The owners of The Car Wash have asked you to prepare their tax retur.docx

•Download as DOCX, PDF•

0 likes•3 views

The owners of The Car Wash, Tim Smith and Jack Dillard, have asked you to prepare their tax return for their self-service car wash business. You are provided the business's financial statements and additional information about the owners and business. You will prepare the tax return for the business as both a corporation and limited liability company (LLC).

Report

Share

Report

Share

Recommended

Recommended

More Related Content

Similar to The owners of The Car Wash have asked you to prepare their tax retur.docx

Similar to The owners of The Car Wash have asked you to prepare their tax retur.docx (17)

The Be-All, End-All List of Small Business Tax Deductions

The Be-All, End-All List of Small Business Tax Deductions

Chapter TwelveSmall Business Accounting Projecting and Evalua.docx

Chapter TwelveSmall Business Accounting Projecting and Evalua.docx

A.) TrueFalse1 A distribution from a corporation will be .docx

A.) TrueFalse1 A distribution from a corporation will be .docx

Tcp And Hr Screening Tax Credit And Incentive Programs Detail 070209

Tcp And Hr Screening Tax Credit And Incentive Programs Detail 070209

Tax655 final project_guidelines_and_rubric-converted (1)

Tax655 final project_guidelines_and_rubric-converted (1)

ACC 291 GENIUS NEW Introduction Education--acc291genius.com

ACC 291 GENIUS NEW Introduction Education--acc291genius.com

Advocates Letter Format Shor Tpresentation Printable

Advocates Letter Format Shor Tpresentation Printable

OnPoint Publications Tax Week in Review for December 02, 2016

OnPoint Publications Tax Week in Review for December 02, 2016

More from carlz4

More from carlz4 (20)

The paper will be on a current leader in an organisation( Narendra M.docx

The paper will be on a current leader in an organisation( Narendra M.docx

The paper will adhere to the American Psychological Association styl.docx

The paper will adhere to the American Psychological Association styl.docx

The paper will be a five pages (excluding the Tittle page, Abstract,.docx

The paper will be a five pages (excluding the Tittle page, Abstract,.docx

The paper should report on what that insider says are the key themes.docx

The paper should report on what that insider says are the key themes.docx

The paper should be typed, double-spaced, 1 margins, arial or times.docx

The paper should be typed, double-spaced, 1 margins, arial or times.docx

The paper should have 4 Journal as the sources, it has to be 5 pag.docx

The paper should have 4 Journal as the sources, it has to be 5 pag.docx

The paper should be two parts. The first part is where stude.docx

The paper should be two parts. The first part is where stude.docx

The paper should be a summary of all the important concepts in Unit .docx

The paper should be a summary of all the important concepts in Unit .docx

The paper should be a 15 pages long research paper with the topic pr.docx

The paper should be a 15 pages long research paper with the topic pr.docx

The Paper should be a minimum of five pagesTitle pageBody.docx

The Paper should be a minimum of five pagesTitle pageBody.docx

The paper should be 4 pages with cover below topics with Company ove.docx

The paper should be 4 pages with cover below topics with Company ove.docx

The paper should address the following promptReferring to at le.docx

The paper should address the following promptReferring to at le.docx

The paper needs to be about learning disabilities. Write an eight to.docx

The paper needs to be about learning disabilities. Write an eight to.docx

The paper needs to be a rhetorical analysis of another writer’s .docx

The paper needs to be a rhetorical analysis of another writer’s .docx

The paper must discuss problems and constitutional develop of ineffe.docx

The paper must discuss problems and constitutional develop of ineffe.docx

The paper must include the following1. History and epidemiology o.docx

The paper must include the following1. History and epidemiology o.docx

The paper must be in APA format and 2-5 pages.Your paper must includ.docx

The paper must be in APA format and 2-5 pages.Your paper must includ.docx

The paper must be in APA format and 2-5 pages.Your paper must in.docx

The paper must be in APA format and 2-5 pages.Your paper must in.docx

The paper must be typed; double-spaced, 5-10 pages in length (not in.docx

The paper must be typed; double-spaced, 5-10 pages in length (not in.docx

The paper must be at least three thousand words in length, not count.docx

The paper must be at least three thousand words in length, not count.docx

Recently uploaded

Mehran University Newsletter is a Quarterly Publication from Public Relations OfficeMehran University Newsletter Vol-X, Issue-I, 2024

Mehran University Newsletter Vol-X, Issue-I, 2024Mehran University of Engineering & Technology, Jamshoro

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Recently uploaded (20)

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

HMCS Vancouver Pre-Deployment Brief - May 2024 (Web Version).pptx

HMCS Vancouver Pre-Deployment Brief - May 2024 (Web Version).pptx

21st_Century_Skills_Framework_Final_Presentation_2.pptx

21st_Century_Skills_Framework_Final_Presentation_2.pptx

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Exploring_the_Narrative_Style_of_Amitav_Ghoshs_Gun_Island.pptx

Exploring_the_Narrative_Style_of_Amitav_Ghoshs_Gun_Island.pptx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

The owners of The Car Wash have asked you to prepare their tax retur.docx

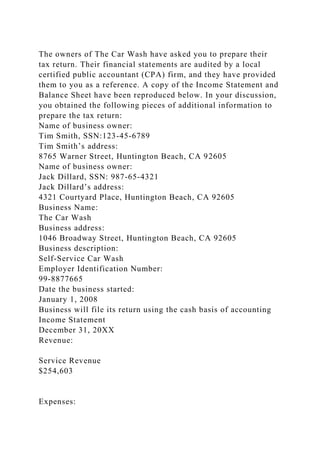

- 1. The owners of The Car Wash have asked you to prepare their tax return. Their financial statements are audited by a local certified public accountant (CPA) firm, and they have provided them to you as a reference. A copy of the Income Statement and Balance Sheet have been reproduced below. In your discussion, you obtained the following pieces of additional information to prepare the tax return: Name of business owner: Tim Smith, SSN:123-45-6789 Tim Smith’s address: 8765 Warner Street, Huntington Beach, CA 92605 Name of business owner: Jack Dillard, SSN: 987-65-4321 Jack Dillard’s address: 4321 Courtyard Place, Huntington Beach, CA 92605 Business Name: The Car Wash Business address: 1046 Broadway Street, Huntington Beach, CA 92605 Business description: Self-Service Car Wash Employer Identification Number: 99-8877665 Date the business started: January 1, 2008 Business will file its return using the cash basis of accounting Income Statement December 31, 20XX Revenue: Service Revenue $254,603 Expenses:

- 2. Advertising 2,520 Depreciation 31,250 Insurance 7,260 Interest expense 36,204 Licenses and fees 7,260 Miscellaneous 4,074 Office expense 8,911 Salaries and wages 67,460 Payroll taxes 9,444 Employee benefits 1,349 Professional fees 1,210 Repairs and Maintenance 20,674 Telephone 900 Travel 1,500 Utilities 27,752 Net income before taxes 26,835

- 3. Balance Sheet January 1, 20XX December 31, 20XX Assets Cash $28,638 $64,979 Buildings and other depreciable assets 555,000 555,000 Accumulated depreciation (62,500) (93,750) Total assets 521,138 526,229 Liabilities and equity Loans 183,757 167,962 Mortgage 233,229 227,280

- 4. Equity investment 160,000 160,000 Retained earnings (55,848) (29,013) Total liabilities and equity $521,138 $526,229 Deliverable Length: Prepare the tax return for your client, addressing the following 2 scenarios: Scenario 1: The Car Wash is a corporation. Scenario 2: The Car Wash is a limited liability company (LLC). Obtain the appropriate tax return forms at the following Web site and save them to your computer: www.irs.gov Instructions for how to prepare the applicable forms are available at the same Web site. You may directly input text and numbers on to these forms using Reader. The forms do not self- calculate. Once complete, upload your tax return to the submitted assignments. Complete all of the requested attachments for the applicable tax return. Assume the following: The initial investment for each owner was $80,000. Each owner has an equal interest in the business. A $30,000 salary was paid to each owner. A part-time employee

- 5. was paid $7,460. The loans and mortgage are long-term obligations. The annual tax depreciation on the car wash building is $47,453. The $555,000 property was depreciated for tax purposes using a 15-year recovery period, half-year convention (HY) and the Modified Accelerated Cost Recovery System (MACRS) depreciation method. Assume no change in the tax depreciation when calculating whether the alternative minimum tax applies. The organization does not have any carry forward net operating losses or tax credits. The organization does not qualify for any current year tax credits. Assume the following for a corporation: The corporation made estimated payments of $3,000 in 2010. Assume the business owners want to receive any applicable refunds. Only common stock has been issued. Assume the following for a partnership: The salary paid to each owner is a guaranteed payment. Partnership profit, losses, and capital are shared 50/50. The loans and mortgage are both recourse debt. Neither owner is a LLC member-manager. The K-1 should reflect the partner’s capital account according to the United States' Generally Accepted Accounting Principles (U.S. GAAP). Part II Deliverable Length: At least 700 words Your client has been informed that an S corporation is a popular business form and wants to know more about it. Please write a professional memo to your client responding to his inquiry. Be sure to at least discuss the following items: What is an S corporation

- 6. ? When is it advisable to be taxed as an S corporation? How does an organization become an S corporation? If The Car Wash is a corporation, can they be taxed as an S corporation? Why or why not? What criteria must be met? If The Car Wash is a LLC, can it be taxed as an S corporation? If so, what does it need to do to elect S corporation status? How would The Car Wash report and pay tax if it is an S corporation?