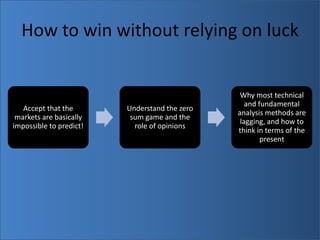

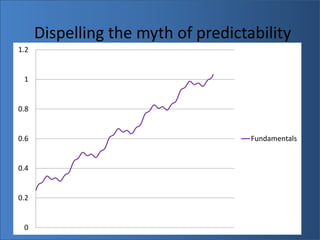

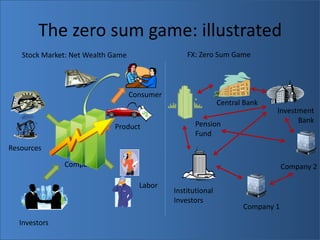

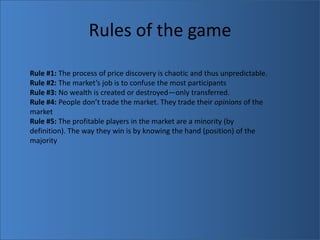

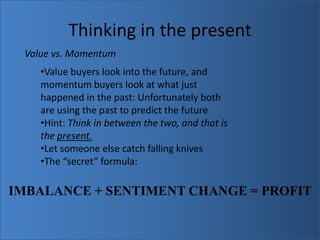

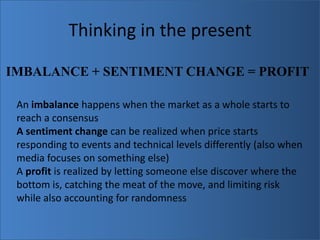

The document discusses strategies for making money in the financial markets by understanding that they function as a zero-sum game where wealth is only transferred, not created. It emphasizes the unpredictability of price discovery and the importance of balancing present value with momentum value for successful trading. Key concepts include recognizing market imbalances and sentiment changes to capitalize on profitable opportunities while managing risk.