This document discusses resilient compounders - companies that can replicate and scale from scratch while maintaining indestructible intangibles to bounce back from crisis. It uses Buffett, Bosch, and Baiyao as examples. Bosch rebuilt completely after losing all tangible assets in WWI. Baiyao scaled its blood clotting drug formula into personal care products. The document introduces a "Bamboo Innovator" mental model - like bamboo that bends not breaks in storms. It cautions against only remembering isolated facts and discusses open innovation at Baiyao through partnerships.

![“Emptiness” in Trust and Support from Community of Bamboo nnovator

Customers/Suppliers/Partners… R.E.S.-ilience in Value Creation

“I know we have the only clean,

“This is going to be probably one of the most honest franchise.”

competitive businesses in the U.S. and we have

the only real solid approach to this business.

The other ones are going to die like flies. They

are rackets. They are fast-buck deals. Those

fellows [the franchisees] are going to do any

doggone thing they want to do, and the

owners of the name are just going to let them

do anything they want as long as they are McDonald’s “Rootedness” = No Kickbacks + No Up-

getting money out of it. It will be a survival of front Fees + No Side Income + Sacrifice Quick Franchising

the fittest, and we are going to be on the top Profits = Truly care about subsequent performance of

partners.

of the list of the fittest”.

McDonald’s “emptiness” and a culture/system that

“I want nothing from you but a good product. cultivates and acts upon ideas from the “periphery”: Big

Don’t wine me, don’t dine me, don’t buy me Mac, Apple Pie, Fillet-O-Fish, Egg McMuffin, Chicken

McNuggets, Happy Meal, “You Deserve a Break.” etc

any Christmas presents. If there are any cost

Flops (eg fried chicken, pasta, fajita, pizza, McLean

breaks, pass them on to the operators of Deluxe, Arch Deluxe) were introduced from the central

McDonald’s stores.”. HQ… same for “My McDonald’s” campaign.

Ray Kroc was 59 years old when he bought McDonald’s in 1961 for US$2.7m (Very pricey valuations then!).

24

(1) Buffett + Bosch + Baiyao (2) Mental Model: Bamboo Innovator

(2) Mental Model: Bamboo Innovator (3) Boobytraps in the Asian Capital Jungle (4) An Asian Stock Discussion](https://image.slidesharecdn.com/emergingvaluesummitapril2013bambooinnovatorpreview-130304230713-phpapp01/85/Emerging-Value-Summit-April-2013-R-E-S-ilient-Compounders-in-the-Next-Crisis-Buffett-Bosch-Baiyao-Bamboo-Innovators-24-320.jpg)

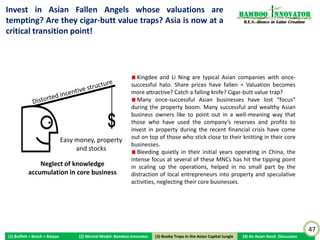

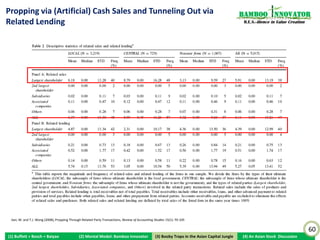

![The Mungerian I-O (Incentive [Why]-Opportunity [How]) Bamboo nnovator

Framework R.E.S.-ilience in Value Creation

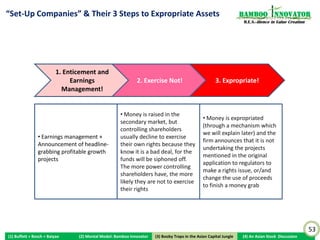

1. Easy 1. RPTs

Money

Easy to 2. Asset

expropriate Transfer/

How are Injection

and don’t Incentives Opportunities

2. Wedge assets

have to be (Why?) / Mechanism

expropriated?

held (How?) 3.

accountable Laddering

in IPO

Expiration

3. “Easy”

Secondary 4.

Issues Delisting

57

(1) Buffett + Bosch + Baiyao (2) Mental Model: Bamboo Innovator (3) Boobytraps

(3) Booby Traps in the Asian Capital Jungle (4) An Asian Stock Discussion](https://image.slidesharecdn.com/emergingvaluesummitapril2013bambooinnovatorpreview-130304230713-phpapp01/85/Emerging-Value-Summit-April-2013-R-E-S-ilient-Compounders-in-the-Next-Crisis-Buffett-Bosch-Baiyao-Bamboo-Innovators-57-320.jpg)

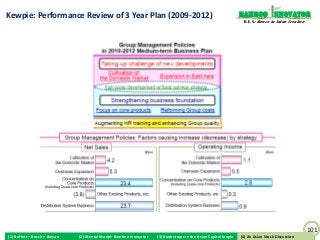

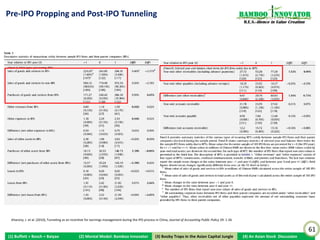

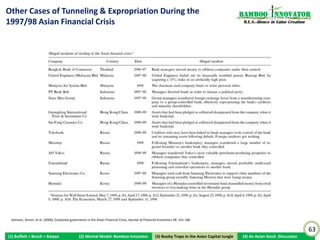

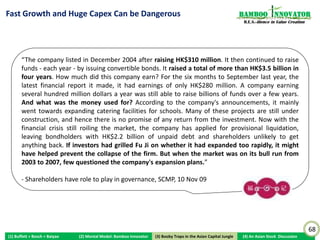

![Case Study: Wei Dong & His “Business Model” for Fu Ji Bamboo nnovator

Food & Catering: $2B Olympic Caterer & Forbes Richest R.E.S.-ilience in Value Creation

Restaurant Caterer

Restaurants are “slow”. Franchise to lighten up? Load up aggressively on the fixed

cost investments instead!

2002: “Millions of factories” + long-term contracts for planning/budgeting

Possibly the first in China to operate on such a big scale.

Listed on HKSE in Dec 04. Raise HK$3.5 billion in funds from investors in 4 years.

Net worth $515m, Forbes 400 Richest Chinese [Forbes: 2 Nov 06]

http://www.forbes.com/lists/2006/74/biz_06china_Wei-Dong-Yao-Jun_FE7U.html

Olympic 2008 caterer, >$2 billion market cap

70

(1) Buffett + Bosch + Baiyao (2) Mental Model: Bamboo Innovator (3) Boobytraps

(3) Booby Traps in the Asian Capital Jungle (4) An Asian Stock Discussion](https://image.slidesharecdn.com/emergingvaluesummitapril2013bambooinnovatorpreview-130304230713-phpapp01/85/Emerging-Value-Summit-April-2013-R-E-S-ilient-Compounders-in-the-Next-Crisis-Buffett-Bosch-Baiyao-Bamboo-Innovators-70-320.jpg)

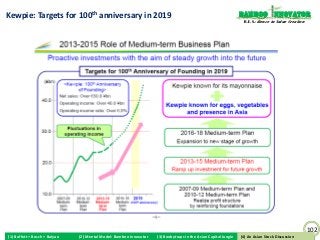

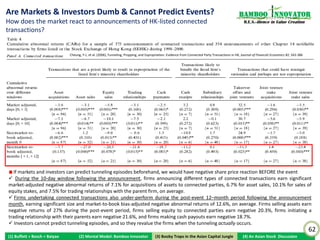

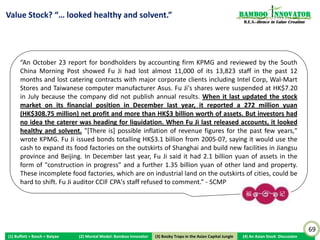

![Value Stock? “… looked healthy and solvent.” Bamboo nnovator

R.E.S.-ilience in Value Creation

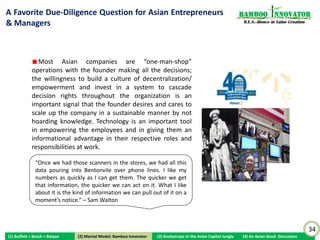

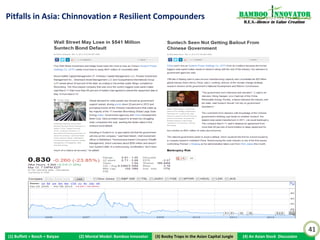

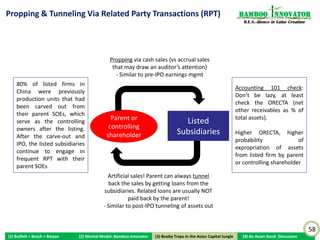

“An October 23 report for bondholders by accounting firm KPMG and reviewed by the South

China Morning Post showed Fu Ji had lost almost 11,000 of its 13,823 staff in the past 12

months and lost catering contracts with major corporate clients including Intel Corp, Wal-Mart

Stores and Taiwanese computer manufacturer Asus. Fu Ji's shares were suspended at HK$7.20

in July because the company did not publish annual results. When it last updated the stock

market on its financial position in December last year, it reported a 272 million yuan

(HK$308.75 million) net profit and more than HK$3 billion worth of assets. But investors had

no idea the caterer was heading for liquidation. When Fu Ji last released accounts, it looked

healthy and solvent. "[There is] possible inflation of revenue figures for the past few years,"

wrote KPMG. Fu Ji issued bonds totalling HK$3.1 billion from 2005-07, saying it would use the

cash to expand its food factories on the outskirts of Shanghai and build new facilities in Jiangsu

province and Beijing. In December last year, Fu Ji said it had 2.1 billion yuan of assets in the

form of "construction in progress" and a further 1.35 billion yuan of other land and property.

These incomplete food factories, which are on industrial land on the outskirts of cities, could be

hard to shift. Fu Ji auditor CCIF CPA's staff refused to comment.” - SCMP

74

(1) Buffett + Bosch + Baiyao (2) Mental Model: Bamboo Innovator (3) Boobytraps

(3) Booby Traps in the Asian Capital Jungle (4) An Asian Stock Discussion](https://image.slidesharecdn.com/emergingvaluesummitapril2013bambooinnovatorpreview-130304230713-phpapp01/85/Emerging-Value-Summit-April-2013-R-E-S-ilient-Compounders-in-the-Next-Crisis-Buffett-Bosch-Baiyao-Bamboo-Innovators-74-320.jpg)