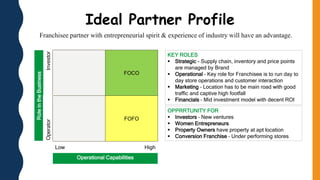

The document is an invitation for franchise partners to join The Happy Store brand. It provides an overview of the brand and the grocery market landscape in India. Key points include:

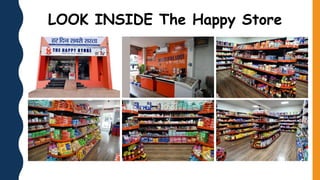

- The Happy Store operates both online and offline and serves thousands of customers daily across many regions of the country.

- It offers a wide range of food and grocery products from major brands. The company prides itself on excellent customer service.

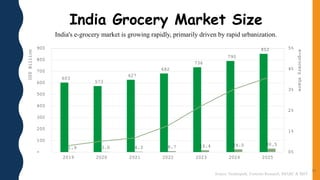

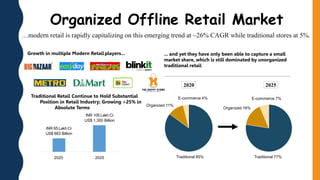

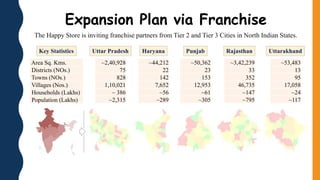

- The grocery market in India is growing rapidly and shifting towards organized retail formats. The Happy Store sees franchise opportunities in tier 2 and 3 cities across several North Indian states.

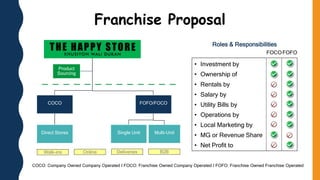

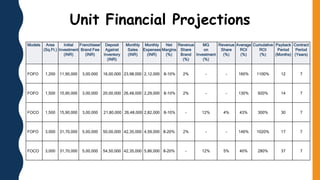

- The document outlines the franchise models and provides financial projections for stores of different sizes. Franchise support functions are also