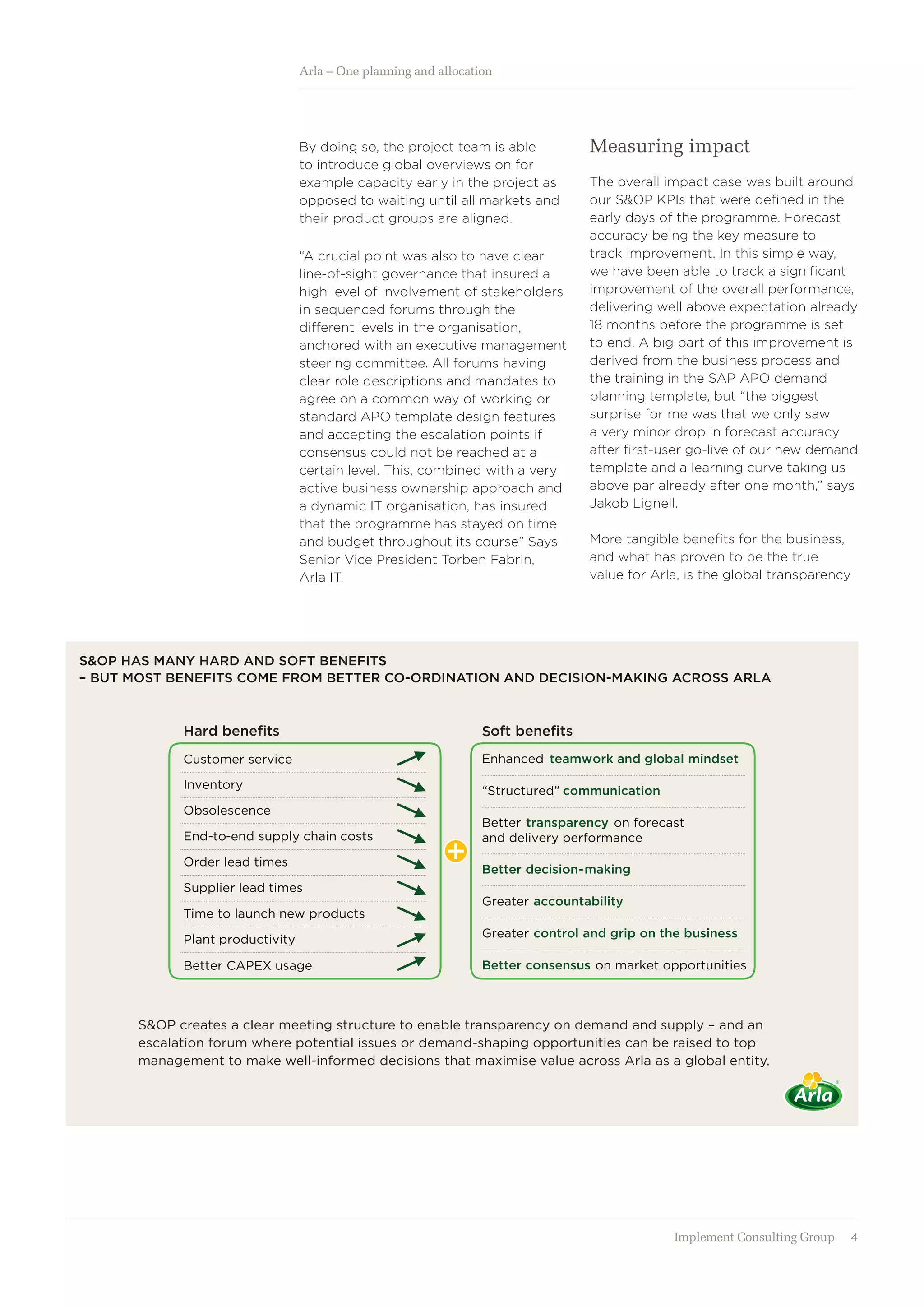

After the EU milk quota system was scrapped in 2015, Arla Foods faced a significant increase in milk production which destabilized milk prices and pressured farmers. To gain global transparency and coordination, Arla implemented a Sales & Operations Planning (S&OP) process and standardized SAP system. The new process provided integrated demand forecasting, production planning, and inventory projections across Arla's global operations. Early results showed improved forecasting accuracy and coordination. The program increased transparency, improved decision making, and helped Arla maximize value across its global business.