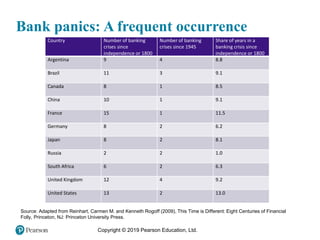

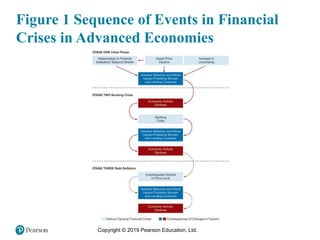

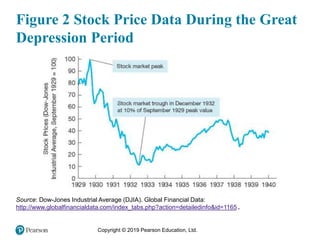

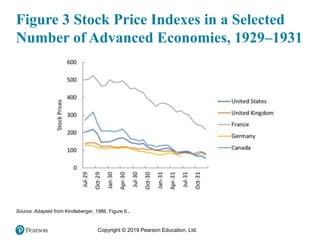

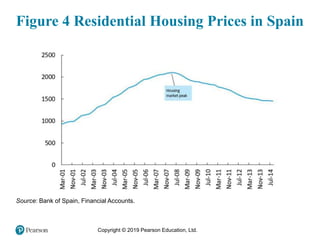

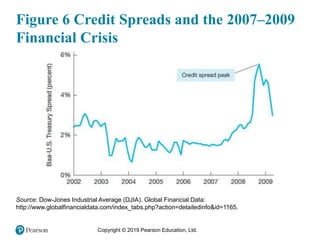

The document discusses the causes and dynamics of financial crises based on agency theory and asymmetric information. It provides an overview of past crises including the Global Financial Crisis of 2007-2009 and the European sovereign debt crisis. The crisis originated from risky lending and securitization practices in the US that spread globally. Government interventions included bank bailouts and fiscal stimulus but longer term regulatory reforms were still needed to stabilize the financial system internationally.