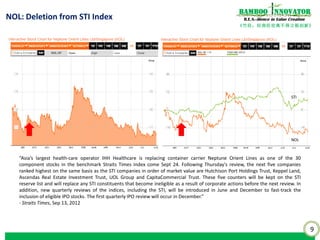

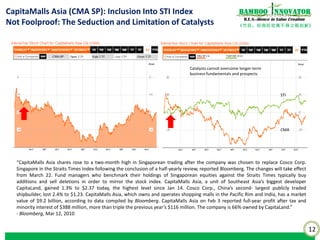

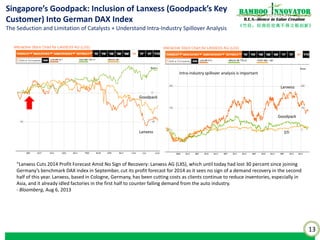

3) The document uses examples from index inclusions and deletions to illustrate how catalysts may not always reflect underlying business fundamentals and prospects. Understanding intra-industry effects is also important.