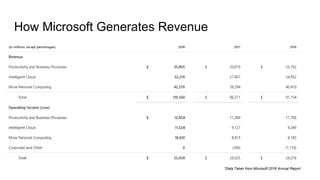

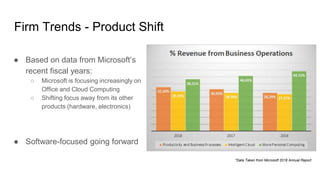

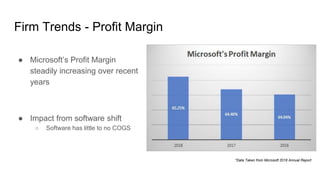

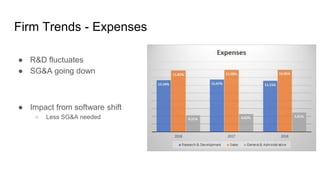

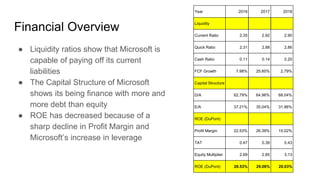

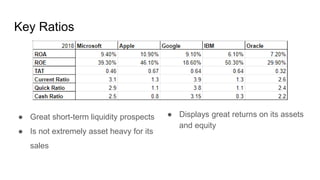

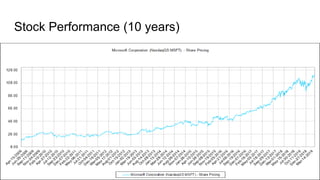

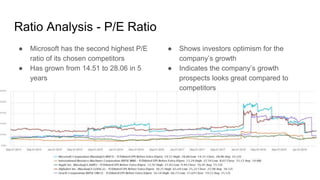

Microsoft was founded in 1975 by Bill Gates and Paul Allen to produce software for computer company Altair. By 1979, sales surpassed $1 million and Microsoft licensed its operating system to IBM in 1981. Today, Microsoft is a leading technology company specializing in software and services with a brand value of $104.9 billion. The company generates most of its revenue from Office 365 subscriptions and cloud computing services. Microsoft has transitioned its focus from hardware to software and services, which has increased profit margins. It remains financially stable with high liquidity and returns.