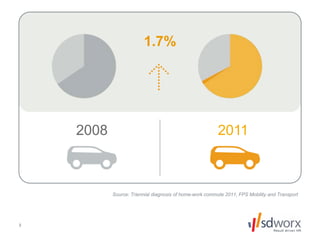

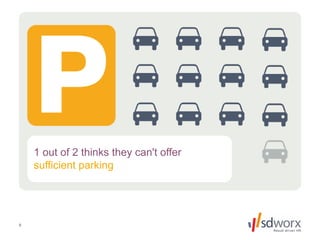

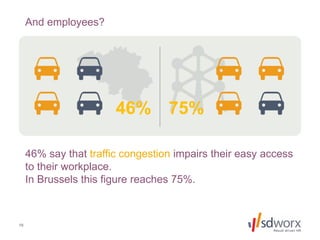

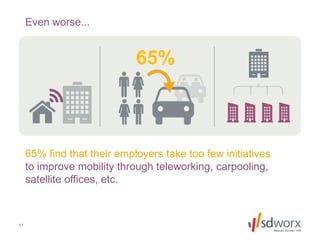

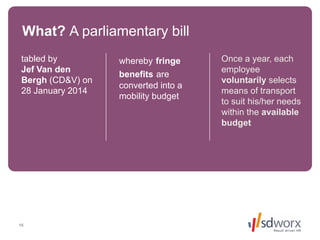

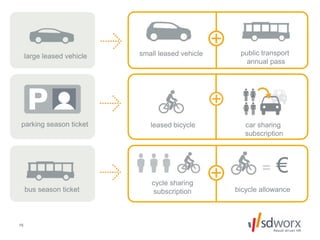

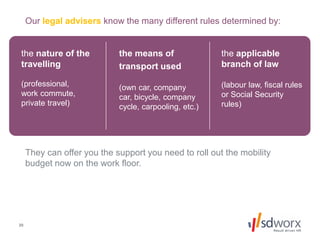

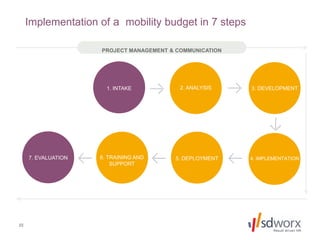

The document discusses the challenges of mobility faced by firms and how implementing a mobility budget can improve employee access and satisfaction. It highlights the demand for company cars as a key benefit for attracting talent, with statistics showing that poor accessibility leads to loss of job applicants. The proposed mobility budget allows employees to choose from various transport options to meet their needs while reducing reliance on company cars.