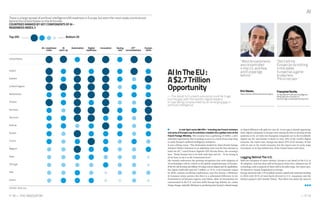

This document discusses whether Europe can become a global leader in innovation. While Europe has pioneered many technologies, it has struggled to commercialize them, with companies in other regions dominating markets like consumer internet, mobile operating systems, and networking equipment. For Europe to succeed with new digital technologies like AI, it will need to keep talent from moving elsewhere, increase funding throughout the innovation process, overcome market fragmentation, and develop its own strengths in collaboration and industrial sectors rather than mimicking other models. Reasons for optimism include Europe's skilled workforce and potential to leverage data from public services.